American Realty Investors, Inc. (NYSE:ARL) recently reported a massive increase in assets, net income growth, and new agreements to develop a 240 unit multifamily property in Lake Wales, Florida. If the advisor of ARL continues to successfully select assets and sign sale agreements at beneficial valuations, I believe that ARL would most likely see a growth in its stock price. There are risks from the action of related parties, failed assessment of assets, inflation, or further increase in the interest rates. However, the stock appears quite undervalued right now.

American Realty Investors Reported An Impressive Increase In The Total Amount Of Assets

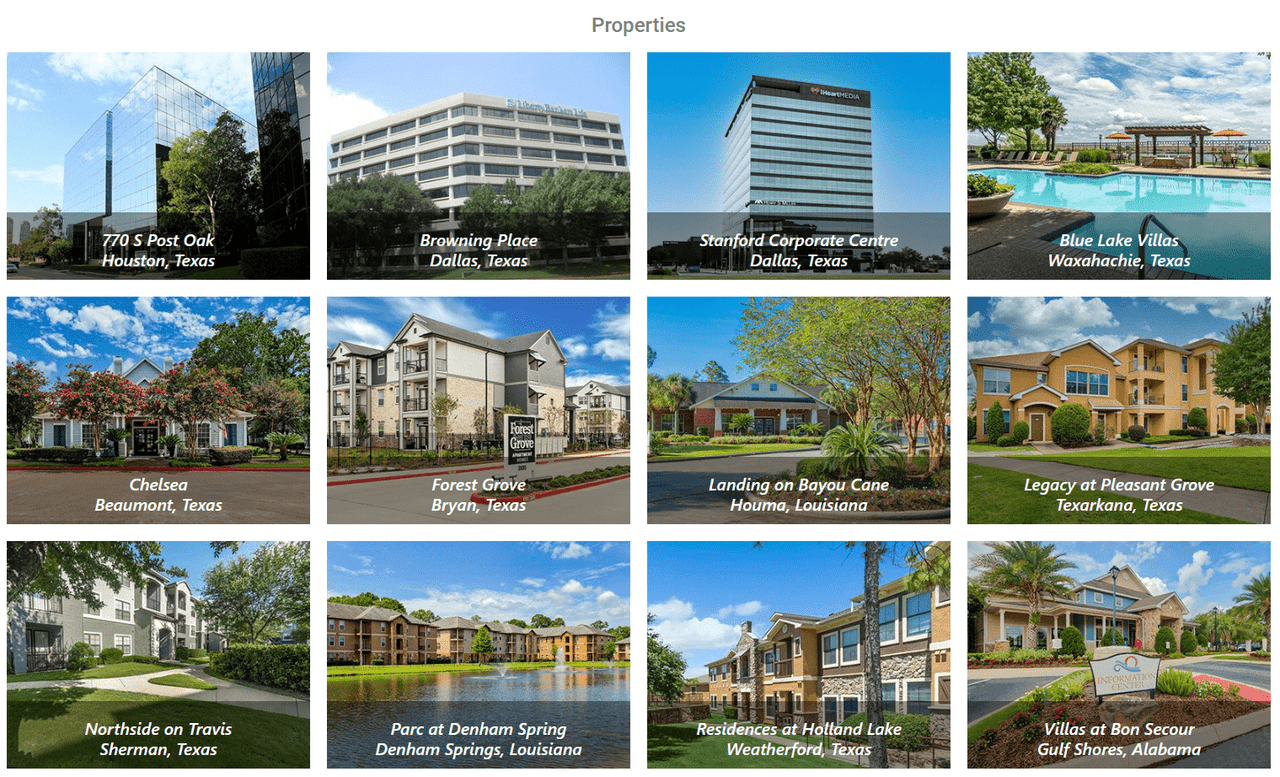

Focusing its activities on the management of multi-family and commercial properties in the southern United States, American Realty Investors is an investment company in the real estate sector. The company disclosed some of its properties on the corporate website.

