Energy Income Performance

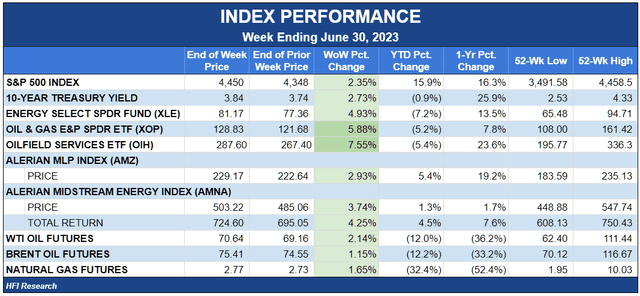

The energy sector ended June with a bang. The sector at large (XLE) rose 4.9%, outperforming the S&P 500’s 2.4% gain. All energy sub-sectors traded higher. Oilfield services (OIH) led the way, up 7.6%, followed by E&Ps’ (XOP) 5.9% gain and midstream’s 2.9% gain.

HFI Research

Over the first half of the year, energy income stocks outperformed the overall energy sector, supported by stable cash flows, healthy balance sheets, inflation protection, and high dividend yields. The Alerian MLP Index rose 4.1% in the month of June. It was up 5.4% in the second quarter and 9.7% in the first half of the year.

The setup for the rest of the year is particularly attractive. Nearly all energy stocks—income stocks included—perform well in an environment of rising commodity prices. Fortunately, the second-half outlook continues to progress favorably on that score.

For oil, the week began what is likely to be a multi-week trend of inventory draws. On Wednesday, the EIA announced that crude inventories decreased by 9.6 million barrels in the previous week, or 11.0 million barrels excluding the 1.4 million barrels released from the Strategic Petroleum Reserve. Sustained draws are the historical norm during this time of year.

Fortunately, U.S. commercial oil inventories stand around historical averages after increasing by only 10 million barrels in the first half, which featured unusually low refinery utilization. In the first quarter, refinery utilization fell to levels only seen before in 2008 and 2020. Going forward, since inventories aren’t overly bloated, a period of sustained draws should have a noticeable impact on prices.

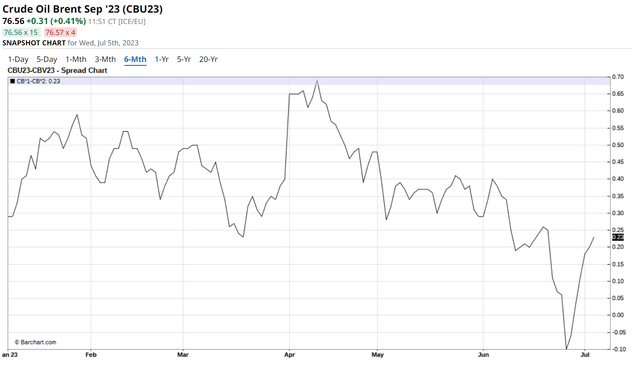

Physical market indicators increasingly incentivize inventory draws. Timespreads have finally turned the corner, as shown below for Brent

Barchart

Source: Barchart.com.

The market will need to see timespreads improve further if oil prices are to increase significantly.

Refining margins remain robust, reflecting healthy refined product demand, currently low refined product inventories, and normal crude oil inventories.

Barchart

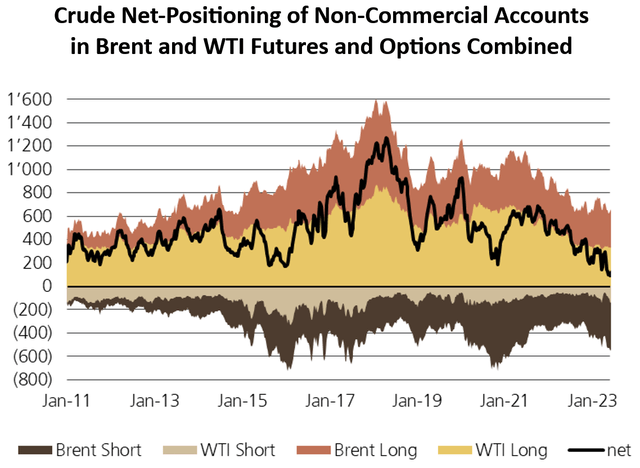

Meanwhile, crude speculative positioning has fallen to record lows. Long-time oil investors will find the chart below breathtaking—particularly those who lived through the ugly markets of late-2018 and 2020. It’s incredible to see positioning grow this bearish amid today’s bullish fundamental outlook.

