Since March 2020, one of the most discussed topics in the CRE industry has been the office building. As Covid accelerated the work-from-home phenomena of the past ten years, companies and investors alike started to wonder if an office lease was an unnecessary expense. Companies started to reduce space, and some even went as far as going fully remote with no office space whatsoever.

Now, it’s important to note, not all offices are made equal. You’ve got the old, worn-down Class C and D office parks in suburban areas of the country, and then you’ve got the glamorous, amenity-filled Class A trophy buildings in major cities. Both are suffering but to varying degrees.

As a contrarian value investor, one Office REIT that has been on my radar through the thick of it has been SL Green (NYSE:SLG).

I want to want to buy SL Green… at face value, it satisfies nearly every requirement I look to check when evaluating a REIT Investment.

Focused Asset Class ✅

Oversold due to falling sky ✅

Long and successful track record ✅

Experienced management ✅

Trusted and Well known Brand Name ✅

Large, covered Dividend Yield ✅

Strong Industry Economics ❌

Strong Balance sheet ❌

There’s a lot to like about SL Green, but their balance sheet is heavily burdened by debt while the industry economics simultaneously deteriorate. CRE and Office trends still point towards further decline, reinforcing the idea that things will get worse before they get better, and this does not give me the comfort to jump into the stock at this time.

Let’s take a closer look at the numbers.

First, let’s dive in to the fundamentals and trends of the U.S. Office Market

I know what you’re thinking, the office market is over-saturated with unbalanced supply and demand dynamics in the renters favor.

This looks to be true on a macro level, but when you take a closer look, you see that Trophy and Class A office buildings in large cities are a different story. Rental rates and leasing are up, and it makes sense as to why. These types of fancy, amenitized buildings cater to the businesses for which the office is a cornerstone of their brand. These are client-facing service businesses, such as financial services and law firms, for which their office is an extension of their brand. They regularly host their clients there and, in that world, there is a general perception that a nicer office must mean more profits, which means a good business which means they must be good at their job.

U.S. Office Trends

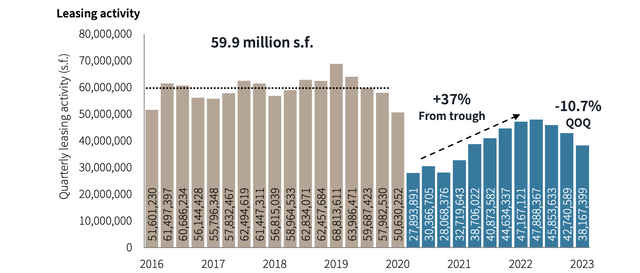

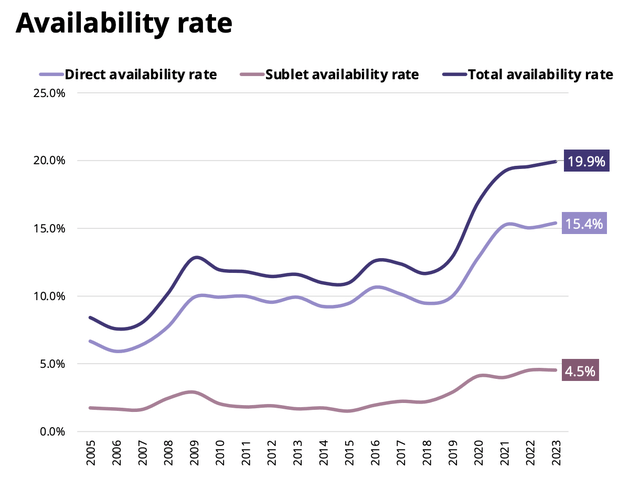

As seen below, U.S. Office leasing trends countrywide are not looking so rosy.

