Intro

Churchill Downs Incorporated (NASDAQ:CHDN) is a prominent entertainment company in the United States that operates in the racing, online wagering, and gaming sectors. It is structured into three main segments: Live and Historical Racing, TwinSpires, and Gaming. The company owns and manages three pari-mutuel gaming venues in Kentucky, featuring around 3,050 historical racing machines. Additionally, it operates TwinSpires, an online platform for horse racing, sports betting, and iGaming.

CHDN also offers retail sports books, casino gaming with thousands of slot machines and table games in multiple states, and provides streaming services for live horse races, replays, and racing information. Furthermore, the company manufactures and operates pari-mutuel wagering systems for various betting establishments within the industry.

The purpose of this article is to offer a comprehensive evaluation of CHDN’s financial performance and growth prospects. We will conduct a detailed analysis of CHDN’s revenue and profitability trends, its capacity to generate free cash flow, and assess the overall financial stability reflected in its balance sheet. Furthermore, we will utilize a discounted cash flow analysis to estimate the intrinsic value of CHDN, providing valuable insights to investors who are contemplating CHDN as a potential investment opportunity in the current market.

Performance

CHDN is a dynamic and rapidly growing company in the gaming industry. With a track record of consistent revenue growth, robust free cash flow, and impressive profitability, CHDN has established itself as a formidable player in the market.

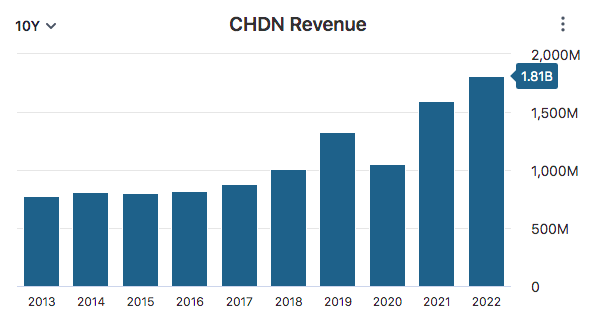

Over the past decade, CHDN has demonstrated remarkable revenue growth, with a total growth of 132.31%. This growth has been consistent, averaging a compounded annual growth rate (CAGR) of 8.79%. Such a high growth rate is vital for a company as it signifies its ability to expand its customer base, market share, and overall presence in the industry. Moreover, sustained revenue growth often leads to increased profitability, attracting investors and driving shareholder value.

Data by Stock Analysis

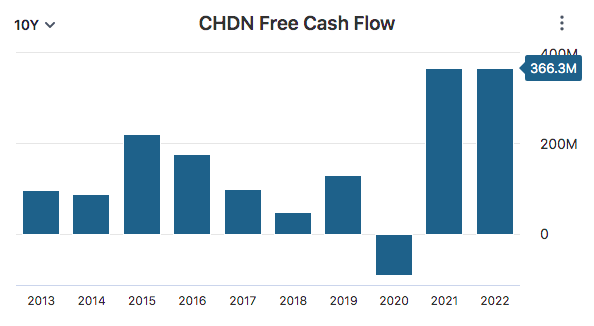

CHDN’s free cash flow has exhibited significant improvement over the years. Despite a dip in 2020, the company rebounded swiftly and saw its free cash flow grow by 281.01% during the decade and a compounded annual growth rate (CAGR) of 14.31%. This increase reflects CHDN’s efficient management of its operating cash flow and capital expenditures. Positive free cash flow is crucial for the company’s ability to reinvest in its business, pursue strategic acquisitions, reward shareholders with dividends, and ensure long-term financial stability.

Data by Stock Analysis

While CHDN has shown impressive revenue growth and profitability, it is important to address certain concerns related to its balance sheet. The company’s balance sheet exhibits some areas of weakness that investors should carefully consider.

One area of concern is CHDN’s current ratio, which stands at 0.54. This indicates that the company may have difficulty covering its short-term liabilities with its current assets. A current ratio below 1.0 suggests a potential liquidity risk, as CHDN may face challenges in meeting its immediate financial obligations. It’s also worth noting that CHDN’s current ratio is lower than many industry peers including Caesars Entertainment (CZR), Wynn Resorts (WYNN), DraftKings (DKNG), and Boyd Gaming (BYD). It is crucial for the company to improve its liquidity position to mitigate any potential cash flow issues.

