Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

During the second quarter, the economy continued to tread a path of “better than feared, but far from strong.” US economic data remained steady, but not spectacular. The labor market stayed strong and financial conditions continued to be quite easy despite the best efforts of central bankers around the world. A debt ceiling crisis was averted, and the systematic bank failure that many people feared in the wake of the Silicon Valley Bank (OTCPK:SIVBQ) collapse did not come to pass. Inflation data moderated and market participants grew more confident that the Federal Reserve was largely done with its current tightening cycle.

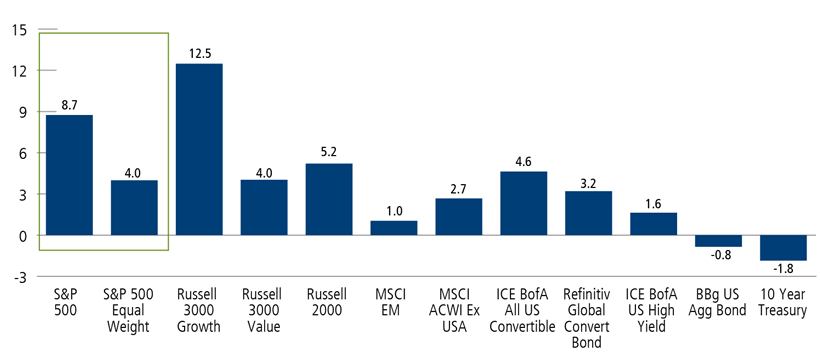

During the quarter, the market-cap-weighted S&P 500 Index gained 8.7%, crossing into bull market territory from the lows of 2022. However, the rally was remarkable for its narrowness – a handful of mega-cap names with a strong emphasis on technology drove the gains of the index. Meanwhile, most other stocks in the S&P 500 posted more modest returns, as measured by the Equal Weight Index’s advance of 4.0%. Convertible securities continued to tally up gains, and small caps found their footing, with the Russell 2000 Index advancing a brisk 5.2%. Global benchmarks also advanced but at a more moderate pace than in the first quarter.

Global Asset Class Returns, 2Q 2023

Past performance is no guarantee of future results. Source: Morningstar. Data as of 6/30/23 for the Refinitiv Global Convertible Bond Index, the most recent available.

The quarter will also be remembered – likely for decades to come – for the mass adoption of the first AI “killer app” ChatGPT. AI dominated earnings calls as the mainstream media focused on little else. Our teams are getting many questions about if and how AI will reshape the world. Certainly, AI offers tremendous potential to drive productivity enhancements and additional innovations across all sectors of the economy – far beyond larger-cap tech names. As our teams discuss in their commentaries, they are carefully analyzing the different opportunities they see within their asset classes.

Looking to the second half of the year, we believe the US can continue on a growth path, albeit at a slowing pace. Although inflation is moderating, we’re not out of the woods, and fiscal policy uncertainty will only increase as the US presidential election grows nearer. Fed policy has become less of a focal point of investor anxiety, but only time will tell how successful the central bank has been in taming inflation and draining the unprecedented liquidity it pumped into the economy over the years. Other wildcards include how economic growth in China unfolds and geopolitical conflicts.

We expect that the extraordinarily narrow equity markets will broaden their leadership, with growth-oriented quality companies having the edge. In the fixed income markets, we’re seeing more variation in credit fundamentals.

We believe the Calamos funds are well positioned. Across asset classes, attention to fundamentals, individual security selection, and risk management will be paramount for navigating higher short-term rates and a moderating economic recovery. It will also be essential to understand the thematic drivers that are disrupting the status quo and creating new winners or losers. Of course, AI is the first that likely comes to mind, but it is not the only one, as you’ll see in our team’s commentaries.

In this environment, we encourage investors to maintain well-diversified asset allocations. Given our expectation that equity markets will broaden, there are opportunities across the capitalization spectrum, supporting the case for multi-cap approaches and small caps. As you’ll read in our investment team commentaries, there are also many reasons to be excited about non-US markets, including a number of emerging economies.

Given our expectation of continued market volatility, we see tailwinds for convertible securities, which combine equity and fixed income characteristics. Through active management, convertibles can offer benefits that stocks and bonds alone cannot by providing participation in equity upside with downside risk mitigation. Within traditional fixed income, our teams are continuing to identify opportunities on a bond-by-bond basis.

The case is as strong as ever for including alternatives within both equity and fixed income allocations. One area that we’re particularly excited about is private credit, which may offer attractive yield and total return potential with less correlation to traditional fixed income investments. We’re pleased to be able to provide investors with access to a broad spectrum of private credit opportunities through our partnership with Aksia, a leader in the asset class.

Below, our teams share their views on what they see on the horizon, where they are finding opportunity and how they are managing risks.

The Easy Part of 2023 Is Behind Us

Calamos Phineus Long/Short Fund (CPLIX)

Michael Grant

We believe:

- By late summer, the easy part of “fixing inflation” gives way to the harder part. This may be the key driver of markets into autumn and determine whether we see a hard or soft landing in 2024.

- Disinflation momentum has been the key narrative, but the entry point for this trade was last October. We see a wide dispersion of possible outcomes for what comes next.

- Beyond summer, rising volatility seems inevitable as investors await the resolutions of key debates, including the one over Fed policy.

As we discussed in “A Very Different Decade Ahead,” there is a further mild upside for equities, but equities are not in a new bull market. The end of “free money” implies the investment landscape is being reconstituted. We anticipate a new set of winners and losers in coming years versus those that characterized the long era of excessive monetary accommodation.

Growth stocks can lead as interest rates stabilize but selectively for two reasons. First, the removal of excess liquidity by central banks will be extended. Second, corporate profitability for many has peaked structurally (with the reversal of globalization and quantitative easing). Across industries, Calamos Phineus Long/Short Fund’s positioning emphasizes quality and profitability within sensible valuation parameters. This style “wins” as long as investors believe a recession is only a matter of time.

