Introduction

ImmunoGen (NASDAQ:IMGN) is a commercial-stage biotech firm focused on developing innovative antibody-drug conjugates (ADCs) to enhance cancer treatment. These targeted therapies boast improved anti-tumor efficacy and more tolerable profiles, disrupting cancer progression and providing patients with better quality of life. Leveraging proprietary technology, ImmunoGen’s ADCs target tumor cells for precise payload delivery of potent anti-cancer agents. As an industry leader with a robust portfolio, their strategic priorities include launching Elahere, expanding its use in platinum-sensitive ovarian cancer, advancing their novel ADCs clinical pipeline, and amplifying their pipeline through both in-house discovery and external partnerships.

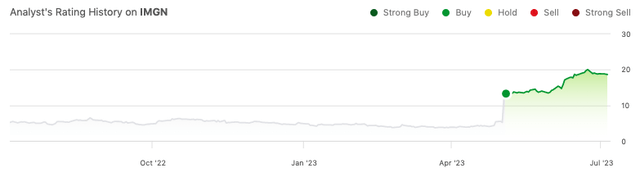

In my first analysis on ImmunoGen, I noted that the MIRASOL trial results confirmed Elahere’s potential as a novel treatment for platinum-resistant ovarian cancer, strengthening ImmunoGen’s market position and prospects for revenue growth. Elahere’s efficacy, safety, and target patient group make it appealing to clinicians and patients. I anticipated strong market penetration with peak annual sales reaching approximately $957 million. ImmunoGen’s healthy financial forecast, robust cash position, and share offering mirrored a promising future. Hence, despite potential biotech investment risks, I recommended a “Buy” stance for ImmunoGen, seeing a compelling long-term growth opportunity. Since my “Buy” recommendation, ImmunoGen is trading 48% higher.

Seeking Alpha

Recent Developments: ImmunoGen presented comprehensive MIRASOL data at the ASCO conference in June, resulting in further increases in IMGN stock value. A detailed analysis of these advancements is provided below.

Q1 2023 Earnings

In Q1 2023, ImmunoGen reported a revenue increase to $49.9 million, primarily due to Elahere sales and an upfront fee from Vertex Pharmaceuticals. This was partly counterbalanced by license fees from past collaborations. Research, development, and administrative expenses rose, leading to a net loss of $41.0 million. With $201.2 million in cash reserves and $73.7 million operational cash usage, the firm revised its 2023 financial guidance and expects to sustain operations until 2025. In the wake of confirmatory data, ImmunoGen announced plans to close a $325 million underwritten public offering.

Complete MIRASOL Data Reinforces Elahere’s Potential

The MIRASOL trial results underscore Elahere’s potential as a transformative therapy for platinum-resistant ovarian cancer. The trial demonstrated significant improvements in both progression-free survival [PFS] and overall survival (OS). The median PFS for Elahere-treated patients was 5.62 months compared to 3.98 months with chemotherapy, representing a 35% risk reduction in tumor progression or death. Similarly, the median OS was notably longer at 16.46 months with Elahere versus 12.75 months in the chemotherapy arm, reflecting a 33% risk reduction in death.

The 42.3% objective response rate in the Elahere group, including 12 complete responses, far surpassed the 15.9% rate in the chemotherapy group. This distinct disparity in responses further enhances Elahere’s position as a viable and more effective treatment option.

Interestingly, Elahere’s efficacy was not significantly influenced by prior bevacizumab exposure, as the hazard ratios for PFS were similar in both bevacizumab-naïve and bevacizumab-pretreated subsets. This is significant because it suggests that Elahere’s effectiveness is not markedly affected by the patients’ prior treatment history, which potentially broadens its clinical application.

Moreover, Elahere exhibited a manageable safety profile, with lower rates of severe treatment-emergent adverse events (42% vs 54%) and serious adverse events (24% vs 33%) compared to chemotherapy. This suggests that patients might endure the treatment better, which could lead to better adherence and ultimately, better outcomes.

In summary, these specific insights from the MIRASOL trial data strengthen the assertion that Elahere may potentially revolutionize the treatment landscape for platinum-resistant ovarian cancer. With its marked efficacy, broad applicability, and better tolerability, Elahere could become a pivotal treatment option, catalyzing significant revenue growth for ImmunoGen.

My Analysis & Recommendation

In conclusion, with its successful development of Elahere and promising MIRASOL trial results, ImmunoGen has demonstrated the potential to disrupt the oncology market, specifically in treating platinum-resistant ovarian cancer. The combination of strong clinical efficacy data, the robust pipeline of ADCs, and a promising financial outlook has significantly enhanced the company’s prospects. The robust performance since my previous “Buy” recommendation is a testament to ImmunoGen’s strong market potential, and even with a market capitalization of $4.6 billion, the company appears to be on a solid growth trajectory.

Investors should, however, remain cautious and attentive to several key factors. Regulatory hurdles, market penetration rates, and the development of competing therapies are among the factors that could influence ImmunoGen’s performance. Furthermore, while the company’s current cash reserves are expected to support operations until 2025, the long-term financial sustainability will rely on achieving revenue growth and managing R&D and administrative costs effectively.

Nonetheless, considering the compelling MIRASOL data and the enormous unmet need in the platinum-resistant ovarian cancer space, ImmunoGen’s prospects appear bright. The company continues to demonstrate its potential to create substantial shareholder value, and thus, ImmunoGen remains a “Buy” in my analysis for those who can tolerate the risks associated with biotech investments.

Risks to Thesis

When the facts change, I change my mind.

While I maintain a bullish stance on ImmunoGen, several key risks could potentially undermine my thesis. First, there’s the inherent unpredictability of the biotech sector, including unexpected clinical trial results or regulatory setbacks. While Elahere has shown promising results, any future trials may not yield the same level of success.

Second, the drug approval process can be complex and lengthy, and any delays or rejections from regulatory authorities like the FDA can significantly impact ImmunoGen’s market position and financial health.

Third, while ImmunoGen currently enjoys a robust financial status, sustained financial health hinges on successful commercialization of Elahere and other pipeline drugs. Unforeseen challenges in marketing, manufacturing, or distributing the drugs could hamper revenue growth.

Fourth, competition is fierce in the oncology space. The emergence of a more effective treatment or therapy could limit Elahere’s market share and impact ImmunoGen’s growth prospects.

Lastly, the broader macroeconomic environment and market sentiment can also affect ImmunoGen’s stock performance, which can be volatile and subject to fluctuations unrelated to the company’s performance.

Read the full article here