Companhia de Saneamento Básico do Estado de São Paulo – SABESP (NYSE:SBS) is a Brazilian company that operates as a mixed economy enterprise and holds the concession for water and waste management services in the State of São Paulo – the most populous and recognized as the economic powerhouse of Brazil. The State of São Paulo is Sabesp’s majority shareholder, owning 50.3% of the company’s total shares.

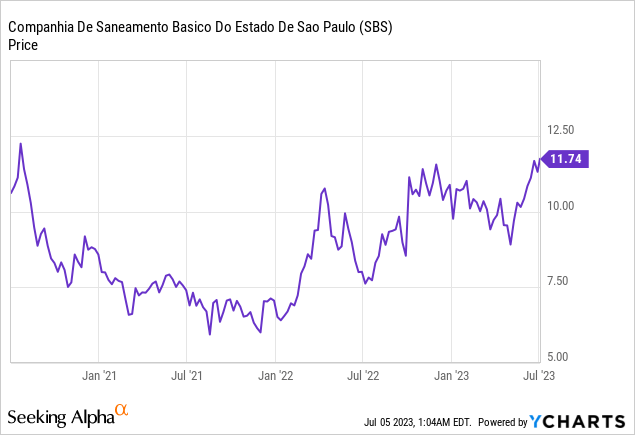

Sabesp’s shares have been severely punished in recent years in the face of the water crisis in Brazil, affecting its revenue generation mainly after the pandemic.

However, with São Paulo’s state government increasingly considering the company’s privatization, Sabesp’s shares have been significantly impacted by this development. Potential privatization is expected to impact the company’s operations and efficiency positively.

Despite experiencing high volatility recently, Sabesp trades at discounted valuation multiples. Given that there is still a long way to go before privatization occurs, I believe that the performance of Sabesp shares may be negligible, considering the defensive nature of the utilities sector and the prevailing trend of interest rate reduction in Brazil throughout the semester.

Therefore, I remain hesitant to invest in the company guided by expectations of privatization.

Sabesp’s latest results

Sabesp’s most recent results were satisfactory, given a few blemishes in a few areas that affected the company’s net profit generation.

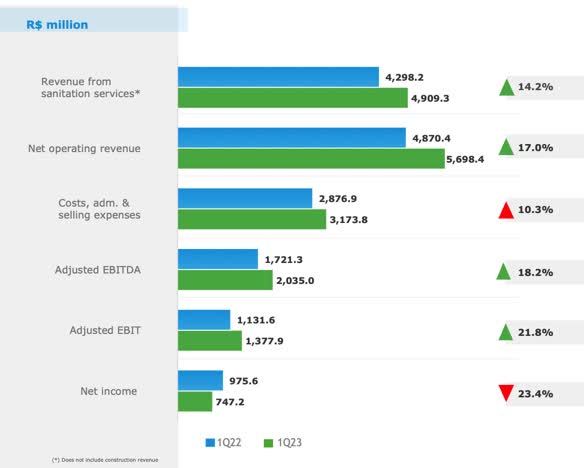

In the first quarter of 2023, the sanitation company reported net operating revenues of R$5.6 billion, representing a 17% increase year-on-year. The explanation for this increase lies mainly in the positive impact of the fare adjustment of 12.8% in May last year and the small growth in total invoiced volume – about 14% YoY. Construction revenues explain another increase in this number, as it grew 32.8% YoY as a reflection of the company’s increased investment.

Sabesp’s Investor Relations

On the ugly side, financial expenses rose 49% YoY to R$257 million. The increase in the cost of debt and the rising interest rate in Brazil, which currently stands at 13.75%, were responsible for the rise in financial expenses. In addition, operating costs and expenses increased by 15.6% compared to the same period in 2022, with a reported amount of R$4.3 billion.

These costs showed double-digit gains, with material costs rising by 15% and personnel costs increasing by 11%.

On the other hand, the company made significant progress by approving the implementation of the Incentive Dismissal Program (IDP), estimating a workforce reduction of about 2,000 people, which should boost the company’s efficiency by easing costs.

Looking at adjusted EBITDA, Sabesp reported a growth of 18.2% versus the same period last year, totaling R$2.03 billion. EBITDA margin exceeded market expectations as Sabesp reported 35.7% versus a consensus of 35.3%.

Finally, looking at net income, Sabesp reported R$747 million in its first quarter of 2023, which indicates a decrease of 23% YoY. Although the drop, the main driver that sustained this profit was the R$512 million positive exchange rate variation that occurred in the same period last year, which distorted the company’s profit, putting the bar much higher.

Privatization at the core of the thesis

Since Sabesp became the target of the private sector, its trading performance has been in line with the rumors surrounding its privatization, guiding the investment thesis of many investors in Sabesp.

The market views the company’s privatization positively due to expectations of improved operational and management efficiency, access to capital and investment, and greater transparency and accountability. Therefore, privatization would allow Sabesp to become more efficient, attract investors and obtain resources for expansion and innovation while reducing political interference and promoting more transparent governance.