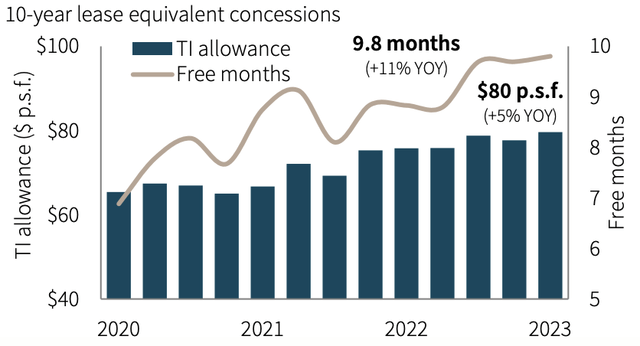

Leasing activity is still way down from pre-Covid times and rental concessions are up, showing the power still lies with the lessee.

JLL Research JLL Research

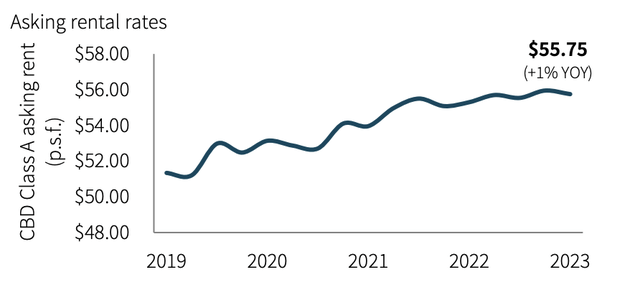

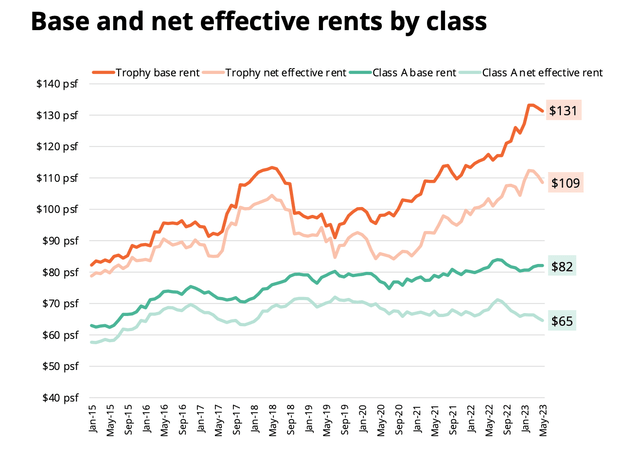

However, contrary to popular belief, rental rates are actually trending upwards… for some offices at least. As mentioned, Class A and Trophy in particular, such as the ones that SL Green owns, are still in demand in many markets, keeping rental rates floating upwards.

JLL Research

Manhattan Office Trends

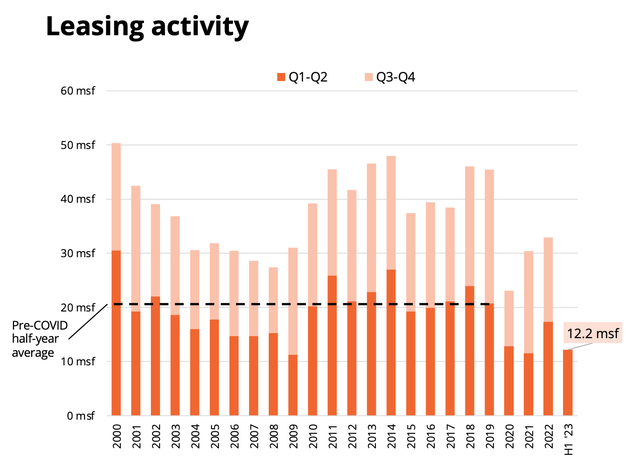

You get a very similar picture when looking at just the Manhattan market, where SL Green owns most of their properties. Leasing is down, and available space is up as seen below.

Avison Young Research Avison Young Research

However, Trophy Asset net effective rents reached all-time highs at $109, ~28% higher than pre-pandemic levels. Class A office floated around $65, just a small decline from pre-Covid levels.

Avison Young Research

All in all we can see that office occupancy and leasing trends are moving down while rental rates for Class A and Trophy assets, just like those owned by SL Green, are trending upward in the past few years.

