A few months ago, I wrote a cautious article on the Hoya Capital High Dividend Yield ETF (RIET). While RIET’s 10% distribution yield was attractive, I was concerned about the fund’s small size, limited operating history, and narrow focus on dividend yields.

For investors looking to gain REIT exposure, I believe the Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP) may be a better investment vehicle. It has close to $1 billion in net assets and has been in operation for over 2 decades. Its solid long-term performance gives me greater confidence that its 8.5% distribution yield is sustainable.

Fund Overview

The Cohen & Steers REIT & Preferred Income Fund is a closed end fund [CEF] that attempts to generate high current income from a portfolio of real estate equities and preferred securities. The fund has been in operation for over 20 years and has $1.37 billion in managed assets as of May 31, 2023 and charges a 1.78% net expense ratio.

The RNP fund employs leverage to enhance returns and as of May 31, 2023, the leverage ratio was 32.9%.

Portfolio Holdings

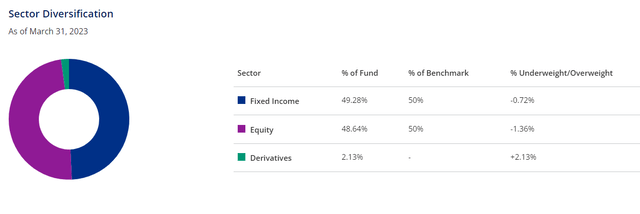

Figure 1 shows the asset class allocation of the RNP fund as of March 31, 2023. The fund is roughly split 50/50 between equity securities (primarily REITs) and fixed income securities (primarily preferred securities).

Figure 1 – RNP asset class allocation (cohenandsteers.com)

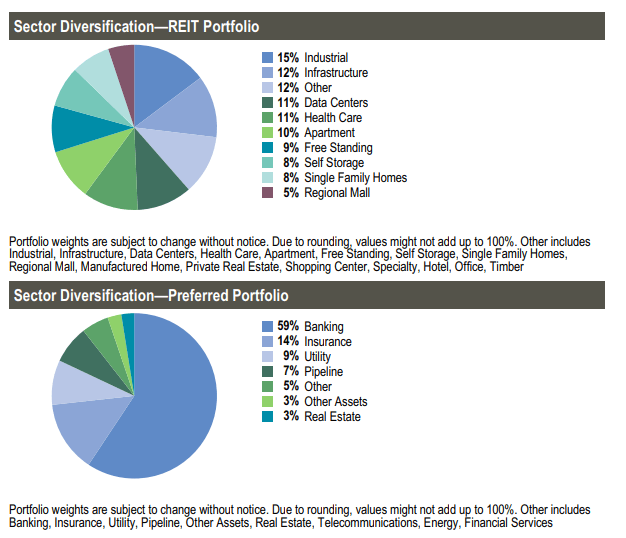

Figure 2 shows RNP’s sector allocation of the REIT and preferred share portfolios respectively to March 31, 2023. Within REITs, the largest sector exposures are to Industrials (15%), Infrastructure (12%), Data Centers (11%), Health Care (11%), and Apartments (10%). Within preferred shares, Banking is the largest sector exposure at 59%, followed by Insurance (14%) and Utility (9%).

Figure 2 – RNP sector allocation (RNP factsheet)

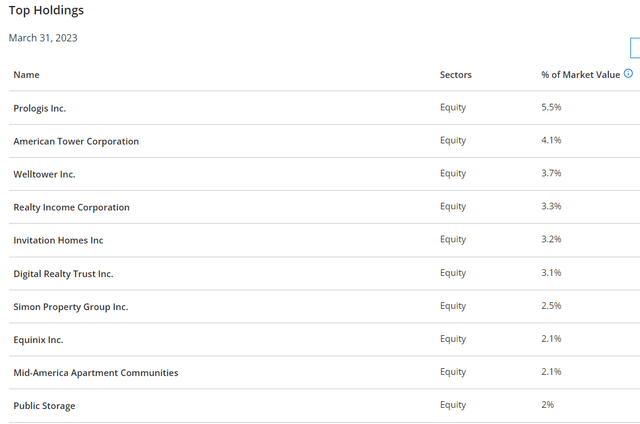

Figure 3 shows the top 10 holdings of the fund as of March 31, 2023. The top 10 holdings are primarily REITs and account for 31.6% of the fund.

