Investment performance (%) as of June 30, 2023

|

Total Return |

AnnualizedReturn |

|||||

|

Inception |

Quarter |

YTD |

1 Year |

3 Year |

Inception |

|

|

Palm Valley Capital Fund |

4/30/19 |

1.62% |

4.67% |

6.73% |

6.13% |

7.52% |

|

S&P SmallCap 600 Index |

3.38% |

6.03% |

9.75% |

15.19% |

7.07% |

|

|

Morningstar Small Cap Index |

5.60% |

10.77% |

15.19% |

12.51% |

6.23% |

|

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be higher or lower than the performance quoted. Performance of the Fund current to the most recent quarter-end can be obtained by calling 904-747-2345. As of the most recent prospectus, the Fund’s gross expense ratio is 1.53% and the net expense ratio is 1.28%. Palm Valley Capital Management has contractually agreed to waive its management fees and reimburse Fund operating expenses through at least April 30, 2024. |

The Way of the Future

Few people have the imagination for reality.

-Goethe

Dear Fellow Shareholders,

In the final scene of Martin Scorsese’s 2004 drama, The Aviator, Leonardo DiCaprio, in the role of unwell billionaire Howard Hughes, is overcome by his OCD and cannot stop repeating, “The way of the future.” After his handlers usher him to a private bathroom, Hughes begins to regain his composure. He silently stares into a mirror while recalling a childhood memory. His lips briefly turn up into a soft smile as he says slowly this time, and with confidence, “The way of the future.” But he says it again. And again. And again. The pace begins to quicken. Cut to black.

At the point in Hughes’ accomplished young life when the movie ended (1947), his future was arguably bleak. Hughes went from being one of the world’s richest people to its most famous recluse, increasingly haunted by social anxiety and mental illness. This shouldn’t overshadow his impressive achievements in filmmaking (Hell’s Angels, 1930; Scarface, 1932) and aviation. A survivor of four plane crashes, in the 1930s and 40s Hughes set multiple air speed records. He acquired Trans World Airlines and later Air West. He was undeniably bullish on air travel.

World air passenger traffic grew from basically nothing in the mid-1940s to 4.5 billion passengers by the end of 2019. Hughes was right – traveling by plane was the way of the future. It changed the world.

However, as any student of market history well knows, growth in demand for air travel did not translate into favorable financial or investment performance for the providers of that travel. Not by a longshot.

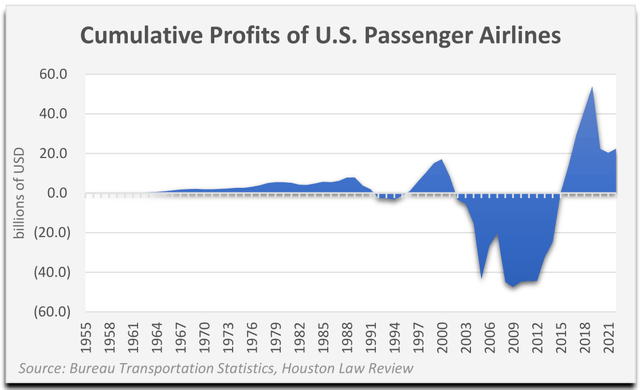

As recently as 2015, the domestic airline industry was in a since inception loss position. Airline industry dynamics improved after 2015 due to mergers and capacity reductions, even enticing Berkshire Hathaway back into the space…until Buffett bailed at the market’s early pandemic lows. In the aggregate, investing in air travel has been a gigantic disappointment, even as aviation has been a seminal human achievement.

As we stare and marvel at the NASDAQ-100 Index (NDX) up 39% year-to-date, we wonder if the Artificial Intelligence (AI) choo choo train will be any different. Considering the mindless investment crazes of the past few years, from meme stocks and SPACs to altcoins and NFTs, AI may be the most credible bubble. There are real companies involved, and most people who have toyed with ChatGPT 4.0 believe it can be harnessed to improve productivity. Even value investors cursed by a lack of imagination, like us, are amused and intrigued by the latest AI tools.

We asked Microsoft’s (MSFT) Bing Image Creator, powered by DALL-E, to make a bronze bear statue in the same style as the Charging Bull near Wall Street (pictured). Neat, right?