Source: Corporate Website

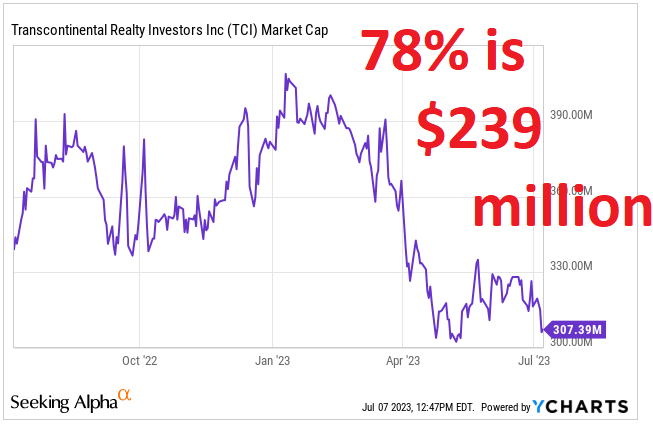

The company also has investments in mortgages and land with real estate development projections. The company owns 78.4% of the common stock of Transcontinental Realty Investors (TCI), and its business is managed by Pillar Income Asset Management.

The activities are divided into two business segments: the multi-family complexes segment and the commercial properties segment. In both cases, the activity is subject to acquisition, development, and management of properties and projects, with the difference of the ultimate purpose for one reason or another.

The commercial projects segment is mainly focused on the rental of commercial offices as well as other tenant services such as parking or storage. Similarly, the multi-family segment has the similar logic of rents and leases for homes in complexes of large units. In this sense, it is important to realize that the company does not allocate properties for sale to businesses or individuals, and all of its assets are being developed for rent.

Towards the end of 2022, American Realty had a portfolio of commercial offices estimated at 1 million square feet, 14 multi-family properties comprised of a total of 2,328 units and 1,858 hectares of land for projects under development or not yet developed.

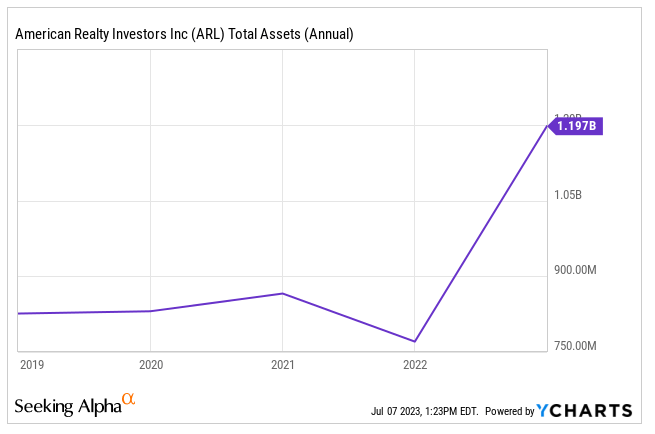

Only because of the recent increase in total assets, I believe that American Realty is a company to follow carefully. Total assets increased from less than $900 million in 2019 to about $1.19 billion in 2023.

