AbbVie Inc. (NYSE:ABBV) is one of those businesses where I expressed slightly different opinions in different articles over the years and while this might sound like a problem, it actually shouldn’t be one. A crucial part of analyzing a business and stock is to adapt to new developments and therefore conclusions about an investment might differ.

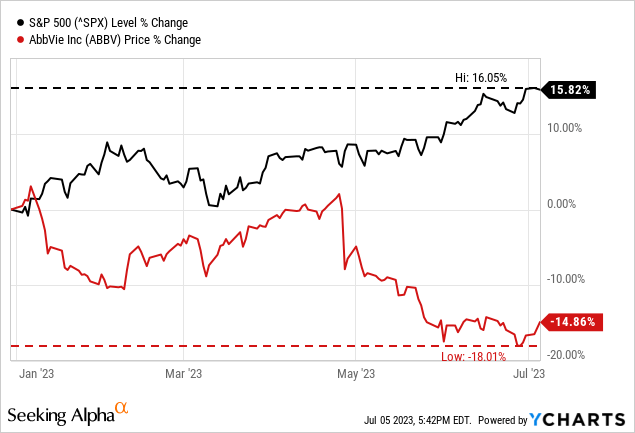

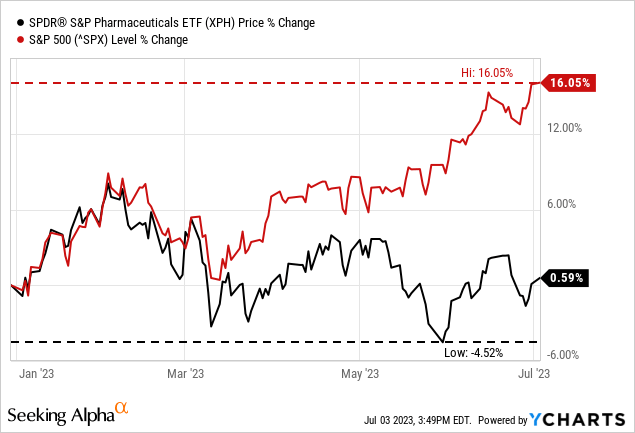

In my last article about AbbVie – published in March 2023 – I was bullish and called AbbVie a better investment than banks, which was the major news story at the time with Silicon Valley Bank collapsing (only four months later, this seems to be forgotten already – but it shouldn’t be). AbbVie might have been a better investment than many banks, but AbbVie clearly underperformed the S&P 500 (SPX) – while the index increased about 15%, AbbVie lost about 11% in value.

My thesis was that AbbVie is a great investment in times of distress – and despite any short-term stock price fluctuations, I still think the thesis is valid. But it seems like the stock market is not really expecting a recession and this might one of the reasons for the underperformance of recession-resilient businesses like AbbVie. The company is also seeing the negative effects of losing patent protection for Humira and, of course, the last quarterly results were also underwhelming.