Additionally, the debt-to-equity (D/E) ratio of 6.28 raises concerns about CHDN’s capital structure. A high D/E ratio indicates a significant reliance on debt financing, which can increase financial risk and interest expense. While CHDN’s growth-oriented strategy may justify some level of debt, a high D/E ratio could potentially limit the company’s flexibility in the face of economic downturns or changes in interest rates. Compared to some of its peers, CHDN does not perform well in this regard, with a D/E ratio nearly 3x higher than BYD and nearly 5x higher than DKNG, it is important for CHDN to carefully manage its debt obligations to avoid financial strain in the future.

CHDN’s profitability record is exceptional, as evident from its return on equity (ROE) figures. Over the past decade, the company achieved an average (ROE) of 31.53%, surpassing the industry benchmark of 9.9% by a wide margin. Furthermore, CHDN experienced positive (ROE) in nine out of the ten years, with five years exceeding a remarkable 20%. (ROE) represents a company’s ability to generate profits from shareholders’ investments. A high (ROE) compared to industry rivals, demonstrates the efficiency of CHDN’s management in utilizing shareholders’ equity to generate substantial returns, making it an attractive investment option.

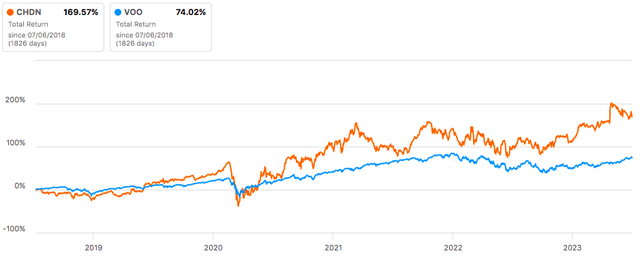

In terms of total return, CHDN has significantly outperformed the S&P 500 over the past five years. With a total return of 169% for CHDN compared to the S&P 500’s 74%, the company has provided substantial value to its shareholders. This outperformance highlights the success of CHDN’s growth strategy and underscores its ability to generate superior returns even in a broader market context.

Data by Seeking Alpha

Outlook

CHDN’s 2023 Q1 earnings results have surpassed expectations, reflecting the company’s strong performance. The earnings per share (EPS) of $0.98 has exceeded analysts’ estimates by $0.08, indicating robust profitability. Additionally, CHDN’s revenue of $559.50 million represents a significant year-over-year growth of 53.67%, surpassing expectations by $22.93 million. This impressive revenue growth showcases CHDN’s ability to capture market share and capitalize on favorable industry trends. These Q1 earnings results highlight CHDN’s solid financial performance and reinforce its position as a leading player in the market.

These strong results were driven by the company’s strategic focus on historical racing machines (HRMs) which have proven to be successful since the first property opening in 2018. HRMs will be a key area for future growth. The company plans to expand its HRM operations in various states, including Kentucky, Virginia, New Hampshire, and Louisiana. This expansion strategy aims to increase CHDN’s market presence and capitalize on the growing popularity of HRMs.

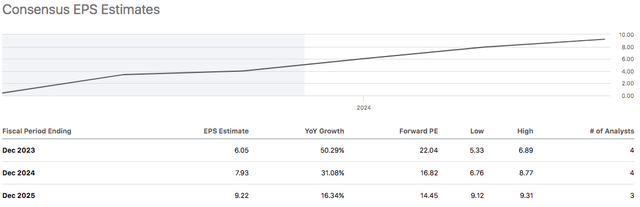

Analysts have high expectations for CHDN’s future performance, anticipating substantial growth over the next three years. The projected earnings growth rate for 2023 stands at an impressive 50.29%, followed by a growth rate of 31.08% for 2024 and 16.34% for 2025. These estimates highlight the market’s confidence in CHDN’s ability to continue its upward trajectory and deliver strong financial results in the coming years.

Data by Seeking Alpha

CHDN has been making notable strides in Kentucky, which serve as additional growth drivers for the company. The expansion of Derby City Gaming, their first HRM property, has reached completion, and they are on track to open a new hotel by the end of Q2. Despite the challenges posed by the expansion and construction activities, CHDN seems delighted with the performance of Derby City Gaming. These developments showcase the company’s ability to successfully execute expansion plans and capitalize on the market’s demand for HRM entertainment.

