Risky For Different Reasons

The primary risk with Tesla, Inc. (NASDAQ:TSLA) is its valuation, which seems to be decoupled from reality as misconceptions swirl around Tesla’s autonomous drive, EV semis, and Superchargers. On the other hand, the primary risk with Ford Motor Company (NYSE:F) is leverage. Let’s dig in.

Ford’s Leverage And How Tesla Compares

First of all, we need to understand that Ford has a massive financing business compared to Tesla. Ford Credit offers customers financing in the form of loans and leases. The company also offers financing to Ford dealerships, allowing them to afford their inventory and high operational costs. All of this is leverage, and it’s inherently risky. But, Ford is paid for the risk it takes on in the form of interest (Sort of like a bank).

Tesla also offers loans and leases in select locations, but it simultaneously leans on financial institutions to provide 3rd party financing. Tesla doesn’t appear to be financing dealerships, but instead sells vehicles through its website and “company-owned stores.” I like this business model better because it has less leverage. However, I wonder if Tesla can expand to be the size of Ford or General Motors (GM) using this business model. This remains to be seen.

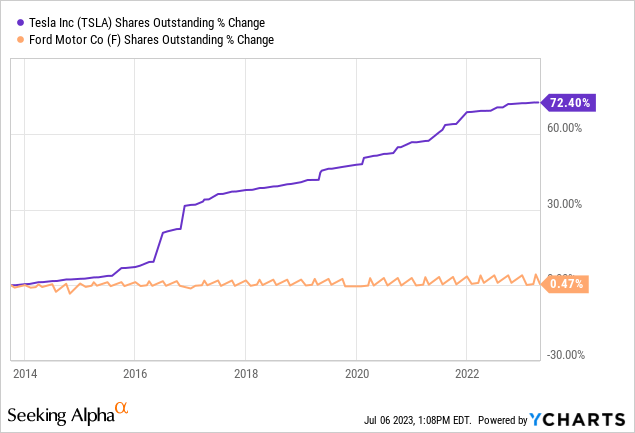

Tesla’s business model is also made possible by its share dilution, which raises cash from investors:

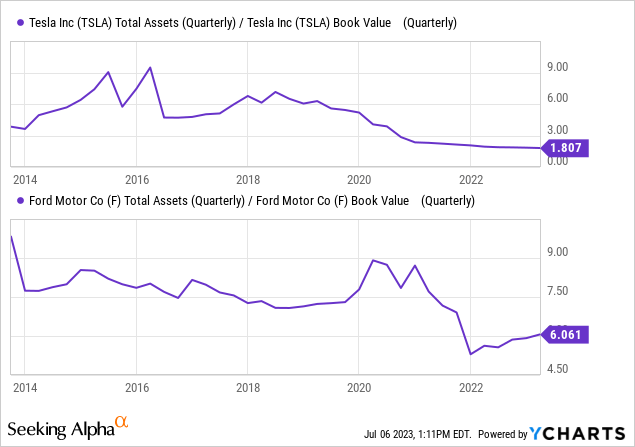

Because of Tesla’s business model and share dilution, it has the better balance sheet on an assets to equity basis (a lower number means less risk):

It’s more difficult for the shareholder (you) to be wiped out by recession losses when you have a larger amount of equity compared to liabilities and assets.

Notice that both these companies have been de-risking their balance sheets over the past 10 years. Still, Ford’s balance sheet is more levered than many of its competitors:

| Automaker ______ | Assets To Equity |

| Ford | 6.1 |

| General Motors | 3.6 |

| Volkswagen (OTCPK:VWAGY) | 3.1 |

| Stellantis (STLA) | 2.6 |

| Toyota (TM) | 2.5 |

| Honda (HMC) | 2.1 |

| Tesla | 1.8 |

Looking at the balance sheets of banks and automakers in the United States, I think the next recession in the U.S. will be far less severe than what we saw in 2008. Just looking at the assets to equity ratio, GM had a ratio of 17 in 2004; Ford’s was 18. So Ford had 3x less leverage now.

