There are a lot of things that I like, but overpaying for stocks is not one of them. With so many stocks generating high dividend yields across different sectors, it’s simply hard to justify paying a nosebleed valuation for a stock that’s priced for high growth, especially in the current environment.

This brings me to Nike (NYSE:NKE), which remains expensive despite falling from the ~$125 range in May. In this article, I highlight the headwinds on the stock and why there may be room for more decline before it stabilizes, so let’s get started.

Winter Is Coming

Nike recently reported fiscal fourth quarter earnings that didn’t seem bad on the surface, with revenue growing by 8% YoY on a currency neutral basis. However, growth has clearly decelerated, as this growth rate was just half of the 16% full-year revenue growth on a currency neutral basis.

Q4 revenue growth was driven in large part to Nike Direct revenues, which grew by 18% on a currency neutral basis. This growth, however, came at a cost to Nike’s wholesale business, which has been its traditional bread and butter, through retail channels such as Foot Locker (FL). This business grew by just 2% on a currency neutral basis.

While lots have been said about the benefits of shifting to a direct-to-consumer relationship, the wholesale side remains a critical component for Nike, considering the wide reach that only retail channel partners can provide. Retail partners like Foot Locker also have decades of experience in selling shoes, and Nike’s moves to shift away from these partners may have unintended consequences that may be hard to reverse. For instance, Foot Locker plans to close 400 stores this year, and that’s a trend that’s hard to reverse once it’s set in motion, with lasting impacts to Nike that may be felt for years down the line.

Moreover, shifting towards a DTC relationship is supposed to benefit margins, since that cuts out the middleman. However, gross margin is heading the other way, with it declining by 140 basis points to 43.6% during the fiscal fourth quarter.

Capital allocation also remains questionable, as management spent $5.5 billion on share buybacks during fiscal 2023. With the stock having hovered around a 30 forward PE for much of the trailing 12 months, the company is essentially achieving a 3.3% earnings yield for every dollar spent on buybacks. At this low of value accretion to shareholders, perhaps the company ought to pursue more aggressive dividend growth (which it did grow by 9% YoY) or buy higher yielding treasury and corporate bonds instead.

Looking ahead, China remains a key market for Nike, and its economy delivered less than impressive results during Q2, with GDP growing by just 0.4% over the prior year, missing analyst expectations of 1% growth. This could spell lackluster growth in that market for the remainder of the year.

Also, the recent SCOTUS ruling that student loans must be repaid means that buyers may struggle to afford premium goods like Nike products. Moreover, more nimble fast-growing brands like Hoka represent a legitimate competitive threat to Nike. According to an analyst from TD Cowen, emerging sportswear companies Hoka and On spent the equivalent of what Nike spends in 2 weeks to grow their revenue by $3 billion in recent years.

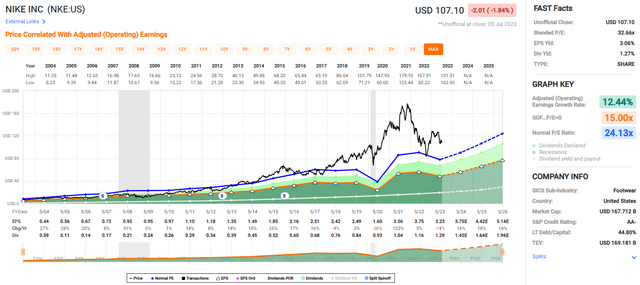

Lastly, Nike stock remains expensive at the current price of $107 with a forward PE of 29. This is considering the aforementioned headwinds and capital allocation towards buybacks that do not appear to be very accretive to shareholders. As such, I see potential for downside in the stock to a PE range of 20 to 25, which would be closer to fair value, with the expectation of a EPS growth rate in the high single digit to low teens range.

FAST Graphs

Investor Takeaway

Nike stock remains expensive despite recent declines in its share price, and there are headwinds to growth that could pressure the stock further. With gross margin declining and capital allocation decisions lacking significant value-accretion for shareholders, I believe that Nike stock may still have room to decline before it stabilizes. As such, investors should be mindful of these risks when considering the stock at the present level.

Read the full article here