- In Technology, we emphasize GARP quality, while avoiding names without valuation support. We have tactical positions in the semiconductor industry as investors wrestle to identify the winners and losers of an AI future. (See our post, “The AI Foreshock – Evaluating Potential Winners and Losers.”)

- Financials are an “Up Cycle” group, but investors are fixated on the inevitability of recession. We have reduced exposure materially in the past year. The profitability of banks is more in question today than in past decades due to normalized interest rates and, thus, higher funding costs and more competition for deposits.

- The US Consumer is in pole position globally, though the bigger story is the shift from goods to services. The latter is a long way from normalization. We favor a range of businesses that benefit from structural undersupply in air travel and sustained strength in consumer leisure.

- In Energy, structural underinvestment has been overshadowed by slower global growth and war-related inventory excesses. The key swing factor may now be Chinese economic growth – a dominant source of incremental demand. For China, the pandemic years have likely camouflaged the dawn of numerous structural headwinds.

- Consumer Staples are vulnerable to normalized rates and challenged to pass through cost inflation. We see capital rotating into other stable businesses with stronger pricing power like railroads, industrial gases, and defense contractors.

- Valuations in Healthcare have been reset as the pandemic distortions are largely worked through. We look for opportunities to add.

Chair Powell has been tightening the screws of monetary policy and so far winning the battle to return markets to the promised land of Goldilocks. Equally important has been the story of economic resilience. Investors and the Fed alike no longer anticipate a US recession in the second half of 2023 – contrary to consensus thinking in late 2022.

But we see the easy part of 2023 giving way to a murkier horizon this autumn. All of these key debates – the path of inflation, rising recession risk, and Fed policy – will become less friendly for risk assets, reinforcing our view that investors should embrace a more tactical and cyclical approach to equity allocation, and to style and security selection.

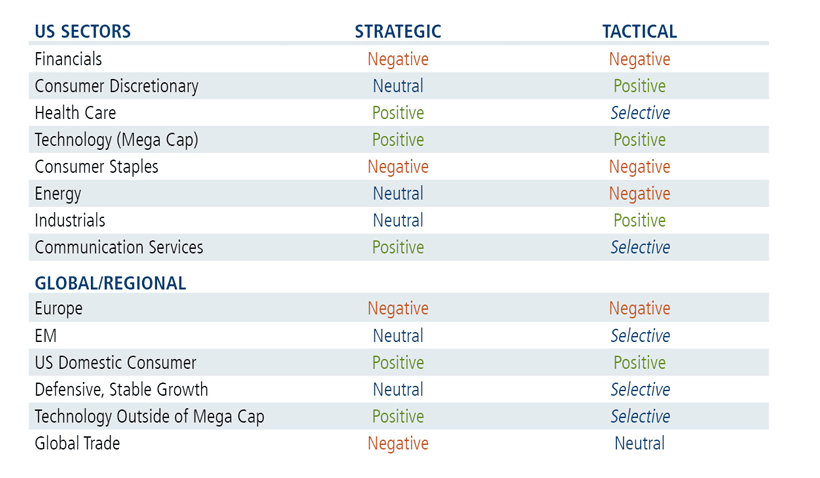

CPLIX Positioning Outlook

Capitalizing on Rising Interest Rates and a Slow Grind Up in the S&P 500 Index

Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX)

Eli Pars, CFA

- We see an attractive opportunity set for convertible arbitrage continuing, supported by rising overnight interest rates and increased convertible issuance.

- CIHEX and the hedged equity sleeve of CMNIX have benefited from the slow grind-up in the S&P 500 Index and higher interest rates.

- During the quarter, we reduced CMNIX’s allocation to SPACs and added incrementally to our other arbitrage strategies.

Calamos Market Neutral Income Fund (CMNIX) is designed to enhance a traditional fixed income allocation. The fund combines two complementary strategies – arbitrage and hedged equity – to pursue absolute returns and income that is not dependent on interest rates. During the second quarter, both the arbitrage and hedged equity strategies gained ground.

We actively manage allocations to the strategies based on our view of market conditions and relative opportunities. The fund’s current allocation to the arbitrage strategy is 53%, with 47% in the hedged equity strategy. At the start of the year, the fund’s allocation to the arbitrage strategy was 51%, with 49% allocated to the hedged equity strategy.

Within the arbitrage strategy, we have the flexibility to utilize different strategies, including convertible arbitrage, merger arbitrage, and special purpose acquisition company (SPAC) arbitrage.* We continue to like the opportunity in convertible arbitrage most, and the fund’s allocation to this strategy grew from 39% at the start of the year to 46% on June 30. We expect to continue adding to convertible arbitrage, particularly if we see the attractive new convertible issuance that we anticipate.

We funded the increased allocation to convertible arbitrage primarily through a reduction of our SPAC book. SPACs are now 3% of CMNIX, after peaking at almost 10%. While we have sold a few SPACs, the lower allocation is primarily the result of the natural runoff of SPACs issued in 2021 with terms of two years or less.

A principal driver for our bullishness in convertible arbitrage is our heightened return expectations for the strategy on the back of the rise in overnight interest rates. Convertible arbitrage returns have historically been correlated with overnight rates. This is partly because of the direct linkage of the rebate the fund receives on its short stock positions, which is directly tied to the fed funds rate. Although returns don’t necessarily go up tick-for-tick with rates, we expect a meaningful tailwind in 2023 and beyond.

We would buy new SPACs if we saw similar terms to those we bought in 2021. Then, SPACs were profitable for the fund, with limited volatility, and our allocation served the fund well over the past few years. However, the SPAC new issue market has been quiet since late 2021. The gating factor for SPAC issuance is sponsors willing to commit capital in exchange for the opportunity to make a multiple of their investment if they can get a deal across the finish line. This tends to be a bull market trade, and we are not seeing those levels of animal spirits in the small-cap space, where most “de-SPAC-ed” equities reside.