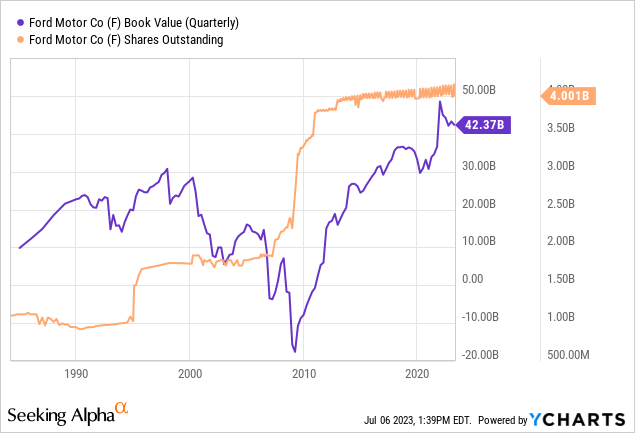

As losses began to mount from 2005-2009, Ford’s shareholders’ equity actually went negative:

General Motors went bankrupt, and the only reason Ford survived was it diluted shareholders big-time. Could Ford experience losses and declining shareholders equity again? Sure it could, and this is a risk. But will it risk the equity of the company like it did in 2008? I don’t see that happening anytime soon.

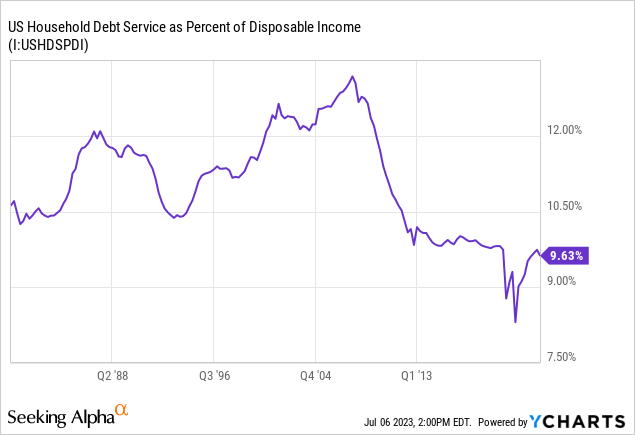

When compared to income, household debt in the United States is now more affordable than ever before:

With a Ba2 (BB equivalent), “junk bond” credit rating, the real risk for Ford would be a deterioration of its competitiveness alongside its poorly graded balance sheet. Ford operates is a brutally cyclical business and is doing so with one of the worst balance sheets among the big auto companies.

The Tesla Risk

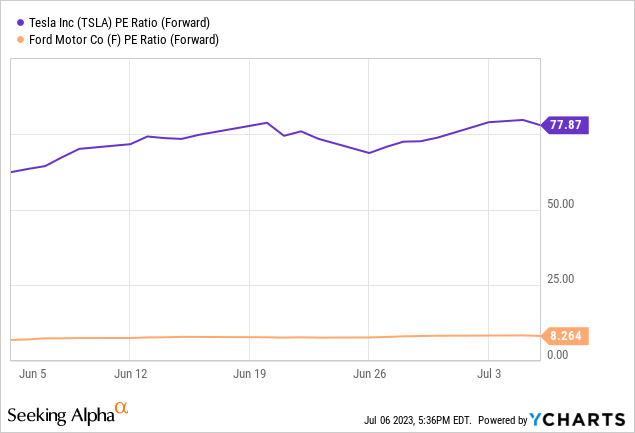

Tesla is risky because its’ valuation decouples from its underlying growth prospects. Let me explain.

Contrary to popular opinion, Tesla is actually losing in autonomous drive. Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY) recently became the first company to be approved for Level 3 autonomous drive in the U.S. Meanwhile, Ford and Tesla are still only capable of Level 2 autonomy. Sam Abuelsamid, an analyst at Guidehouse Insights recently said:

“Tesla’s technology is kind of a joke. It’s not even remotely close to being something that can operate without a human being behind the wheel, supervising, ready to take over at any time. It’s a decent level 2 system like Super Cruise or Ford’s BlueCruise.”

This doesn’t align with fund manager Cathie Wood’s claims that

“The robotaxi opportunity, globally, will deliver $8 to $10 trillion in revenue by 2030.”

Cathie Wood’s analysis of Tesla just doesn’t make sense. To put this crazy number into context, the #1 company in the world by revenue, Walmart (WMT), make only $600 billion in revenue (1/15th the amount claimed by Cathie). Meanwhile, you see headlines like this:

Headline (Yahoo! Finance)

Also, Tesla now has its AI robots picking items off the table:

Tesla Bot (Tesla)

This is cool, but I think it is doing more heavy lifting in terms of boosting up the valuation of Tesla’s stock than it is in creating economic value:

We have seen Amazon (AMZN) venture into exciting new areas before, like the Fire Phone and Amazon Alexa, only for headlines like this to hit the news years later:

Article Title (Extreme Tech)

So we don’t know which of Tesla’s ventures will ultimately generate more cash flow than they burn.