Figure 3 – RNP top 10 holdings (cohenandsteers.com)

Investors should note that the RNP fund appears to have been negatively affected by the recent regional banking crisis, as it held preferred shares of SVB Financial and Credit Suisse as recently as the December 31, 2022 annual report, and continued to hold Credit Suisse preferred shares as of March 31, 2023.

Returns

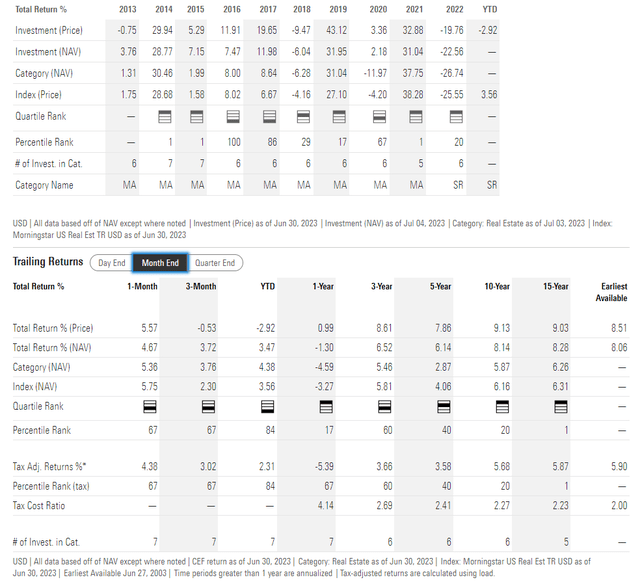

Figure 4 shows historical returns of the RNP fund to June 30, 2023. Overall, the RNP fund has delivered solid long-term returns with 3/5/10/15Yr average annual returns of 6.5%/6.1%/8.1%/8.3% respectively.

Figure 4 – RNP historical returns (morningstar.com)

Furthermore, although RNP’s short-term returns have been marred by a -22.6% return in 2022, it has been able to generate 2023 YTD returns of 3.5% despite getting hit with landmines like SVB Financial and Credit Suisse mentioned above.

Distribution & Yield

RNP’s solid long-term returns backstop the fund’s generous $0.136 / share monthly distribution with a forward yield of 8.5% that has been maintained since the beginning of 2022. The RNP fund also pays special distributions funded by realized gains. In 2022, the special distribution was $1.0714 / share.

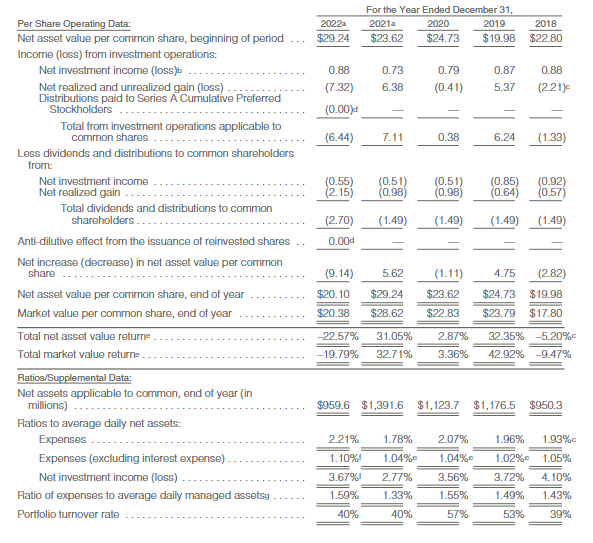

RNP’s distribution is funded from a combination of net investment income (“NII”) and realized gains (Figure 5). While RNP’s NII is not sufficient to fully fund its monthly distributions, I do not have major concerns regarding the distribution’s sustainability as the fund’s long-term average annual returns of 8.1% over 10 years appear sufficient to fund its current 8.5% yield.