Source: Ycharts

Beneficial Changes In The Balance Sheet In The Last Quarter

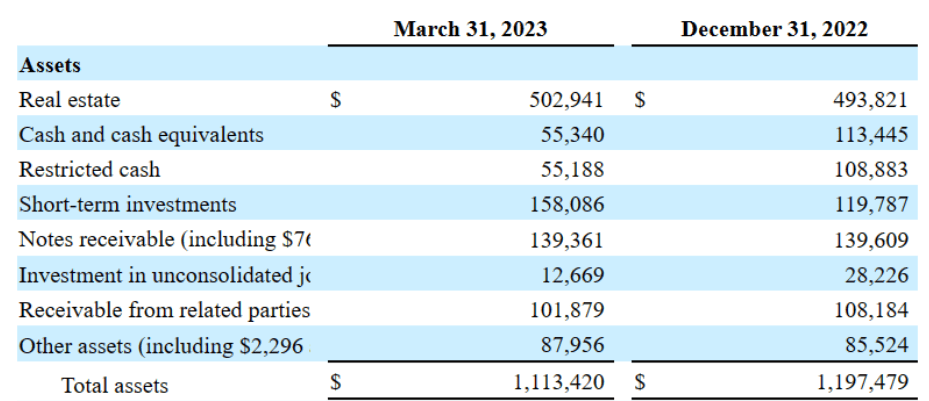

The new balance sheet reported in March 2023 included a small decrease in the total amount of assets driven by decreases in accounts receivable, notes receivable, and restricted cash. With that, it is beneficial that real estate is worth a bit more than that in 2022 and the increase in short-term investments. The new list of liabilities is also quite beneficial because management successfully reduced the total amount of bonds payable, and the mortgages remained at the same level reported in 2022.

As of March 31, 2023, the company reported real estate worth $502 million, cash and cash equivalents close to $55 million, and restricted cash of $55 million. Besides, with short-term investments of about $158 million, notes receivable close to $139 million, and receivable from related parties of $101 million, total assets stand at $1.113 billion.