Today, ChatGPT seems most beneficial for quickly producing well-articulated generic content. Seeking mainstream, CliffsNotes answers to questions that don’t involve recent events? ChatGPT dunks on Google.com. Usually. Google’s (GOOG,GOOGL) AI bot, Bard, comes across as a dumber imitator. Ask ChatGPT how money printing is a threat to Western civilization, and you will receive a cogent, synthesized hedged response. On the other hand, it can’t tell you the address for Palm Valley Capital Management, which is child’s play for conventional search engines. “Hallucinations” (fake information) are also a risk. For now. While AI may not change our lives or yours as Fund shareholders anytime soon, we can imagine how later iterations might be able to enhance our ability to research companies. However, like most of Wall Street, AI is too programmed to autonomously succeed at absolute return investing. While the technology appears transformative and disruptive to certain roles, in our opinion, overall progress is more likely to come in small steps than giant leaps. Faster. ☑️Cheaper. ☑️ Better.❔

On the bullish end of the spectrum are AI zealots who expect by the end of the decade for everyone to have their own android butlers while humankind collects universal basic income payments from OpenAI, purveyor of ChatGPT. That assumes the Jeeves Army hasn’t wiped out the human race by then! Venture capitalist and book talker extraordinaire Marc Andreesen recently declared, “AI is quite possibly the most important-and best-thing our civilization has ever created, certainly on par with electricity and microchips, and probably beyond those.” Beyond electricity! The computers powered by electricity and microchips generating all those gorgeous AI calculations might beg to differ. The ChatGPT engine itself will tell you that its output doesn’t reflect “understanding” in the human sense, but a mathematical approximation based on patterns found online, with no ability to independently verify information or check its accuracy.

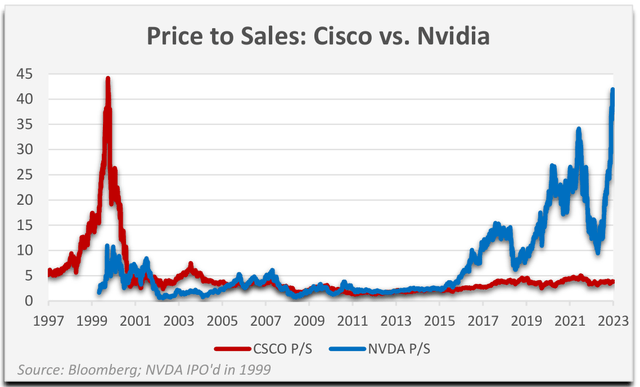

Regardless of how groundbreaking this technology may turn out to be, experience tells us to not jump on a bullet train moving at 200 MPH. Back in 1999, Cisco (CSCO) was perceived as the picks and shovels stock for powering the Internet. Alas, it couldn’t possibly justify its peak $546 billion market capitalization and 45x revenue valuation, with shares collapsing 89% from their March 2000 all-time high and still not fully recovering over two decades later. Just as Cisco’s products powered the Internet explosion, Intel’s (INTC) processors the PC revolution, and IBM dominated the early computer market, new trillion-dollar club member Nvidia (NVDA) is the vanguard of the AI boom, along with Microsoft. If the U.S. government attempted to split up Microsoft at the turn of the century because it used its operating system dominance to promote Internet Explorer over Marc Andreesen’s Netscape, imagine what the DOJ will demand of Microsoft’s 49% stake in OpenAI. There is no margin of safety in stocks that price in world domination.

As for the notion that AI will simply bring productivity gains that are broadly distributed as profit enhancements across Corporate America and beyond, how much more margin accretion do investors think labor will tolerate? Wages are still catching up to 2022’s inflation. They may never catch up to the decades of asset inflation that preceded it. Nevertheless, scores of companies, including a few held in Palm Valley’s portfolio, are pushing out press releases touting their AI plans and capabilities. Existing processes are being relabeled as “AI.” It all seems very marginal and opportunistic to us, at this stage. The earnings of Meta Platforms (META) are down 45% from the 2021 peak, but the stock has more than doubled year-to-date as Ultimate Fighter CEO Zuckerberg said AI-generated recommendations for content on Facebook and Instagram are driving results. Let’s not forget about the metaverse. It was less than two years ago that virtual real estate was billed as the next big thing.

Since the beginning of 2023, a capitalization-weighted basket of seven mega cap tech stocks has gained 61%. Facebook, Apple (AAPL), Tesla (TSLA), Microsoft, Amazon (AMZN), Nvidia and Google (“FATMANG”) have accounted for 10.5% of the S&P 500’s (SP500) 16.9% year-to-date performance. Until June, these firms were the only show in town, even though the combined operating income for the group fell 4% year-over-year for the latest quarter. This is worse than the average S&P 500 company’s earnings growth (+1%).

