Artificial intelligence tools and many years of expertise in the media industry will most likely help Gannett Co., Inc. (NYSE:GCI) to offer beneficial digital tools to clients. The total amount of debt is large, but the company is making relevant efforts to lower the net debt/EBITDA levels including the recent repurchase of debt. Risks from failed restructuring initiatives, interest rate increases, or failed introduction of products are not small, however, I think that the stock could be more expensive.

Gannett

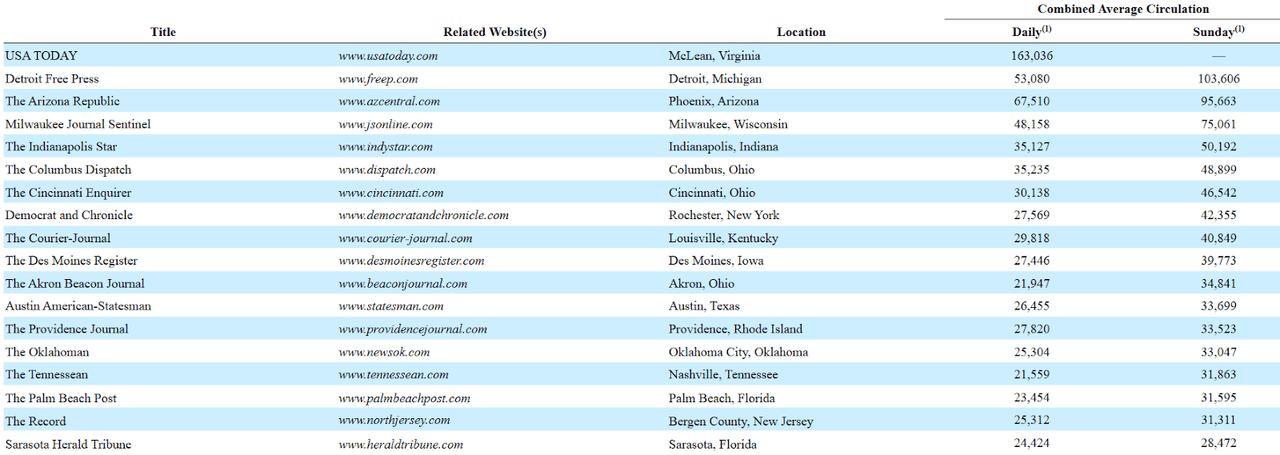

Gannett is a company dedicated to digital marketing and business scale solutions, offering a broad platform of media resources with integrated data and data analytics. The company has assets in the United States, and is spanning a national network with regional agencies in 43 states, through the USA TODAY NETWORK Ventures. In addition, it has assets in the United Kingdom and a digital base platform that serves to provide service to small and medium-sized businesses internationally. The most remarkable publications are shown in the table below.

Source: 10-k

Operations are divided into two business segments: Gannett Media and Digital Marketing Solutions. The first of these segments covers domestic operations in the United States and those in the United Kingdom through Newsquest. In addition to print editions, it has a large number of daily or weekly editions in the digital field.

The digital marketing solutions segment offers a cloud storage and data collection and analysis platform that serves its clients to generate outreach and dissemination campaigns. This platform includes tools such as the automation of marketing channels, artificial intelligence tools for presence in different channels, customized reports with the possibility of integrating them with other platforms, and simple configurations for its operation.

Although the services are offered internationally in Canada, the United Kingdom, New Zealand, and the United States, 94% of the revenue of this segment came, in 2022, from domestic activities, and only the remaining 6% of the revenue came from international activities. This is partly explained because the customer target is small or medium-sized businesses that want to generate marketing campaigns and positioning in regional markets rather than businesses on a global scale.

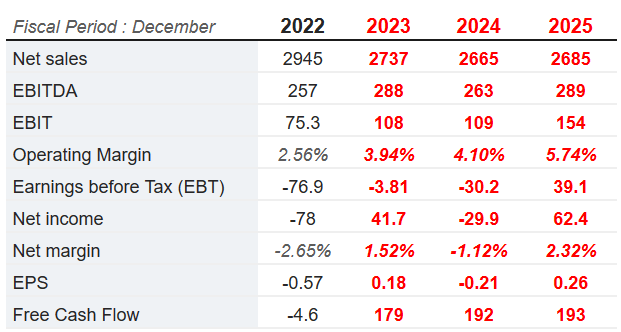

Beneficial Market Expectations

Market expectations include 2025 net sales worth $2.685 billion, with EBITDA of around $289 million, EBIT close to $154 million, and net income close to $62.4 million. 2025 Net margin would be close to 2.32%, which would be better than that in 2022 and 2023. Finally, 2024 free cash flow would stand at close to $192 million.

