Mark Zuckerberg’s Meta Platforms (META) is in the spotlight this afternoon, after the social media revealed it will release Threads, its Twitter competitor, on Thursday. This comes just after Elon Musk announced over the weekend that tweets will become capped, a move that was met with widespread derision and has users seeking social media alternatives. META was last seen up 9.3% at $295.34, and earlier touched $298.12 — its highest mark since February 2022.

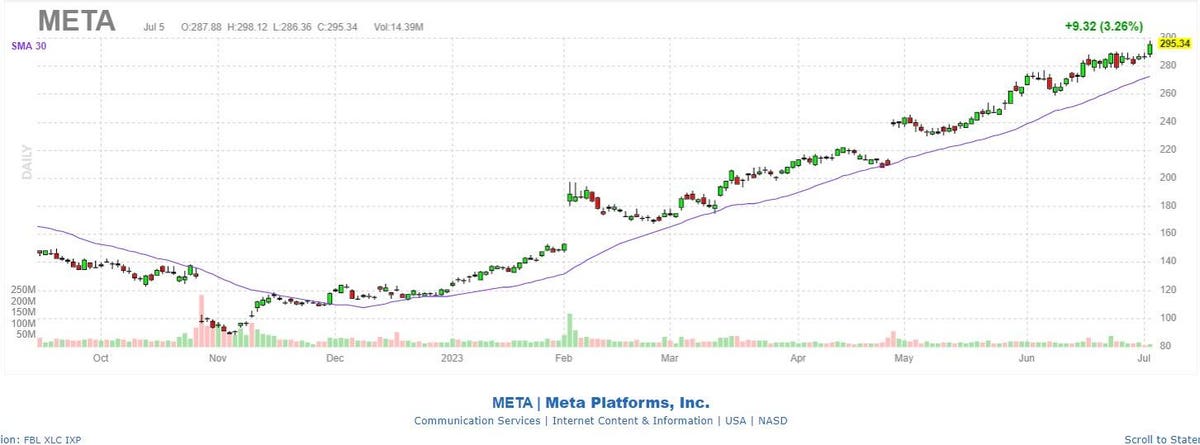

To say it’s been an outstanding year for the Facebook parent would be an understatement. The equity has surged almost 150% in 2023 alone, with long-term support stemming from the 30-day moving average. This trendline has captured several pullbacks in both March and April of this year. The shares have also enjoyed no fewer than two impressive bull gaps higher during this time frame.

In reaction to today’s buzz, options traders have been coming in droves. Currently 276,000 calls and 131,000 puts have crossed the tape so far, volume that’s double the intraday average. Most popular so far is the weekly 7/7 295- and 300-strike calls, where new positions are being bought-to-open. In other words, bulls are expecting META’s stock price to continue to climb by the end of the week as Threads becomes unspooled.

Speculating on Meta Platform stock’s next move with options looks like a prudent play. The stock’s Schaeffer’s Volatility Index (SVI) of 29% stands higher than just 1% of readings from the last year. This means options traders are pricing in relatively low volatility expectations for the time being. Even better, META tends to outperform said volatility expectations, per its Schaeffer’s Volatility Scorecard (SVS) tally of 89 out of 100.

Read the full article here