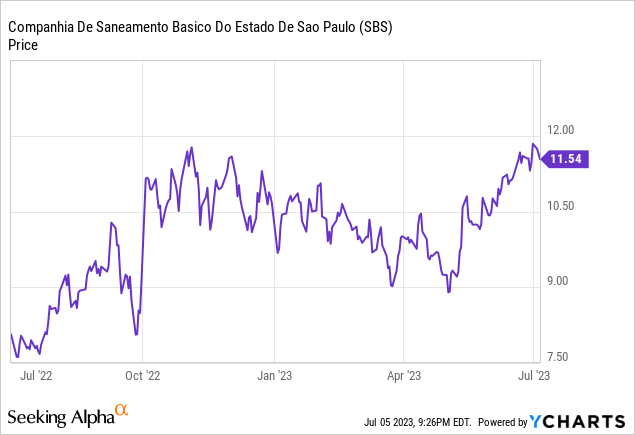

The new governor of São Paulo elected at the end of last year, Tarcisio de Freitas, defends a liberal pro-privatization agenda and has made clear his intentions to privatize Sabesp during his term in office, something that has excited the market with the signaling of Tarcisio’s election in October of last year pushing Sabesp shares up 40% by the beginning of this year.

The most recent pro-privatization update occurred in April of this year when the governor of São Paulo took the first step by signing a decree authorizing the state to contract studies for the privatization of the company. The completion of the study is expected to be in early 2024. However, a few analysts expect privatization to only take place in 2025 after the municipal elections due to the risk of the operation.

Another drawback, closely tied to the anticipation of imminent privatization, stems from the recent amendments to the “Basic Sanitation Legal Framework.” These changes essentially make it easier for state-owned companies that haven’t demonstrated sufficient financial capacity to continue operating.

However, the changes currently at risk of being overturned by Congress were initially planned to be enacted through an executive order known as a decree. This shift has created heightened legal uncertainty for potential investors considering involvement in the sector.

The new regulation eliminates the 25% limit on subdelegating concession contracts to Public-Private Partnerships (PPPs). Now, there is no specific limit on this type of partnership. This means that public companies with concession contracts can establish partnerships with the private sector without predefined restrictions on the amount of responsibilities that can be transferred to PPPs. The alteration in question provides more flexibility for public companies and expands the possibilities for collaboration with the private sector in infrastructure and public services.

In my opinion, a wave of privatization should take over the sanitation sector in Brazil, tendering out concession areas as soon as the goal of failing to meet the access to water and sewage services for the population. In São Paulo (the city) alone, until last year, about 1.5 million people lived in a property without a sewer connection.

Moreover, the high competition resulting in significant prizes in recent auctions has made governors reconsider keeping an inefficient and poorly managed state-owned company under their command.

In this way, updating the legal framework allows the sector’s maintenance to limit growth and political interference—something certainly negative for Sabesp as investors should be discouraged from joining the industry via new privatization auctions.

The valuations are somewhat attractive.

A widely used multiple to value companies with the nature of utilities such as sanitation is the EV/RAB (Enterprise Value/Regulatory Asset Base), where the RAB refers to the value of Sabesp’s assets considered essential to provide the regulated services. These assets include water distribution networks, treatment plants, and sewage systems. As such, the EV/RAB ratio helps give a perspective of Sabesp’s market value concerning the regulatory assets that support its operations.

Currently, Sabesp trades at multiples of 0.8 times its EV/RAB. As the multiple goes below 1, the company’s market value is lower than its regulatory assets, suggesting it is trading at a discount. This discount is likely due to concerns about the company’s operational efficiency.

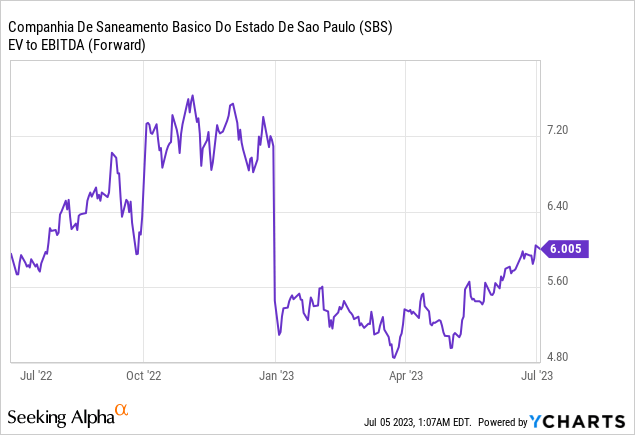

Looking ahead, when analyzing Sabesp’s forward EV/EBITDA multiple, the company is also currently discounted according to trades at 6 times, something around 40% below the industry average.

The bottom line

The investment thesis for Sabesp revolves around the potential privatization event, which could unlock significant shareholder value.

However, I consider investing in Sabesp based solely on the privatization case quite risky, as it still has a long way to go before yielding results. If privatization does occur, it could be a significant success, leading to substantial upside. Sabesp currently trades at a discounted EV/RAB multiple, and if privatization proceeds as anticipated, it has the potential to generate immense value for shareholders in the future.

However, there are considerable risks to consider, such as the impact of the new Basic Sanitation Legal Framework, which may present obstacles and potentially weigh down the company’s share performance for an extended period.

Considering that Brazil’s economy is showing signs of improvement, with indications of reduced inflation and the possibility of lower interest rates by year-end, the defensive investment thesis is diminished due to Sabesp’s business nature.

Therefore, I prefer to be in a neutral position, as I view the speculation surrounding privatization as the primary driver for Sabesp shares.

Read the full article here