Source: 10-Q

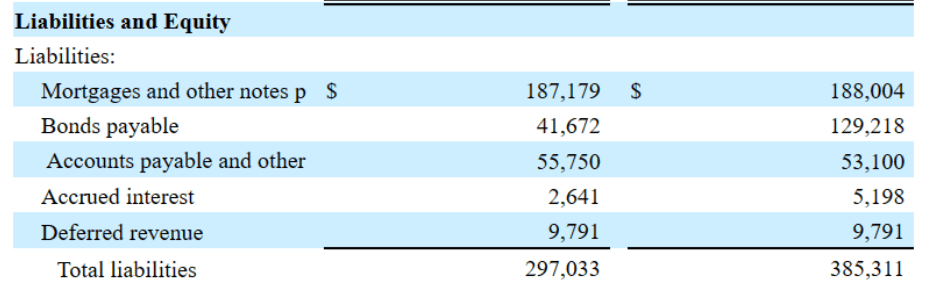

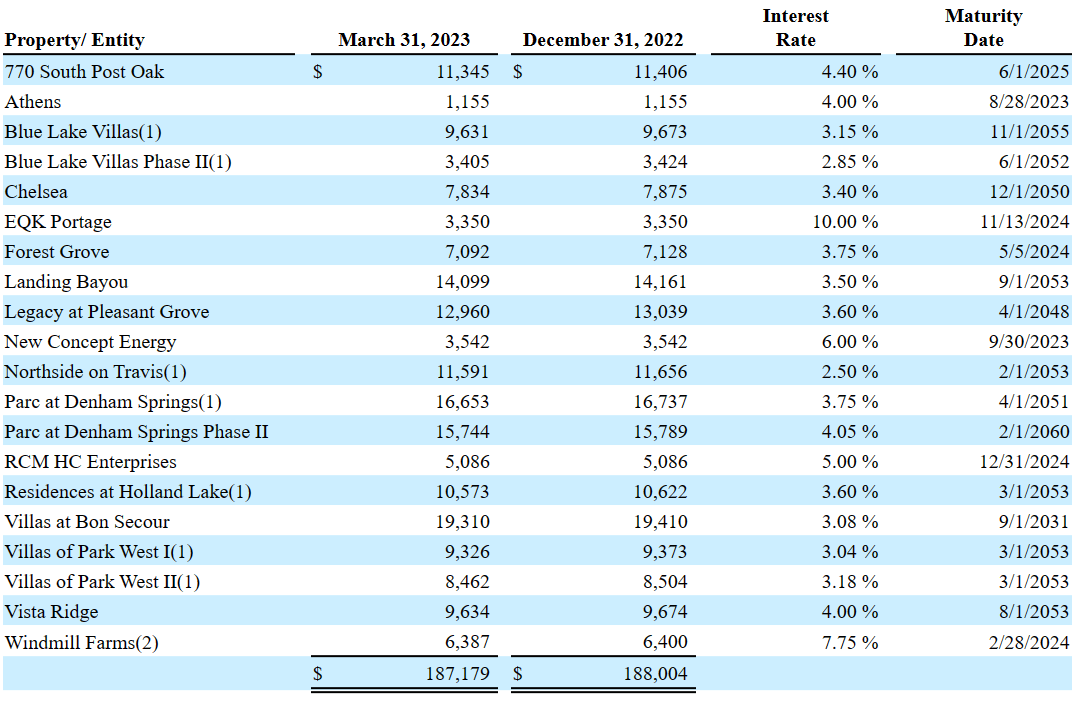

The list of liabilities includes mortgages and other notes payable worth $187 million, bonds payable close to $41 million, accounts payable and other liabilities of about $55 million, and deferred revenue of $9 million. The total amount of liabilities stands at $297 million, so the asset/liability ratio is larger than 3x. I believe that the balance sheet appears quite stable. With the total amount of cash in hand and real estate, I believe that most investors would not worry about the total amount of debt.

Source: 10-Q

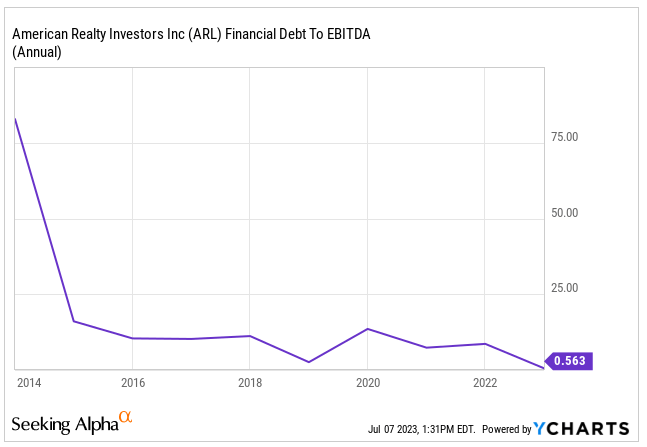

In my view, if management continues to deliver less financial debt/EBITDA, more investors would most likely have a look at the investments made by Pillar Income Asset Management. The cost of capital used by financial advisors may also decrease, which would lead to higher fair valuation.