Figure 5 – RNP financial summary (RNP 2022 annual report)

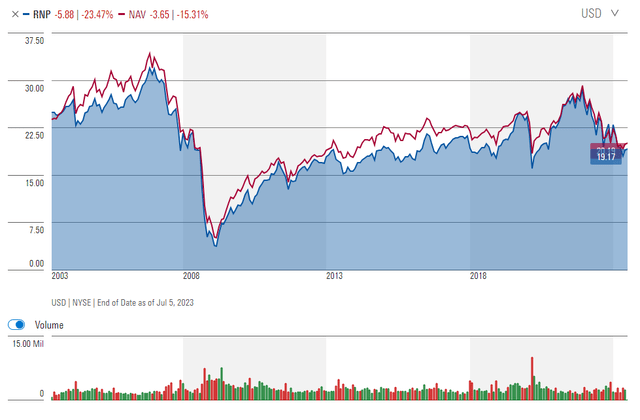

My conclusion on RNP’s distribution sustainability is confirmed by an analysis of the fund’s historical NAV, which does not show the classic amortization pattern of ‘return of principal’ funds that must liquidate NAV to fund their distributions (Figure 6).

Figure 6 – RNP historical NAV (morningstar.com)

Watch Out For Financial Crisis Risks

Instead, RNP’s NAV profile reminds me of the Flaherty & Crumrine Preferred Securities Income Fund (FFC), which saw a plunge in 2008 due to the markdown of preferred securities from the Great Financial Crisis. Similarly, both funds have had poor recent performance, as they appear to traffic in similar bank preferred securities like SVB Financial and Credit Suisse.

I believe the warning I wrote about FFC’s financials preferred securities exposure is worth repeating for readers interested in RNP:

The 2008/2009 Great Financial Crisis (“GFC”) was a terrible period for FFC, as many banks and insurance companies were forced to suspend their preferred dividends. In fact, some financial companies like Lehman Brothers even went bankrupt, wiping out preferred stock holders. While ultimately, most banks and insurers returned to financial health and resumed paying preferred dividends, FFC’s NAV never returned to its pre-GFC peaks, indicating permanent loss of capital from the episode. If the global economy suffers a financial crisis similar in scale to the GFC, then FFC shareholders could be at risk due to its heavy concentration in financial services.

March 2023 was a mini financial crisis centered on regional banks and weak financial institutions like Credit Suisse, as they buckled from the pressures of higher interest rates.

Is Now A Great Time To Buy?

Following RNP’s horrible 2022 when the fund lost more than 22%, investors may be wondering if the worst is over and is now the time to buy discounted shares of RNP?

While I agree RNP’s long-term performance and 8.5% distribution yield is compelling, I have reservations about committing capital to the RNP fund at the current time.

On the positive side, preferred security yields are quickly becoming attractive, as I wrote in a recent article on Vornado’s preferred shares. It is not uncommon to find preferred securities yielding 8-10%, i.e. equity-like returns, plus the potential for capital appreciation if they trade back to par.