The S&P 500 Index’s slow upward grind during the quarter also benefited the hedged equity side of the fund. Call volatility has come in a bit recently, but it has generally been higher this year, which has allowed us to generate more income from the options strategy while still having a significant degree of downside risk mitigation. Higher interest rates also have flowed through to the hedged equity strategy in the form of higher call prices and lower put prices, making our collar strategy more attractive. Also, a relative bid to tail risk has made put spreads an attractive tool for us to layer in extra downside risk mitigation.

Calamos Hedged Equity Fund (CIHEX) is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. As discussed above, the S&P 500 Index’s slow grind-up in the quarter was profitable for CIHEX. In addition to benefiting from its net long exposure in a rising market, elevated call volatility allowed us to generate more income from the options strategy without sacrificing significant downside risk mitigation. Although call volatility has come in recently, we have been taking advantage of this bid to call volatility while still maintaining lighter-than-usual use of call writing. We also continue to layer in put spreads over and above our typical minimum level of notional long puts to provide additional downside risk mitigation. Finally, as noted above, higher call prices and lower put prices have made our collar strategy more attractive.

*SPACs are shell companies that raise money, which they use to acquire companies seeking to go public. The closing of the acquisition is called a de-SPAC process, at which point the SPAC is usually a small-cap equity.

Favorable Tailwinds for Convertible Securities

Calamos Convertible Fund (CICVX)

Jon Vacko, CFA, and Joe Wysocki, CFA

- Balanced convertibles remain the mainstay of the fund because they offer an attractive level of equity upside participation with less structural exposure to downside volatility.

- The fund is aligned with secular trends, including artificial intelligence, productivity enhancement, cybersecurity and electric vehicle adoption, and cyclical opportunities tied to consumer activity.

- Issuance trends this year are encouraging, with investment-grade companies increasingly recognizing the potential benefits of issuing convertibles.

We entered 2023 with the view that the macro variables – most notably inflation, economic growth, monetary policy, and geopolitical events – that had driven recent market volatility would likely dominate headlines to start the year. However, we also believed that as the year progressed, market participants would gain clarity around the severity of these headwinds, and stabilization could potentially turn into a tailwind for risk assets.

As we reach the second half of 2023, inflation has continued to cool, the Fed has paused interest rate hikes, geopolitical risks have not escalated, and a systemic spread of major bank failures has been avoided. Although macro variables are far from signaling “all clear,” we are cautiously optimistic that this relative stability can continue into the back half of the year.

With this backdrop, our focus remains on actively managing the risk/reward tradeoffs within Calamos Convertible Fund (CICVX). Broader equity market indexes posted solid gains during the first half of 2023, but a small set of larger-cap companies have primarily driven returns. We believe a continued stabilization of the macro backdrop could turn this narrow market leadership into broader strength, which would benefit convertible issuers that tend to be more mid-cap, growth-orientated companies.

We maintain our preference for balanced convertible structures that provide a favorable asymmetric payoff profile by offering attractive levels of upside equity participation with less exposure to downside moves. We also see select opportunities within the bond-like segment of the convertible market in issues that can potentially benefit from spread compression while offering attractive yields and good structural risk mitigation from potential equity market weakness. We remain especially selective in the group’s most distressed names, focusing on those with solvent business models that have liquidity.

Technology, healthcare, and consumer discretionary are the largest sector allocations in the fund. We emphasize bottom-up company analysis, favoring companies that are executing well despite macro uncertainties and positioned to benefit from thematic tailwinds. Select cyclical trends, particularly among consumers’ resilient demand for services over goods, remain strong. In addition, secular trends such as artificial intelligence, productivity enhancement, cybersecurity, and electric vehicle adoption are strong long-lasting growth opportunities. Many companies within these areas have shifted their focus toward efficient growth, improving margins, generating free cash flow, and increasing profitability. These efforts should prove advantageous going forward as higher-quality growth becomes scarce as the era of free money ends.

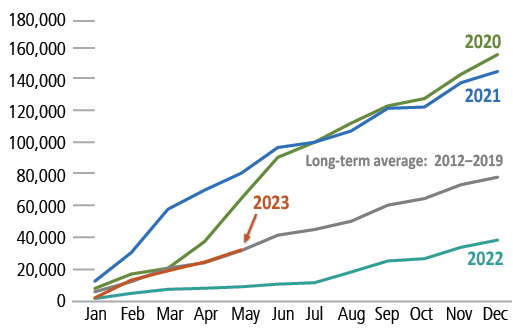

Convertible new issuance has accelerated after a subdued pace last year, with issuance returning to longer-term trend levels (Figure 1). In particular, investment-grade companies are coming to the convertible market at a more rapid pace than we have seen in many years. We are optimistic about issuance prospects going forward and believe the pace will continue to be strong as companies increasingly recognize the benefits of taking on lower borrowing costs by issuing convertibles instead of traditional bonds in an environment of higher interest rates.

Figure 1. New issuance: Back to trend

Global convertible new issuance by year ($ mil)

Source: BofA Global Research. Data through May 2023.

Global Convertibles: Staying Focused on Fundamentals Amid Signs of Economic Slowdown

Calamos Global Convertible Fund (CXGCX)

Eli Pars, CFA

- The US economy has been resilient in the face of rising rates, but plenty of data suggests a slowdown is likely.

- We’ve got a healthy degree of skepticism that the stock market can rip further from here, but we’re confident we can continue to find opportunities in global convertibles, guided by our focus on fundamentals.

- Although we can’t predict if it will be this year or next, we continue to expect a ramp-up of investment-grade convertible issuance on the horizon.

It’s easy to forget that a year ago rate increases were just starting to pick up. On June 15, 2022, the Fed surprised the market with a 75 basis point hike bringing short-term interest rates to 1.5%. This was the first of what would become four consecutive 75 basis point hikes. So, we are just getting to the one-year mark for rates rising to levels that start to bite.

