Investment thesis

Our current investment thesis is:

- JHG has struggled with growth, as investors are increasingly unconvinced by the value offered by active management. This has contributed to competitive pressures from passive funds such as ETFs.

- Numerous industry tailwinds can be exploited, such as alternative investments, but have yet to materially improve JHG’s performance.

- JHG is attractively profitable but lags behind its peers.

- Although the company looks cheap, we consider it unattractive due to the forecast weakness ahead.

Company description

Janus Henderson Group plc (NYSE:JHG) is a company that specializes in asset management. It offers a range of services to institutional, retail, and high-net-worth clients. The company manages customized equity and fixed income portfolios for individual clients and also provides mutual funds in the areas of equity, fixed income, and balanced investments.

The company was formed as a merger between Janus, a US asset manager, and Henderson, a UK asset manager.

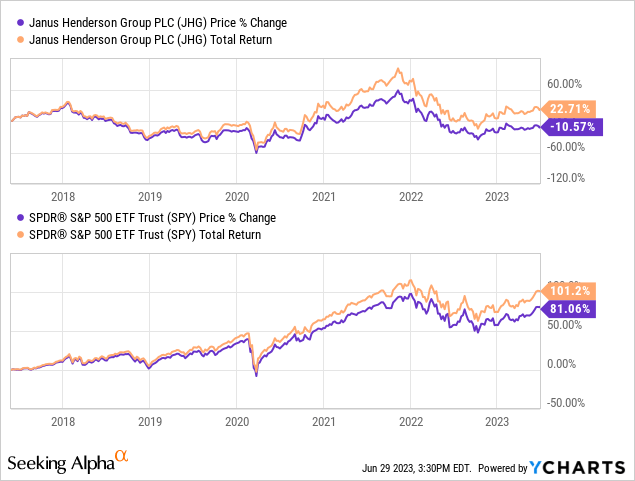

Share price

Since the formation of JHG, the company has significantly underperformed the market, with its share price down relative to its 2017 level. This is due to difficulties with the integration of the two businesses, as well as struggles with achieving growth and merger benefits.

Financial analysis

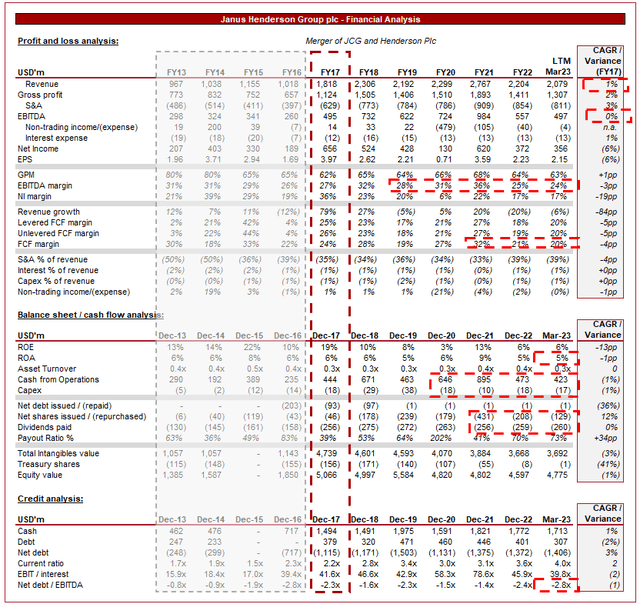

JHG Financials (Capital IQ)

Presented above is JHG’s financial performance for the last decade.

Revenue & Commercial Factors

Since FY17, Revenue has grown at a CAGR of 1%, an extremely underwhelming level, materially driven by market conditions rather than business improvement. Compared to its FY18 level, JHG is $300m below.

Business Model and Competitive Positioning

JHG operates as an active asset manager, offering a diverse set of investment products and services across various asset classes. Its objective is to tailor portfolios to its clients’ needs, as well as offering generic funds which provide the desired exposure.

JHG primarily earns revenue through the levying of management fees, which are usually a % amount of the funds invested by clients. In addition to this, JHG is able to earn a performance fee if it exceeds an agreed upon performance metric. Other revenue streams are mainly servicing fee related.

The company’s business model revolves around providing active investment management strategies, combining fundamental research, quantitative analysis, and experienced portfolio management. Given the business is an active investment manager, the expectation is that it is in a position to outperform the “market”, and especially its biggest competitor, passive funds. For this effort, JHG is able to earn higher fees. We are concerned about the future of active investing. A quick Google search will illustrate the issue the active investing industry is facing. Again and again, the active market is unable to outperform passive funds or the market, when accounting for fees. As a result of this, investors are rapidly moving money out of these funds and into a shrinking group of star managers, and at increasing levels, passive alternatives. JHG is in the group underperforming group. For this reason, we are concerned that JHG will continue to see outflows and mild inflows, impacting its ability to generate higher fees YoY.

JHG’s investment teams comprise seasoned professionals with deep expertise, many of whom have been part of the legacy business for an extended period of time. The concern is that JHG has faced some churn of investment professionals, potentially due to its weakness. Further, the company has a strong global footprint, with offices and investment teams located across major financial centers worldwide. This is critical for both winning new clients and the generation of new investment ideas through local research.