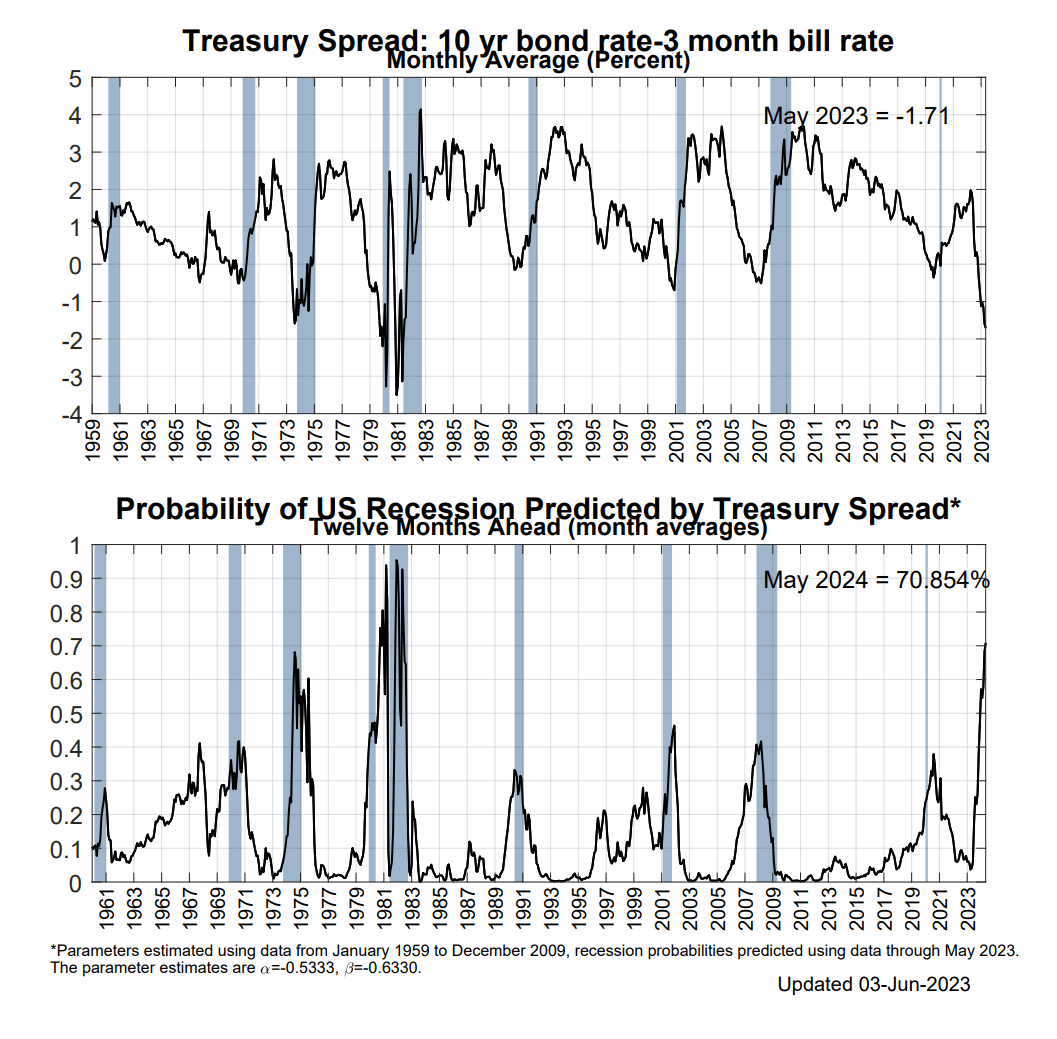

However, on the downside, macro fundamentals like a deeply inverted yield curve still argues for a pending recession. A New York Fed recession model based on the yield curve suggest there is a 70% probability of a recession in the next 12 months (Figure 7).

Figure 7 – Yield curve suggest a 70% probability of a recession (New York Fed)

A recession could lead to deteriorating credit performance for RNP’s preferred shares and steep losses for its portfolio of REITs.

Furthermore, even if the U.S. economy is able to avoid a recession, we still have to contend with a Federal Reserve that has pledged to stay ‘higher for longer’ in order to stamp out stubbornly high inflation.

Recently at ECB Sintra Forum, Fed Chair Powell suggested inflation may not return to the Fed’s 2% target until 2025 and the Fed will maintain restrictive interest rates until the job is done. My take is that the Fed will maintain high short-term interest rates unless a recession short-circuits the economy. Higher interest rates will act as a headwind for preferred shares and long-duration REITs.