To date, the economy, especially the labor market, has been remarkably resilient. But that may be starting to change. The four-week moving average of jobless claims is said to be the most accurate predictor of the labor market, and it has been going almost straight up for nine months, albeit from a low base. Other signs of a pending slowdown include contracting money supply (M2), a yield curve that has been inverted for a while, some survey data, and some bodies floating to the surface (e.g., Silicon Valley Bank).

In the face of what looks like a pending slowdown at minimum, it’s tough to see stocks ripping … except for the fact that most of this has been known for a while. And the stock market (or at least mega-cap tech) has been ripping. Luckily, we’re not macro traders, just convertible managers. We will stick to our fundamental process and work to get the best risk/reward profile we can.

The global convertible market continued to see a recovery in new issuance in the first half of 2023. Although issuance during the second quarter was slightly off the pace of the first quarter, global issuance should end up around $35 billion for the first half of 2023. This compares with $40 billion in issuance for 2022.

We remain active in the new issue market, which helped us keep Calamos Global Convertible Fund (CXGCX)’s risk level in line with the market. We continue to position the fund with the aim of participating in any upside rally while mitigating downside if the market pulls back. The fund continues to be overweight to the US and the technology sector and underweight to Europe.

In recent commentaries, we’ve written about the potential for a large uptick in investment-grade issuance, and we’re excited to see that trend begin. In terms of when this trend ramps up in a big way, we just don’t know if it will be this year or next. We continue to hear that treasurers find the coupon savings of a convertible compelling but they are reluctant to be the first among their peers to issue a convertible. As the large maturity wall (which starts in 2025) across the credit markets gets closer, we believe it will give issuers the courage to move forward.

In a Multispeed Economy, Improving ROIC Guides the Way

Calamos Growth and Income Fund (CGIIX)

John Hillenbrand, CPA

- We continue to believe that optimal portfolio positioning emphasizes areas that have real growth tailwinds, in companies with improving returns on capital in 2024, and in equities and fixed income with valuations at favorable expected risk-adjusted returns.

- Key developments in 2Q 2023 have in aggregate supported CGIIX’s current risk profile, and we continue to reassess and reposition the portfolio as our views of expected returns change.

- We see attractive long-term upside in the US equity market from current market levels.

At the beginning of 2023, we outlined the case for increasing the risk in the fund, focusing on selective areas of the economy that we believed should show improving economic growth in 2023 and 2024 as well as on companies that can improve returns on capital during that time.

Our premise to selectively add risk was based on several factors, including our conviction in the long-term US economic growth trajectory, positive policy changes, and improvement in certain parts of the economy. The events of 2H 2023 (a slowing of central bank rate increases, continued moderate slowing of inflation and economic growth, corporate cost-cutting measures, and the acceleration of spending in AI-related areas) have in aggregate supported that risk profile. We continue to assess the investment opportunities within this environment with a further focus on real growth and return improvement areas. Areas within technology including productivity drivers have become more attractive during the quarter, whereas some of the stable companies in consumer staples have become less attractive. Finally, we continue to monitor security and asset class valuations to target appropriate returns in this volatile environment.

We remain confident that the positive long-term growth trajectory of the US economy and the cash flow generation capabilities of US companies are intact. The ability of management teams to identify emerging short- and long-term trends and the adaptability of business models and cost structures are central to our long-term favorable view. We see an attractive long-term upside in the US equity market from current market levels, which we believe are at fair value for a majority of US companies.

We continue to see a divergence in growth in different parts of the economy and in corporate returns on capital for individual companies. Some parts of the economy have been slowing for several quarters and may be nearing their individual cyclic bottoms, while other parts of the economy are still showing improvement from pre-Covid levels. Many companies are focused on improving their returns on capital through improved efficiencies, normalized supply chains, clarity on the interest-rate environment, and in the case of multinationals, an improved currency environment. The pace of corporate cost-cutting and restructuring has increased over the past several months across several areas, providing more opportunities to identify companies with improving returns on capital. The dispersion of cost-cutting measures through time should also provide some cushion to overall economic growth. Over the short- and intermediate-term, improved real returns on capital should drive higher equity prices.

We believe several recent policy changes will be catalysts for future growth in certain parts of the economy. These policies include recently passed US legislation, such as the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, and the CHIPS and Science Act, and increased US fiscal discipline from a divided federal government. Global policy shifts are also having an impact, including the reopening of Asian economies, and the slowing of global central bank interest rate increases. The potential for additional bank regulation and changes to the FDIC insurance limit could improve the stability of the banking industry while increasing compliance costs. Although these policies will take time to have a direct positive impact, we believe equities will reflect these positives in the short term.

We believe the best positioning for this environment is a defensive risk posture, with additional risk in specific areas that have real growth tailwinds, in companies with improving returns on capital in 2024, and in equities and fixed income with valuations at favorable expected risk-adjusted returns. We see compelling prospects for companies that have exposure to new products and geographic growth opportunities (examples can be found in healthcare, electric vehicles, and AI-related infrastructure and software), specific infrastructure spending areas (in materials and industrial sectors), and the normalization of supply chains and parts of the service economy.

We are still favoring higher-credit-quality companies with improving free cash flow. We are selectively using options to gain exposure to some higher-risk industries. From an asset class perspective, cash and short-term Treasuries remain useful tools to lower volatility in a multi-asset class portfolio given their yields.

Growth Stocks: Attractive Prospects in 2H 2023 but Selectivity is Key

Calamos Growth Fund (CGRIX)

Matt Freund, CFA and Michael Kassab, CFA

We believe:

- Markets may advance at a slower pace in the coming quarters, but we see solid growth prospects for many companies supported by secular themes.

- Although the rally may slow, we expect leadership will broaden beyond the “Magnificent Seven” of mega-cap stocks, rewarding a broader group of companies with consistent cash flow generation and strong balance sheets.

