By James Smith, Developed Markets Economist

Some good news on inflation for once

If you’re looking for some good news on the UK inflation story, then on the face of it there’s plenty of it in the latest Decision Maker Panel from the Bank of England. This survey, which historically policymakers have paid close attention to, asks chief financial officers (CFOs) a variety of questions about their expectations. And for several months now, it has pointed to more muted price pressure from the corporate sector. Here are a few of the stand-out figures:

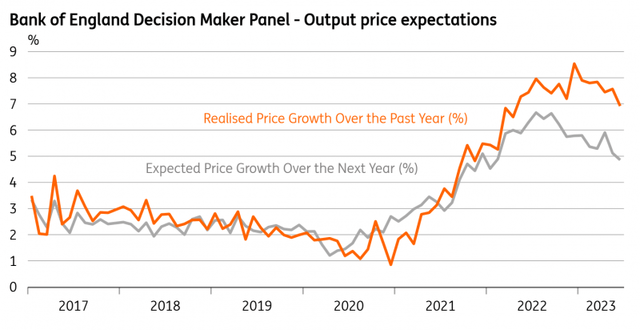

- Expected price growth over the next year is 4.9%, down from a peak of 6.6% a year ago (and 5.9% in April).

- Wage growth is seen at 5.3% over the next year, having peaked at 6.3% in December.

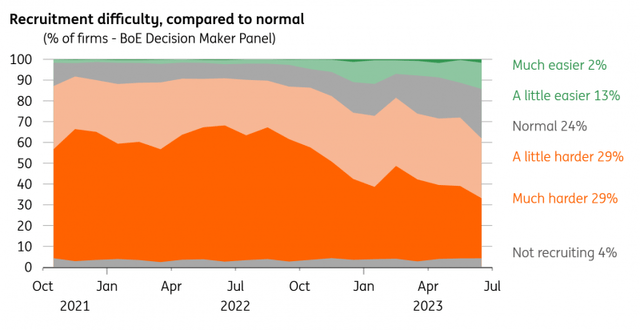

- The proportion of firms finding it “much harder” to recruit compared to normal is 29%, comfortably the lowest it has been since the question was introduced in October 2021. It was typically between 50-60% through much of 2021/22.

- One-year ahead CPI expectations are at 5.7%, down from a peak of 9.5% seen last September, though three-year expectations nudged up slightly.

All of this echoes what we’ve seen in some of the other leading indicators of inflation, including producer price inflation which has come down dramatically over recent months. The doves at the Bank of England would argue that all of this suggests inflation should come down dramatically later this year, and the recent stickiness is simply a longer-than-expected lag time from lower input price inflation.

Recruitment difficulties are easing

Bank of England Decision Maker Panel, Macrobond

The BoE is losing confidence in these surveys

But June’s decision to lift rates by 50 basis points, having been hiking more gradually over recent months, showed that the wider BoE committee is losing patience and confidence in these forward-looking measures. The hawks would point to the survey question on “price growth”, which shows firms consistently predicting inflation to be lower than what is actually realised, as the chart below demonstrates. The Bank has also produced interesting research showing that firms are resetting prices more regularly than in the past, which the hawks could argue shows that inflation is more ingrained than it once was.

The reality is that the Bank is likely to pay less attention than usual to these surveys, and we think the next few policy decisions will be guided by CPI inflation, and to some extent average earnings, and not a lot else. We’ll get fresh data on the latter next week, and it looks like regular pay growth (which excluded volatile bonuses) will stay either flat or a touch lower on a year-on-year basis. The key question is whether the recent re-acceleration in pay growth is largely a function of the higher National Living Wage, or whether it reflects renewed underlying momentum in wage setting.

Realised price growth has typically been higher than what firms had expected

Bank of England Decision Maker Panel

When it comes to CPI, we expect to see the headline rate dip to 8% in June’s numbers from 8.7% currently, and down again to 6.5-7% in July. But that’s mainly a function of lower electricity/gas prices and a reflection of the sharp rise in petrol prices we saw at the same time last year. We’d expect services inflation to notch slightly lower over the summer, but probably not enough to prompt another change in strategy among committee members.

We, therefore, expect a 25 basis point rate hike in August and another in September – and we certainly wouldn’t rule out more. But ultimately we think the surveys, including the Decision Maker Panel, do contain some useful signals. And by November, we think the committee will have more confidence that inflation is indeed easing, to enable it to pause its rate hike cycle.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation, or investment objectives. The information does not constitute an investment recommendation, and nor is it investment, legal, or tax advice, or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here