Investment Overview – BMY’s Recent Progress Beginning To Look More Like A Vicious Cycle

Ever since expressing my concern that Bristol-Myers Squibb (NYSE:BMY) shares were trapped in a trading range of $50-$65 ad infinitum, and ad nauseum, in a note for Seeking Alpha back in October 2020, I have been consistently bullish on the company – and that optimism has generally been rewarded with a rising share price.

In November last year, BMY stock hit an all-time high valuation of $81, justifying my optimism, but since then, it has been all downhill for the New York based Big Pharma, and this week, shares slipped back into the dreaded $50 – $65 range for the first time in ~18 months.

Since my October 2020 note warning about share price stasis, BMY’s total return has been +17%, versus the S&P 500’s 29% gain over the same period. BMY’s dividend, which currently pays $0.57 per quarter and has been raised every year for the past decade at least, is the Pharma’s saving grace, yielding 3.6% at the time of writing.

In terms of pure share price gain, BMY’s stock has risen just 14.5% across the past 5 years, and 6% across the past 3 years. It is down 16% across the past year, in what has admittedly been a tough period for the Pharma sector in general, thanks to the pressure on drug pricing brought about by the Inflation Reduction Act (“IRA”), which forces drug manufacturers to pay rebates if they raise prices above the rate of inflation.

BMY Versus The Remaining “Big 8” US Pharmas

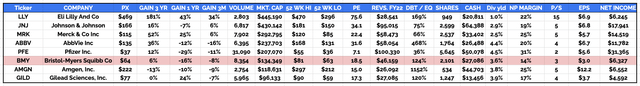

“Big 8” US Pharmas compared (my table – data from TradingView, Google Finance)

I tend to share the above table whenever I write about what I term the “Big 8” US Pharmas – in order of market cap, Eli Lilly (LLY), Johnson & Johnson (JNJ), Merck & Co (MRK), AbbVie (ABBV), Pfizer (PFE), BMY, Amgen (AMGN) and Gilead Sciences (GILD). I find it to be a useful bellwether for assessing the company’s relative performance – although it does not necessarily tell the full story.

To highlight a few numbers – BMY’s share price decline of 16% across the past year is the second worst in the sector, behind Pfizer. Its trailing PE ratio of 18.5x is low for the sector – which can be interpreted as a positive, although its net profit margin of 14% is the lowest in the sector. A high PE often indicates the market is expecting a company to outperform in the long run – Lilly’s PE has risen, for example, thanks to its soaring share price on the market’s expectations of record-breaking revenues for its diabetes / weight loss franchise. It seems the market does not have anything like the same level of enthusiasm for BMY.

BMY’s current assets of >$27bn is relatively strong, although low for the sector, and its debt to equity is high. As of Q1’23 BMY reported current liabilities of $19.1bn, and long-term debt of $35m – nearly 6x 2022 net income. BMY’s investment grade credit rating is not in doubt – according to the company’s 2022 10K submission (annual report):

Our current long-term and short-term credit ratings assigned by Moody’s Investors Service are A2 and Prime-1, respectively, with a stable long-term credit outlook, and our current long-term and short-term credit ratings assigned by Standard & Poor’s are A+ and A-1, respectively with a stable long-term credit outlook.

Even so, interest expense on debt is likely to be $1.5bn – $2.5bn for the next several years, eating into the company’s profitability.

CEO Caforio Leaves With Turnaround Only Half Complete?

In my last note on BMY discussing Q1’23 earnings – revenues fell ~3% year-on-year to $11.3bn, while non-GAAP earnings per share (“EPS”) grew 5% to $2.05 – FY23 guidance is for non-GAAP EPS of $7.95 – $8.25 – I highlighted the fact that BMY’s CEO of 8 years, Giovanni Caforio, had decided to retire after 8 years at the helm, with Christopher Boerner, PhD, formerly Chief Commercialization Officer, taking the reins.

During his tenure, Caforio oversaw the ~$74bn acquisition of Celgene – a transformative moment in BMY’s 90-year history – battling BMY’s largest shareholder Wellington Asset Management to get the deal done. BMY’s revenues increased from $22.6bn in 2018, to $42.5bn in 2020, and $46.4bn in 2021, but they failed to grow last year, shrinking slightly to $46.2bn.

The issue with the Celgene deal was that although it added >$16bn of revenues to BMY’s top line in 2020 – thanks to a $12.1bn contribution from multiple myeloma (“MM”) therapy Revlimid, a $3.1bn contribution from Pomalyst, also indicated for MM, and a $1.25bn contribution from chemotherapy Abraxane, these assets only had a couple more years of patent protection before generic competitors could challenge them for market share, at much cheaper price points.