- Semiconductor, cloud infrastructure, and software stocks have been the primary beneficiaries of “AI euphoria” but the ultimate winners will likely include a wide array of businesses across many sectors.

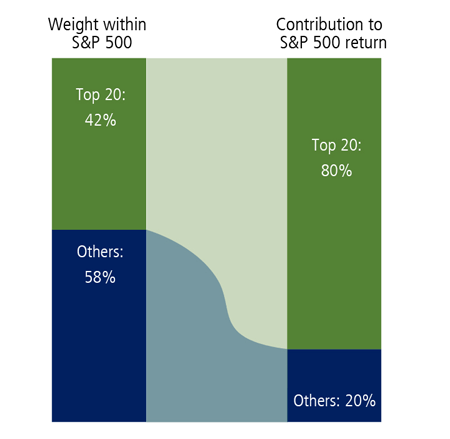

Growth stocks continued their strong recovery in the second quarter. With lingering concerns about the economic impact of higher interest rates and tighter lending standards following the March bank failures, investors gravitated toward the relative safety of mega-cap companies with reliable growth profiles and fully funded capital needs. Against this backdrop, the largest seven market-cap companies in the S&P 500 Index (often called the “Magnificent Seven”) accounted for 80% of the index’s year-to-date gains.

The economy has remained surprisingly resilient throughout the Federal Reserve’s aggressive rate hike cycle, which may finally be close to its conclusion. Fears of a significant slowdown in bank lending have mostly faded and the much-anticipated recession continues to get pushed out. While the lagged effects of higher rates may weigh on growth in 2024, employment data is holding remarkably steady with historically low layoffs and consumer spending remains healthy. Americans of all income levels continue to play “catch-up” on the activities they skipped during the pandemic lockdowns, including family vacations, concerts, and dining out.

As we look ahead, we see reason for caution given economic uncertainties and believe the broad markets may find it difficult to repeat the first half’s strong performance. At the same time, we see opportunities for continued strength in certain investment themes. One of the true bright spots in the past few months has been the growth of artificial intelligence (“AI”). Although AI has been around for years, it reached an inflection point in early 2023, when a new application brought the technology to the mass market along with the stunning realization of its capabilities – AI could not only answer questions but also write literature and create images.

Investing in companies at the forefront of innovation can be highly rewarding but extremely volatile. We have significant positions in strong technology companies that are now viewed as key AI players. There is little doubt that artificial intelligence has the potential to be game-changing for the global economy, in much the same way that the internet has been over the past 20 years. But as we learned through those early days of the internet, the list of potential winners and losers can change frequently and rather abruptly.

Semiconductor, cloud infrastructure, and software stocks have been the primary beneficiaries of the “AI euphoria” so far. However, the ultimate winners will likely include a wide array of businesses across many sectors. At the current pace of development, artificial intelligence could soon be deployed by companies both large and small to make their workforces much more efficient by automating everyday tasks and streamlining more complex processes. This, in turn, may help rationalize workforces and benefit cost structures, but at a potentially high cost to society overall. Time will tell how this all plays out.

Although the broad equity market may see more modest gains in the second half, we believe active management with a disciplined risk-management approach will prove beneficial. We expect the current market run to broaden beyond the Magnificent Seven but will continue to reward companies with consistent cash flow generation and strong balance sheets. This group of growth-oriented companies may prove to be more “defensive” than the traditionally defensive segments of the market (i.e. consumer staples and utilities) that are richly priced and may not provide the protection that investors expect. As always, we remain committed to a selective and thoughtful approach as we sort through the next exciting phase of technological innovation.

When Stocks Have Rallied off Bear Market Lows, Small Caps Have Stood to Gain

Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX)

Brandon Nelson, CFA

- We expect markets to broaden, and small caps are likely to participate.

- History provides many examples of small caps outperforming large caps after the S&P 500 Index has rallied off bear market bottoms.

- We’re encouraged small caps outpaced large caps in June, with the Russell 2000 Index returning 8.1%, versus the S&P 500 Index, up 6.6%.

- We’re also encouraged that the market is rekindling its appreciation for stocks with above-average growth prospects and visible fundamental strength.

The second quarter’s market performance can best be explained by examining it as two halves. During the first half, concerns about US and global economic activity dominated everyone’s attention, with many investors particularly worried about the US regional banking system. During the second half, investors focused on the momentum of artificial intelligence (AI).

Although each half had unique catalysts, both led investors to buy the same types of stocks: mega-cap growth. In the first half, investors bought them for defense as a safe haven in a murky macro environment. In the second half, investors bought mega-caps for offense because AI will likely be a revenue and profit driver for most mega-cap growth names.

While large-cap growth stocks were the star of the show during the quarter, many investors have commented on their discomfort with the concentration of the recent Nasdaq-led mega-cap growth rally, expressing concerns that the narrowness may be a sign of a flimsy, unsustainable rally. However, history shows that extreme Nasdaq leadership is often a leading indicator for broadening market strength.

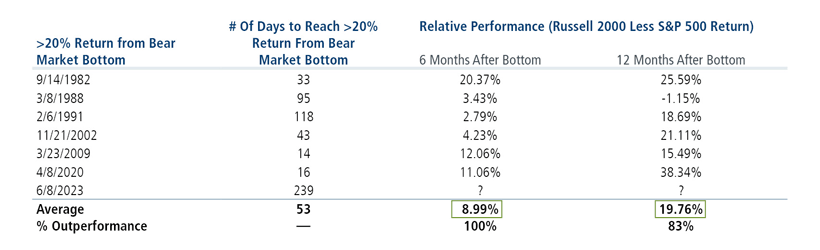

We believe the second half of the year is setting up advantageously for small caps, and we expect the narrow market leadership of 1H 2023 will broaden out to include small caps. Not only are small caps relatively inexpensive versus large caps currently, but they historically outperformed in the months after the S&P 500 Index has risen 20% above a bear market low. We believe the bear market low was in October 2022, and the index reached that 20% threshold gain on June 8, 2023. After past 20%+ rallies, small caps (as represented by the Russell 2000 Index) have historically outperformed large caps (as measured by the S&P 500 Index) by about 9% over the following six months and by about 20% over the following 12 months (Figure 1).

