Investment Thesis

1 – Presentation

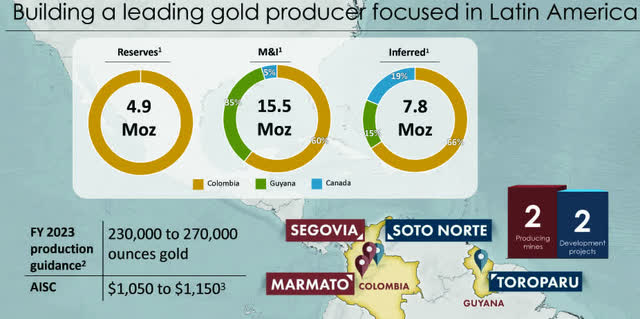

The Canada-based Aris Mining Corporation (OTCQX: TPRFF) owns Segovia operations and the Marmato Mine in Colombia, the company’s principal producing assets.

Note: On September 28, 2022, GCM Mining Corp. (GCM Mining) and Aris Gold Corporation (Aris Gold) completed their business merger.

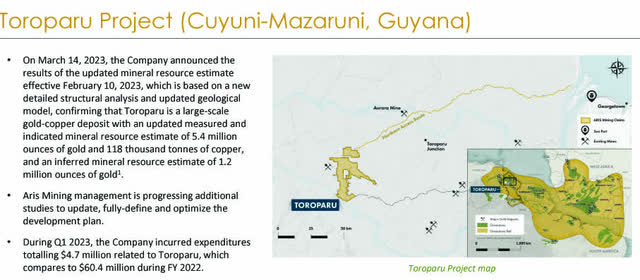

Aris Mining is a leading Latin American gold producer with two producing mines, a gold project in Colombia, the Soto Norte, and a significant project in Guyana called the Toroparu Project and the Juby Project in Ontario, Canada.

Below is indicated the last update.

TPRFF The Toroparu Project (Aris Mining Presentation)

The Segovia mine in Colombia is the flagship producing asset.

On March 3, 2023, the updated mineral resource and reserve estimates were announced, effective December 31, 2022, which includes full replacement of gold ounces mined during 2022.

Reserves for the Segovia Mine are 4.9 Au Moz. Also, production guidance for 2023 is now 230K to 270K Au oz at an AISC of between $1,050 and $1,150 per ounce, as indicated in the Presentation below:

TPRFF Assets Map (Aris Mining Presentation)

Important note: This article updates my February 23, 2023, article. I have been following TPRFF on Seeking Alpha since January 2021.

2 – 1Q23 Production results snapshot and commentary

The company reported its first-quarter 2023 production results and provided 2023 guidance on May 10, 2023.

In April 2023, Aris Mining completed the repairs at the processing plant and achieved a throughput of 2,097 TPD to exceed the 2,000 tonne-per-day nameplate capacity.

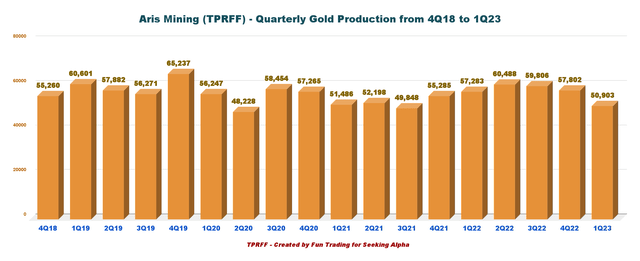

Aris Mining produced 50,903 ounces of gold from the Segovia Operations and the Marmato Upper Mine, with 18% of the total contained gold sourced via the purchase of mill-feed from partnerships with small-scale miners around the Segovia Operations. In the M&A release:

The Segovia Operations processing facility was expanded to 2,000 tonnes per day (tpd) in late 2022, but a small fire caused by a maintenance procedure resulted in throughput that averaged 1,785 tpd in Q1 2023, holding back gold production. Required repairs have been completed and throughput averaged 2,097 tpd in April 2023.

2.1 – Gold Production and Sales by Quarter

|

Operation |

Q1 2022 |

Q2 2022 |

Q3 2022 |

Q4 2022 |

Q1 2023 |

|

Segovia Operations |

49,864 |

53,077 |

54,630 |

52,592 |

46,513 |

|

Marmato Upper Mine |

7,419 |

7,411 |

5,176 |

5,210 |

4,390 |

|

Total Gold Production |

57,283 |

60,488 |

59,806 |

57,802 |

50,903 |

|

Total Gold Sales |

61,343 |

61,583 |

59,336 |

59,157 |

49,158 |

2.2 – 2023 Guidance

Aris Mining’s consolidated gold production for 2023 is expected to be between 230K Au Oz and 270K Au Oz, with all-in sustaining costs per ounce (“AISC/oz”) between $1,050 to $1,150.