In 2022, for example, after Revlimid’s loss of market exclusivity, its revenues fell to $9.98bn, whilst Abraxane’s fell to $811m. These figures will only get lower going forward as generic competition intensifies, and Pomalyst patents are set to expire this year. Looking further ahead, BMY has even bigger problems – its anticoagulant Eliquis – $11.8bn of revenues last year – will lose patent protection in 2027, and its immuno-oncology therapy Opdivo – $8.25bn revenues in 2022 – will lose patent protection in 2028.

On the positive side, one of the key elements of the Celgene deal is the pipeline assets BMY also got its hands on. Anemia therapy Reblozyl, cell therapy Abecma (another member of the MM franchise), autoimmune drug Zeposia (approved for ulcerative colitis), b-cell lymphoma cell therapy Breyanzi, and myelofibrosis drug Inrebic have all secured approval since the Celgene deal completed.

These 5 assets contributed $1.6bn of revenues in FY22, but BMY believes that Reblozyl has peak revenues potential of >$4bn per annum, Breyanzi >$3bn, Zeposia >$3bn, and Abecma >$1bn. Plus, from its own pipeline, BMY has brought autoimmune therapy Sotyktu, and melanoma therapy Opdualog to market, both of which have peak sales expectations >$4bn, whilst heart disease drug Camzyos – acquired via BMY’s $13bn buyout of Myokardia in 2021 – is also expected to break $4bn in annual revenues.

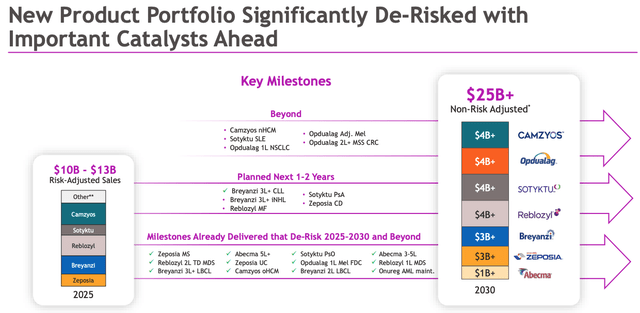

New Product Portfolio – expected performance (Q123 earnings presentation)

In its Q1’23 earnings presentation BMY shared the above slide, detailing how it expects to see its new product portfolio grow between today and the end of the decade, making a $10bn – $13bn contribution by 2025, and by 2030, driving $25bn or more of annual revenues.

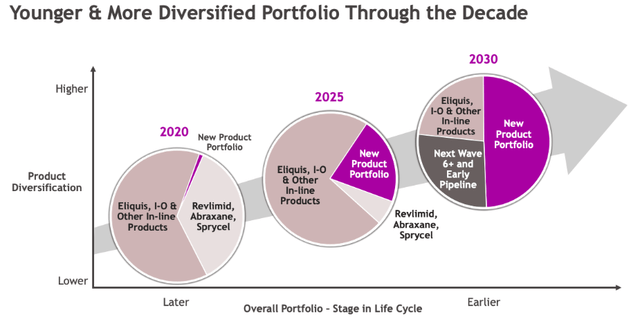

BMY portfolio evolution (JPM Healthcare Presentation)

At the JP Morgan Healthcare conference in January, BMY also shares the above slide, showing how its reliance on patent expired products such as Revlimid, and looking ahead, Eliquis and Opdivo, will decline as the new products come to the fore. I have written before about how management’s clarity – and success navigating the clinical trial process and bringing all of its new products to market – was impressive, but Caforio’s departure means that the long-term plan’s chief architect has departed midway through the rebuild.

Mapping Forward Sales Projections – How BMY’s Revenues Will Rise & Fall

In response to my last article several readers noted that the incoming CEO Christopher Boerner is no greenhorn, and the loss of Caforio may have been planned for some time, and a succession plan put in place.

I have been modeling forward product-by-product sales forecasts for BMY and, assuming BMY’s carefully laid plans are not derailed by Caforio’s departure, the outlook for BMY remains relatively promising.