RNP vs. RIET

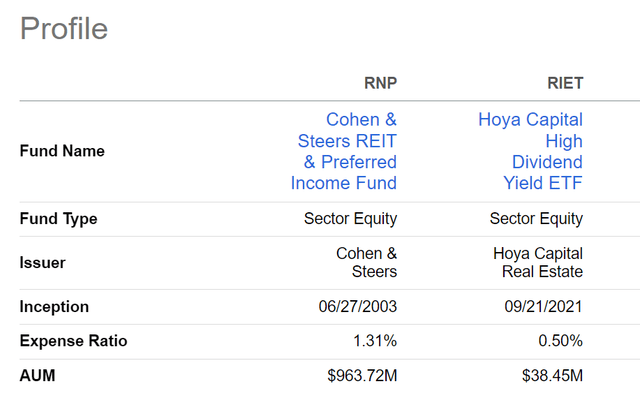

Returning to the main point of this article, I believe the RNP fund is a better investment vehicle compared to the RIET ETF for those seeking REIT exposure.

First, comparing their structures, the RNP fund is managed by Cohen & Steers and has been in operation for 20 years compared to upstart Hoya Capital with limited operating history (Figure 8). The RNP fund also has close to $1 billion in net assets vs. just $38 million for RIET. More AUM means more liquidity for investors looking to transact in the fund.

Figure 8 – RNP vs. RIET fund structure (Seeking Alpha)

The downside is that the RNP fund is much more expensive, as it has a net expense ratio of 1.78% (note, Seeking Alpha’s expense ratio data appears inaccurate) compared to 0.50% for RIET.

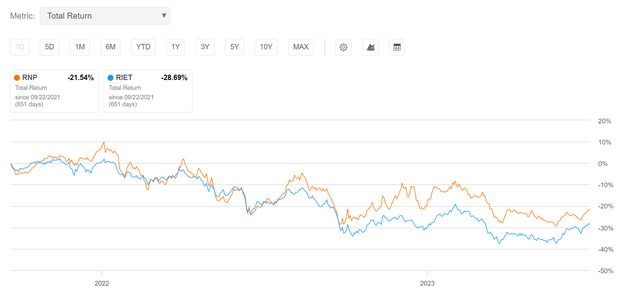

In terms of returns, the RNP fund has delivered superior total returns measured from the inception of the RIET ETF (Figure 9). Although since returns have been negative for both funds, this is like asking who is the taller dwarve.

Figure 9 – RNP vs. RIET total return (Seeking Alpha)

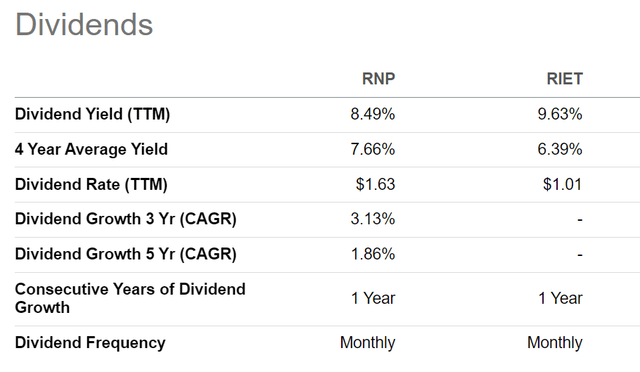

Finally, in terms of distribution, RIET’s distribution yield is slightly higher with trailing 12 month distribution yield of 9.6% (Figure 10). However, RNP’s 8.5% yield is backed by the fund’s long-term track record whereas the RIET ETF has no such record.

Figure 10 – RNP vs. RIET distribution yield (Seeking Alpha)

Overall, if one were inclined to gain REIT exposure at the present time, I believe the RNP fund is a better choice compared to the RIET ETF.

Conclusion

The Cohen & Steers REIT & Preferred Income Fund aims to deliver high current income from a portfolio of REITs and preferred securities. The fund has a solid long-term track record supporting its 8.5% distribution yield. Looking at the fund as a stand-alone investment, I have reservations whether now is a good time to invest, as there are potential headwind from a pending recession and/or higher for longer interest rates.

However, when compared to the Hoya Capital High Dividend Yield ETF, I believe the RNP fund is superior. First, it is much larger, giving investors more trading liquidity if necessary. Second, total returns have been higher for RNP compared to the RIET ETF. Finally, although the RIET ETF pays a higher distribution yield, RNP’s far longer track record gives me more confidence that the RNP fund can generate long-term returns that can sustainably fund its distribution.

Read the full article here