Quarterly Results

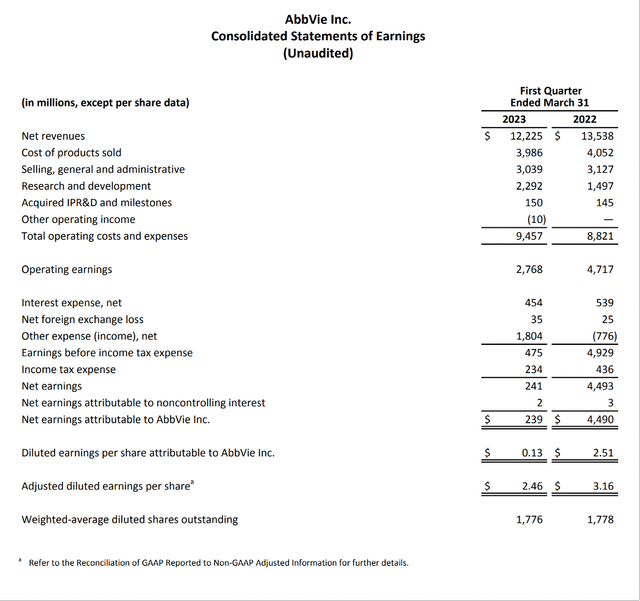

When looking at the last quarterly results, AbbVie disappointed its investors and analysts and missed on revenue as well as earnings per share estimates. But we must point out that the company missed estimates only slightly in both cases. Aside from missing estimates, net revenues also declined from $13,538 million in Q1/22 to $12,225 million in Q1/23 – resulting in 9.7% year-over-year decline. Operating earnings also declined 41.3% YoY – from $4,717 million in the same quarter last year to $2,768 million in Q1/23. And finally, diluted earnings per share declined from $2.51 in Q1/22 to $.013 in Q1/23 (on GAAP basis). When looking at adjusted diluted earnings per share, we still see a 22.2% year-over-year decline from $3.16 in Q1/22 to $2.46 in Q1/23.

AbbVie Q1/23 Earnings Release

The only bright spot in the first quarter results is the guidance for fiscal 2023, which was raised. Instead of a range from $10.62 to $11.02 in a previous guidance, adjusted diluted earnings per share are now estimated to be between $10.72 to $11.12 (but compared to $13.77 in adjusted diluted earnings per share in 2022, this is still a huge decline).

Humira Patent Cliff

One of the reasons for the disappointing first quarter results was the Humira patent cliff. In the first quarter, Humira reported $3,541 million in sales, which is a decline of 25.2 % year-over-year. Nevertheless, Humira is still responsible for a huge part of the company’s sales – in the first quarter Humira was responsible for 29% of the company’s total sales.

In the last few months, more and more biosimilars were launched. The first launched biosimilar was Amjevita by Amgen Inc. (AMGN) in January 2023 and Novartis’ (NVS) Sandos division has begun selling biosimilar versions of Humira and they are selling for about 80% to 85% lower prices than AbbVie, which is leading to extreme price pressure. Fresenius Kabi – a subdivision of Fresenius SE (OTCPK:FSNUF) – launched its biosimilar adalimumab Idacio.

In fiscal 2022, AbbVie still generated $21.2 billion in sales and there is still a huge downside risk in the coming quarters as AbbVie could lose a lot of revenue due to biosimilars. However, AbbVie is also able to compensate revenue losses by Skyrizi and Rinvoq.

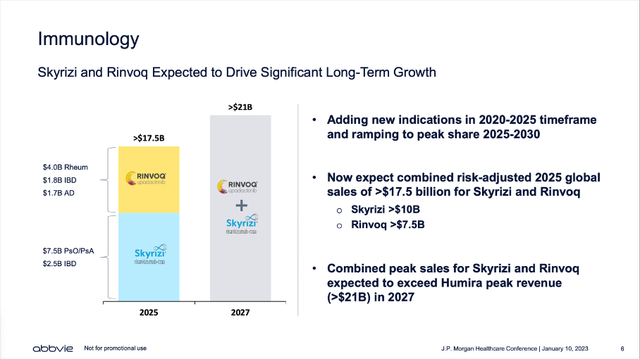

AbbVie JPM Healthcare Conference Presentation

In the first quarter of fiscal 2023, Skyrizi generated $1,360 million in sales and could increase its sales 44.7% year-over-year and Rinvoq generated $686 million in sales – resulting in 47.5% year-over-year growth. And until 2025, AbbVie is expecting sales from those two to reach at least $17.5 billion.

Big Pharma Underperformance

And not only AbbVie underperformed in the last few months, but it also seems like the entire “Big Pharma” sector is underperforming. In articles, the often-cited reasons are a major wave of patent expiries, which are expected to occur in 2025-2030. A good overview of different pharmaceutical company and which products will lose patent protection in the next few years can be found here. Additionally, regulatory woes are also cited as reason for the underperformance of many pharmaceutical companies.

And when looking at the performance of the pharmaceutical sector since the beginning of 2023 – compared to the S&P 500 – we see both performing more or less in line until March 2023. But in the following months the S&P 500 started its uptrend while the pharmaceutical sector rather stagnated.