Elon Musk has claimed that Tesla’s EV semi truck has 500 miles of range. However, according to CNBC, Tesla’s EV semis have been seen breaking down around Northern California. And, there seems to be a problem with how much weight the trucks can carry. Pepsi is delivering light bags of chips 425 miles using the trucks, but the company is keeping its heavier soda can deliveries limited to shorter distances. As with EVs, BYD Company Limited (OTCPK:BYDDF) is a big competitor in this space. There’s also Daimler and others. I think this could become profitable for Tesla, but I don’t see outsized profits. The market isn’t nearly as big as the market for light-duty vehicles.

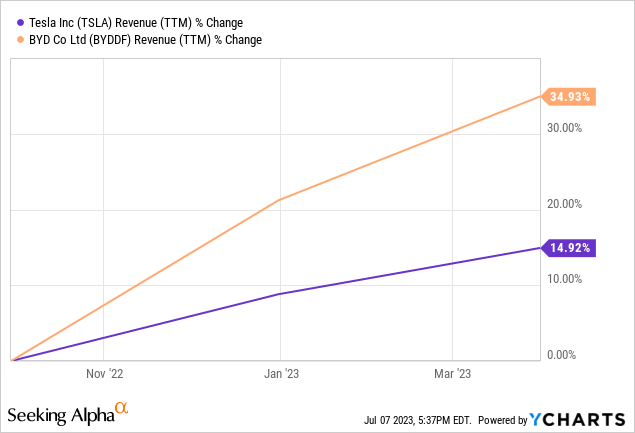

Looking at the EV space, I see the following problems: declining profit margins, limited infrastructure, BYD, mass adoption by ICE automakers, consumers who prefer hybrids, and government subsidies that should dry-up as EVs become the norm. I do not have time to go into detail on each of these, but they do represent risk, in my opinion. For example, Fortune Business Insights and Vantage Market Research have the EV market growing at around 17.5% per annum through to 2030 (growth will likely slow after that). Meanwhile, BYD is growing faster than Tesla:

And, Tesla’s market share and margins are likely to face further pressure as consumers begin to realize that their favorite ICE auto brands are now offering much cheaper EVs.

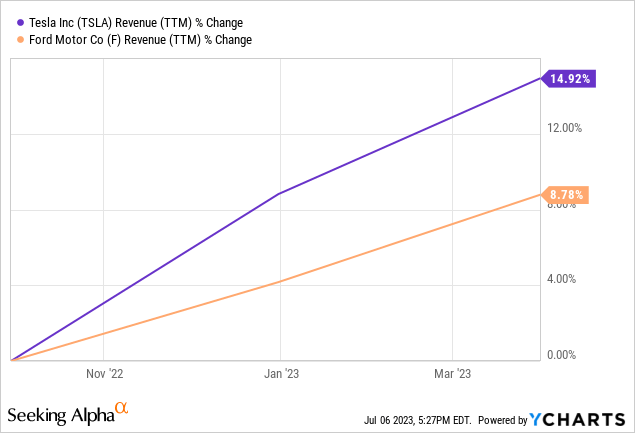

Over the past year, Tesla’s revenue hasn’t grown much faster than Ford’s:

Lastly, with estimates of only $3 billion in revenue by 2030, Tesla’s EV charging partnerships (With Ford, GM, etc.) could be just a drop in the bucket for long-term profitability.

Long-term Returns

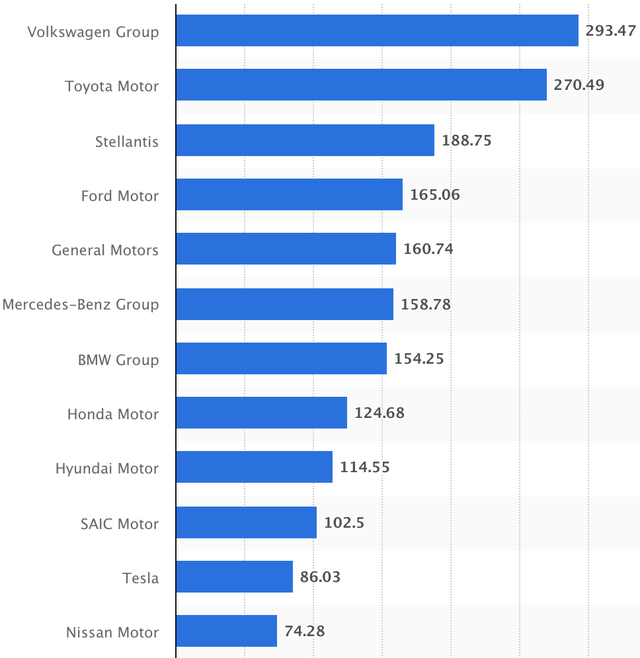

Tesla certainly has room to gain global market share, and I have it growing much faster than Ford from here. Worldwide revenue 2022:

Worldwide Revenue By Automaker 2022 (Statista)

But, Ford is trading at such a large discount to Tesla, that I have Ford outperforming over the next decade with total returns of 8.5% per annum vs negative 1.5% per annum for Tesla (my 2033 price target is just $240 for TSLA):

| ______________________________ | TSLA | F |

| Normalized EPS | $3.40 | $1.60 |

| Current Dividend | $0 | $0.60 |

| Compound Annual Growth Rate | 15% | 4% |

| Year 10 EPS | $13.75 | $2.37 |

| Terminal Multiple | 17.5x | 10x |

| Year 10 Price Target | $240 | $23.7 |

| Annualized Returns (Dividends Reinvested) | (1.5%) | 8.5% |

Note: This is a base-case estimate. The compound annual growth rate is for dividends and earnings. To calculate Tesla’s normalized EPS, I used its diluted EPS. To calculate Ford’s, I used the company’s 10-year average ROA and profit margins, applied against its current asset base and TTM revenue. A risk to the thesis for my “Strong Sell” on Tesla would be if it can maintain current margins whilst growing rapidly, win in autonomous drive, maintain its EV market share, and generate significant long-term profits in the field of AI robotics.

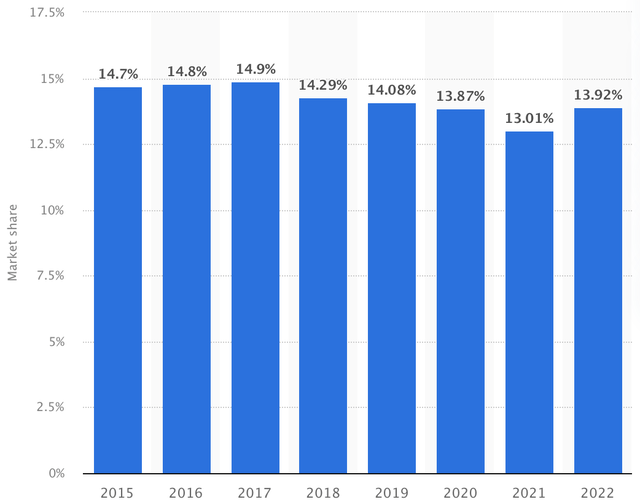

Over the past several years, Ford’s U.S. market share has declined slightly:

Ford’s U.S. Market Share (Statista)

However, Ford’s new offerings (EVs, hybrids, F-150s, and Broncos) seem to be generating excitement, and Ford’s sales rebounded over the past year. The problem I’m seeing is that Ford is also generating a lot of recalls, which may risk its long-term reputation.

Here is a list of the automakers with the most recalls in 2022:

- Ford #1 – 67 recalls

- VW #2 – 45 recalls

- Chrysler #3 – 38 recalls

- Mercedes #4 – 33 recalls

- GM #5 – 32 recalls

- Kia #6 – 24 recalls

- Hyundai #7 – 22 recalls

- Tesla #8 – 20 recalls

- BMW #9 – 19 recalls.

Ford was also #2 in recalls in 2021, signaling it may not be putting enough emphasis on quality control. Combined with its leveraged balance sheet, this has caused me to reduce my expected growth rate and terminal multiple for Ford.

In Conclusion

Investors are playing a dangerous game with Tesla and Ford. Still, if I had to play, I would take the odds on Ford. Tesla has just a 1.4% earnings yield and could easily face a lost decade; I would upgrade Tesla stock to a “Hold” at $122 per share, representing 55% downside. With just Level 2 autonomy, it is losing the autonomous drive race; in fact, experts have it ranked outside the top 10. Cash flows from EV charging, the Tesla bot, and EV semis may also disappoint. For example, Tesla’s EV charging partnerships are only expected to generate $3 billion in revenue, not profits, by 2030.

Meanwhile, Ford had the worst recall numbers in 2022 and has the most leveraged balance sheet of its peers. Still, Ford is generating excitement with its new offerings, and I have it handily outperforming Tesla from here.

My ratings:

- Ford: “Hold”

- Tesla: “Strong Sell”

We currently own a small position in Honda, which we bought at $23.50 per share. I like that it has a rock-solid balance sheet and leading market share in motorcycles, among other things. For more on Honda, click here. I also recently wrote a buy piece on General Motors here.

Until next time, happy investing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here