Source: Ycharts

Valuation And DCF Model

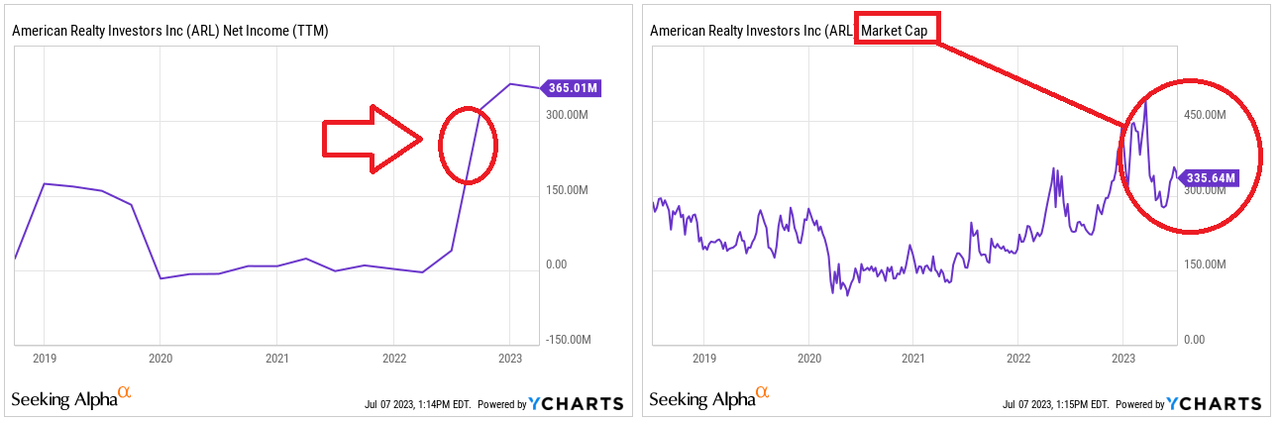

In my opinion, only by looking at the valuation of TCI and the ownership of American Realty, we could suspect that American Reality appears undervalued. American Realty owns a stake of close to 78%, which would imply close to $239 million. The market capitalization of American Realty stands at less than $351 million, and the last net income reported was equal to about $365 million. With these figures in mind, there seems to exist a certain upside potential in the stock valuation.

Source: Ycharts

Source: Ycharts

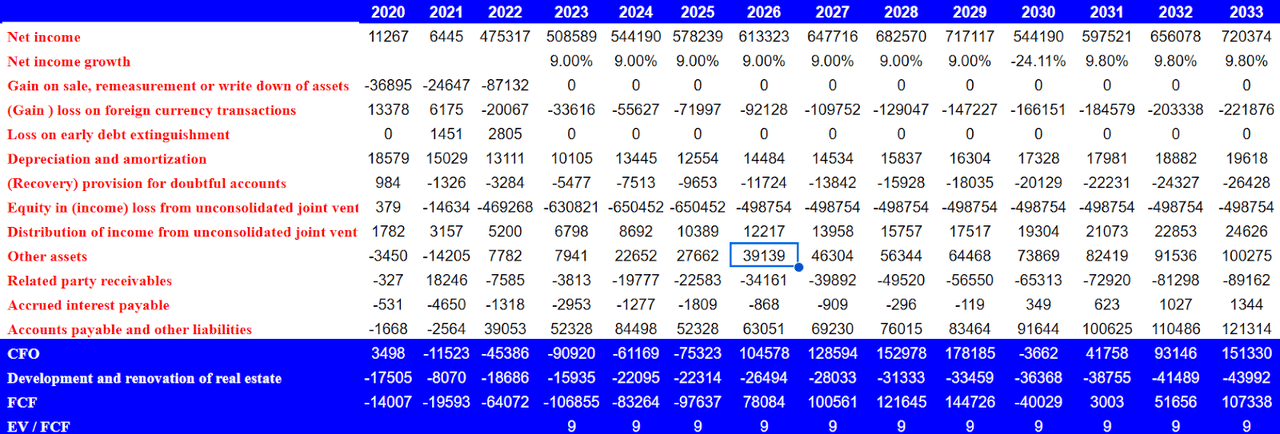

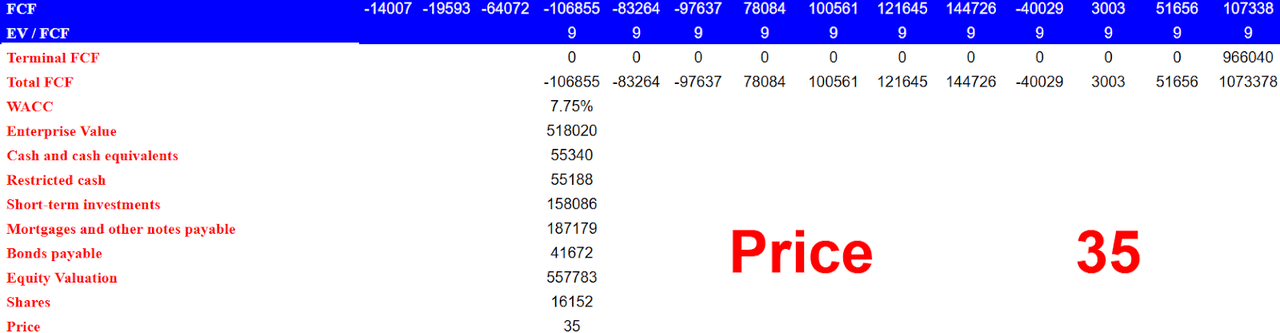

With those figures about valuation of American Realty, I decided to run a DCF model to assess a bit more in detail the fair valuation of the company. I made several assumptions that support future FCF growth and net income growth for the next ten years.

