Shopify’s (NYSE:SHOP) stock has moved higher in recent months on the back of stable growth and the abandonment of its capital-intensive logistics initiative. The company also recently announced a 20% headcount reduction, which will help to control operating expenses. While the logistics rollout was a near term drag on cash flows, Shopify’s long-term potential is probably capped without it. The current share price does not reflect Shopify’s lower growth future or the fact that growth is being driven by inferior businesses. Shopify still has a number of value levers it can pull (additional products, pricing, financial leverage) but the risk-return ratio of the stock is far less favorable than it has been in the past.

Market

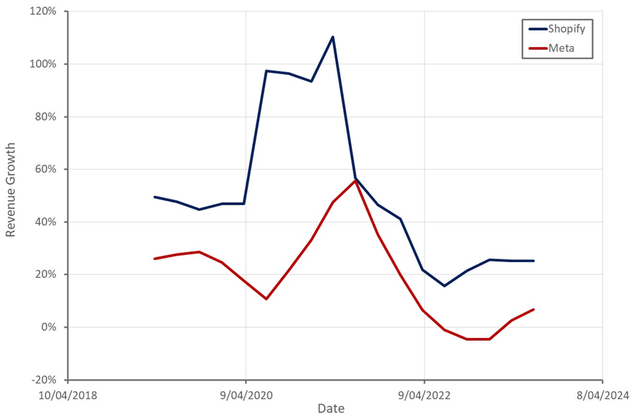

Shopify has had a difficult 18 months, but most of this can be attributed to a post-pandemic hangover combined with the impact of Apple’s (AAPL) ATT initiative. Within ecommerce, Shopify continues to gain share and believes that its market share in the US is in excess of 10%.

Most of the temporary headwinds negatively impacting Shopify are now likely largely over, meaning that the company’s current performance is reflective of what investors should expect going forward. Shopify is lapping easier comparable periods and the adtech ecosystem appears to be adapting to a privacy focused internet.

Meta (META) is illustrative of how companies are adjusting to the changes brought about by ATT. Meta initially estimated that ATT could reduce its revenue by 10 billion USD in 2022, and if anything, this estimate may have ended up being low. Studies suggest that a majority of iPhone users have opted-out of IDFA, negatively impacting both targeting and attribution for advertisers. As a result, the sales of SMBs and in turn Shopify have also been reduced.

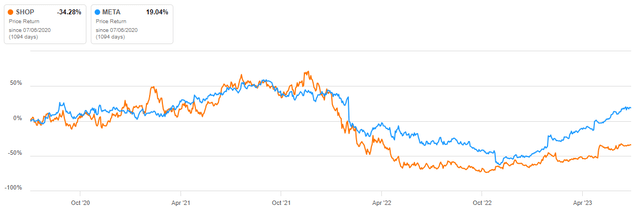

There is evidence that Meta’s advertising efficacy is beginning to recover though on the back of large investments in machine learning. For example, Meta highlighted rapidly improving ad monetization efficiency in the first quarter of 2023. With targeting and attribution apparently recovering, any headwinds to Shopify’s business should now largely be gone. The extent to which Shopify’s recent performance has been dictated by macro factors can readily be seen from its revenue growth and share price.

Figure 1: Shopify and Meta Revenue Growth (source: Created by author using data from company reports) Figure 2: Shopify and Meta Stock Performance (source: Seeking Alpha)

Shopify

After the abandonment of Shopify Fulfilment Network, Shopify now has 3 focus areas:

- Helping customers to scale

- Enabling merchants to expand globally

- Helping merchants to build consumer relationships

Shopify recently launched Commerce Components by Shopify, an enterprise retail solution. This allows retailers to choose the Shopify components that they want to utilize and integrate them with existing systems. This offering is targeted at larger organizations and supports Shopify’s growing enterprise business. Shopify also continues to build partnerships with system integrators to support enterprise adoption, signing agreements with IBM Consulting and Cognizant in the first quarter.

Approximately 15% of GMV was cross-border in the first quarter, with Shopify’s Markets and Markets Pro products gaining traction. Markets makes it easier for merchants to localize the buyer experience, including:

- Enabling sales in the local currency

- Enabling local payment options

- Collecting duties and taxes at checkout

Shopify also offers a translate and adapt app to reduce cross-border friction.

Point-of-Sale

Shopify continues to focus on its PoS solution as it pursues an omnichannel strategy. This initiative is performing well, with offline GMV increasing 31% YoY.

Intuit (INTU) recently made the decision to stop selling its QuickBooks desktop PoS product, likely for competitive reasons. This is a tailwind for Shopify as Intuit has chosen Shopify as its preferred partner for retailers needing a new PoS solution.

Shop App

The Shop App is a digital shopping assistant that offers an end-to-end commerce experience. Features include Shop Pay, Shop Pay Installments, real-time order tracking, delivery updates and product recommendations.