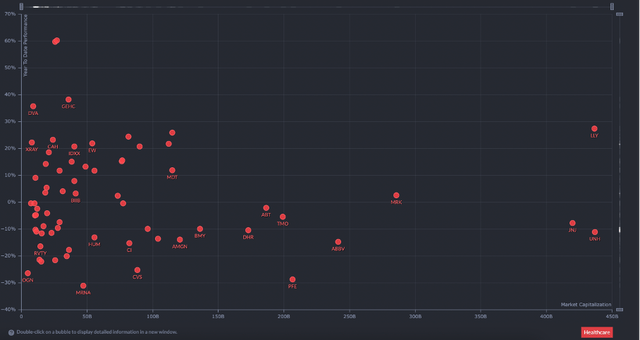

And of course, when looking at the different companies in the sector, we can also find examples of companies performing great – and also outperforming the S&P 500. But when looking at pharmaceutical businesses – and ignoring medical devices companies like Edward Lifesciences or Medtronic – the number of great performing Big Pharma companies is limited. Only Eli Lilly (LLY) is worth mentioning.

Pharmaceutical Sector Year-to-date Performance (Finviz)

But overall, the sector can be seen as rather recession-resilient and with a potential recession on the horizon, this might be a sector to invest in as we can expect a solid performance even during the next few years.

Dividend

In the last few years, we could point to many stocks and call them interesting for the dividend yield as a dividend yield of 2% or 3% already made a stock interesting in times when interest rates were close to zero. But with a treasury yield of 5% for the U.S. 2-year treasury notes, many dividend stocks don’t seem interesting anymore.

AbbVie is currently paying a quarterly dividend of $1.48 resulting an annual dividend of $5.92 and a dividend yield of 4.3% right now. When comparing this dividend yield to the 2-year treasury, one might vote against AbbVie as an investment. But we should not forget that AbbVie is also increasing its dividend annually (with a CAGR of 14.53% in the last five years) and we might also profit from the stock increasing in value.

Intrinsic Value Calculation

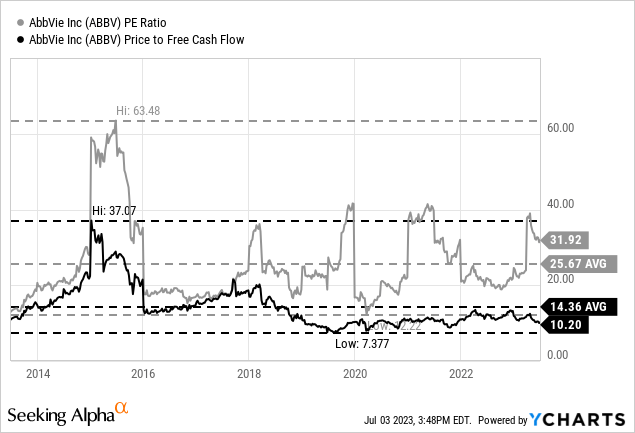

In my last article I already saw AbbVie as undervalued and as a buy. And in the meantime, AbbVie got even cheaper. Right now, the stock is trading for 32 times earnings, which is anything but cheap. It is also above the average P/E ratio of the last ten years (which was 25.67). But instead of the P/E ratio, we can rather focus on the price-free-cash-flow ratio which is 10.20 and not only below the 10-year average of 14.36, but a really low P/FCF ratio for a high-quality business.

Of course, the P/FCF ratio might be so low as analysts and investors are already expecting lower free cash flows in the quarters to come. But when trying to determine an intrinsic value by using a discount cash flow calculation, we must also come to the conclusion that AbbVie is undervalued.

As basis for our calculation, we can take the free cash flow of the last four quarters (which was $23,520 million) and we are also calculating with 1,774 million outstanding shares and a discount rate of 10% (as always). To be fairly valued, AbbVie only has to keep its current free cash flow stable and there is no growth priced into the stock right now. While I expect lower free cash flow in the coming quarters, I think AbbVie will certainly be able to generate a similar free cash flow in the last ten years on average as in the last four quarters.

Conclusion

In my last article, I already saw AbbVie as a “Buy”. And with the stock price even lower than in March 2023, I still see AbbVie as a “Buy”. AbbVie is not only a “Buy” due to the lower stock price, but the company remains a recession-resilient pick and I still expect the global economy to enter a recession in the coming quarters. The dividend yield of 4.3% is also tempting in my opinion and the company is still able to generate an impressive free cash flow – even if free cash flow might be lower in the coming quarters due to the patent loss of Humira.

Read the full article here