Now let’s take a look at SL Green

The Good:

SL Green appears to be mega cheap, both from an FFO multiple and NAV perspective. Additionally, the REIT is continuing to explore growth opportunities, as evidenced by their pursuit of the Times Square casino development.

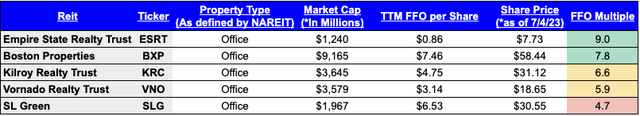

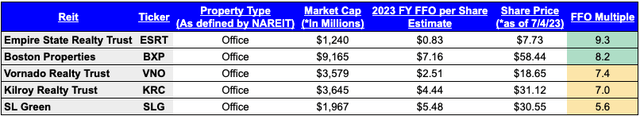

FFO Multiple

As seen below, compared to a group of sector peers, SL Green ranks dead last for both TTM and Forward FFO Multiples, and is way below the sector median of ~12.5x.

TTM FFO Multiple

PI Research

Estimated FY 2023 FFO Multiple

PI Research

NAV

Including share of unconsolidated JV investments, SLG reported about $200 million of portfolio cash NOI in Q1-2023, equating to an annualized ~$800 Million. Apply a 5% cap rate and you get about $16 billion in assets. Subtract the ~11.8 billion in liabilities, and you get around $4.2 billion in Net Asset Value (“NAV”) or ~$46 per share, which would mean shares are available today at over a 50% discount to NAV.

Times Square Casino

SL Green, in partnership with Roc Nation and Caesars Entertainment, is proposing an eight-story casino in the heart of Times Square, and competing for one of three gaming licenses to be allotted by the State of New York.

I like this as a move for SL Green, given limited supply a Manhattan-based large casino is sure to be a huge attraction and allow SL Green to grow and diversify their portfolio into the gaming and leisure space.

The OK:

Rental Rates

Excluding its One Vanderbilt and One Madison trophy offices, the company signed 41 Manhattan office leases in Q1 2023. Average rents were $64.83 per SF, compared to $68.04 in the year ago quarter.

However, SL Green is still getting excellent rent from their Trophiest of properties, One Vanderbilt, with rents peaking as high as $322 per sf! Proving that there is still huge demand for Trophy office space.

245 Park Avenue Sale… good for value confirmation but not much else

On June 26th, SL Green announced the 49.9% interest sale of the 245 Park Avenue, which is still in the middle of a planned conversion.

The market was thrilled to learn that the sale was at a valuation of $2.0 billion, demonstrating the resilience of Manhattan Office Real estate values. However, when you take a closer look you see that the asset is encumbered by $1.76 billion loan equating to 88% LTV leaving very little equity in the property and an accurate representation of SL Green’s over levered portfolio.

The Bad:

Occupancy

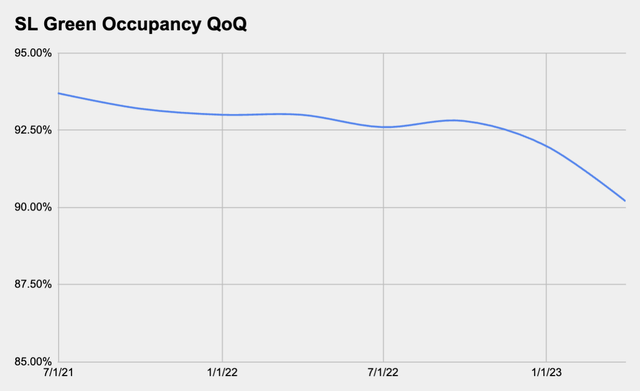

Similar to the National and Local trends, SL Green’s occupancy has been in decline.

Occupancy across SL Green’s 25 Manhattan buildings dropped to 90.2 percent in the first quarter of 2023, as reported by Crains. Down from 93% in the year ago quarter.

Below, you can see the QoQ decline in occupancy from the third quarter of 2021.