Asset management Industry

The growing focus on environmental, social, and governance factors presents a significant opportunity for JHG to develop and offer ESG-focused investment solutions. This segment has rapidly grown in recent years, in part due to pressures from society, as well as changing legislation. We expect growth from this segment will continue to be strong in the coming years.

Emerging markets offer attractive growth prospects, as a growing middle class globally seeks investment support. JHG can leverage its global presence and expertise to capture opportunities in these markets. This is a segment in which the business has performed better, as it has faced weakness in its core markets.

Additionally, we see alternatives as a key value driver in the asset management space. Following a decade of record low interest rates, investors have rapidly expanded beyond equities, as fixed income represented a poor investment choice. JHG’s alternative funds have performed well, outperforming their benchmarks across various timeframes. Given the nature of these funds, JHG can generate higher fees from this segment, helping to offset the impact of fee compression in its traditional funds.

We consider ETFs in particular to be a key threat to the business. ETFs are “exchange-traded funds”, which are quickly becoming the go-to passive investment strategy. The fees associated with ETFs are low due to their passive, linked nature, representing tough competition for JHG. The true difference with ETFs is their accessibility, given the traded nature of them. Investors can easily enter and exit positions, as well as develop tailored exposure through owning various funds.

The asset management industry is subject to market fluctuations and economic uncertainties, which can impact investment performance. This is a critical factor to remember every 10 years or so when we are in a downturn, because outflows significantly exceed inflows, contributing to a rapid slowdown in revenue which cannot be immediately recovered like in other industries. In the most recent quarter (Mar23), AUM recovered compared to Dec22, wholly due to a recovery in the market (Net inflows of $5.5bn v.a market improvement of $16.4bn and FX upside of $1.3bn), but AUM remains 23% below Mar22 levels.

Margins

JHG’s margins are attractively high, with a GPM of 63%, EBITDA-M 24%, and a NIM of 17%. Margins have declined compared to the Janus levels, as a result of weaker performance, AUM underperformance, and wage inflation. Performance fees have the ability to materially improve margins, which is why the top asset managers always rise to the top. JHG’s weakness is a reflection of its inability to perform consistently well.

We suspect further margin deterioration will occur due to the continued weakness JHG faces, with seemingly no response.

Outlook

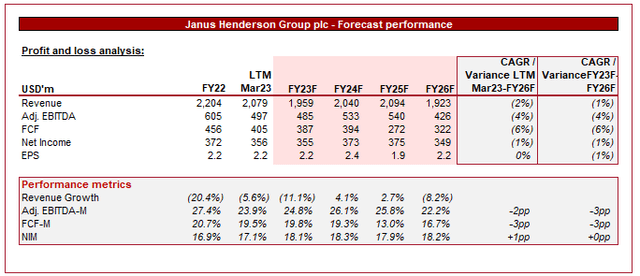

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a decline in revenue over the coming years, a rare sight when considering a 5-year period. This implies analysts are equally bearish on the company’s ability to turn things around.

With underperforms like this, it is understandable that JHG would face issues retaining talented staff, as they seek an environment in which they are provided better resources to success, namely healthy inflows.

Industry analysis

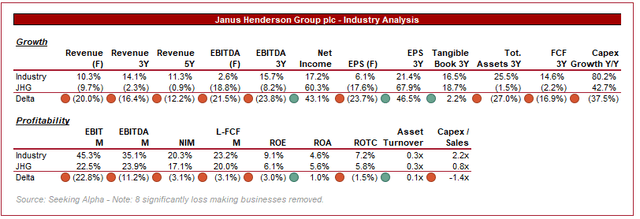

Asset management industry (Seeking Alpha)

Presented above is a comparison of JHG’s growth and profitability to the average of its industry, as defined by Seeking Alpha (88 companies).

JHG’s weakness is in full display here, with the company underperforming on almost every metric. On a profitability basis (NIM and ROE in particular), JHG is close to average, but this is not good enough given the scale of the business.

From a growth perspective, however, JHG is at a substantial deficit. The AM industry has experienced positive tailwinds leading up to the last few years due to record low rates, illustrating how poor the 5Y difference is.

Valuation

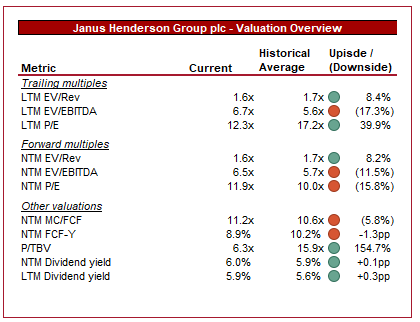

Valuation (Capital IQ)

JHG is currently trading at 7x LTM EBITDA and 6.5x NTM EBITDA. This is a premium to its historical average.

JHG pays attractive distributions, with both dividends and buybacks. Given its strong cash flow conversion and cash balance, we suspect these levels will be maintained.

Even with this in mind, however, we struggle to see how a premium is warranted. The multiple is very low on an absolute basis but when contextualized by its historical level, we believe it is too high. The fundamental issue is that we see no material scope for improvement sufficient to propel the business to a sustainable level of growth.

Final thoughts

JHG is an underperforming asset management, facing pressures on its AUM due to its funds becoming less attractive and active management falling out of favor. We see some industry tailwinds that could support JHG, such as alternatives and emerging markets, but we do not believe this will be material enough to stem its revenue decline

Read the full article here