In June 1897, an English journalist from the New York Journal contracted Samuel Clemens, aka Mark Twain, to ask if rumors he was gravely ill or dead were true. Twain wrote a response leading to the following report:

Mark Twain was undecided whether to be more amused or annoyed when a Journal representative informed him today of the report in New York that he was dying in poverty in London … The great humorist, while not perhaps very robust, is in the best of health. He said: ‘I can understand perfectly how the report of my illness got about; I have even heard on good authority that I was dead. James Ross Clemens, a cousin of mine, was seriously ill two or three weeks ago in London but is well now. The report of my illness grew out of his illness. The report of my death was an exaggeration.

As time passed, the quote morphed into “The reports of my death are greatly exaggerated.” Meanwhile, recent events in the commodities ETF/ETN markets could mean that the bull market in the asset class is ending after several commodity-specific agricultural products ceased trading. Higher interest rates have weighed on raw material prices, and after reaching multi-year highs, prices have turned lower. However, the ETF/ETN redemptions and recent bearish price action could mean the rumors of the end of the bull market are “greatly exaggerated.”

A host of agricultural ETNs cease trading

In a sign that interest in the agricultural and commodity sector has declined, many ETN products experienced redemptions in June 2023. The agricultural products that ceased trading last month include:

- JJA – The iPath Agricultural ETN.

- JJG – The iPath Grains ETN.

- BAL – The iPath Cotton ETN.

- SGG – The iPath Sugar ETN.

- NIB – The iPath Cocoa ETN.

- JJS – The iPath Soft Commodity ETN.

- JO – The iPath Coffee ETN.

- COW – The iPath Livestock ETN.

Agricultural commodities were not the only sector suffering a loss of products. Some of the other commodity ETNs that fell by the wayside in June include:

- JJP – The iPath Precious Metals ETN.

- JJU – The iPath Aluminum ETN.

- GAZ – The iPath Natural Gas ETN.

- JJC – The iPath Copper ETN.

- JJM – The iPath Industrial Metals ETN.

- BCM – The iPath Broad Commodity ETN.

- OIL – The iPath Crude Oil ETN.

- PGM – The iPath Platinum ETN.

- JJE – The iPath Energy ETN.

- JJN – The iPath Nickel ETN.

- JJT – The iPath Tin ETN.

- GSP – The iPath GSCI ETN.

- LD – The iPath Lead ETN.

Low assets and volumes caused these ETNs to cease trading, limiting choices for market participants seeking exposure in specific commodities or raw material sectors.

A boost and bust for the futures arena

The de-listings create an enigma for the commodities asset class.

On the one hand, the lack of ETN products could drive market participants to the futures and futures options markets and increase volumes and open interest. Commodities are volatile assets that attract participation from those seeking wide price variance. Moreover, the fundamental nature of commodities causes supply and demand dynamics to create significant technical trends.

On the other hand, the ETNs fostered increased liquidity as market makers used futures to hedge product activity. As many commodity-specific products disappear, liquidity could decline as market makers no longer use the futures to hedge the ETN products.

The Teucrium products stand to gain

In the commodities arena, the Teucrium family of ETFs could experience an increase in trading volumes.

According to Teucrium’s website, Teucrium Trading “is an ETF provider focused solely on U.S. Agriculture.” Teucrium offers six agricultural ETFs, including:

- CORN – The Teucrium Corn ETF, at $22.34 per share, had $92.78 million in assets under management and trades an average of 131,618 shares daily.

- WEAT – The Teucrium Wheat ETF, at $6.62 per share, had $162.61 million in assets under management and trades an average of over 1.1 million shares daily.

- SOYB – The Teucrium Soybean ETF, at $27.81 per share, had $37.43 million in assets under management and trades an average of 32,557 shares daily.

- CANE – The Teucrium Sugar ETF, at $12.92 per share, had $23.65 million in assets under management and trades an average of 94,555 shares daily.