Strong employment is supporting corporate earnings. When you have a job, you’ll spend. However, even with a robust labor market, the economy seems to be sputtering. Nearly half of domestic banks are tightening lending standards for business loans. The last four times it was this tough to get a business loan were 2020, 2008, 2001, and 1990. The Small Business Optimism Index is the lowest in a decade.

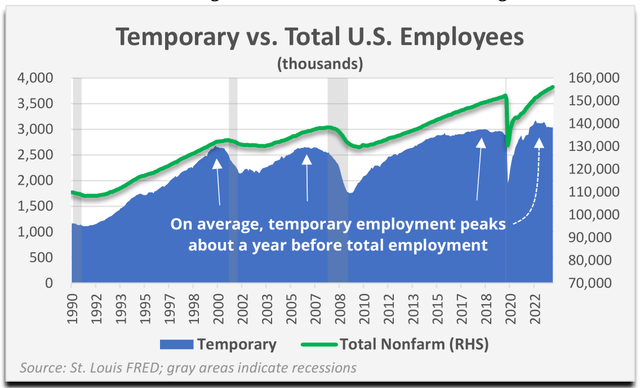

The Conference Board’s leading economic indicators are screaming recession, with stock prices an outlier component showing strength. While we prefer bottom-up signals over macro indexes, this would be the first time since 1960 when the leading indicators turned negative that the U.S. didn’t enter a recession. Temporary staffing turned down a year ago. Typically, when this happens, full-time employment follows with a lag. The clock is ticking.

Charge-offs are rising consistently at credit card issuers like Capital One (COF) and Discover (DFS), and delinquency rates are worst among the young, even though student loan repayments haven’t even resumed yet. After a gangbusters pandemic performance, home improvement and furniture chains are falling back to earth, with Home Depot (HD) citing less spending by consumers on big ticket items. Poor people are suffering.

Consumer staples companies have successfully passed through higher costs, and then some, in what many are calling “greedflation.” Big Lots has been massacred, showing that lower-end discretionary spending could be in deep trouble.

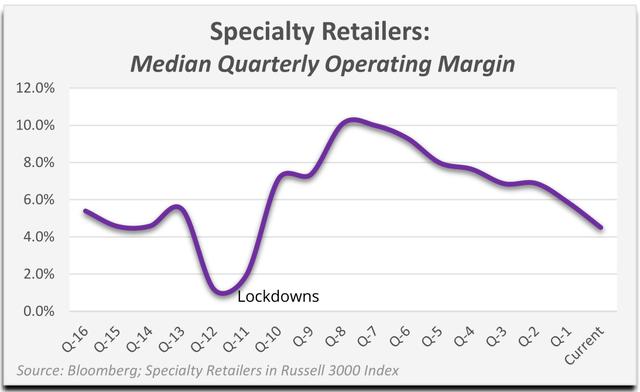

In 2023, investors latched onto AI to help forget about the mini banking crisis, but in June the rally broadened significantly. Many investors are not expecting a significant economic downturn or severe impact to earnings. S&P 500 profit margins edged higher in the first quarter after six straight quarters of declines. Results at smaller firms were comparatively worse, with lower average earnings (-6% for S&P 600 firms) even as revenues have been boosted by inflation. Profits are down, but really not much compared to the post-pandemic surge. Approximately 45% of S&P 600 small caps reported higher year-over-year profits in the most recent quarter. It won’t last, in our opinion. The largest earnings declines have been experienced by the primary pandemic beneficiaries. Specialty retailer margins have sunk toward pre-pandemic levels. Earnings are now catching down to the low valuation multiples we’ve seen for many retailers over the past year.

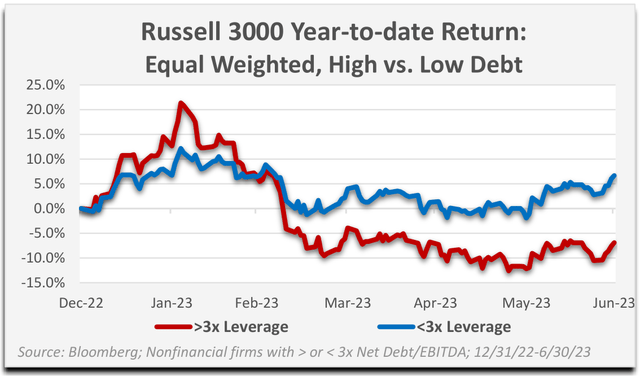

Quality company valuations are still very inflated, in our view. The median nonfinancial EV/EBIT multiple for the S&P SmallCap 600 Index (SP600G) is 19x. In January, stocks of companies with weaker balance sheets rose faster, but this unwound quickly. By March, higher debt was associated with weaker investment performance. As of the end of the second quarter, nonfinancial businesses with more than 3x leverage (Net Debt/EBITDA) had underperformed others this year by 1,350 basis points, on average.