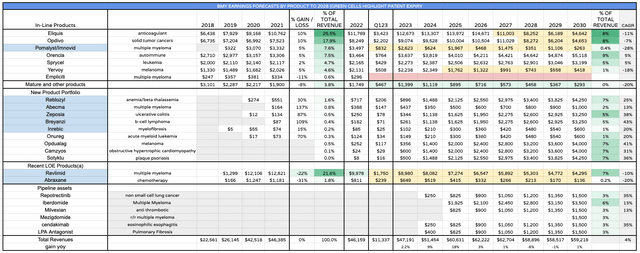

BMY forward revenue projections (my table and assumptions based on mgmt guidance)

In the above table I have modeled forward, product by product sales for BMY based on what I believe management will also be modeling for.

Cells highlighted in yellow indicate an expired patent, and in each year of patent expiry I have reduced revenues by 25% year-on-year – the actual figure, I suspect, could be as high as 35% per annum, but is unlikely to be lower than 20%.

In 2025, I assume that each of the “New Product Portfolio” – inrebic and onureg aside, since management’s outlook is less clear where these 2 drugs are concerned – are generating 55% of their peak revenue figure. That gives me a New Product contribution of $12.6bn – at the higher end of management’s forecasts outlined in the Q3’21 earning presentation.

By 2030, new product sales slightly exceed $25bn in my projections, matching management’s forecasts. Importantly, if we look at those revenues as a percentage of total revenues, it is just over 43%, again matching management’s projections outlined at the JP Morgan Healthcare conference in January. Meanwhile, the revenue contribution of Eliquis, Opdivo, Revlimid, Pomalyst, an Abraxane has also fallen <25%, as per management’s guidance – and wishes.

The third part of the equation is the “Next Wave” of the pipeline, and here I have had to be a little more speculative.

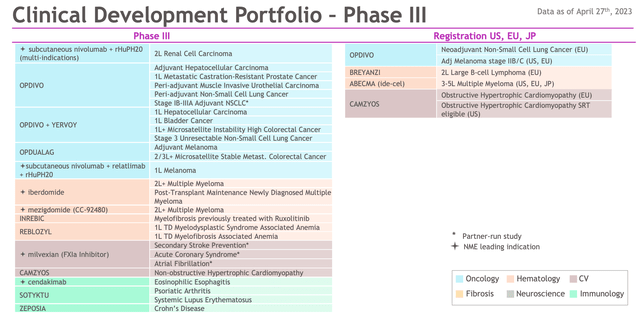

BMY Phase 3 stage pipeline (BMY earnings presentation)

Shown above is a slide from the Q1’23 earnings presentation detailing which pipeline assets are at the Phase 3 / registrational study stage, meaning an approval may be imminent, subject to positive data. As we can see, most of the opportunities are related to label expansion opportunities for already approved assets – Opdivo and Yervoy, Opdualog, Camzyos. breyanzi and abecma, and so on.

Lurking amongst these however are assets such as lung cancer therapy reprotectinib, multiple myeloma therapy iberdomide, anti-thrombotic milvexian, later stage MM therapy mezigdomide. These are some of the 6 new assets BMY hopes to launch in the coming years, that will, by 2030, account for ~25% of revenues, management believes. I have not been quite that optimistic – I have their contribution at ~19% by the end of the decade – taking a more cautious approach by factoring in the risk of late stage study setbacks.

Broadly speaking, then, we can match management’s ambition to drive >$25bn of revenues from its new product portfolio, and offset losses of patent expired products with 6 newly approved drugs by 2030, without having to stretch the bound of possibility too far. My modeling suggests that BMY’s revenues will grow by 2.2% in 2023, which is similar to what management is predicting, then by 9%, and 18% in the following 2 years as new products challenging their peak revenue expectations, and new drug launches, more than offset revenues lost to the Revlimid / Pomalyst / Abraxane patent expiries.

Perhaps that is a little too optimistic, but after that the growth momentum slows, and then stops as Eliquis and Opdivo lose patent protection. After reaching a high of $62.7bn in 2027, revenues then slip by 6% and 1% before gaining 1% to reach $59.2bn at the end of the decade.

If Management Hits Targets – How Should We Value BMY?

I have shared rudimentary income statement forecasts and discounted cash flow analysis to try to establish a target price for BMY shares several times before in Seeking Alpha and therefore I will share my calculations based on my revised numbers and management’s update guidance.

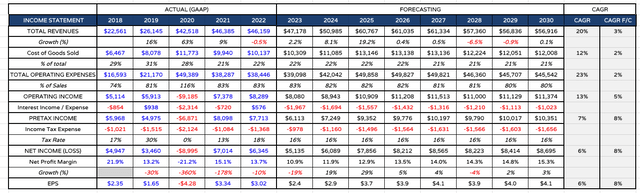

BMY forecast income statement (my table and assumptions)

Beginning with the income statement, the overall CAGR growth I forecast is ~3%, increase in operating income 5%, and increase in net profits 8%, whilst GAAP EPS increased by 8% to $4.1 in FY30.