Shopify continues to update the Shop App, recently introducing an out-of-the-box mobile storefront solution for Merchants. Brands often benefit from having their own mobile app, but most do not have the resources to build and maintain one. The storefront product helps merchants overcome this and build stronger relationships with their customers.

Audiences

Audiences is another growing part of Shopify’s business that is strengthening the company’s competitive position. Audiences helps merchants to target high-intent customers with advertising, which improves conversion rates and return on ad spend.

Audiences provides a hashed list of high intent buyers for the products that merchants would like to market. Lists are developed from Shopify data using machine learning. These lists can be exported to digital advertising platforms like Facebook and Instagram, and helps to offset some of the loss of signal caused by Apple’s ATT initiative.

Audiences continues to drive paid advertising performance across Meta, Google (GOOG) and Pinterest (PINS) for Plus merchants. Shopify continues to iterate on Audiences and improve performance for merchants, with average return on ad spend on the platform nearly doubling.

Merchant adoption of Audiences is increasing, with Shopify believing it is now a key reason why merchants choose to upgrade to Plus. Audiences is currently monetized indirectly via Shopify Payments, but Shopify is likely to revisit monetization in the future.

Shopping Assistant

Shopify is also trying to capitalize on generative AI hype, launching an AI shopping assistant in March. The assistant helps shoppers to find relevant products using a natural language interface. The near-term impact of this is likely to be incremental, but it highlights Shopify’s ability to provide merchants with capabilities that would otherwise be out of reach.

Logistics

Shopify recently abandoned its fulfilment ambitions and is selling its logistics business to Flexport, including most of its SFN assets and Deliverr. Shopify will continue to offer the merchant facing SFN app though.

Shopify will receive a 13% equity interest in Flexport, which will take its total ownership stake up to a high-teens percentage, and Flexport will be Shopify’s preferred logistics partner. The sale was expected to happen towards the end of the second quarter, with the majority of the financial impact occurring in the second half of the year.

Shopify claims that this decision was taken because logistics infrastructure is necessary to support ecommerce but not a core activity for Shopify. The company was developing its own fulfilment network because it felt infrastructure was lacking and it was placed to address the problem because of its scale. Flexport had been a partner on this, and Shopify now feels that Flexport is better positioned to provide logistics infrastructure on its own.

It is hard not to feel that Shopify has abandoned logistics because if found it too difficult though. Shopify is a software company, meaning the pivot to a capital-intensive business requiring operational excellence was never going to be easy.

Financial Analysis

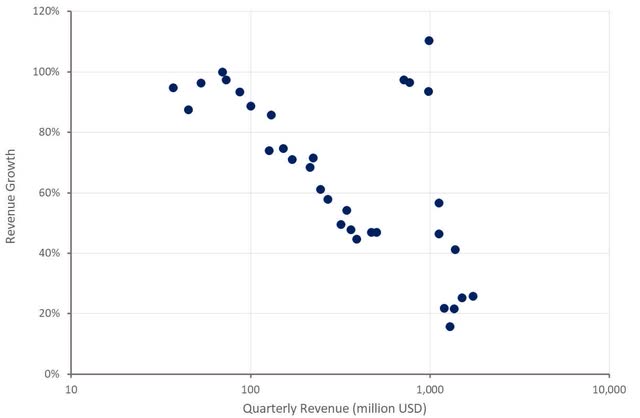

GMV in in the first quarter increased 15% YoY to roughly 50 billion USD. GMV growth was supported by resilient consumer spending, strength in Europe and growth in Shopify’s merchant base. Revenue grew 25% YoY driven by GMV, as well as payments penetration and Subscription Solutions. Shopify’s attach rate increased from 2.79% in Q1 2022 to 3.04% in Q1 2023. Pricing was not a material driver of growth though, with the full impact of recent price increases only expected to be seen later in the year. Shopify is beginning to see some benefit from the promotional trials it rolled out in October 2022 though. The initial cohorts are now converting to full-priced standard subscriptions, contributing to MRR growth. Revenue growth in the second quarter is expected to be similar to the first quarter.

Figure 3: Shopify Revenue Growth (source: Created by author using data from Shopify)

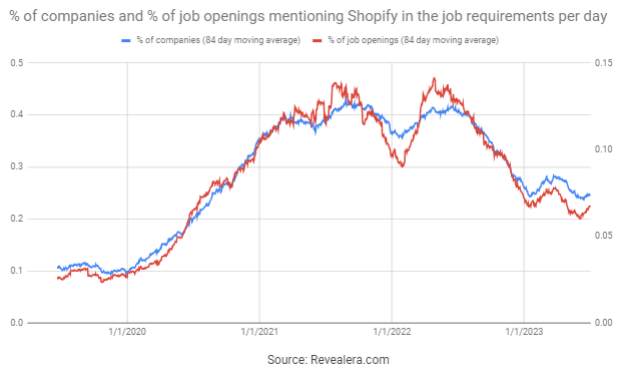

The number of job openings mentioning Shopify in the job requirements appears to have stabilized somewhat in 2023, although is down significantly from the peaks in 2021 and 2022. This could indicate that merchant demand is normalizing, which should be supportive of growth going forward.