Giovanni Staunovo, Twitter

Source: Giovanni Staunovo, Twitter, June 30, 2023.

In previous weeks, we’ve likened oil futures positioning to a powder keg ready to explode higher with the slightest reversal of the recession trade and/or the long-tech/short-energy trade. It became even more so this week.

Meanwhile, U.S. demand is healthy. On Friday, the EIA revised higher its April demand estimate by a whopping 750,000 barrels per day, from 19.671 million bpd to 20.42 million bpd, a 3.8% increase.

The revision puts April 2023 demand at a record high, above both April 2022 and April 2019. A more accurate estimate in the EIA’s preliminary demand estimates, reported every Wednesday, would have created a more bullish oil-market consensus than existed in the second quarter. Frankly, the magnitude of the revision suggests either gross incompetence on the part of the U.S. Department of Energy or some other non-market motive for distorting oil-market information flow.

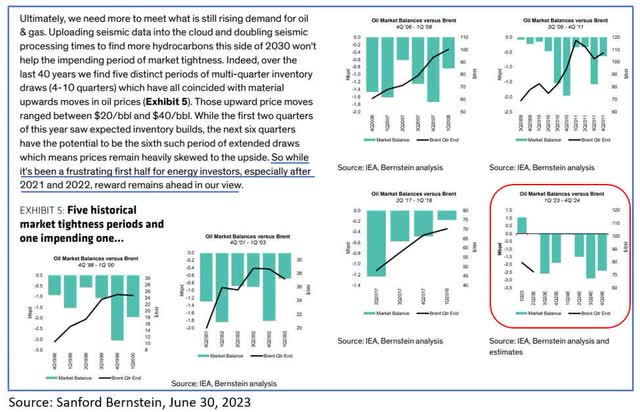

As a final tidbit on the macro outlook, consider this series of charts posted in a tweet by Eric Nuttall yesterday. The charts were published by Sanford Bernstein’s oil market analysts on Friday. They depict oil price experience during multi-quarter inventory draws over different historical periods.

Sanford Bernstein, Eric Nuttall, Twitter

In every instance where inventories drew over several quarters, oil prices moved higher. Price increases ranged from $20 per barrel to $40 per barrel. The last chart, circled in red, shows Bernstein’s forecasted inventory draws over the next several quarters, implying a very bullish setup for prices.

This historical angle provided by Bernstein adds weight to our thesis that large inventory draws will push prices significantly higher in the second half of the year. We have positioned our portfolio accordingly and recommend that subscribers do the same.