Source: Marketscreener.com

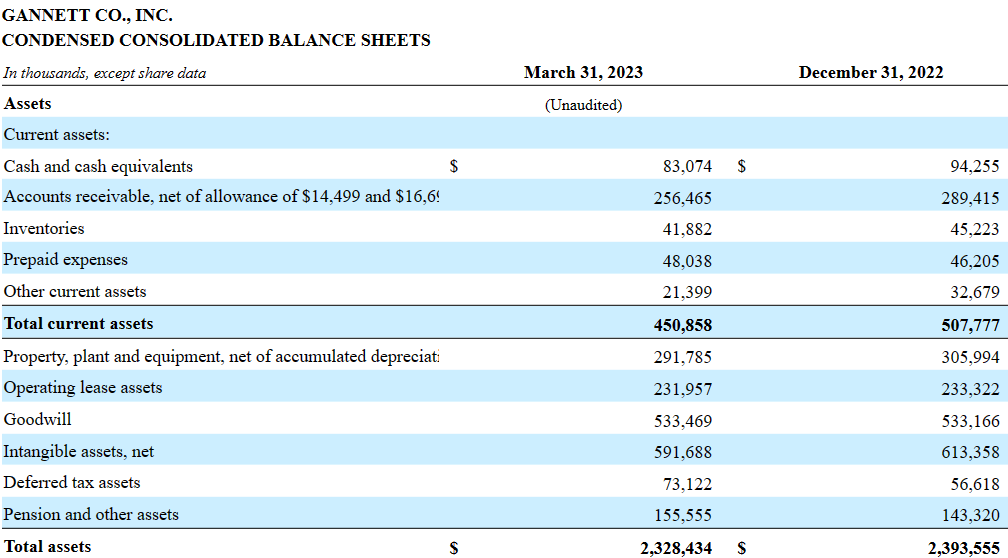

Balance Sheet: Investors Need To Monitor Carefully The Total Amount Of Debt

Investors may not really appreciate the balance sheet noted in the last quarterly report. With that, financial figures did not change quite a bit. Gannett reported less cash in hand, less accounts receivables, and less intangible assets than that in 2022. The total amount of assets also decreased.

More in particular, management reported cash and cash equivalents of close to $83 million, accounts receivable of $256 million, and inventories of about $41 million. Also, with prepaid expenses worth $48 million, total current assets stood at $450 million. I do not appreciate that the ratio of total current assets/current liabilities is below 1x, however I would not be afraid of a liquidity crisis. In my view, considering the amount of intangible assets, banks would be ready to offer short term debt if necessary.

Long term liabilities include property, plant, and equipment of close to $291 million, operating lease assets worth $231 million, goodwill of $533 million, and intangible assets close to $591 million. Besides, with pension and other assets worth $155 million, total assets stood at $2.328 billion.

Source: 10-Q

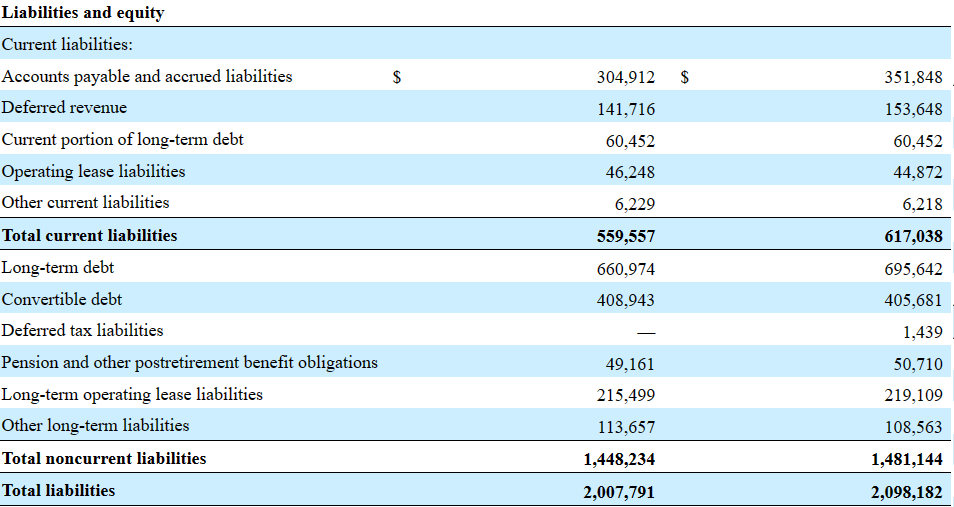

The list of liabilities includes accounts payable and accrued liabilities worth $304 million, deferred revenue close to $141 million, current portion of long-term debt of $60 million, and operating lease liabilities worth $46 million. Convertible debt stands at $408 million. With pension and other postretirement benefit obligations worth $49 million, total liabilities become $2.007 billion.

