Summary

With its strong brand equity across numerous durable product categories and its good track record of innovation, YETI Holdings (NYSE:YETI) continues to be a company that I see as a long-term winner in the outdoor industry. The business’s potential for expansion through the direct-to-consumer channel is also promising. However, I previously said that investors should remain on the sidelines until the market began pricing in slower core US growth, which I believe has occurred as valuation remains at depressed levels. The most recent outcomes have led me to hope that things are finally beginning to improve. YETI’s wholesale business, led by Coolers & Equipment, showed robust demand. Although management has provided some hints that the second quarter will be more challenging than expected due to headwinds in wholesale (I spoke about this before in relation to the product recall), I believe the market is already prepared for this and will soon begin to look forward to the second half of this fiscal year and the next. Management’s disclosure of a fix for recalled products, an increase in the number of drinkware options available for purchase later this year, demand stabilizing indicators from sell-in vs sell-through rates, and also a relatively cheap valuation have convinced me to change my recommendation from hold to buy. Also, I see healthy margin recapture opportunities following freight and supply chain cost disruptions abating.

Signs of demand stabilizing

There are encouraging signals that demand issues are leveling off, particularly from management’s assurances that sell-through is strong. This tells me that demand from the consumer end is picking up despite the macro environment. This is all that matters, in my opinion, because wholesalers order supply from YETI based on underlying demand trends. From YETI’s point of view, a surge in sell-in is likely to occur if demand continues to be high, prompting them to restock. However, it’s impossible to ignore the fact that 2Q is most likely going to be a challenging quarter, and investors will have to face the risk that this could lead to share price volatility when the results are announced. Due to the difficult comparisons and the product recall, management has guided for a low double-digit decline in the wholesale channel for 2/3Q, with growth expected to resume in the 4Q.

In addition, I think it’s important to point out that YETI’s solid market position has been highlighted by this recall situation. The company’s management estimated that the product recall was a 600 bps drag on quarterly sales. It’s noteworthy to note that as wholesale partners restocked shelves with alternative items, they were able to recoup around half of this loss through stronger growth in other soft coolers. This demonstrates the significance of the YETI brand to retailers at the wholesale level in my view.

Product pipeline should drive growth

Recalled soft coolers are set to be reintroduced in the 4Q, demonstrating that YETI’s capacity to drive innovation at a rapid pace, and also reinvent products to suit newest trend. Across all areas, YETI has a robust product innovation pipeline. The company is working on a wide range of new drinkware options, such as a wider selection of bottle sizes and shapes, drinkware for formal and informal eating, and more. YETI’s early success with the GoBox product inspired the company to continue investing in the cargo category within its coolers and equipment line. The business has stated once again that the recalled M20 and M30 soft coolers will be reintroduced in the fourth quarter of this year, with production starting this month after a successful redesign. The relaunch will include new size options, which I anticipate will increase the product family’s potential applications and demand landscape.

Guidance

In my opinion, the market now has a floor thanks to management’s reassuring reiteration of FY23 guidance. The soft cooler recall has put 900 basis points of pressure on the company’s earnings; therefore, the company has guided for a decline in the low single digits for the second quarter and flat earnings for the third quarter. An acceleration in growth should be a trigger since it signals the beginning of a turnaround, and I believe the stock price will follow this pattern, with 4Q receiving particular attention. My optimistic outlook for margin recapture is reflected in management’s margin projection; they have reaffirmed a gross margin of 55% for FY23, underpinned by neutral-to-positive expectations for inbound freight and product costs.

Overall, I see the guidance as a very positive indicator for the near-term and YETI should have no issues meeting it.

Valuation

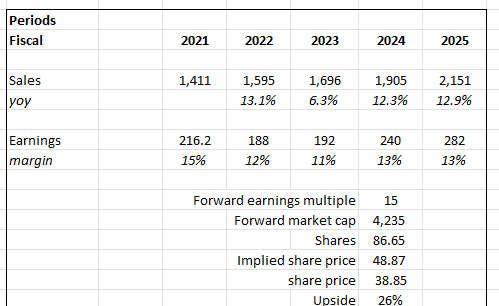

YETI’s valuation is appealing today because, in my opinion, the market is not pricing in the expected improvement after the business gets over this potentially dismal 2Q (due to product recalls, etc.). This is also why the stock’s valuation remains low at 15x forward earnings. My earnings growth projections are similar to the consensus, but I believe multiples will rerate upwards as the market begins to price in normalization. However, given the different interest rate environment and growth profile, it is difficult to predict where multiples might land. As a result, I believe the simplest approach to frame the potential is to assume that multiples do not change, in which case I still predict a 26% upside if the stock remains at 15x projected earnings.

Author’s model

Risks

With macro consumer headwinds, fewer new product traction, and a reversion in spending away from outdoor items, especially in the more profitable DTC channel, YETI’s top-line growth may slow significantly in the coming years. Increased supply chain disruptions and a shift in the channel mix could also lead to a drop in gross margin.

Conclusion

Signs of demand stabilizing, management’s plans for product reintroductions, and a healthy margin recapture opportunity contribute to a positive outlook. While the upcoming quarter may present challenges, I believe the focus will be on 2H23 to see whether YETI’s growth will stabilize and accelerate in 4Q. Notably, YETI’s solid market position is evident in its ability to recoup losses through alternative product growth. With management reaffirming guidance and a favorable valuation, there is potential for the stock price to increase as normalization is priced in. I recommend a buy rating.

Read the full article here