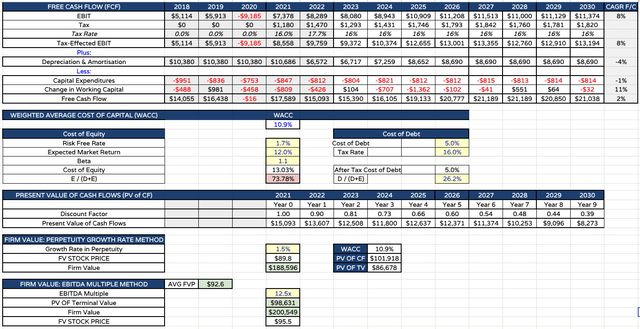

BMY target price using DCF analysis (my table and assumptions)

As for the discounted cash flow analysis, I have calculated both a DCF and EBITDA multiple target price using a weighted average cost of capital of just over 10% – the rate I use for all Big Pharma stock price analysis using DCF – taking the average of both, my target price would be $92 per share, or a premium of 45% to today’s traded price.

With such a premium in play, I would surely conclude that BMY is a strong buy? Not necessarily. As mentioned, these forecast revenue figures represent management’s best case scenario and I detect a few issues.

One issue I would highlight is the apparently strong dependence on the Multiple Myeloma franchise going forward. My projections suggest this franchise is expected to account for 18% of revenues by 2030 – >$10bn of revenues. In fairness, MM is expected to become a >$30bn market by 2026, but even so that implies BMY holding a >30% share of the market which may not be realistic.

Competitive threats must be taken into account – the Pharma industry is constantly innovating, and although BMY believes Sotyktu, for example, is a $4bn selling asset, it is up against entrenched rivals such as JNJ’s Stelara, AbbVie’s Humira replacement Skyrizi, Eli Lilly’s Taltz, and Novartis’s Cosentyx in Plaque Psoriasis alone. The competition is fierce, although of course, should Sotyktu achieve the coveted “best-in-class” award, it could become a >$10bn selling drug.

Finally, I may have been generous in massaging down BMY’s total expenses as a percentage of revenues over time in my forecasting, allowing the profit margin to widen. In the prevailing economic environment and with the IRA in place, growth could be much slower than anticipated.

Concluding Thoughts: BMY Has A Fighting Chance To Recapture Highs >$88 – But The Investment Case Is Not Compelling

My research indicates that BMY shareholders do not need to be panicking about the recent sell-off – this is a Pharma that pulled off the buyout of the decade when acquiring Celgene, and although CEO Caforio is departing, the company has won approval for all 5 of Celgene’s major pipeline assets and made the most it could of Revlimid’s earning potential while the drug was patent protected.

The losses of eliquis and opdivo’s patent protection later this decade will hurt, but there is an interesting sub plot in play here. Merck’s $20bn selling immune checkpoint inhibitor and opdivo’s chief rival Keytruda will also lose patent protection this decade, but Merck is working on a subcutaneous version of the drug that could extend its patent lifetime by another decade. Interestingly, BMY appears to be doing something similar with opdivo – succeed, and we can add $5 – $10bn to the projected 2030 revenue figure.

As such, I do think BY has a good chance of recapturing its former high of $88 and pushing >$90 per share in the post-pandemic era, once the economy is more settled, inflation and interest less rampant, and even in the face of drug pricing pressures – drug development remains a high profit margin industry.

The main issues I would draw reader’s attention to that I believe could hamper BMY’s valuation would be the lack of a truly compelling asset. Eli Lilly’s share price is >400% over the past few years thanks to its weight loss “wonder-drug in waiting” tirzepatide, while the likes of Pfizer has spent big on M&A, and even Gilead Sciences (GILD) may have a new blockbuster HIV drug, and one of its many bets on cancer drugs may eventually pay off.

BMY is short on surprises, it seems – there are no miracle drugs even in the Phase 1/2 pipeline, let alone in late stage studies. The company is a quite transparent business for investors which can be a good thing – and the dividend excuses the lack of growth, to some extent.

In the pre-Caforio era, however, BMY struggled to stay relevant, and it wasn’t unusual to see the stock price drop <$40. I can’t see that happening again, but I would also rule out the possibility of BMY stock hitting 3 figures this decade. As solid a performer as BMY is, this is probably one of the less compelling investment opportunities in the Big Pharma sector at the present time, in my view.

Read the full article here