Source: 10-Q

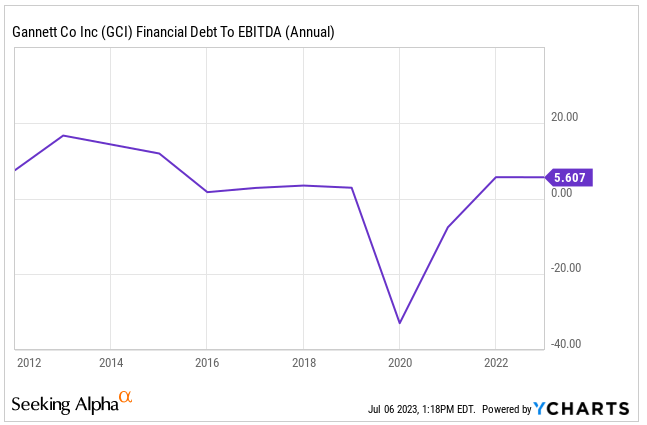

I would understand investors who dislike Gannett because of the total amount of debt and convertible debt. Financial debt to EBITDA stands at about more than 5.6x, which appears elevated even for the media sector. In my view, if management reduces its total amount of debt, more investors would be interested in Gannett. As a result, the EV/EBITDA ratio would most likely decrease.

Source: Ycharts

With regards to recent debt reduction, I would highlight the recent purchase of debt that occurred in 2023. In my view, further transactions that lead to lower debt levels will most likely interest investors, may lower the WACC, and improve the stock price.

In February 2023, we entered into a privately negotiated agreement with a holder of our $400 million aggregate principal amount of 6.00% first lien notes due November 1, 2026 (the “2026 Senior Notes”) to repurchase $6.1 million in aggregate principal amount of outstanding 2026 Senior Notes at a discount to par value. As a result of this transaction, we recognized a net gain on the early extinguishment of debt of approximately $0.9 million during the three months ended March 31, 2023, which included the write-off of unamortized original issue discount and deferred financing costs. Source: 10-Q

DCF Model

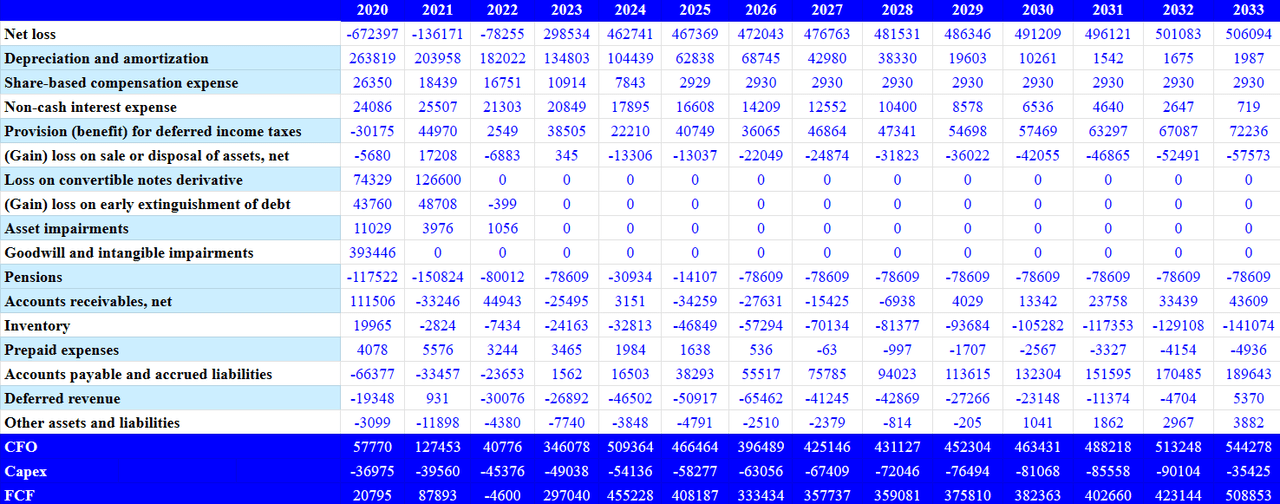

The current trends in media and news consumption mean that the revenue expectation of print editions is small, and the company’s forecast is to gradually migrate its efforts to the digital solutions segment year after year. Under my financial model, I assumed that the strategies in place from Gannett will most likely be successful. I did assume a small net income growth and stable FCF growth from now to 2032.

