Gorilla Technology Stock Analysis

Thesis

Gorilla Technology (NASDAQ:GRRR) has announced a new contract with the Egyptian government worth $270 million over 3 years, generating additional revenue of approximately $90 million per year. Given that the old guidance for 2023 was only around $65-70 million, this new contract has had a real impact on the valuation of the company and has led to a rapid rise today.

But whether this rise is just short-term hype or sustainable will be key to shareholders’ success, as Gorilla operates in the hyped Edge AI industry. I see Gorilla as a high-risk play with the potential for high rewards in the future, but let’s take a closer look at this company in the next few chapters.

Gorilla Technology – An Analysis

Gorilla Technology is an AI-based IoT company specializing in cybersecurity, video intelligence and Edge AI. They went public in the summer of 2022 and merged with Global SPAC Partners for a Nasdaq listing. In 2022, they are also pivoting their business model and have started to focus more on larger, long-term opportunities and recurring revenue streams. This led to a significant drop in revenue from $42m in 2021 to $22m in 2022. However, they still guided to $65m to $70m in revenues for 2023, which was a forward EV/Sales of around 2x. $65m in revenues on a market cap of $140m at the time.

This 2x multiple would have made them slightly undervalued at the time, as the sector median is slightly higher. However, things have changed drastically due to the new government contract and $65m + $90m would give $155m in revenues whereas a 2x multiple would give them a market cap of around $310m if the same multiple were to be applied.

With the strong rally in the shares likely to have priced this in by the end of the day, the question remains whether they have further growth opportunities ahead.

Growth Opportunities

Edge AI is likely to be one of the most in-demand technologies over the next few years because it is faster, more cost-effective and, most importantly, has more real-time applications than cloud computing. The technology also provides greater privacy and is less likely to cause network problems as it works without a connection.

Investor Presentation Gorilla

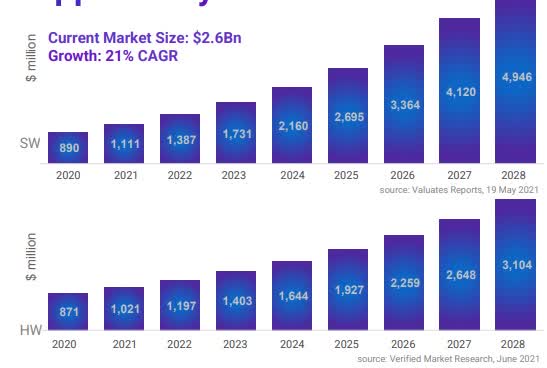

Gorilla itself sees a market opportunity of over $8bn, with a CAGR of 21% going forward. They intend to achieve this through organic growth and M&A activity. Last month, for example, they bought Bacom, a Thailand-based smart infrastructure solution that they believe can grow at a CAGR of 50% over the next three years.

Investor Presentation Gorilla

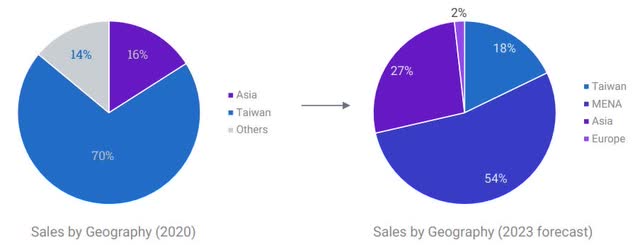

They also plan to expand globally and hope to create synergies within regions as they scale their operations. Brand awareness and building a sales team is one of their top priorities at the moment. As most of their business has been in Taiwan and Asia, they have a lot of opportunity to gain market share in Europe to fund their growth for the next few years and, of course, the opportunities that still remain in Asia.

It will be interesting to see the first earnings report with figures including the Egyptian contract, and more generally the development of Gorilla since the change in strategy. In their most recent earnings report, they had a gross profit margin of only 37%, well below the industry median of 48% and well below the top players they compete with. And as they aim to be a leader in the cybersecurity market, they need to compete with the best, and their competition is currently one of the strongest in the world.

In the Edge AI cybersecurity market, they compete with C3.ai (AI), Palantir (PLTR) and CrowdStrike (CRWD), and in the Edge AI data analytics market, they are joined by Cloudflare (NET). That’s a hell of a lot of competition.

GRRR’s Balance Sheet

The company maintains $23 million in cash and $6.9 million in ST investments versus $8.3 million in LT debt and $23.9 million in total debt. Furthermore, the net loss of $14.6m for 2022 is influenced by the one-off costs associated with the IPO and SPAC merger, and at the moment it looks like the company could be profitable in 2025 or even late 2024.

As a shareholder, if they need more capital in the meantime, it would be preferable for them to take on debt rather than dilute shareholders by selling shares, but depending on the next set of results, they may not need new capital until they are profitable.

Conclusion

Gorilla is a very exciting company in a fast-growing market that is expected to grow at a strong double-digit rate over the next few years. However, their sales team will be the key factor as it will depend on how many new contracts they can sign.

But with insider ownership very high at 33%, I believe the management team is in the same boat as the shareholders and will probably try to do everything to make this company successful, as they also stand to benefit very much from it.

As there are currently no analysts covering this company, this is a very interesting opportunity for individual investors to gain an edge as the small market cap and no coverage could be a perfect situation.

Any new contract is likely to lead to a strong rise in the share price, as it did today, and depending on how this company develops, I can also see it becoming a takeover candidate. In addition, this industry and its products offer the potential for high barriers to entry once they become mission-critical to their customers and switching costs are high. All in all, this is a very interesting company for the long term in my view.

Read the full article here