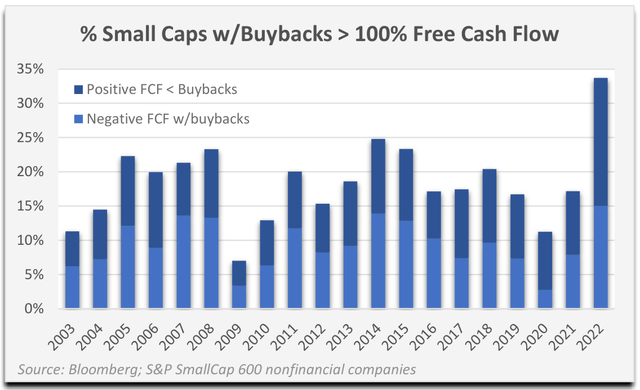

A growing number of small caps find themselves in the unfortunate position of having a market cap lower than their cumulative free cash flow (FCF) over the last five years. In some cases, this has resulted from an extremely aggressive pace of share repurchases. Last year saw the highest percentage of small firms spending more than 100% of their free cash flow on buybacks in at least twenty years.

The lowest percentage year was 2009. Over the last two decades, small caps have spent 50% more than their collective free cash flow on buybacks, dividends, and acquisitions. They borrowed the difference. Certainly, some firms account for a disproportionate amount of the excess. Nonetheless, it has been a fairly common practice for small companies to live beyond their means. The Fed has trained them to act that way. Then, one night they showed up at the dinner table, and it’s, “No soup for you!”

Higher rates are crippling the commercial office sector. Green Street pegs commercial office building values down 25% from the peak a year ago. Celebrations that we’re past the banking crisis may be premature. Nevertheless, the Fed is funneling money to needy banks in various ways, in the front door (e.g., Bank Term Funding Program) and through the back (e.g., Federal Home Loan Bank advances). In spite of higher rates, homebuilder-linked stocks honey-badgered their way to a spot among the best- performing sectors so far in 2023 (+34% for S&P Homebuilder Select Index). To make the math work, we believe many of today’s homebuyers are counting on refinancing once the Fed cuts rates. Few seemed to believe Chairman Powell when he said in June lower rates probably won’t happen until “a couple of years out.” The federal budget deficit is over $2 trillion again. This embarrassing overspending has never occurred when employment was so strong. We suspect calls to reduce interest rates will continue to grow louder. Nothing is fixed.

For the three months ending June 30, 2023, the Palm Valley Capital Fund (MUTF:PVCMX) gained 1.62% versus a 3.38% return for the S&P SmallCap 600 Total Return Index and an increase of 5.60% for the Morningstar Small Cap Index. During the quarter, the securities within our portfolio returned 4.78% before fees and the impact of cash. The Fund ended the period with 82% held in cash equivalents.

We are incredibly grateful for the faith shareholders have placed in Palm Valley since our Fund’s launch in May 2019. Starting a new mutual fund today, without the backing of an entrenched fund complex, is an uphill battle. We could not have gained the distribution we have without our early supporters. Thank you!

We understand our strategy may not be a good fit for all investors, but we feel we’re offering something unique. We believe an absolute return strategy’s results are best reviewed over a full market cycle. In our opinion, the 2020 plunge in equities was too brief to be considered the end of the bull market that began in March 2009. Furthermore, the market decline of 2022 didn’t even fully reverse the 2021 mania.

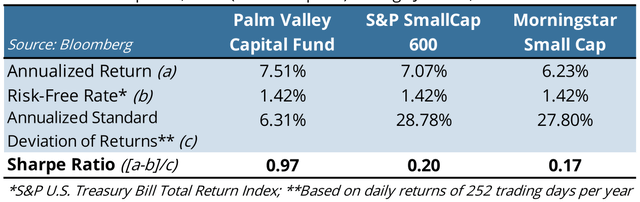

We believe the Palm Valley Capital Fund’s risk-adjusted performance since inception stacks up well compared to our small cap benchmarks. Nevertheless, our primary goal is to achieve favorable absolute returns, and this requires attractive equity valuations. We expect stocks to eventually constitute more than just one-fifth of our managed assets, but until markets are more broadly appealing, we will continue to do our best to maximize returns with the value that’s available to us.