Figure 1. Small-cap performance after bear market bottoms and confirmation of new bull markets

(1980 to YTD)

Past performance is no guarantee of future results. Source: Piper Sandler Technical Research and Bloomberg.

We believe Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) are well positioned. Our funds are tilted toward stocks that we believe offer above-average growth prospects and very visible fundamental strength. Stocks with those characteristics were out of favor for most of 2022, but since early February 2023, many of those stocks are back on track with the market. The funds have an especially strong representation in technology, where we have found several stocks poised to benefit from the emergence of AI. For more on the small and mid-cap opportunities in the AI ecosystem, see our post, “Active and Nimble: Finding Small- and Mid-Cap Opportunities in a Dynamic AI World.”

Japan, Global AI, and an Uneven Covid Reopening

Calamos Evolving World Growth Fund (CNWIX), Calamos Global Opportunities Fund (CGCIX), Calamos Global Equity Fund (CIGEX), Calamos International Growth Fund (CIGIX), Calamos International Small Cap Growth Fund (CSGIX)

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

The following is an adaptation of our recent commentary, “2H 2023 Global Equity Team Outlook: Japan, Global AI and an Uneven Covid Reopening” (Read the commentary in its entirety here.)

- We remain optimistic about global equities and maintain a preference for non-US exposure, including emerging markets.

- As the breadth of opportunities expands globally, we see encouraging trends in Japanese equities.

- Asia’s post-pandemic reopening is multispeed, with China’s recovery reflecting bifurcation.

- Reflecting our emphasis on secular growth themes, global beneficiaries of the AI value chain are well represented in our portfolios.

Japan’s resurgence: The “Yamaji Rally,” improving fundamentals, or both?

After an extended period of underperformance, the Japanese equity market has quietly emerged as one of the strongest over the past year. Japan has long been viewed as attractive from a valuation perspective, but we haven’t seen the catalysts that could unlock and sustain this valuation opportunity … until recently.

Catalyst 1: The TSE is influencing capital allocation policies in a shareholder-favorable way. We’re seeing new momentum driven by the Tokyo Stock Exchange (TSE) and its CEO Hiromi Yamaji focused on improving governance, transparency, and ultimately the valuation of Japanese equities. The TSE’s efforts carry significantly more weight and would require companies to delist if they fail to achieve or show meaningful progress toward required capital efficiency targets before March 2026. Our conversations with company management teams indicate that they are responding swiftly. We’re encouraged to be hearing about improved corporate governance, transparency, and independent oversight, as well as streamlined reporting structures and business segments, rationalized non-core assets, and increased share buy-backs and progress in capital allocation plans.

Catalyst 2: A shift in business and consumer mindsets amid signs of waning deflation. Japan’s economy also benefits from an improving fundamental outlook. While most countries are concerned with elevated levels of inflation post-Covid, Japan is embracing its newfound inflation. And there’s reason to believe that higher inflation may endure: Wages are increasing in Japan at a more significant rate than we’ve seen in recent history, and women’s workforce participation has reached an all-time high, which is bolstering consumption.

Market reform, reflation, and reopening tailwinds should continue to support better Japanese equity performance in the upcoming years. We hold a combination of high-quality multinationals that we believe are some of the better companies globally but have historically traded at a “Japan-market” discount. We also maintain positions in companies more directly exposed to the post-Covid reopening and to companies whose balance sheets and valuations make them more likely to enjoy a boost from market reforms or relation.

Asia’s Multispeed Reopening

Covid reopening and the different speeds at which it is occurring around the world are important factors in our outlook for the second half of 2023 and beyond. The US was quick to reopen compared to many parts of Asia, including China. This speed, combined with stimulus checks, resulted in a quick V-shaped consumer spending recovery. Many Asian countries that reopened before China have experienced strong recoveries in consumer spending, especially travel and entertainment. In contrast, China was one of the last countries to end lockdowns, which leaves its recovery a few years behind the US and with negative impacts that will likely take longer to unwind.

There are many reasons that China’s recovery has been uneven and slower than in the US or other parts of Asia. Among them, wealthier individuals who were less affected by lockdowns have returned quickly to spending on luxury goods, travel, and gambling, providing a boost to areas like domestic tourism. However, the average Chinese consumer may take longer to recover from the pandemic given there wasn’t stimulus money to spend when the economy reopened. We believe the Chinese recovery will likely remain bifurcated near term, but consumer spending will recover over time.

Secular opportunities in a global AI value chain

A central component of our process is identifying and investing alongside global secular growth themes. Typically, these themes are found in areas undergoing transformative innovation and disruption, and in some instances, can run for decades. Advancements in artificial intelligence (AI) and large language models (LLM) like ChatGPT are a great examples of the evolving and durable nature of a growth theme, in this case intersecting themes like increasing mobility and connectivity, mass digitization and data, and artificial intelligence.

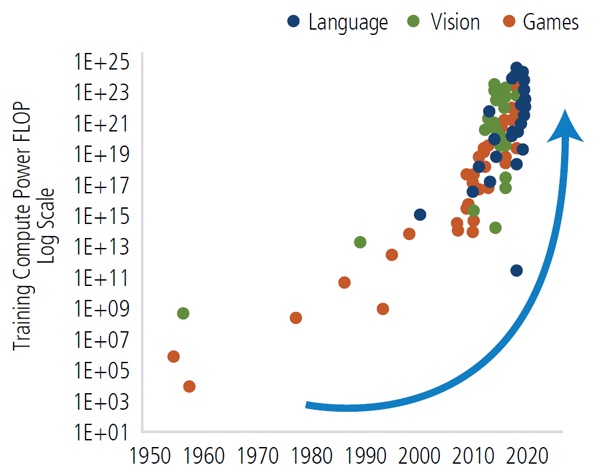

The rise of AI is driving a race to build computing infrastructure to support further advances and mass usage. We are at the early stages of what looks to be a transformational shift, but it stands on the shoulders of advancements in computing power that have been powering a variety of other themes for more than a decade (Figure 1).