However, there are some risks associated with investing in the company. CHDN is subject to strict government regulations, and any changes in the laws can have a negative impact on its operations. CHDN is involved in activities like live and historical wagering, online wagering, casino gaming, online gaming, and sports betting, which are heavily regulated by state and local authorities. These regulatory bodies have the power to impose restrictions, suspend or revoke licenses, or prevent others from owning a stake in the company based on the laws and regulations in place. Their decisions can significantly affect CHDN’s ability to conduct business.

Still, CHDN has an array of exciting growth projects in progress that are poised to fuel the company’s future success. In Virginia, CHDN’s six HRM properties have demonstrated strong performance, even surpassing expectations in certain cases. The construction of the Rosie’s Emporia HRM venue, strategically located near the Virginia and North Carolina border, remains on schedule for completion in Q3. Furthermore, CHDN is constructing a larger HRM facility in Dumfries, strategically positioned to cater to the sizable population in Northern Virginia and along the bustling Interstate 95 corridor.

In addition to the HRM ventures, CHDN is actively pursuing a full Class 3 casino in the city of Richmond, Virginia, in collaboration with Urban One. The company is currently securing the necessary approvals from the City of Richmond to conduct a referendum in the fall. This milestone will enable the construction of a comprehensive entertainment complex comprising a casino, hotel, and event center. This opportunity presents CHDN with a distinct avenue for further growth and diversification, separate from its HRM operations in the state.

While regulatory risks exist, the company’s commitment to adhering to regulations and its success in executing expansion plans mitigate these concerns. Overall, CHDN’s future looks promising as it continues to drive growth and solidify its position as a leading player in the industry.

Valuation

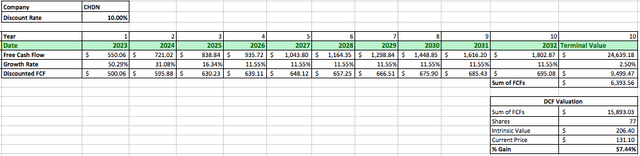

We will utilize the discounted cash flow (DCF) analysis, our preferred method of assessing a company’s value, to evaluate CHDN’s true worth. This approach involves determining the present value of CHDN’s projected future cash flows in order to derive its intrinsic value.

To begin the analysis, we will start with CHDN’s previous year’s free cash flow of $366 million. We will apply the average analyst earnings growth rate of 50.29% for 2023, then a growth rate of 31.08% for 2024 and 16.34% for 2025 based on average analyst earnings estimates. CHDN, being a small company, presents challenges in predicting its future free cash flows beyond the next three years due to uncertainty and limited visibility. However, we will use a growth rate of 11.55% for the next 7 years based on the average of the compounded annual revenue and free cash flow growth rates over the last decade.

In order to calculate the terminal value, we will employ a conservative perpetual growth rate of 2.5%. Applying a discount rate of 10%, which accounts for the long-term return rate of the S&P 500 with dividends reinvested, we determine CHDN’s intrinsic value to be $206.40 This suggests that CHDN may currently be significantly undervalued, potentially offering investors a potential gain of 57.4% compared to the company’s current market price.

Author’s Work

Final Thoughts

In conclusion, Churchill Downs Incorporated is a leading entertainment company in the United States, operating in the racing, online wagering, and gaming sectors. With its strong financial performance, consistent revenue growth, and robust profitability, CHDN has established itself as a formidable player in the market.

The company’s Q1 earnings results surpassed expectations, reflecting its ability to capture market share and capitalize on favorable industry trends. CHDN’s strategic focus on historical racing machines (HRMs) has been successful, with expansion projects in Kentucky and plans for further growth in states like Virginia, New Hampshire, and Louisiana.

Despite the regulatory risks associated with its operations, CHDN has demonstrated its commitment to adhering to regulations and successfully executing expansion plans. The company’s future looks promising, driven by its array of exciting growth projects, including the construction of HRM venues and the pursuit of a Class 3 casino in Richmond, Virginia.

Based on a discounted cash flow (DCF) analysis, CHDN’s intrinsic value shows potential for further growth. The company’s current share price compared to its estimated intrinsic value suggests an attractive investment opportunity. Considering CHDN’s strong financial performance, growth prospects, and the market’s confidence in its future earnings growth, we recommend a buy rating for investors seeking a promising opportunity in the gaming and entertainment industry.

Read the full article here