Under my DCF model, I assumed that management would successfully sign more agreements like that signed with Pillar to develop a 240 unit multifamily property in Lake Wales, Florida. Considering the expertise of American Realty in making valuations and conducting projects, with sufficient amounts of equity financing, I believe that future developments will most likely accelerate the FCF generation. The following lines include details about the new projects as they were disclosed in the last quarterly report.

On March 15, 2023, we entered into a development agreement with Pillar to build a 240 unit multifamily property in Lake Wales, Florida that is expected to be completed in 2025 for a total cost of approximately $55.3 million. The cost of construction will be funded in part by a $33.0 million construction loan. The development agreement provides for a $1.6 million fee that will be paid over the construction period. As of March 31, 2023, we have incurred a total of $10.1 million in development costs. Source: 10-Q

Currently, the company’s strategy is focused on maximizing long-term value through the development of projects in second-tier real estate markets in the southern United States. For this, the objective of keeping occupancy as high as possible and sustaining the position of its investments is fundamental. In my financial model, I assumed that the expertise accumulated by management will help keep occupancy elevated.

In this sense, the company has decided to assign the construction of multi-family complexes to contractors, unlike its historical model in which it dedicated its own workforce for this purpose. In my view, this business model will most likely bring further flexibility, and less risks from conflicts with employees.

I also assumed that the company will be able to sell portions of its joint ventures with other operators at compelling valuations. Note that I believe that American Realty knows well how to assess the valuation of real estate assets. A clear example of the expertise in the industry is the sale of 45 properties for $1.8 billion in 2022.

On September 16, 2022, VAA sold 45 properties for $1.8 billion, resulting in gain on sale of $738.4 million to the joint venture. In connection with sale, we received an initial distribution of $182.8 million from VAA. Source: 10-QOn March 23, 2023, we received a $18.0 million distribution from VAA, which represented the remaining distribution of the proceeds from the sale of the VAA Sale Portfolio. Source: 10-Q

I also believe that further recent announcements about incoming reduction of the total amount of debt would most likely bring new investors. In this regard, it is worth noting that American Realty intends to use the cash from the sale of 45 properties to pay down its debt.

We plan to use our share of the proceeds from the sale of the VAA Sale Portfolio to invest in additional income-producing real estate, pay down our debt and for general corporate purposes. Source: 10-Q

My financial model includes 2033 net income of $720 million, 2033 loss on foreign currency transactions of about -$222 million, 2033 depreciation and amortization worth $19 million, and provision for doubtful accounts close to -$27 million.

Besides, with equity loss from unconsolidated joint ventures worth -$499 million, distribution of income from unconsolidated joint ventures worth $24 million, and changes in related party receivables of -$90 million, 2033 CFO would stand at $151 million. Finally, if we assume 2033 development and renovation of real estate of -$44 million, 2033 FCF would not be far from $107 million.