Energy Income News

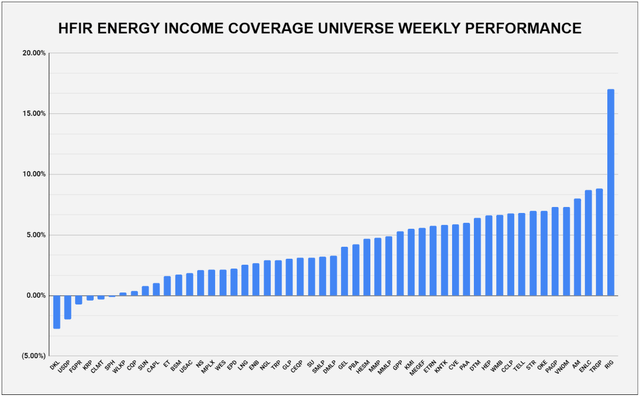

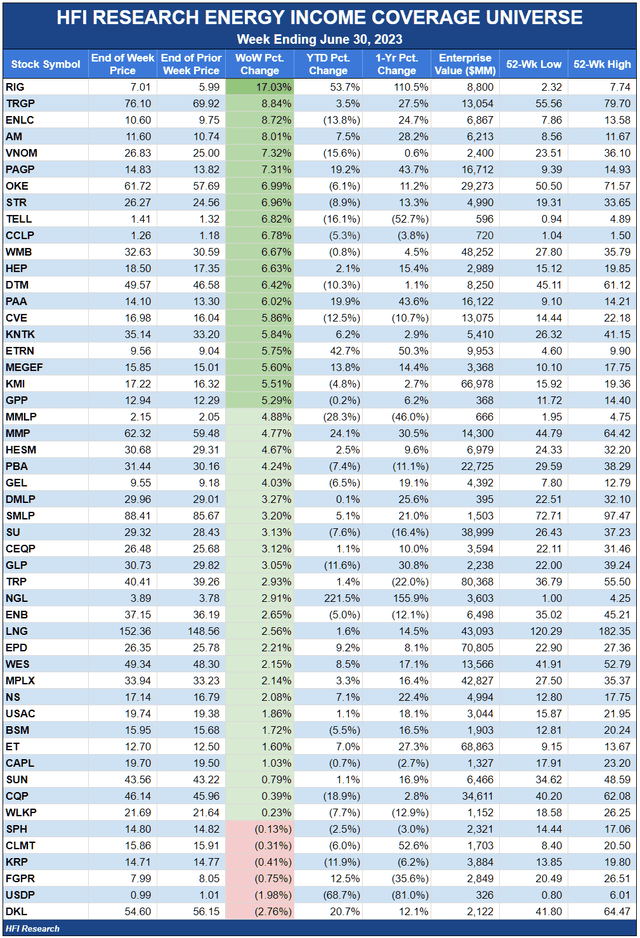

It was a week of big gains for energy income equities. Breadth was unusually strong, with only six of the 51 names in our coverage universe traded lower.

HFI Research

Transocean (RIG) stock was the week’s standout performer, rising 17.0% after the company announced a $184 addition to its backlog in the form of a 16-well award for its Equinox rig in Australia. The contract is set to span 380 days, representing a $484,000 dayrate. It could be extended through 2028.

The interesting part of this deal is that the Equinox is a harsh environment semisubmersible rig, but it won’t be working in harsh conditions for its contracted work in Australia. This is a favorable sign for Transocean’s fleet and for offshore oilfield service companies in general. The four unnamed operators contracting the rig bid high enough to keep it in Australia and away from the North Sea, where it presumably would have been contracted for harsh environment work. The same could be said for the previous rig that Transocean contracted to Australian customers on May 10, the Equinox.

These are the sorts of developments that happen in a tight market, where rig supply is constrained, and competition for existing rigs is stiff. We expect day rates to continue to improve, which bodes well for the long-term prospects for Transocean stock. We rate Transocean stock a Buy and maintain our $12 price target.

ONEOK (OKE) stock gained 7.0% after its proposed acquisition of Magellan Midstream Partners (MMP) received a key regulatory clearance from the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act. Oneok expects the deal to close in the third quarter, pending the approval of MMP unitholders.

Despite the news, the arbitrage spread between Oneok’s offer and MMP units widened during the week, signaling that investors are skeptical that the deal will close. We rate Oneok shares as a Buy with a $66.00 price target. An MMP acquisition would be positive for Oneok stock and could cause us to increase our Oneok valuation and price target after a few quarters of financial performance for the combined entity.

Suncor Energy (SU) was hit by a cyberattack that affected transactions with customers and suppliers. News came through complaints on social media that customers couldn’t use debit cards at the company’s Petro-Canada gas stations. If cyberattacks hit SU’s oil sands facilities, refineries, or other infrastructure, they could cause problems for its production and logistics.

The incident highlights the risks that cyberattacks pose to every energy company and its equity owners. The most dangerous cyberattacks are conducted through ransomware. In fact, the attack on SU occurred days after the Canadian Center for Cyber Security reported that ransomware attacks were “almost certainly the primary cyber threat to the reliable supply of oil and gas to Canadians.”

Enbridge (ENB) asked a U.S. judge to provide certainty that its Line 5 pipeline won’t be shut down before it can be rerouted around an Indigenous band’s territory in Wisconsin. The company is responding to the judge’s order that Line 5 must be moved in the next three years.

These developments don’t pose a direct material hazard to ENB’s companywide cash flows or intrinsic value, but they do showcase the increasing difficulty of operating and maintaining pipeline systems in the U.S. The more difficult operations and maintenance become, the less likely that new pipelines get built, and the higher the value of existing infrastructure.

Capital Markets Activity

June 27. Hess Midstream (HESM) announced a signing of a $100 million Class B unit repurchase from its sponsors, Hess Corp. (HES) and Global Infrastructure Partners. The purchases came at a price of $29.85, which is around the midpoint of our intrinsic value estimate. Share repurchases are only accretive to shareholder value if they’re made at prices below intrinsic value, and unless management is privy to information that the market is not, these stock purchases make little sense. It’s as if the company is exchanging its dollar bills for liquid assets worth $1. A distribution to shareholders would have been a better use of capital. That said, the repurchases will increase the trading float of HESM stock, which will increase trading volume and reduce volatility, albeit with no impact on shareholder value.

HFI Research

Read the full article here