Summary

Nuvei (NASDAQ:NVEI) share prices have underperformed significantly against my expectations. I previously expected the share price to raise as the worst was over with crypto only representing mid-single digits of NVEI revenue. As the market shift their focus to ex-crypto growth, valuation should be well supported. However, this did not play out as expected.

I believe the share price action was a reflection of investors taking a more risk averse approach given the continuous deceleration of consumer spending in light of the inflationary environment, and also a rather weak 2Q guide. Regarding NVEI, I still believe that the worst is over (crypto exposure) and that the current consumer slowdown in spending is merely a function of economic cycles. As the word cycle suggests, I suspect a turnaround will happen soon, and hopefully the sooner the better. Hence, I view the current share price as an opportunity to size up any existing investment positions as I expect NVEI to continue to see very high growth rates in the mid-term (in fact consensus are projecting 20+% CAGR through FY25 as well). My growth forecast is supported by the fact that NVEI has been riding higher on the back of online gaming’s more stable trends than the general economy, the travel recovery, and the long-term tailwind of ecommerce spending. With PAYA’s cost synergies in place, profits should improve as well.

Paya continues to be value accretive

The integration of Paya has been proceeding smoothly, as noted by management at the JP event, and 2Q23 will be the first full quarter since NVEI’s acquisition of Paya. Previously, I discussed why the Paya deal excites me: by giving NVEI access to defensive, non-cyclical, stable-growing end markets it should help to balance the company’s vertical exposure resulting in less growth volatility. The results have been positive, with Paya’s primary markets expanding by the mid-teen percentage point. Despite being under NVEI’s 20% goal, this stable demand allows the company to reinvest heavily during slow periods in growth industries like travel and e-commerce. However, this does not imply that NVEI cannot expand the current 15% core vertical in Paya. Given NVEI’s existing presence in international markets and accelerated go-to-market strategy, I believe there are opportunities to expand payer’s reach, particularly in the B2B and ISV verticals, overseas.

Guidance / growth expectations

Here is the catch for NVEI, which I believe was the driver for weak share price action. Management provided 2Q23 guide and updated FY23 guide, in which, they now expect volume of $50 to $52 billion in 2Q23 and revenue of $300 to $308 million. Now, this is still a very decent growth rate of 45% on a reported basis, but if we adjust for inorganic contribution, the organic growth rate is only guided for 14%. This is lower than management’s full year organic revenue growth rate expectations. If we look at history, 2Q is usually the better performing quarter out of the 4 quarters, it is worrying that 2Q is guided to be weaker than expected. The problem is now magnified as management guided revenue of $1.225 billion to $1.264 billion, which implies an acceleration in growth towards 2H23. I acknowledge both the bull and bear viewpoint on this as they both have merits:

- Bear view: 2H23 acceleration in growth will break historical trends, and the direction of how the macro environment will move in 2H23 is something that could swing NVEI results. In short, there is elevated risk for NVEI not being able to hit 2H23/FY23 expectations

- Bull view: Revenue acceleration in 2H23 should not be an issue as it will lap an easy comp last year (3Q/4Q22 grew only 8/9% respectively), and there is no more headwinds exposure to digital assets.

My take is more towards the bull view as management sounds confident and the reduced exposure to a declining digital asset vertical should make growth comparison a lot easier.

Valuation

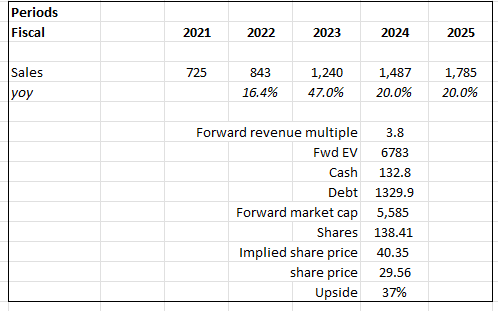

The upside for NVEI is attractive at $29 today against my price target of $40. I believe NVEI continue to grow revenue as guided in FY23 and easily could grow at 20% over the mid-term given the secular trend it is enjoying due to exposure in the gaming and ecommerce vertical. I think this strong growth expectation also warrants a higher valuation multiple than peers like Western Union (0.9x forward revenue,) and Payoneer Global (1.4x forward revenue), as such I assumed a 3.8x forward revenue multiple (which is where it is trading at today). I believe multiple could likely go higher if NVEI margins accelerate back to the heights of FY20/21.

Own calculation

Risk

What is NVEI strength could also become its weakness – its exposure to online gaming and e-commerce, both of which are technically discretionary spendings which would be hit in a deep recession. Given the uncertainty in the coming months/quarters, I would not entirely rule out this from happening.

Conclusion

Despite Nuvei’s underperformance in share prices, I remain optimistic about its future prospects. While the current consumer slowdown in spending and inflationary environment have impacted the company, I believe this is a temporary situation dictated by economic cycles. The acquisition of Paya has been a value accretive move, providing NVEI access to stable-growing markets and balancing its vertical exposure. Although the recent guidance for 2Q23 and FY23 growth rates was lower than expected, I lean towards the bull viewpoint, considering the absence of headwinds from the digital asset vertical and the potential for an easier growth comparison in the second half of 2023. With the company’s strong growth potential in the gaming and ecommerce sectors, I see an attractive upside for NVEI’s valuation. Therefore, I view the current share price as an opportunity to increase investment positions.

Read the full article here