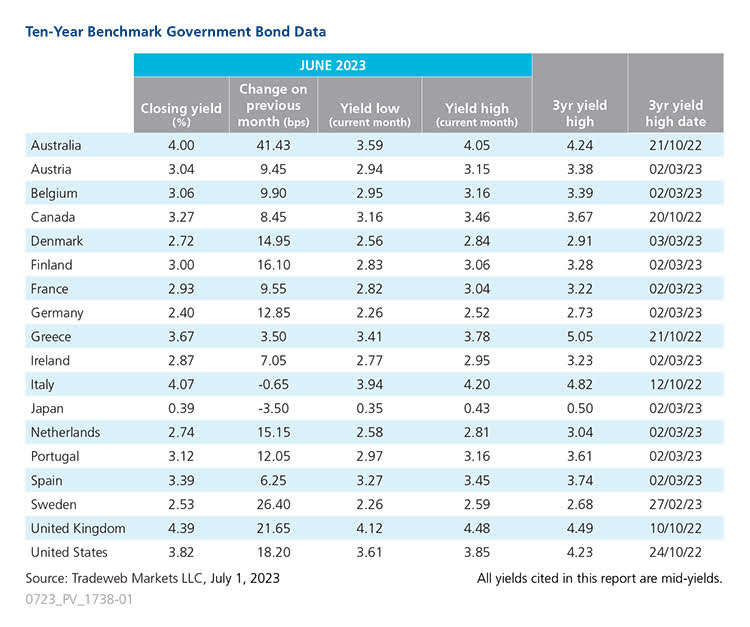

Most major government bond markets experienced sell-offs for the second straight month in June, with yields on 10-year benchmark bonds from the UK to Germany to the U.S. to Australia logging double-digit basis point increases over the course of the month.

Starting with the U.S., 10-year Treasury yields increased by 18 basis points to finish the month at 3.82%. The Federal Reserve left the federal funds rate unchanged at 5-5.25% at its June meeting. However, at the end of the month, Chair Jerome Powell said it was likely there would be at least two more rate increases this year.

The latest Consumer Price Index and Producer Price Index showed inflationary pressures abating, as did the Personal Consumption Expenditures Price Index, the Fed’s preferred measure, with the core measure coming in at 4.6% year-over-year, lower than anticipated. GDP for the first quarter of 2023 was revised up to 2%.

Across the Atlantic, the UK 10-year Gilt yield rose by more than 21 basis points to end the month at 4.39%, well above other benchmark yields. The Bank of England (BoE) raised its bank rate by 50 basis points to 5% in a 7-2 decision, citing ongoing and sticky inflationary pressures.

The move came after data showed UK inflation rising 8.7% year-over-year in May, with core inflation increasing by 7.1%. Governor Andrew Bailey suggested rates may stay higher for longer given current inflationary trends. According to data from the Office for National Statistics, monthly real gross GDP is estimated to have grown by 0.2% in April 2023, after a fall of 0.3% in March 2023.

In the Eurozone, the largest moves were seen in the 10-year mid-yields for Finland (up 16 basis points to 3%) and the Netherlands (up 15 basis points to 2.74%). Germany’s 10-year Bund yield rose by nearly 13 basis points to close June at 2.4%.

Only the Italian 10-year bond yield fell, declining by less than a basis point to 4.07%. Like the BoE, the European Central Bank (ECB) raised rates albeit by 25 basis points, bringing the deposit facility rate to 3.5%.

ECB President Christine Lagarde said it was likely the central bank would hike rates again in July. Data from Eurostat showed Euro area annual inflation is expected to be 5.5% in June 2023, down from 6.1% in May 2023.

Meanwhile, the yield on Sweden’s 10-year benchmark note also saw a significant increase during June, climbing over 26 basis points to finish at 2.53%. The country’s central bank, Riksbank, raised the policy rate by 25 basis points to 3.75%, and decided to increase sales of government bonds.

This is to ensure that inflation continues to fall and stabilises around the target of 2% within a reasonable time. Governor Erik Thedeen said there may be at least one more hike this year.

However, June’s biggest mover was the Australian 10-year government bond yield, which ended the month 41 basis points higher at 4% The Reserve Bank of Australia unexpectedly raised its cash rate by 25 basis points to 4.1% on June 6.

Deputy Governor Michele Bullock said the country’s jobless rate will need to rise to 4.5% and the economy would need to grow at a “below-trend pace” for inflation to return to the central bank’s target of 2-3% over time.

Elsewhere in the Asia-Pacific region, the Japanese 10-year bond mid-yield fell by 3.5 basis points to 0.39%, as the Bank of Japan left rates and its yield curve control policy unchanged yet again.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here