|

Operation |

Segovia Operations |

Marmato Upper Mine |

Consolidated |

|

Gold Production in Ounces |

200,000 – 230,000 |

30,000 – 40,000 |

230,000 – 270,000 |

|

Cash Cost (US$/oz) |

$650 – $750 |

$1,100 – $1,200 |

$700 – $800 |

|

AISC (US$/oz) |

$950 – $1,050 |

$1,650 – $1,750 |

$1,050 to $1,150 |

|

Exploration (US$ million) |

$17 |

$2 |

$19 |

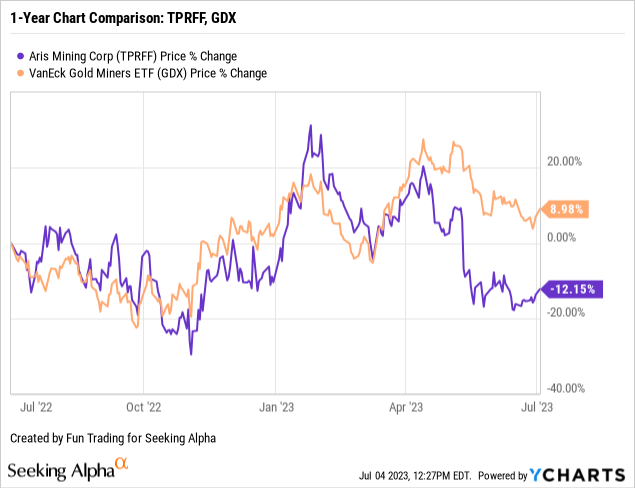

3 – Stock Performance

TPRFF has underperformed the VanEck Vectors Gold Miners ETF (GDX) and is down 12.2% on a one-year basis.

Aris Mining – Historical Snapshot ending 1Q23 – The Raw Numbers.

| Gran Colombia | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues In $ Million | 101.32 | 101.37 | 93.91 | 103.36 | 96.91 |

| Net Income in $ Million | 5.24 | 38.97 | -48.35 | 4.77 | -5.40 |

| EBITDA $ Million | 35.18 | 73.48 | -21.02 | 35.87 | 23.60 |

| EPS diluted in $/share | 0.05 | 0.15 | -0.48 | -0.04 | -0.04 |

| Operating Cash Flow in $ Million | 24.21 | 31.53 | 8.28 | 12.94 | 19.77 |

| Capital Expenditure in $ Million | 20.26 | 35.27 | 28.83 | 30.65 | 19.76 |

| Free Cash Flow in $ Million | 3.95 | -3.75 | -20.55 | -17.71 | 0.01 |

| Total Cash $ Million | 315.06 | 265.50 | 325.74 | 299.46 | 229.35 |

| Total Long-term Debt (incl. current) In $ Million | 311.31 | 310.90 | 376.58 | 429.94 | 373.29 |

| Shares outstanding -(diluted) in Million |

99.96 |

108.13 |

101.00 |

144.91 |

136.19 |

| The dividend is paid per month now/ Quarterly dividend in $/share. |

0.034 |

0.034 |

0.034 |

Data Source: Company release. (More data available for subscribers only).

Analysis: Revenues, Earnings Details, Free Cash Flow, Debt.

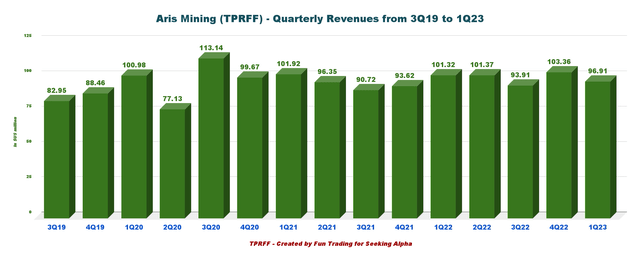

1 – Total Revenues and others were $96.91 million in 1Q23

TPRFF Quarterly Revenue History (Fun Trading)

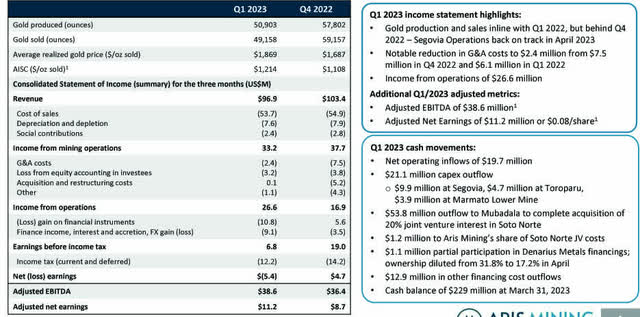

The spot gold price in the first quarter of 2023 was $1,869 per ounce sold, compared with an average of $1,860 per ounce sold in 1Q22.

