Intro

Verisk Analytics, Inc. (NASDAQ:VRSK) is a leading provider of data analytics solutions globally. The company operates in three segments: Insurance, Energy and Specialized Markets, and Financial Services. In the Insurance segment, VRSK focuses on predictive analytics and decision support solutions, assisting property and casualty customers in risk selection, pricing, compliance, and fraud detection.

The Energy and Specialized Markets segment provides data analytics and consultancy services to various sectors such as energy, chemicals, metals, mining, and renewables. The Financial Services segment offers customized analytics and decisioning solutions to financial institutions, payment networks, and regulators.

This article aims to provide an in-depth analysis of VRSK financial performance and growth potential. We will examine the company’s revenue trends, profitability indicators, and its ability to generate free cash flow. Additionally, we will explore VRSK’s strategic position in the insurance industry and outlook for the future. By evaluating these key factors, investors can gain valuable insights into the company’s prospects and determine its attractiveness as an investment opportunity in the current market.

Track Record

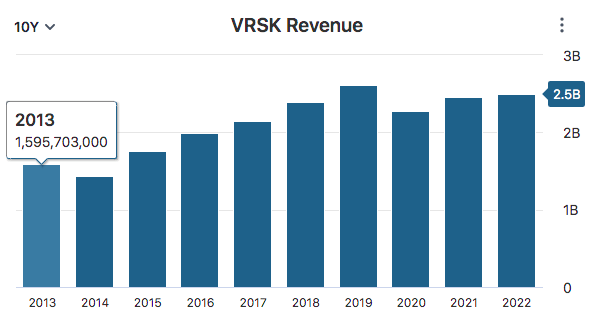

VRSK has firmly established itself as a leader in the industry with a remarkable track record of growth and profitability, consistently delivering high returns for its shareholders. The company’s revenue growth has been impressive, achieving a total growth of 56.48% from 2013 to 2022. This sustained growth is a testament to VRSK’s ability to meet the rising demand for its cutting-edge data analytics solutions and services. As the company continues to expand its market presence, its strong revenue performance positions it for long-term success in the dynamic data analytics landscape.

Data by Stock Analysis

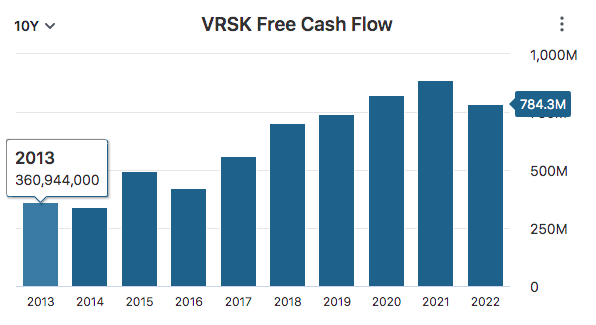

Furthermore, VRSK’s robust free cash flow performance, with a total growth of 117.29% and a compounded annual growth rate of 8.07% over the same period, showcases the company’s ability to generate cash and reinvest in its business, pursue growth opportunities, and reward shareholders.

Data by Stock Analysis

While VRSK has shown strength in revenue growth and free cash flow, there are concerns regarding its balance sheet. The current ratio of 0.89 indicates a potential liquidity challenge, as the company may have difficulty meeting short-term obligations with its current assets. Additionally, the debt-to-equity (D/E) ratio of 45.04 suggests a significant reliance on debt financing, which can increase financial risk and limit flexibility. A strong balance sheet is crucial for weathering economic downturns, pursuing strategic initiatives, and maintaining investor confidence. VRSK should prioritize improving its liquidity position and reducing its debt burden to enhance its financial stability and unlock further growth potential.

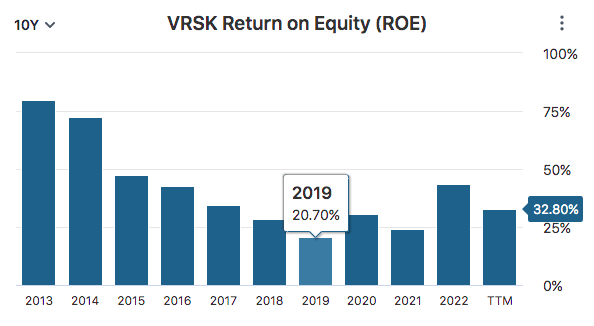

VRSK has consistently delivered a remarkable record of profitability, as indicated by its return on equity (ROE) figures. The company has achieved an average 10-year ROE of 42.37%, demonstrating its ability to generate high returns for shareholders over the long term. Additionally, VRSK’s ROE exceeded 20% in every year over the last decade, showcasing its efficiency in utilizing shareholders’ equity to generate profits. A high ROE is important as it indicates the company’s ability to generate substantial returns on investment and reflects its effective utilization of capital to drive growth.

Data by Stock Analysis

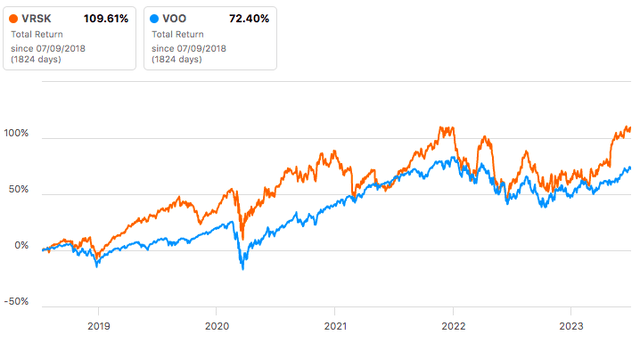

VRSK has outperformed the S&P 500 in terms of total return over the past five years, with a return of 109% compared to the S&P 500’s return of 72%. This outperformance highlights the company’s ability to generate value for investors and underscores its position as a strong player in the data analytics industry.