Risk-Adjusted Results: Sharpe Ratio (April 30, 2019 (Fund Inception) through June 30, 2023)

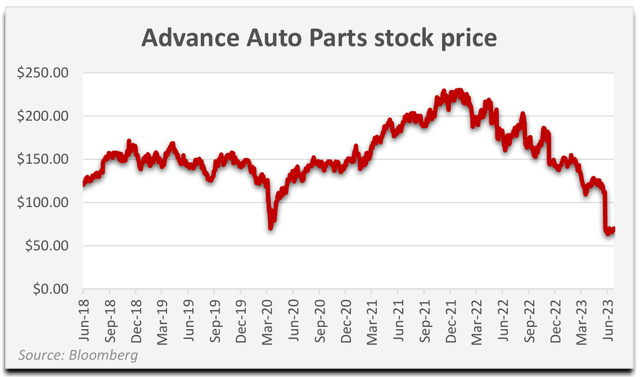

We acquired small stakes in two new names during the quarter: Advance Auto Parts (AAP) and TrueBlue (TBI). Advance Auto Parts is an automotive aftermarket parts provider serving professional installers and do-it-yourself customers. Palm Valley briefly owned the stock during the 2020 lockdowns, when the shares quickly reached our valuation. Advance has almost 5,000 U.S. locations. Margins for the business have been inferior to those of O’Reilly (ORLY) and AutoZone (AZO), two leading competitors. This is due both to customer mix and operating efficiency.

The shares of Advance plummeted from a high of $230 reached in January 2022 to the $60’s in June 2023. Profitability is being negatively impacted by pricing decisions designed to bolster market share in the professional sales channel.

As a result, the firm reduced earnings guidance and its dividend. Auto parts retailers have historically been recession-resistant and are benefiting from the expanding average age of vehicles. While there remain risks, such as growth in electric vehicles that require fewer parts, we believe Advance’s stock is cheap based on normalized earnings. Furthermore, we expect its balance sheet to improve later this year as inventories decline and operating margins rise.

TrueBlue is a leading provider of staffing and recruitment solutions for blue collar manufacturing, transportation, and warehouse roles. While overall U.S. employment remains very strong, demand for contingent workers has turned lower since the end of last year. Investors have pushed the stocks of public staffing firms sharply lower, and the industry appears to be one of the few that is pricing in a recession. After the company recently posted a first quarter 2023 loss, TrueBlue’s shares fell to the lowest levels reached since the 2020 COVID lockdowns. Management expects profitability to rebound sequentially in the seasonally stronger second quarter. While we expect operating performance to further deteriorate in 2023 with a weakening economy, TrueBlue has historically remained profitable even during tough times. The company carries no debt and has been a reliable generator of free cash flow. The stock was trading for 7x operating profit and 9x normalized free cash flow at the time of our purchase.

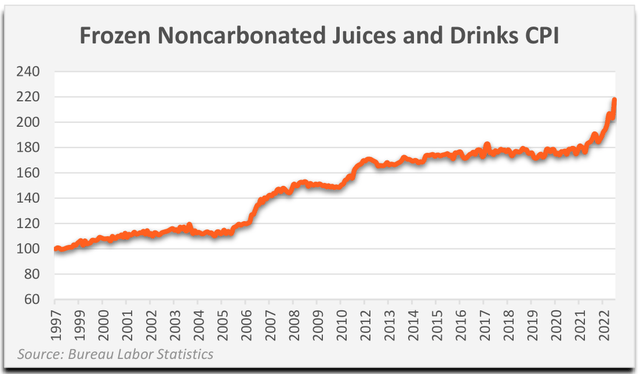

We significantly increased our weighting in Lassonde Industries (OTCPK:LSDAF) this quarter when the stock declined to multiyear lows. Recent sales growth has been robust due to sharp price increases for the company’s fruit juices and drinks. Gross margins have been pressured by soaring input costs for apple and orange concentrate, but price increases are beginning to catch up to cost inflation. Transportation expenses are also falling. The firm is engaging in a strategic overhaul to improve the performance of its U.S. operations, which account for 56% of revenue but have generated scant profitability.