PI Research

Cash Flow

Interest expense is starting to accelerate, up over 25% on a trailing 12-month basis compared to 2022. This combined with deteriorating office economics has resulted in drop of profitability metrics. AFFO/share continues to decline, leading to more pressure on their Balance Sheet and Dividend.

Balance Sheet

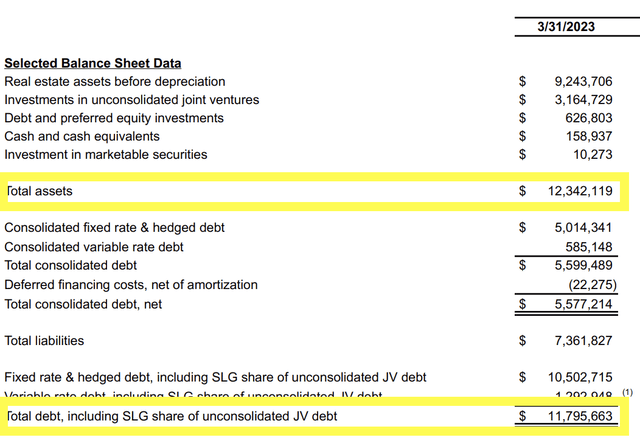

It seems that SLG proudly presents their unconsolidated JV Investments as assets, but, in some cases, fails to report the debt as liabilities.

When you take a closer look, you see that SL Green’s debt, including their share of unconsolidated JV, is almost equal to their assets at cost.

SL Green 2023 Q1 Supplemental

This large debt load is putting real pressure on the REIT. With long term debt of nearly $5.6 billion, the REIT’s Debt to EBITDA ratio floats around a sky high level of over 12x.

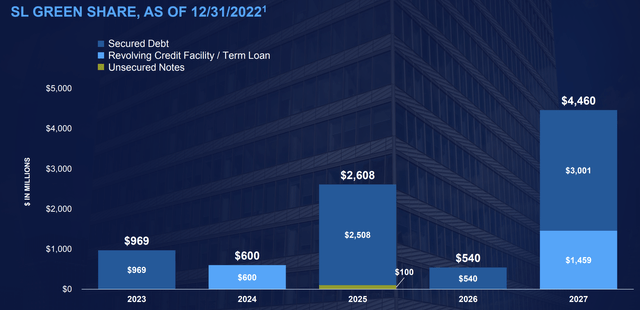

Maturity schedule

SL Green 2022 Investor Presentation

SL Green’s maturity schedule is not dire, but it’s not great either. They’ve got over $3.5 billion in debt maturing through 2025.

The REIT has approximately $160 million in cash and less than $80 million of leftover annual cash flow after paying out the dividend, which leaves two options for paying down debt: Refinancing and Asset Sales.

Given the higher interest rate environment, SL Green will be forced to refinance into higher interest rates or sell Assets through fire sales. Of course, this is a problem for all REITs right now, however given SL Green’s larger debt load on properties acquired at extremely low cap rates, it becomes more of a problem for them.

SL Green is no stranger to asset sales as they’ve been a net seller for much of the past decade, but being forced into asset sales due to maturing debt is a tough position to be in given the deteriorating industry economics.

The Bottom Line

Though this REIT screams value to me, the debt levels and leasing trends are keeping me from jumping in.

I was recently speaking to a partner at a large law firm who noted that his work from home allocation has gone up over 50% since Covid and remained that way. He remarked that they are reducing their space as soon as their current lease expires.

Including unconsolidated JV debt, SL Green’s debt at ~11.8 billion is too big of a burden and without immediate improvement in office economics it could continue to put real pressure on the REIT’s cash flow as loans mature, and interest expenses rise.

I want to want to buy SL Green, but the debt levels are too high for me to take the plunge today. Due to SL Green’s debt load paired with short term cash flow and refinance risk, I rate SL Green a speculative Hold as I expect more troubles on the horizon before a return to stability and growth. I would need to see a significant improvement in leasing rates and occupancy before I start a position in the REIT. Until then, I will continue to explore other options.

Read the full article here