The first-quarter adjusted EBITDA was $38.6 million.

TPRFF Highlights (TPRFF Presentation)

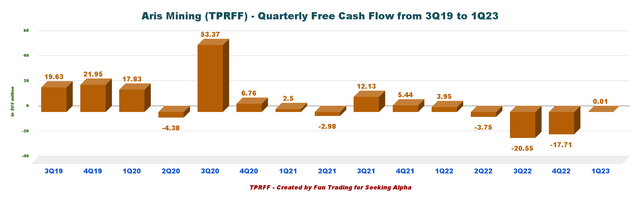

2 – Free cash flow was a loss of $0.01 million in 1Q23

TPRFF Quarterly Free Cash Flow History (Fun Trading) Note: Generic free cash flow is cash flow from operations minus CapEx. Aris Mining uses another calculation that indicated $27 million in free cash flow in 1Q23, including the CapEx for Toroparu.

The trailing 12-month free cash flow is a loss of $42.02 million, with free cash flow in 1Q23 of $0.01 million.

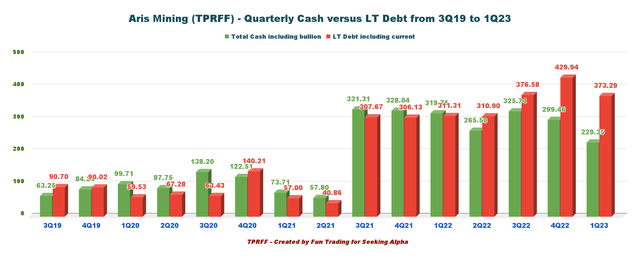

3 – Aris Mining’s net debt was $143.94 million at the end of the 1Q23

TPRFF Quarterly Cash versus Debt History (Fun Trading) At the end of March 2023, Aris Mining had a cash position of approximately $229.35 million, and the total debt was $373.29 million, including current.

Note: The LT Debt, including current, is not including the warrant liabilities long-term and current for a total of $22.694 million.

Production Analysis

1 – Production was 50,903 Au Oz in 1Q23 (including Marmato Mine)

1.1 – Gold and Silver production: Historical chart

TPRFF Quarterly Production History (Fun Trading)

Note: Gold sold in 1Q23 was 49,158 Au Oz.

- Sandra K mine.

- Providencia mine.

- El Silencio mine.

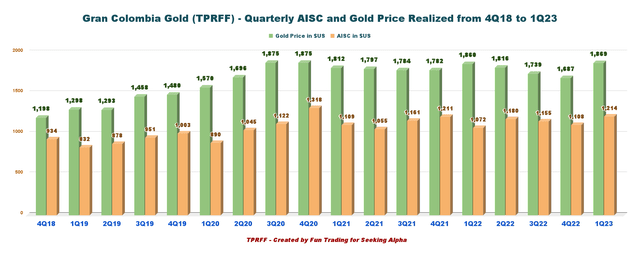

2 – AISC and Gold Price Realized per Oz Sold

Total cash costs of $922 per ounce, and all-in sustaining costs (“AISC”) of $1,214 per ounce in 1Q23.

TPRFF Quarterly AISC and Gold Price History (Fun Trading)

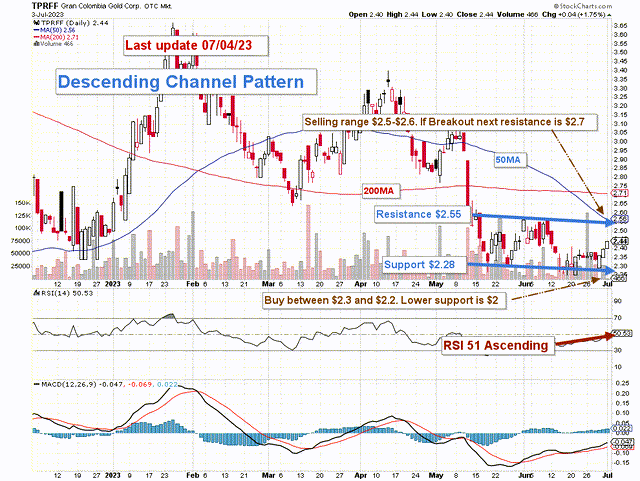

Technical analysis (short-term) and commentary

TPRFF TA Chart Short-Term (Fun Trading StockCharts)

TPRFF forms a descending channel pattern with resistance at $2.55 and support at $2.28.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. Higher prices usually follow The descending channel pattern but only after an upside penetration of the upper trend line.

The trading strategy is to sell about 30% between $2.50 and $2.60 with higher resistance at $2.70 and accumulate between $2.30 and $2.20 with lower support at $2.00.

For those who have decided to keep a long-term position, I strongly recommend trading LIFO while holding a core long-term position for a potential test of $3.80 or higher.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here