It may surprise investors to know that DigitalOcean Holdings, Inc. (NYSE:DOCN), once a high-flying cloud computing stock, is now a value stock. The cloud computing sector has lost some of its shine over the past year, and DOCN is often considered a lower-quality operator in the sector facing stiff competition from the mega-cap tech titans. A tough macro environment has slowed down customer expansion programs, but the company has offset those headwinds through pricing initiatives.

Meanwhile, DigitalOcean is generating cash and repurchasing stock. It is unclear how the rise of artificial intelligence, or AI, may impact the cloud computing competitive environment, but DOCN stock looks too cheap here – I reiterate my strong buy rating.

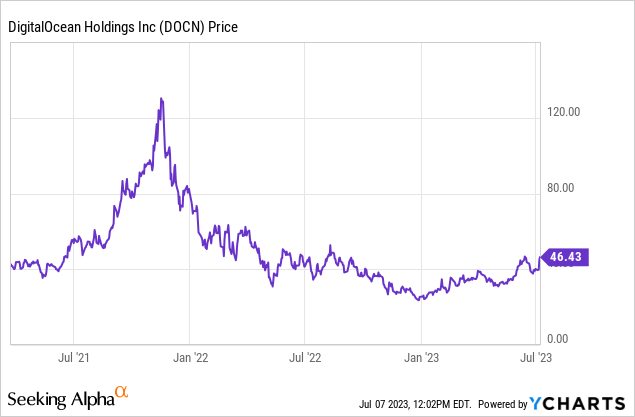

DOCN Stock Price

DigitalOcean Holdings, Inc. still trades at a fraction of its all-time high price, but one can make the argument that the stock should never have traded so high in the first place, despite being the only pure-play cloud computing stock in the market today.

I last covered DOCN in April, where I rated the stock a strong buy due to the rising free cash flows. That thesis remains in play today, as management remains committed to driving profitability gains in spite of the tough macro environment.

DOCN Stock Key Metrics

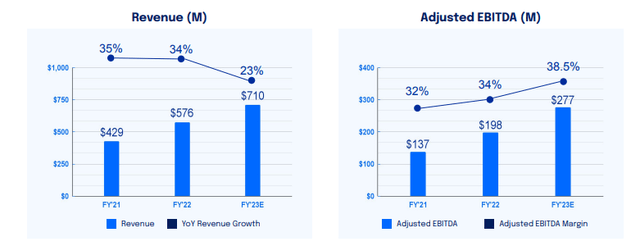

In its most recent quarter, DOCN delivered 30% YOY revenue growth to $165.1 million and a 34% adjusted EBITDA margin.

2023 Q1 Presentation

DOCN saw its net dollar retention rate decline significantly as the company faced the same “cloud optimization” headwinds mentioned by other cloud computing providers. DOCN was able to nonetheless continue to boost average revenue per user due to its price increases implemented last year.

2023 Q1 Presentation

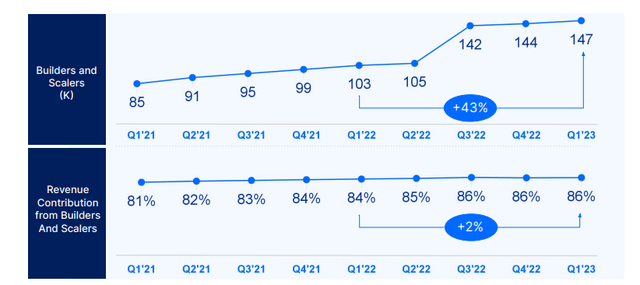

DOCN had previously seen a large jump in its “builders and scalers” in the third quarter of last year due to the aforementioned price increase and has since seen sequential growth slow back down to near historical levels. The next quarter will be the last quarter that the company laps times without the price increase, and I expect top line growth to show material deceleration at that point, barring any improvement in the macro environment.

2023 Q1 Presentation

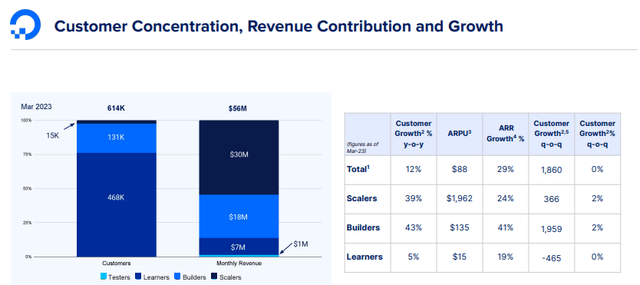

DOCN has disclosed that while “testers and learners” make up the vast majority of its customer base, builders and scalers account for the bulk of revenue.

2023 Q1 Presentation

DOCN ended the quarter with $613 million in cash and investments versus $1.5 billion in debt. This net leverage position is somewhat atypical for a newer tech company and reflects the company’s history of M&A, including its recently closed acquisition of Cloudways.

Looking ahead, management has guided for the second quarter to see up to $170.5 million in revenue, representing 27.3% YOY growth. Management did however maintain their guidance for up to $720 million in full-year revenue, representing 24.9% YOY growth. That implies growth in the second half may decelerate to just 22%.