I assumed that Gannett would most likely achieve the growth of the digital segment, through the increase in subscriptions and the offer of marketing services. Besides, I believe that successful optimization of the company’s traditional business through advertising in print editions and prioritization of investments in inorganic growth and not in the acquisition strategies could enhance revenue growth. I believe that with more than 100 years in the media industry, the company has accumulated know-how to create new newspapers in-house.

In my view, the unified solution offered to clients is smart, and will most likely successfully retain the attention of advertisers. If Gannett successfully invests in digital experience and efficiency, I would be expecting inorganic growth and FCF margin increase.

SMBs are facing a more complex marketing environment and need to create digital presence to capture audience online. Advertisers are increasingly looking for more effective ways to analyze their return on marketing investments and they are seeking solutions that offer greater attribution. We offer a broad suite of digital marketing services products that offer a single, unified solution to meet their digital marketing needs. Source: 10-Q

Under my financial model, I also assumed that the restructuring programs that Gannett is currently conducting and the sale of real estate and other assets would not damage the company.

Over the past several years, the Company has engaged in a series of individual restructuring programs, designed primarily to right-size the Company’s employee base, consolidate facilities and improve operations, including those of acquired entities. Source: 10-Q

For the three months ended March 31, 2022, we recognized a gain on the sale of assets of $2.8 million, primarily related to sales of real estate, partially offset by losses on the sales of non-core products which were divested at Gannett Media. Source: 10-Q

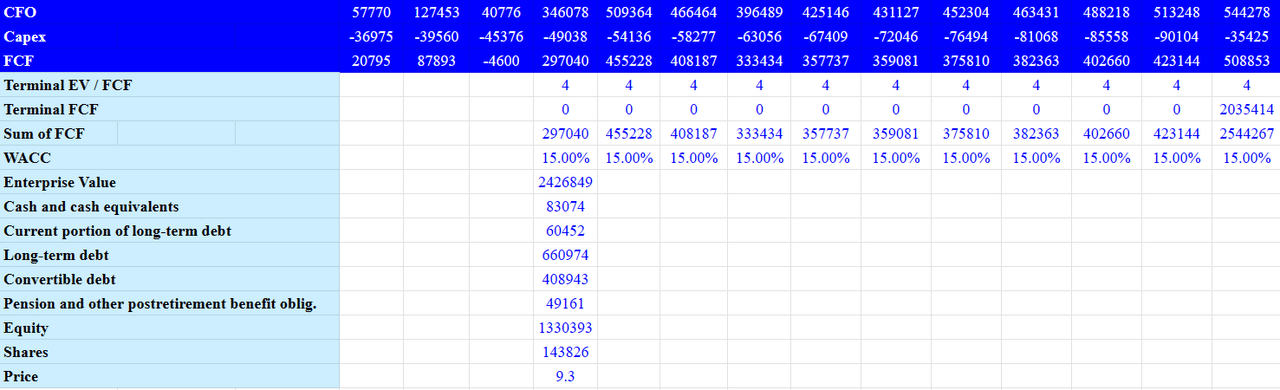

My financial model includes 2033 net income close to $506 million, 2033 depreciation and amortization of $1 million, and 2033 share-based compensation expense worth $2 million, in addition to changes in pension obligations of about -$79 million. I also include changes in accounts receivables of about $43 million, changes in inventories of -$142 million, changes in prepaid expenses of close to -$5 million, and changes in accounts payable and accrued liabilities worth $189 million. Finally, I obtained 2033 CFO of close to $544 million, and with 2033 capex of -$36 million, 2033 FCF would be close to $508 million.