Figure 1. AI models require exponentially more computing power

Source: Stanford AI Index, Evercore ISI Research.

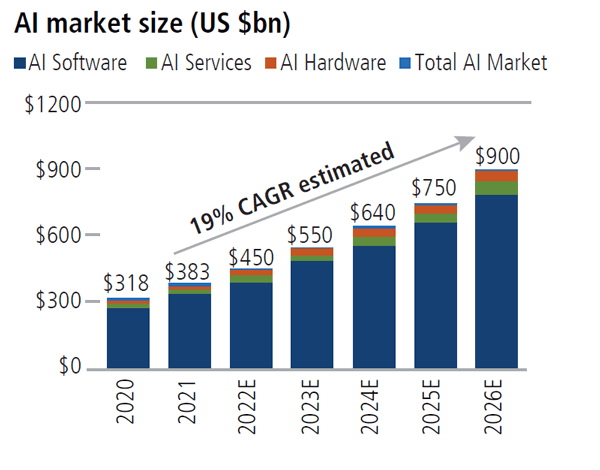

Indeed, the semiconductor industry of the digital age is analogous to the pickaxe and shovel suppliers of the gold rush. And while the world is only beginning to understand the productivity-enhancing potential of generative AI for consumers and businesses, significant capital spending to build the infrastructure to train and use these huge models is already underway (Figure 2).

Figure 2. Global AI market is expected to reach $900 billion by 2026

Source: BofA Global Research, “Me, Myself and AI-Artificial Intelligence Primer,” February 28, 2023

In the near term, we believe the opportunity lies with many of the companies leading computing advancements over the last decade. And that is a truly global group.

Narrow Market Likely to Broaden to Quality Stocks Across Sectors

Calamos Antetokounmpo Sustainable Equities Fund (SROIX)

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

- The dominance of US mega-cap tech stocks looks set to give way to broader leadership, favoring quality companies across sectors.

- We believe SROIX will be well positioned in an environment where quality is rewarded and risk management matters.

- We consider not only financial risk but also nonfinancial risks to identify fundamentally strong companies that are at the cutting edge of secular trends and ahead of the curve in managing the challenges of the global economy.

Stock markets held up during the second quarter as investors piled into US large-cap technology stocks, despite aggressive central bank policy, fading fiscal support, lower levels of liquidity, and growing worries about China’s economy. The S&P 500 Index’s rally was primarily attributable to a bull run in a handful of mega-cap stocks boosted by the exuberance over artificial intelligence.

Figure 1. Narrow leadership: A handful of stocks drove S&P 500 returns in 1H 2023

Source: Bloomberg. Past performance is no guarantee of future results.

The prospect for further outperformance in big-cap tech is becoming less likely given extended valuations and continued central bank hiking in developing markets. We believe that broader exposure to other economic sectors will pay off. As such, Calamos Antetokounmpo Sustainable Equities Fund (SROIX) is overweight quality stocks with reasonable valuations in the industrials, materials, and healthcare sectors. Quality, more broadly, should hold up given that interest rates are not likely to go down soon, global economic growth isn’t rebounding, and 2023 earnings are flattish. After several months of investor complacency, the “risk” part of the risk-and-return equation is likely to matter in the coming quarters. The fund is positioned accordingly.

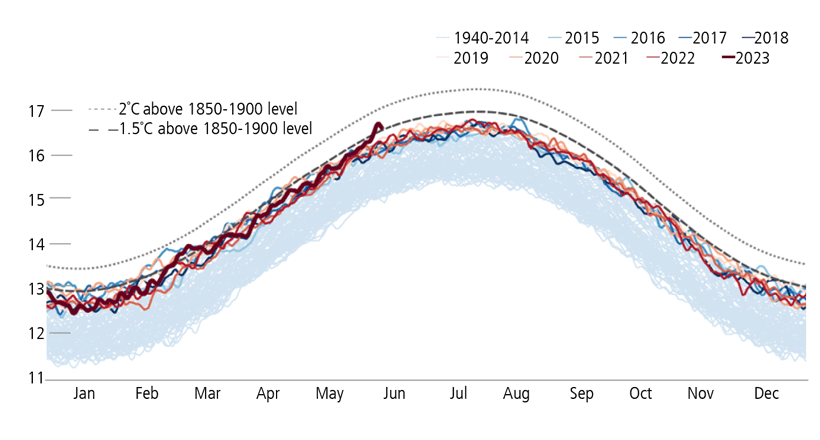

It’s not just big-cap technology stocks that have been hot as of late. Global temperatures in June hit the highest level on record for this time of the year, causing temperatures to exceed pre-industrial levels by more than 1.5°C for the first time. A heat wave smashed temperature records in China, and the country joins India, the UK, and other nations in bracing for a scorching summer. Europe already had the warmest summer on record last year, contributing to thousands of deaths, marine heat waves, and extreme weather. The world’s oceans were the warmest on record in April and May, a development that could mean more severe weather over the next few months and trigger a rise in sea levels. Texans’ power prices surged 80% in a matter of hours amid shrinking spare electricity supplies in June as searing heat puts the state’s grid to the test.

Figure 2. Daily global average temperatures (°Celsius) from January 1, 1940

Source: Copernicus.

