Cryptos resilient, sign of strength

Cryptos and related stocks have shown a lot of resilience since June. This says a lot about their relative strength because firstly, the broad market was pulling back in mid-June, but the sector hardly wavered.

News on a potential Bitcoin ETF late June also gave the sector a lift. Importantly, when the SEC came out to say that the filings for the Bitcoin ETF were inadequate on 30 June, the sector remained stoic.

The sector’s ability to shrug off bad news, coupled with the strong momentum seen in crypto-related stocks, tells me that this sector is likely to outperform the broad market in the next few months.

First, let us look at the technical charts of spot cryptos.

Bitcoin – price has broken above downtrend resistance, and is now consolidating recent gains while surfing its 10-day moving average. The manner in which the price shrugged off the negative SEC news tells me there is likely more upside in this market. Bitcoin is also not giving back any of the gains since breaking above downtrend resistance, which is a sign of strength.

Daily Chart: Bitcoin

Tradingview

Ethereum – not seeing as much momentum as Bitcoin, but I think if this gets going, so will the rest of the altcoin space. Ethereum currently holding above key supports. Watching for follow through higher.

Daily Chart: Ethereum

Tradingview

Bitcoin Miners ETF (WGMI) – pushed to new 52-week highs despite uncertainty surrounding the Bitcoin ETF. Price leads fundamental news – note that WGMI broke out from a big base on 11 April, and from a subsequent one on 21 June. Technicals are bullish.

Daily Chart: WGMI

Tradingview

Another tailwind behind the sharp climb in crypto stocks is the high level of short interest in some of these miners.

Marathon Digital (MARA), for example, has a short interest as a % of float at 25%. Shorts were forced to cover when MARA broke out strongly from a large flag pattern on 20 June.

Daily Chart: MARA

Tradingview

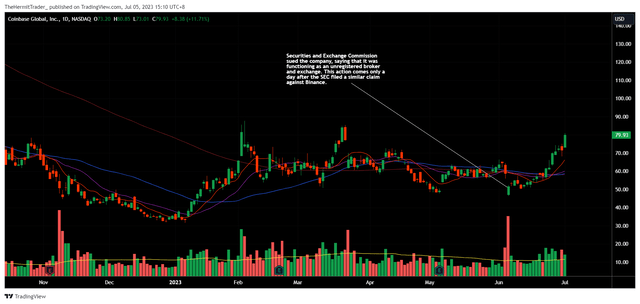

Take also Coinbase (COIN), which has a short interest as a % of float at 20%. The shorts piled on after the SEC sued the company in early June, saying that COIN was an unregistered broker. Since then, COIN has risen more than 50%, even surpassing levels before the SEC announcement was made.

Daily Chart: COIN

Tradingview

Cryptos are a very speculative space, and one of the pertinent issues has always been whether it can become mainstream, as that would lead to inflows from large institutions.

I think the crypto ETFs will eventually be launched, and that would be a strong beneficial catalyst for the space. Before these ETFs are approved, I would be happy to buy into the crypto miner space, as they are enjoying extremely strong upside momentum.

Read the full article here