2023 Q1 Presentation

Notice that DOCN is now guiding for shares outstanding to stand at around 105 million, down from 116 million as of the earlier guidance. The company repurchased 7.76 million shares for $266 million in the quarter and on the conference call, management indicated that they intend to deploy the remaining $175 million in their share repurchase program this year.

While management stated uncertainty regarding when macro headwinds would subside, they did state that they intend to offset any deceleration in growth rates with big improvements in profitability. Management expects to exit 2023 with adjusted EBITDA margins “in the low 40s” and with free cash flow margins near 30%. Management outlined a resounding commitment to its buyback program, stating expectations for their share count to decline by 15% to 20% in the coming years.

Is DOCN Stock A Buy, Sell, or Hold?

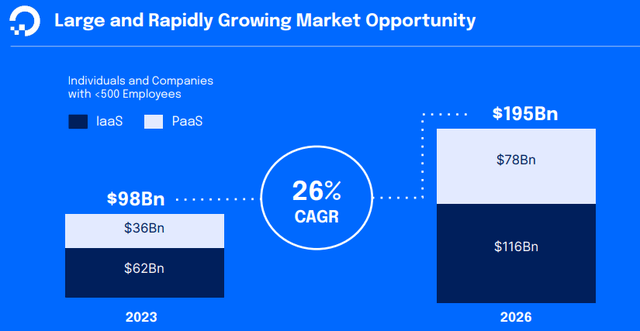

DOCN is a pure-play cloud computing platform competing against the likes of Amazon’s (AMZN) AWS and Microsoft (MSFT) Azure. Despite near term headwinds, cloud is expected to be one of the fastest growing sectors in the market with a 26% estimated CAGR through 2026.

2023 Q1 Presentation

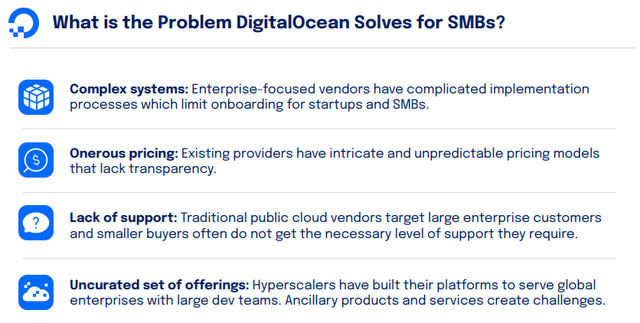

DOCN is a much smaller operator than the mega-cap tech titans, but it believes that it has found a niche offering a simpler and cheaper solution for small and medium-sized businesses, or SMBs.

2023 Q1 Presentation

That said, one must wonder if the increased enthusiasm in AI may pose a threat to DOCN, as its competitors undoubtedly are more advanced in that area. Management stated that they “have businesses running AI based models and businesses on our platform today and they’ve been doing it for many years” but I am of the view that AI may be a critical differentiating offering for cloud computing providers moving forward. Subsequent to quarter-end, DOCN announced that it was acquiring privately-held Paperspace for $111 million in cash “to boost its artificial intelligence offerings.” It is possible that this acquisition can help address any AI-related competitive threats, but the true benefits of the acquisition remain to be seen. In the meantime, this deal looks to further increase the net debt position.

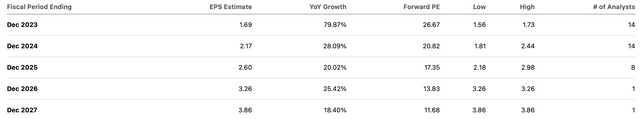

These competitive threats appear to be adequately priced into the stock price. DOCN was recently trading hands at under 6x sales in spite of consensus estimates for around 18% growth moving forward. I note that consensus estimates appear to show substantial doubt in management’s assertion that they can sustain around 30% growth over the long term.

Seeking Alpha

Due to the company’s strong push into profitability, the stock was recently trading hands at around 27x non-GAAP earnings.

Seeking Alpha

There aren’t many stocks capable of growing their top-line at an 18% rate while trading at just 27x non-GAAP earnings. One can make the argument that DOCN deserves to trade at a rich premium due to being a cloud computing provider, but it is hard to weigh that against competitive pressures. Based on 30% long term net margins, 18% growth, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see DOCN trading at around 8.1x sales, implying considerable upside. The competitive pressures may hold back valuation, but management’s commitment to improving margins and repurchasing stock should help to offset that.

What are the key risks? While the valuation appears somewhat “de-risked,” the main risk is that of irrelevance from competition. It is very difficult to determine if this is a secular growth story based on the long-term growth of cloud computing, or if DOCN will eventually see elevated churn and be unable to offset lost customers with growth. DOCN appears to have boosted its growth rates with M&A in the past – given the net leverage balance sheet and higher interest rate environment, I find it unlikely that the company can be as aggressive on the M&A front moving forward. It is possible that growth rates eventually crumble as management has to walk back previous projections.

Even before the growing interest in AI, the competitive threats were significant, but I am growing concerned that the tech titans may be able to steal market share due to superior AI offerings. Perhaps DOCN has been able to thrive in the past due to the simplicity and cheaper offerings – but it is possible that it is unable to do so in the future if customers are unwilling to sacrifice on AI capabilities. Given the solid near term growth and aggressive share repurchase program, I continue to see the case for significant multiple expansion ahead – I reiterate my buy rating for DigitalOcean Holdings, Inc. stock.

Read the full article here