The U.S. segment delivered its first profit in a year last quarter. Fortunately, Lassonde’s Canadian business is solid, and earnings exclusively from this geography were more than enough to support recent trading levels. Lassonde’s shares sell for less than 6x normalized and 9x trailing EV/EBITA, and even these multiples are probably inflated by excessive inventories that will be partly worked down as the year progresses.

During the second quarter, the Fund fully exited three positions. Oil Dri (ODC) was sold after the stock exceeded our valuation. We also sold our stake in SSR Mining (SSRM) as the shares approached our intrinsic value estimate, and the company’s operational and financial risk increased after it announced a new investment in the Hod Maden Gold-Copper Project based in Turkey.

Lastly, we exited our stake in Natural Gas Services (NGS). The firm’s aggressive expansion plans have elevated capital expenditures and increased debt significantly, and we anticipate borrowings that will exceed our maximum threshold of debt-to-free cash flow for cyclical businesses.

The three securities contributing most to the Fund’s second quarter return were Crawford & Co. (CRD.A, CRD.B), Oil Dri, and TrueBlue. Crawford’s stock has been jumpstarted this year by Hurricane Ian weather-related claims activity and a budding turnaround in its International segment. First quarter revenues increased 15% in constant currency and operating income doubled. The shares have traded at a depressed valuation for several years, reflecting stagnant operating performance, but they are now more fully pricing in Crawford’s normalized profitability.

|

Top 10 Holdings (6/30/23) |

% Assets |

|

Sprott Physical Silver Trust (PSLV) |

3.13% |

|

Lassonde Industries (OTCPK:LSDAF) |

2.60% |

|

Crawford & Company (CRD.A) (CRD.B) |

1.93% |

|

Sprott Physical Gold Trust (PHYS) |

1.84% |

|

Miller Industries (MLR) |

1.36% |

|

WH Group (ADR) (OTCPK:WHGLY) |

1.33% |

|

Kelly Services (KELYA) |

1.16% |

|

Gencor Industries (GENC) |

0.90% |

|

Hooker Furnishings (HOFT) |

0.89% |

|

Carter’s (CRI) |

0.72% |

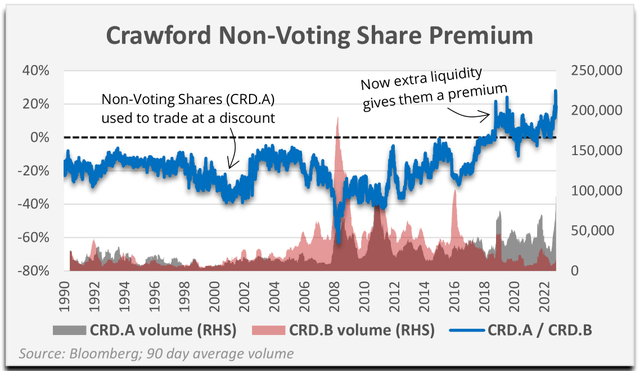

One of the more interesting facts related to Crawford is the diverging performance between its voting and non-voting share classes. For most of the firm’s public history, the voting shares (CRD.B) have traded at a meaningful premium to the non-voting class (CRD.A). However, the company and its controlling shareholder have continued to mop up the voting class, draining its prospective liquidity.

As a result, a couple years ago index providers switched Crawford’s representation to the non-voting share class. What was formerly a consistent 20%+ discount for the non-voting shares has morphed into a 20%+ premium. The Fund primarily owns Crawford’s non-voting shares because it has become more difficult to trade the other class. We have reduced our weighting in Crawford as the shares have closed in on our valuation.

Oil-Dri Corporation of America, producer of sorbent mineral products, was also a top contributor during the quarter. Fiscal third quarter revenues reached an all-time high of $105 million, increasing 23%, while earnings per share rose to $1.94 from $0.35. Operating results benefited from higher selling prices and a decline in the cost of natural gas used in its manufacturing process. Trends improved in all divisions, including cat litter, fluids purification, and agricultural products.