Source: My DCF

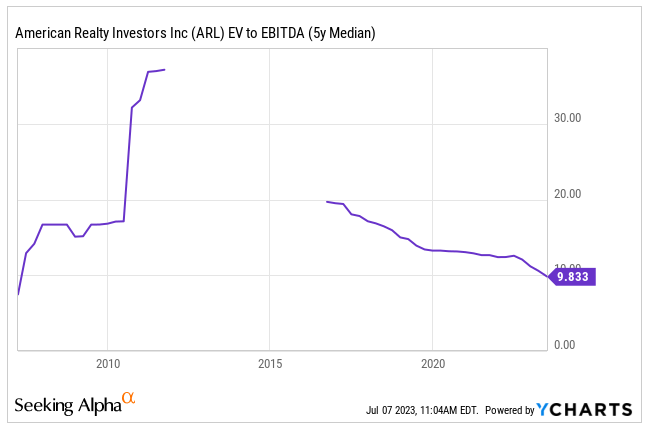

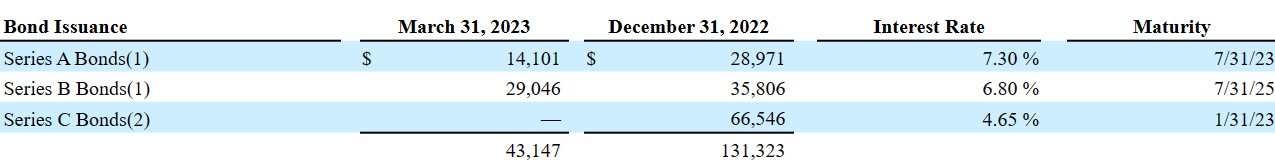

Considering the EV/EBITDA 5 Years median of close to 9x, I believe that assuming EV/FCF of 9.055x would be reasonable. I also included a WACC of 7.755%, which appears conservative if we study the bonds and notes payable reported by American Realty. The company is paying interest between 2.5% and 10%.

Source: Ycharts

Source: 10-Q

Source: 10-Q

With the previous assumptions, I obtained an implied enterprise value of $518 million. If we add cash and cash equivalents worth $55 million, restricted cash worth $55 million, short-term investments close to $158 million, mortgages and other notes payable of $187 million, and bonds payable worth $41 million, the equity valuation would be $557 million. Finally, the implied price would be close to $35.5.

Source: My DCF

Highly Competitive And Highly Fragmented Market

The real estate market in the United States is highly competitive and highly fragmented by region and property category. In particular, American Realty has a presence and position in the southern United States market, where a large number of companies with greater resources and development or financing capabilities participate.

Competition is driven by a series of factors such as management capacity, management of operating costs, appearance and comfort of the properties offered for rent, and, in the case of multi-family complexes, the community atmosphere that can be given to future inhabitants or those interested in leasing the units.

Risks

If we talk about risks for American Realty, we must first focus on the lack of diversification of its portfolio. The company develops projects only in the southern region of the United States, resulting in total dependence on the economic conditions of this region for its activities.

Besides, the competition and the corporate capacity of the other companies are greater, and for this reason, the company depends to a large extent on its ability to carry out the commercial and financial strategy to maintain its position in the market. Of course, the risk of not succeeding in the strategy or not being able to integrate future acquisitions into its infrastructure is a relevant factor.

In any case, the way in which the US economy develops, taking into account inflationary conditions and the possible increase in interest rates could directly affect the company’s strategy and eventually the ability to positive return on investments.

I also see some risks from the fact that the investments are conducted by Pillar Income Asset Management, Inc. I cannot really know whether the fees obtained by this advisor are fair, or whether the deals signed with lenders and investors are close to those obtained under other conditions. I cannot really say whether there are no conflicts of interest out there. In this regard, I believe that the following lines are a good read.

Our operations are managed by Pillar Income Asset Management, Inc. in accordance with an Advisory Agreement. Pillar’s duties include, but are not limited to, locating, evaluating and recommending real estate and real estate-related investment opportunities. Pillar also arranges our debt and equity financing with third party lenders and investors. Employees of Pillar render services to us in accordance with the terms of the Advisory Agreement. Pillar is considered to be a related party due to its common ownership with Realty Advisors, Inc., who is our controlling shareholder. Source: 10-Q

Conclusion

American Realty recently reported an impressive increase in the total amount of assets, net income growth, several profitable sales of assets, and development agreements. Taking into account the stake owned in Transcontinental Realty Investors, in my view, the stock appears quite undervalued. With that, I believe that Pillar Income Asset Management is undertaking a very good job of selecting real estate assets and assessing their valuation. Further reduction in the total amount of debt was also indicated, which would most likely accelerate the demand for the stock. Yes, there are risks from the action of third parties, failed assessment of assets, or failed sale of real estate, however the stock appears quite undervalued.

Read the full article here