Climate change is clearly taking a major human, economic and environmental toll. Putting a price on carbon is one of the strongest levers to tackle climate change. This is happening. Today, there are 70 carbon pricing initiatives globally, whether a carbon tax or emissions trading scheme, covering 23% of global emissions.

Companies that are already reducing their emission profiles – and future environmental liabilities – have a competitive advantage and are better positioned to outperform over the long term. We continue to work diligently to identify the best US-listed investment opportunities in this regard.

Fixed Income Update: Credit Market Fundamentals Call for Active Risk Management

Calamos High Income Opportunities Fund (CIHYX), Calamos Total Return Bond Fund (CTRIX), Calamos Short-Term Bond Fund (CSTIX)

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

We believe:

- A recession is not likely in 2023 – credit remains available to most borrowers, the banks are systematically stable, and the labor market is strong.

- The market’s expectation of additional Fed hikes in 2023 is reasonable.

- Fundamentals for investment-grade and high-yield credit may look strong on the surface but have become more mixed and defaults are increasing, which makes selectivity and a bond-by-bond approach essential.

Following the surprising failure of three banks in the first quarter, the market was unsure whether the Fed would be able to stick to its stated policy prescription of higher rates for longer. Bank stress has often led to tighter lending conditions that magnify the impact higher rates have on the economy. Fast forward 90 days and systemic stability seems to have returned. Lending standards appear to have tightened, but the worst-case scenario has been avoided and credit remains available to most borrowers. While questions remain around bank profitability, weak banks are not considered a sufficient deterrent to change the course of Fed policy.

Labor market strength was notable, as all three non-farm payroll releases during the quarter beat expectations. Although jobless claims have been increasing slowly, they have yet to reflect the level of job losses that many feel will be necessary to bring inflation down to the Fed’s long-held 2% goal. When viewed in totality, we believe these conditions indicate that a 2023 recession remains unlikely.

During the first quarter, the market anticipated multiple Fed rate cuts before year-end. That timeline has been pushed further out, and futures now indicate an additional rate hike (or two) is possible, with no cuts before May 2024 at the earliest. Our team views the updated timeline as reasonable, although we still believe the risk is to the upside on both terminal rates and the length of time that policy is held in restrictive territory.

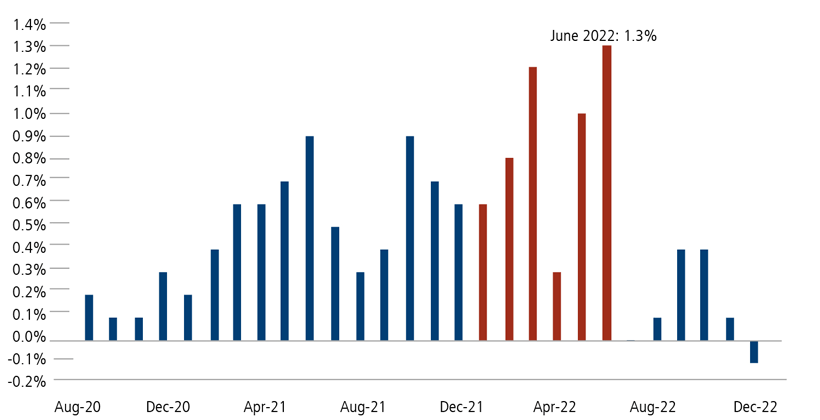

We do not foresee a reacceleration of inflation as the base case. However, we caution against claiming victory too early, as downward pressure on year-over-year (YoY) measures has benefited from large base effects from 2022 rolling off (Figure 1). In July, headline base effects give way to much lower hurdle rates from last year that could lead to higher YoY levels just as the Fed enters “the last mile” in its efforts to return price gains to 2%.

Figure 1. Higher year-over-year inflation levels are on the horizon as base effects wane

Month-over-month inflation increases in 2H 2022 drop precipitously

Source: Bianco Research, “Pivot Hopes Still Dominant,” January 12, 2023.

Fundamentals across corporate credit markets, both investment grade and high yield, have become more mixed. At first glance, headline numbers reflect considerable strength, but a closer look shows weakening performance from elevated levels. For instance, EBITDA measures in the high-yield market show YoY growth of +7.5%. That appears to reflect significant strength, but if you remove the three strongest sectors of gaming/leisure, energy, and transportation (which all benefited from strong accelerations off Covid lows), the YoY measure contracts ‑11.1%.

Management teams appear to be reacting to this deterioration, as we are seeing a simultaneous drop in both capital expenditures and cash return to shareholders while outstanding debt balances are unchanged. Market-wide leverage and interest-coverage measures (longstanding measures of overall credit strength) remain healthy. However, continued pressure on cash flows could lead to a reversal of recent trends, and we would expect wider spreads to emerge from such a development.

Defaults and distressed exchanges are increasing, trending back toward the long-term average of 3.5% on a trailing 12-month basis. Although balance sheets are starting from a position of relative strength, we expect continued pressure on top-line revenue growth and margins. If those materialize and persist, it is our view that the market is most likely to experience a more protracted default cycle than average, but one where defaults peak at lower levels.

Positioning Implications

The interest rate market has moved to what we believe is a more balanced representation of potential forward rate paths, and as such, the team took opportunities in the second quarter to extend portfolio durations. In Calamos Total Return Bond Fund and Calamos Short-Term Bond Fund, this leaves us neutral to slightly long. Duration is a less material driver of prices and returns in the high-yield market, and Calamos High Income Opportunities Fund continues to be positioned short of benchmark durations.

In our estimation, credit spreads reflect too sanguine of an outlook. Although overall fundamental metrics are buoyant, unfolding trends are more concerning. As in the first quarter, when we warned against complacency, we are actively reducing exposure to credits we evaluate to be more exposed to a downturn in cyclical activity or a rapid deterioration of asset value and those with weak liquidity. We are maintaining allocations to select high-yield issuers where we believe we are being well compensated for the risks taken as we follow our disciplined research process, which helps us identify value.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here