Source: My Financial Model

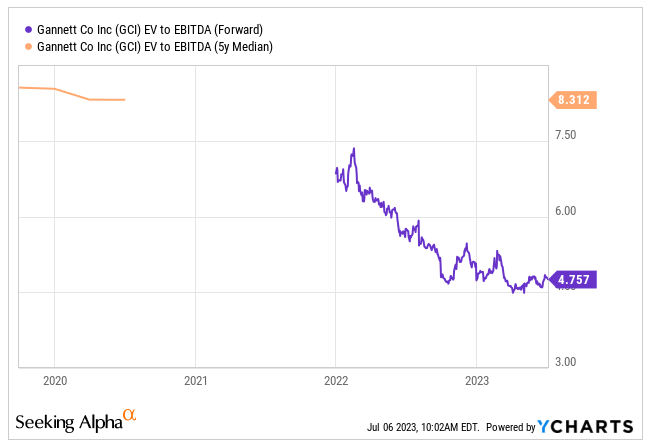

If we include a terminal EV/FCF of 4x and a WACC of 15%, we would obtain an enterprise value of close to $2.426 billion. Note that the EV/EBITDA 5 Years median stands at close to 8x, and the current EV/EBITDA is close to 4.7x. With these figures in mind, I believe that my EV/FCF multiple appears conservative.

The 2027 Notes and the 2026 Senior Notes include effective tax of close to 7.3%-10.5%. I believe that my discount of close to 15% is also very conservative.

The unamortized original issue discount and deferred financing costs will be amortized over the remaining contractual life of the 2026 Senior Notes. The effective interest rate on the 2026 Senior Notes was 7.3% as of December 31, 2022. Source: 10-k

The unamortized original issue discount and deferred financing costs will be amortized over the remaining contractual life of the 2027 Notes. The effective interest rate on the liability component of the 2027 Notes was 10.5% as of both December 31, 2022 and December 31, 2021. Source: 10-k

Source: Ycharts

Now, if we add cash and cash equivalents of about $83 million, and subtract the current portion of long-term debt worth $60 million, long-term debt close to $660 million, convertible debt of $408 million, and pension obligations of $49 million, the implied equity would be $1.33 billion, and the fair price would be $9 per share.

Source: My Financial Model

A Lot Of Competition And Low Barriers To Enter The Market

The company’s traditional segment competes with other print publishing companies as well as consumer attention in digital media. The news delivery environment is varied, and includes different arrival channels such as emails, radio, television, regional and local media, and very recent information trends such as social networks. In this sense, the barriers to entry are very few, and the initial capital to do so may be low, generating great diversification in information providers as well as the paths chosen by consumers. Gannett hopes to sustain its historic position by adapting the way it produces news and expanding business channels and partnerships with other media companies.

When it comes to the market for digital solutions for regional advertising, competition is not only high but also highly fragmented. The company competes with a large number of competitors offering similar services at lower cost. In addition, some of the companies through which Gannett offers its marketing services, such as Google (GOOG) or Microsoft (MSFT), also offer the same services through their own distribution channels.

Risks

Much of the future success for this company depends on the ability to carry out its current strategy, moving the percentage of its revenues to the segment of digital solutions, and optimizing the useful life of print editions. Starting from this point, we can name some risk factors that accompany the company’s activities.

In the first place, the total amount of debt is not small, which may lead to limitations in access to credit lines. Besides, an eventual increase in interest rates could also bring significant complications. If management cannot find sufficient debt investors to refinance its debt, or the terms obtained are not beneficial, I would expect a decline in the net income. As a result, investors may leave Gannett, which may push the stock price down.

We can also add the volatility of the economy in general and of the United States in particular, where a large percentage of the company’s annual revenue currently comes from. In my experience, advertising expenses are drastically reduced during periods of recession. If revenue from advertisers declines, I would be expecting a decline in revenue growth and stock price.

Besides, changes in the way news is consumed, the useful life of the printed editions of newspapers, or regulatory changes with respect to data regulations may also affect the business of Gannett. For instance, if regulators decide to change the way cookies are stored or managed, or data privacy becomes more strict, management may have to make more investments, which may lower the free cash flow.

In the last quarterly report, Gannett noted that inflation does have a negative impact on the cost structure. Even taking into account that the company expects that inflation may lower from 2022, I still believe that management could suffer from further inflationary pressures.

Inflationary prices across a number of categories such as labor, fuel, delivery costs, newsprint, ink, and printing plates have had and are expected to continue to have a negative impact on our overall cost structure. In the short term, we believe the impact of inflationary pressure peaked in 2022. Source: 10-Q

Conclusion

Equipped with artificial intelligence tools and having accumulated a significant amount of expertise through many years in the industry, Gannett will most likely be successful in offering its digital platform to clients. I dislike the total amount of debt, however, the recent repurchase of debt indicates that Gannett is making efforts to lower its net debt/EBITDA levels. Even taking into account risks from failed restructuring efforts, failed acquisition integration, or failed sale of assets, I think that the stock could be trading at more than the current price mark.

Read the full article here