Famous investor Peter Lynch said in the 90s that investors should look for great businesses in boring industries. Trucking certainly fits this description and Old Dominion Freight Line (NASDAQ:ODFL) certainly is a great business. The company has outperformed all indices over the last decades with steady execution against its goals. Let’s look what made the company a ten bagger in the last decade and see if it can continue to outperform.

What does ODFL do?

ODFL does less-than-truckload (“LTL”) carrier services. LTL is in between full truckloads and single parcels. Everything above four pallets. ODFL has invested a lot into its service network over the last decade, investments that most of its competitors did not do. In logistics and distribution the density of the network matters a lot. This can also be observed in recent activities from Amazon (AMZN) and Ashtead Group (OTCPK:ASHTF). Amazon has been switching its US logistics network from a national delivery network to a regional network. Here is a quote from Amazon’s last earnings call about the benefits of a denser delivery network:

It means we’ve created 8 interconnected regions in geographic areas with each of these regions having broad relevant selection to operate in a largely self-sufficient way while still being able to ship nationally when necessary. We just recently completed this rollout and are quite bullish on the early results. Not surprisingly, shorter travel distances means lower cost to serve and customers getting their orders faster.

Andy Jassy, Amazon CEO, Earnings Call Q1 23

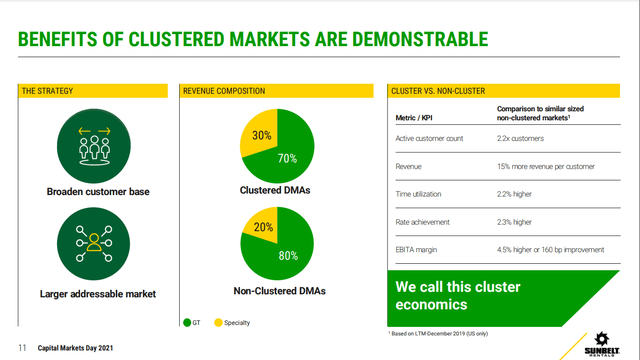

Ashtead is investing in its clustering approach, where more locations are opened closer to each other in strategically important areas. This improves its ability to serve its customer and generates more business. Below you can see a slide from Ashtead’s Capital Markets Day showing the benefits of clustering locations. Customer count, Revenue per customer, Time utilization and margins are all benefiting from it.

Benefits of clustering service centers (Ashtead CMD)

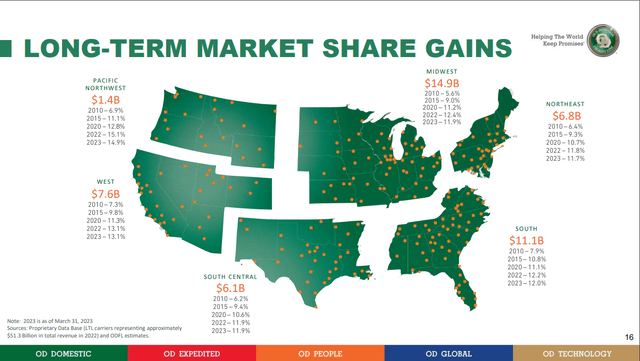

A similar situation can be observed with Old Dominion. Over the last decade, the company broadened its footprint over the US and has benefited greatly by gaining large market shares in each region.

ODFL long-term market share gains (ODFL Investor Presentation)

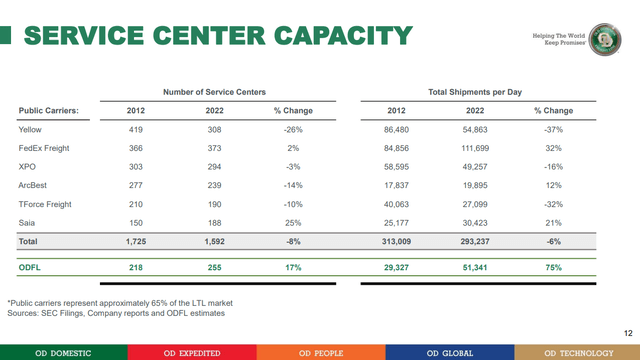

The company shared a comparison between its expansion over the last decade compared to some of its public competitors like FedEx (FDX), Yellow Corporation (YELL) or XPO (XPO). We can see that the competition saw their service center count decline by 8%, while ODFL grew it by 17%. Note that the companies shown here represent only 65% of the LTL market and that other private competitors exist. Saia (SAIA) is an outlier, seeing strong growth of 25% over the same period. On total shipments per day, we see a similar picture: The competition saw a decline of 6% over the last decade, while ODFL grew 75%. Here we can see the large efficiency gains ODFL achieved per service center. Saia grew its number of service centers faster than ODFL, but total shipments grew a lot less as the company couldn’t increase the efficiency of its service centers. Some competitors like FedEx and ArcBest (ARCB) saw a nice increase in shipments per day even with stagnating or declining service center counts. The data clearly shows that ODFL is best in breed in these KPIs.

ODFL Service Center capacity (ODFL Investor Presentation)

ODFL is not cheap

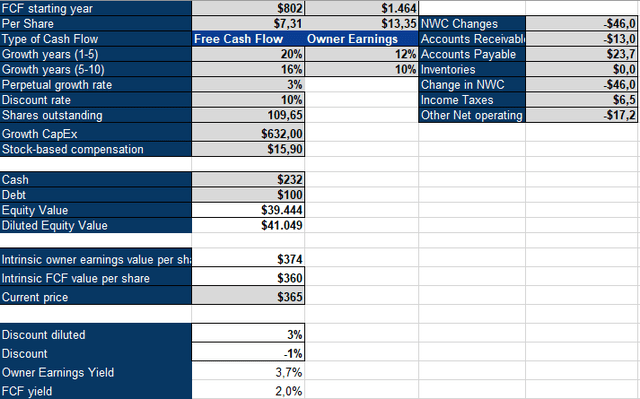

To value ODFL, I’m using an inverse DCF model. I use a 10% discount rate and a 3% perpetual growth rate; I also calculate Owner Earnings besides normal Free cash flows. I believe that Owner Earnings are a better representation of the cash flows to owners than normal free cash flow, which several factors can easily distort:

- Stock-based compensation is paid out in shares and replaces cash expenses, but it is a cost to shareholders.

- Often not all of the CapEx spend is going towards maintaining the business, but rather to grow it. These investments could be cut, returned to owners and thus added back to Owner Earnings.

- Changes in Net working capital can distort cash flows, so I adjust them out.

Owner Earnings = FCF – SBC + Growth Capex +/- NWC changes

ODFL spent $916 million on CapEx last year and $284 million in D&A. A rule of thumb to approximate maintenance CapEx is to use D&A to get to $623 million of growth CapEx. We can see a large difference between the Free Cash Flow and Owner Earnings of ODFL. Based on FCF alone ODFL looks very expensive, but if we account for its reinvestment into its network we get to a much more reasonable 12% required growth rate over the next five years, followed by 10% growth. Historically ODFL grew revenues by 12.8% over the last 20 years, while doubling gross margins and quadrupling profit margins. ODFL most likely won’t be able to match this performance going forward, but it should be able to continue outperforming the market. For now, I think the stock has room to cool off, with the macro being uncertain and with a tough period for trucking we could see a correction in the stock. While I’m not one to try and time the market, this isn’t the environment where I want to buy a somewhat cyclical company that ran up a lot 50% and is 17% above its 200-day SMA.

ODFL Inverse DCF model (Authors Model)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here