Figure 4: Job Openings Mentioning Shopify in the Job Requirements (source: Revealera.com)

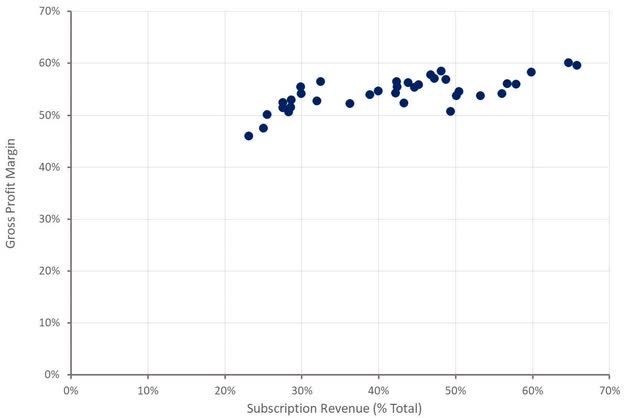

Shopify’s gross profit margins continue to deteriorate as the company grows, although the sale of its logistics business and price increases should be supportive of margins going forward. Subscription Solutions are a higher quality source of revenue than Merchant Solutions and as its contribution declines, so will gross profit margins.

Figure 5: Shopify Gross Profit Margins (source: Created by author using data from Shopify)

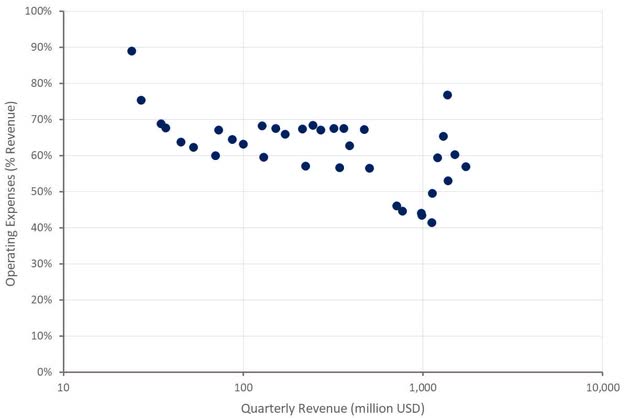

Shopify’s bottom line has also been pressured by elevated operating expenses. The company is hoping to address this by reducing its headcount by approximately 20%. This is expected to result in a 140-150 million USD expense though. In addition, Shopify expects a 1-1.5 billion USD impairment in relation to its logistics business.

Despite cost cutting efforts, investors shouldn’t expect a rapid return to pandemic-era operating profit margins. With gross profit margins hovering around 50%, Shopify will likely be doing well to bring operating profit margins back to the low single digit range in the short term.

Figure 6: Shopify Operating Expenses (source: Created by author using data from Shopify)

Valuation

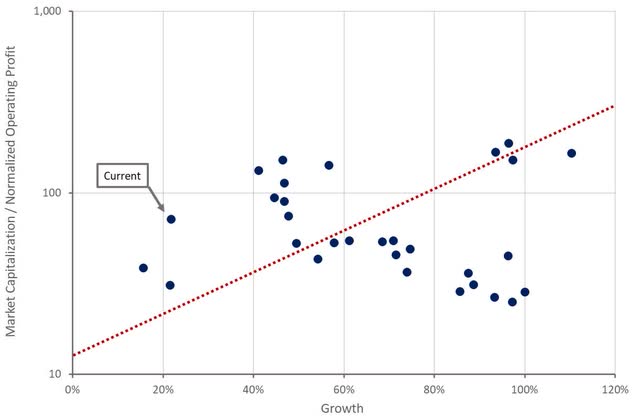

Shopify is a high-quality company that will likely continue to do well in the long run, but the stock is expensive given the company’s prospects. Shopify’s 40-50% growth days are behind it, and growth from lower quality revenue sources will likely continue to weigh on margins. In addition, the sale of its logistics business may reduce cash burn in the near term, but it also caps the company’s potential.

Shopify’s stock performed extremely well in the past because the stock price didn’t reflect the company’s potential. This situation has now reversed, with the valuation reflecting past performance rather than what Shopify is likely to do going forward.

Figure 7: Shopify Relative Valuation (source: Created by author using data from Shopify and Yahoo Finance)

Read the full article here