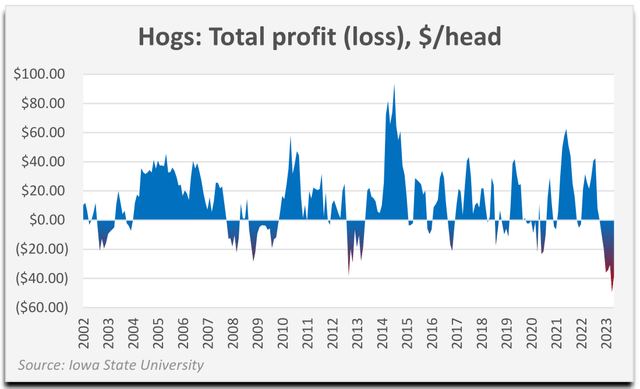

The Fund had two positions that negatively impacted quarterly performance by more than 10 basis points: Sprott Physical Silver Trust (PSLV) and WH Group (OTCPK:WHGLY). Silver didn’t suffer much of a hit during the quarter, but it was down modestly as investors warmed to equities all over again and risk-free yields are currently providing an alternative to precious metals. This is not WH Group’s first time on the Fund’s top decliner’s list. The shares appear extremely cheap, which can be explained by two attributes that are appalling to some U.S. investors: raising hogs and investing in China. Hog farming is a tough business. The CEO of Smithfield, a WH subsidiary, recently predicted that severe industry conditions will lead to a reduction in the hog herd size, which should support hog prices. Hog farming is cyclical, so we expect it to recover.

Regardless, the company’s profitability is driven more by sales of packaged meats (i.e., the Smithfield bacon you buy from the grocery store) than operations downstream.

On the second issue-Chinese exposure-it’s a risk, but one we feel is priced in. WH Group is a global enterprise that has a track record of solid profitability, with its two primary businesses in China (Shuanghui) and the U.S. (Smithfield). The entire valuation of WH Group today can be supported by the value of the U.S. business alone, in our opinion. Nevertheless, the company is controlled by Chinese management, and investor sentiment toward China drives movements in WH Group’s share price. We believe the shares are deeply undervalued at less than 5x EV/EBIT but have limited our position size due to China uncertainty.

Behold the turtle. He makes progress only when he sticks his neck out.

-James Bryant Conant

A naive teenager who just watched an action flick featuring an untethered, plunging elevator may wonder why the occupants didn’t jump up at the last possible moment to survive. It’s often the same escape plan for bubble investors, who disregard the velocity of descent and the roof crashing down from above.

Artificial intelligence may be revolutionary. Investing in hype is not. Like tormented Leo at the end of The Aviator, the modern speculator’s market is stuck on repeat, rushing from one trend to the next. During the first five months of 2023, the market’s heavy lifting was performed by seven AI-linked mega cap stocks. In June, after the phony fears of the debt ceiling standoff dissipated, small caps joined the party. The fundamental underpinnings to the small cap rally are thin. Earnings are declining. The weight of higher interest rates is pressuring borrowers. We expect the turbulence to cause real damage to income statements and stock prices. Weaker operators are already under stress, with year-to-date corporate bankruptcy filings the highest in over a decade.

Our counterintuitive opinion is that the investors sticking their necks out today are the ones taking less risk with their capital. By choosing to be underallocated to equities, you are exposing your portfolio to a potential loss of purchasing power in an economy that has been driven by asset inflation. This has been an exceedingly difficult choice for most investors since the credit crisis and until very recently when risk-free yields improved. Even with today’s improved rates, equity bulls could rightly claim, who cares about 5% in a Treasury over a year when you could generate that in two days in June? Or as one options-trading friend quipped, “I make that before breakfast.”

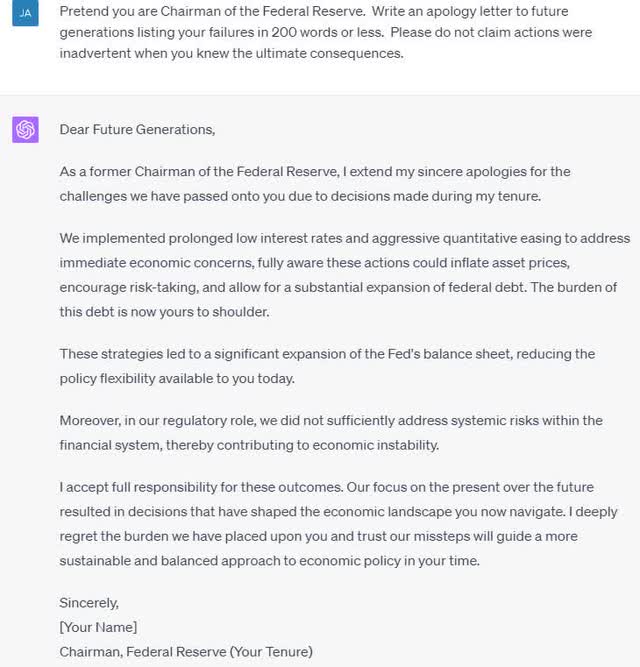

In the longer term, it will be interesting to observe how the central bank prioritizes its stated mandate to manage inflation and employment versus inevitable political pressure to help the government deal with its massive liabilities. Today’s higher rates are increasingly encumbering, so we doubt they can last. We’re delighted there is a yield right now, but when a difficult decision must be made, the Fed will always choose today over tomorrow. It’s the world’s most important marshmallow test, and the outcome is tragically preordained. Inflation is receding at the moment, but on the menu of choices to ultimately address excessive debt, inflation is always the signature dish. We asked ChatGPT to weigh in:

Aye, robot! Step 1: Admitting mistakes. This is the way of the future.