- TAGS – The Teucrium Agricultural Fund ETF, at $30.77 per share, had $24.04 million in assets under management and trades an average of 14,337 shares daily.

- TILL – The Teucrium Agricultural No K-1 ETF, at $34.60, had $8.16 million in assets under management and trades an average of 71,112 shares daily.

Teucrium also offers two machine-learning strategies, offering a “systemic approach, utilizing proprietary machine-learning technology with the goal of turning data into alpha” in agricultural commodities and base metals:

- OAIA – The Teucrium AiLA Long-Short Agricultural Strategy ETF at $23.23 had $6.96 million in assets under management and trades an average of 1,130 shares daily.

- OAIB – The Teucrium AiLA Long-Short Base Metals Strategy ETF at $25.75 had $5.14 million in assets under management and trades an average of 1,275 shares daily.

As products cease trading, the Teucrium products could experience an increase in trading volumes over the coming weeks and months. Teucrium is expanding away from agriculture with its OAIB product.

DBA remains a liquid agricultural ETF product that fills a void

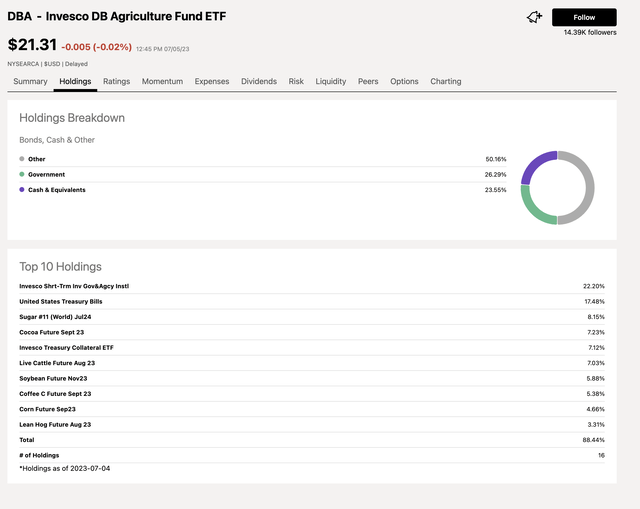

The Invesco DB Agriculture Fund ETF (NYSEARCA:DBA) is a diversified liquid product that tracks agricultural commodity prices. At $21.31 per share, DBA had over $843 million in assets under management and trades an average of 601,679 shares daily. The top holdings include some of the most liquid agricultural futures:

Top Holdings of the DBA ETF Product (Seeking Alpha)

The chart highlights DBA’s futures contracts in cocoa, cattle, hogs, and coffee, commodities that the iPath individual NIB, COW, and JO ETNs no longer cover. Without these products, DBA could attract far more interest from market participants looking for exposure in these agricultural markets.

What do the redemptions signal?

ETF and ETN administrators and issuers are in the business of earning profits. When costs exceed revenues from management fees, or if underlying markets become too challenging for hedging activities that lead to stated performance, it is impossible to offer come of the commodity or other asset-specific products.

The redemptions occurred as asset growth and fees did not increase at levels that support the products. Commodities remain an alternative asset class compared to stocks, bonds, and other more liquid investment and trading assets.

The failure of the iPath commodity products is a function of commodities’ limited investment and trading audience. The rally in commodities since the 2020 pandemic-inspired lows fostered more interest in the asset class. Still, the recent rise in stocks and higher interest rates caused capital to flow to stocks and fixed-income products, decreasing the demand for commodity-based investment and trading products. Time will tell if the redemptions signal lower commodity prices, but less liquidity in the asset class may only increase volatility.

Meanwhile, the limited number of commodity-based products could foster increased volatility as less liquidity exacerbates higher price variance. For those looking for diversified agricultural exposure, DBA is a liquid product. The Teucrium products provide specific exposure to a handful of commodity markets.

Read the full article here