Data by Seeking Alpha

Outlook

VRSK has exhibited strong financial performance and a comprehensive strategy to drive consistent, predictable growth. The company’s recent first-quarter results showcased its ability to deliver impressive organic revenue growth and solid margin expansion, resulting in double-digit profit growth. With broad-based growth across most of its businesses, VRSK has gained significant business momentum.

Looking ahead, VRSK’s outlook appears positive. The insurance industry, one of its key sectors, is recovering from a challenging period marked by underwriting losses and pressure on profitability. VRSK’s partnership with the industry to reduce costs, improve risk selection and pricing, and combat fraud positions it well to capitalize on the market’s recovery. The company’s solutions and expertise enable insurers to adapt to legislative reforms, navigate complex environments, and enhance operational efficiency.

Moreover, VRSK has successfully engaged its clients on a deeper level, fostering transparent dialogue and addressing their specific objectives. The CEO’s direct client engagement and strategic roundtable discussions have received positive feedback from clients, reflecting the company’s improved client-centric approach. Higher Net Promoter Scores (NPS) further underscore the positive change in perception among clients.

During VRSK’s recent earnings call, CEO Lee Shavel highlighted one of the hottest discussion topics from their CEO roundtable: generative AI.

Generative AI was a hot topic. And we discussed how we can help the industry develop safe, ethical and effective use cases and guide policy. Our clients are recognizing the early benefits of change and focus at VRSK and have provided great feedback. A recent quote from an important client stated, I can’t remember a meeting with this degree of transparent dialogue where I felt like VRSK was listening.

There are some risks to investing in VRSK, namely the challenges in the Florida Insurance Market. VRSK is closely monitoring the state of Florida, which has been experiencing an insurance crisis due to a litigious environment and extreme event vulnerability such as hurricanes. Efforts are being made to address the crisis through legislative reforms and increased market oversight. VRSK is actively working with clients to adapt to new legislation, identify systemic issues, and better select and price risk in the state.

Despite these challenges in Florida, there are plenty of future growth drivers. VRSK’s focus on technological innovation and its recent milestone of successfully sunsetting its mainframe demonstrate its commitment to modernizing operations and enhancing the customer experience. This shift allows VRSK to allocate more resources towards innovation and develop solutions that address industry challenges.

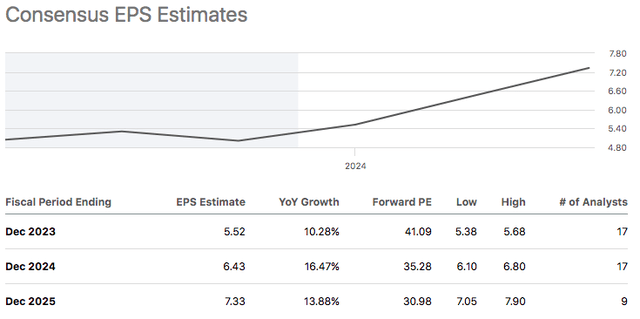

Considering the financial outlook, VRSK is projected to achieve an EPS of $5.52 in the fiscal year ending December 2023, representing a growth rate of 10.28%. The revenue estimate for the same period stands at $2.63 billion, with a year-over-year growth rate of 5.33%. These estimates indicate continued growth and stability in VRSK’s financial performance.

Data by Seeking Alpha

Valuation

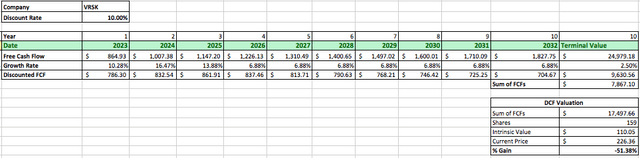

We will employ the discounted cash flow (DCF) analysis, a reliable method for evaluating a company’s value, to assess the true worth of VRSK. This approach involves estimating the present value of VRSK’s projected future cash flows to derive its intrinsic value.

Beginning the analysis, we consider VRSK’s previous year’s free cash flow of $784.30 million. For 2023, we project an initial growth rate of 10.28%, followed by growth rates of 16.47% for 2024 and 13.88% for 2025, based on average analyst estimates. Given VRSK’s size and associated uncertainties, predicting free cash flows beyond the next three years presents challenges. By leveraging the average growth rate of 6.32% observed in both compounded annual revenue and free cash flow over the past decade, we project this rate to extend for the following seven years. This conservative estimate accounts for the historical performance and the potential for sustained growth in VRSK Analytics’ revenue and cash flow.

To calculate the terminal value, we apply a conservative perpetual growth rate of 2.5%. Applying a discount rate of 10%-which accounts for the long-term return rate of the S&P 500 with dividends reinvested-we determine VRSK’s intrinsic value to be $110.05. This suggests that VRSK may be significantly overvalued, potentially offering investors a potential loss of 51.38% compared to the company’s current market price.

Author’s Work

Final Thoughts

VRSK has a strong track record of growth and profitability, driven by its ability to meet increasing demand for its solutions. VRSK’s revenue has experienced consistent growth, and its robust free cash flow generation highlights its financial strength. However, there are concerns about its balance sheet, with a low current ratio and high debt-to-equity ratio. VRSK has demonstrated profitability with high return on equity figures, indicating efficient capital utilization.

The company has outperformed the S&P 500 in terms of total return. Looking ahead, VRSK’s strategic position and engagement with clients, particularly in the insurance industry, bode well for future growth. Despite a positive outlook, the current stock price appears to be too high, suggesting caution for potential investors. A discounted cash flow analysis indicates that the stock may be overvalued, potentially leading to a loss compared to its current market price. As such, a hold recommendation is advised based on the outlook for future growth and the current valuation of the stock.

Read the full article here