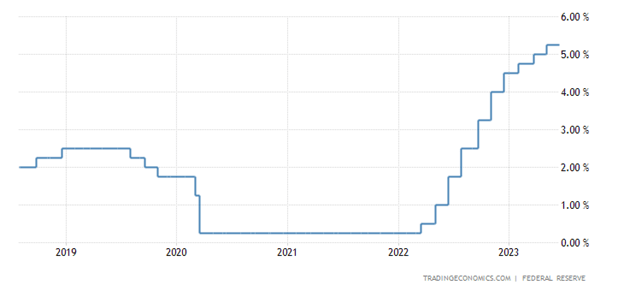

Throughout history, the prominent Wall Street mantra has been, “Don’t fight the Fed.” In essence, the credo instructs investors to sell stocks when the Federal Reserve increases its Federal Funds interest rate target and buy stocks when the Fed cuts its benchmark objective.

The pace of interest rate increases since early 2022 has increased at the fastest rate in over four decades (see chart below). Unfortunately, for those following this overly simplistic guidance of not opposing the Fed, investor portfolio balances have been harmed dramatically during 2023 by missing a large bull market run.

Despite this year’s three interest rate hikes and an 87% probability of another increase next month by the Federal Reserve, the S&P 500 index surged +6.5% last month and has soared +15.9% for 2023, thus far.

Source: TradingEconomics.com

The technology-heavy NASDAQ index has skyrocketed even more by +31.7% this year, thanks in part to Apple Inc. (AAPL) surpassing the $3 trillion market value (+49.3%), thereby exceeding the total gross domestic product (GDP) of many large individual countries like France, Italy, Canada, Brazil, Russia, South Korea, Australia, Mexico, and Spain.

But Apple’s strong performance only explains part of the technology sector’s impact on stock returns this year. The lopsided influence of technology stocks can be seen through the performance of the largest seven mega stocks in the S&P 500 (a.k.a., The Magnificent 7), which have averaged an eye-popping return of +89%.

Artificial intelligence (AI) juggernaut, Nvidia Corporation (NVDA), has led the way by almost tripling in value in the first six months of the year from $146 per share to $423.

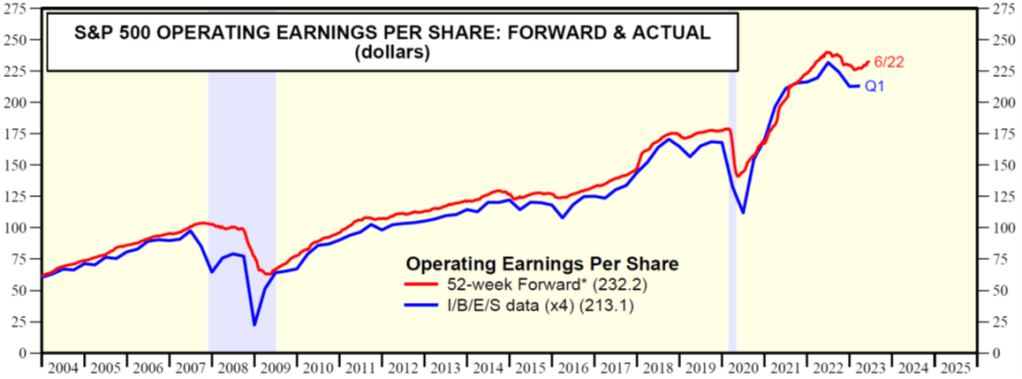

GDP and Profits Growing

Economists and skeptical investors have been calling for a recession for well over a year now, however GDP growth and forecasts remain positive, unemployment remains near generationally low levels (below 4%), and corporate profit forecasts are beginning to creep higher (see chart below – red line). You can see, unlike previous recessions, profits have not collapsed and actually have reversed course upwards.

Source: Yardeni.com

These factors, coupled with the cooling of inflation pressures have contributed to this bull market in stocks that has soared +27% higher since the October 2022 bottom in the S&P 500.

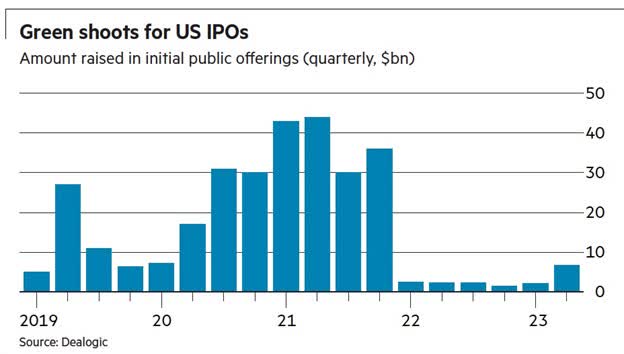

With this advance in stock prices, we have also seen green shoots sprout in the Initial Public Offering (IPO) market for new publicly traded companies (see chart below) like Mediterranean fast-casual restaurant chain CAVA Group, Inc. (CAVA), which has catapulted +86% in its opening month and thrift store company Savers Value Village, Inc. (SVV) which just recently climbed over +31% in its debut week.

Source: The Financial Times (FT)

Dumb Rules of Thumb

Wall Street is notorious for providing rules of thumb and shortcuts for the masses, but if investing was that easy, I’d be retired on my private island consuming copious amounts of coconut drinks with tiny umbrellas.

Case in point, following the guideline to “sell in May and go away” would have cost you dearly last month with prices gushing higher. And although the “January Effect” has been documented by academics as a great period to buy stocks, this so-called phenomenon has failed in three of the last four years, which brings us back to the Fed.

It is true that “not fighting the Fed” worked well last year, given the shellacking stocks took after a steep string of Fed interest rate increases, but following the same strategy this year would have only resulted in a large bath of tears. As is the case with most things investing-related, there are no cheap and easy rules to follow that will lead you to financial prosperity.

The best recommendation I can provide when it comes to investing advice squawked by the media masses is that the true path to wealth creation often comes from ignoring or disobeying these unreliable and inconsistent rules of thumb. Therefore, contrary to popular belief, fighting the Fed may actually lead to knockout returns for investors.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (July 3, 2023).

Disclosure: Sidoxia Capital Management (SCM) and some of its clients hold positions in NVDA, AAPL, and certain exchange traded funds (ETFs), but at the time of publishing had no direct position in CAVA, SVV, or anyother security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Read the full article here