The performance of the U.S. dollar divides the Joe Biden presidency into two separate segments.

The first of these periods begins around January 6, 2021, the day the U.S. capitol was attacked.

The second begins in the fall of 2022.

The first generates a strong movement in the value of the U.S. dollar.

The second generates a weaker U.S. dollar.

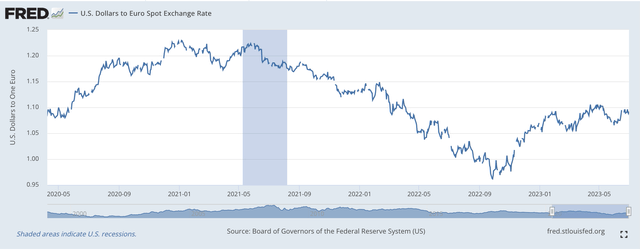

Here is a chart that shows these two periods quite clearly in terms of the price of the U.S. dollars in terms of one Euro.

U.S. Dollars in Euro Spot Exchange Rate (Federal Reserve)

On January 6, 2020, it cost $1.2290 to purchase one Euro.

On September 27, 2022, it cost $0.9616 to acquire one Euro.

And, on July 3, 2023, one Euro cost $1.0910.

What seems to have been going on during these time periods?

The First Period

In the first of these two periods, investors seemed to be transfer a lot of credibility in the Biden administration as the value of the U.S. dollar rose consistently.

The Trump administration was over and investors believed that they were looking at a new administration that would bring inflation under control and steer the economy onto a stronger period of growth than was experienced in the time period between the Great Recession (2007-2009) and the start of the Covid-19 recession beginning in February 2020.

In the middle of March 2022, the Federal Reserve did move to tighten up on monetary policy to fight the high level of recession that existed and began to raise its policy rate of interest.

The federal government moved to keep its fiscal policy supportive of economic growth.

As can be seen, the confidence in the Biden administration grew throughout this period as the value of the U.S. dollar rose and rose and rose.

The fact that one Euro cost only 96 cents signals just how much confidence the investment community had in what the Biden administration was promoting at this time.

One had to go back to the Spring of 2002 to find the dollar at such strength. This was just before the administration of George W. Bush ended the budget surpluses created by the Clinton administration, beginning to generate greater and greater budget deficits that moved us into the era we now find ourselves.

Well, in the first part of 2022, the confidence was high that U.S. economic policy was going to strengthen the U.S. economy relative to the rest of the world and the Biden administration would be the team that brought this about.

The Second Period

Well, that confidence broke toward the end of the summer of 2022 and by the fall, the declining confidence began to show itself in the foreign exchange market as the value of the U.S. dollar began to weaken.

At the close of business on Monday, July 3, 2023, one Euro cost 1.0910. The price has crossed $1.1000 a time or two in this latest period.

The reason for the latest decline in the value of the U.S. dollar seems to be connected with the legislative activity generated by the Biden administration in the late summer and early fall.

Several trillion dollars of new programs were passed through the Congress.

The investment community expressed its concern about the future debt these programs were going to generate and with a debt ceiling limit debate coming on in the near future, investors started to show their concern in the marketplace.

Adding to this budget concern was the fact that several central banks around the world were seen to be tightening up their monetary policies in order to fight the inflation their areas were experiencing. Right now, these central banks seemed to be moving their policy rates of interest up, relative to the Fed’s policy rate of interest.

This scene was the background for the value of the U.S. dollar remaining somewhere in the neighborhood of $1.0900 to $1.1000 per one Euro in the marketplace.

Investors were not moving back to the levels of the pre-Biden period, but to many investors, the feeling is that the Biden administration needs to back off from its spending programs at this time so that the Federal Reserve could continue its battle against inflation.

The general feeling seems to be that the government will be spending too much money and this spending will have to, one way or another, be supported by monetary policy.

The federal government cannot just keep on spending and spending, and not have an impact on what the Federal Reserve is doing.

Not A Strong Dollar

This is not the formula for a strong dollar.

This is not the picture of a strong government and a strong economy.

Investors in the foreign exchange market are trying to tell us something.

Unfortunately, our politicians and policy-makers do not seem to be listening.

It is remarkable how things felt in the year 2000.

The budget surplus was $236.2 billion; the year-over-year rate of consumer price inflation was around 2.25 percent; the labor force participation rate was around a historic high of 67 percent; unemployment was around 4.0 percent, and one Euro cost $0.9200.

This was a “strong” United States.

The value of the dollar was telling us that this was a “strong” United States.

It seems as if the investment community is telling us, telling the United States, that we are nowhere near that “strong” position we once were.

The current recipe for fiscal and monetary policy will certainly not get us there. That seems to be what current markets are telling us.

Read the full article here