Thank you for your investment.

Sincerely,

Jayme Wiggins | Eric Cinnamond

|

Mutual fund investing involves risk. Principal loss is possible. The Palm Valley Capital Fund invests in smaller sized companies, which involve additional risks such as limited liquidity and greater volatility than large capitalization companies. The ability of the Fund to meet its investment objective may be limited to the extent it holds assets in cash (or cash equivalents) or is otherwise uninvested. Before investing in the Palm Valley Capital Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. The Prospectus contains this and other important information and it may be obtained by calling 904-747-2345. Please read the Prospectus carefully before investing. Past performance is no guarantee of future results. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security. Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding or the Fund. The S&P SmallCap 600 Total Return Index measures the small cap segment of the U.S. equity market. The index is designed to track companies that meet specific inclusion criteria to ensure that they are liquid and financially viable. The Morningstar Small Cap Total Return Index tracks the performance of U.S. small-cap stocks that fall between 90th and 97th percentile in market capitalization of the investable universe. It is not possible to invest directly in an index. The Palm Valley Capital Fund is distributed by Quasar Distributors, LLC. Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice. |

Definitions:Bank Term Funding Program: Emergency lending program created by the Federal Reserve in 2023 to provide liquidity to U.S. banks. Basis point: One hundredth of a percentage point (0.01%). Capitalization-weighted: A method of measuring a group of companies where the weighting assigned to each is based on its market capitalization, so larger firms represent a larger share of the total. Conference Board: A nonprofit research organization that distributes economic information. Constant currency: Financial results stated as if there was no change in the value of exchange rates over the period. CPI (Consumer Price Index): A measure that examines the weighted average of prices of a basket of consumer goods and services. EBITDA: Earnings before interest, taxes, depreciation, and amortization. Equal-weighted: A method of measuring a group of companies where the same weighting is assigned to each member. EV/EBIT: Enterprise Value of a company (Market Capitalization – Cash + Debt) divided by its trailing twelve- month Earnings Before Interest and Taxes (i.e., operating income). EV/EBITA: Enterprise Value of a company (Market Capitalization – Cash + Debt) divided by its trailing twelve-month Earnings Before Interest, Taxes, and Amortization of acquired intangible assets. Federal Home Loan Bank: A system of regional banks that lend to U.S. financial institutions. Free Cash Flow: Free Cash Flow equals Cash from Operating Activities minus Capital Expenditures. IPO: An initial public offering is when a private company first offers shares to the public. Mega cap: The largest public companies, which have a market capitalization exceeding $200 billion. Nasdaq 100: The Nasdaq 100 is a capitalization-weighted stock market index comprised of equity securities issued by 100 of the largest non-financial companies listed on the NASDAQ exchange. Net Debt: A company’s total debt minus cash and equivalents. NFT (Non-fungible token): Cryptographic tokens on the blockchain that can’t be replicated. Price to Sales (P/S): The ratio of a stock’s price to the company’s sales per share. Russell 3000: The Russell 3000 Index is an American stock market index based on the market capitalizations of the largest 3,000 publicly traded companies. S&P 500: The Standard & Poor’s 500 is an American stock market index based on the market capitalizations of 500 large companies. S&P Homebuilder Select Index: Stocks from the S&P Total Market Index (large, mid, small and micro-cap) that are classified in the GICS Homebuilding sub-industry. S&P U.S. Treasury Bill Total Return Index: A market-value weighted index that seeks to measure the performance of the U.S. Treasury Bill market. Sharpe Ratio: A risk measure indicating the average return minus the risk-free return divided by the standard deviation of the return on an investment. Small Business Optimism Index: A composite index of ten components that provides an indication of the health of small businesses in the U.S. SPAC (Special Purpose Acquisition Company): A publicly traded company created to acquire an existing publicly traded company. Standard deviation: A measure of the dispersion of a dataset around its average. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here