There are all different types of investments in the market, from index funds to Real Estate Investment Trusts (REIT) and everything in between. Each investment serves as a vehicle to reach a specific goal. If you’re renovating your kitchen, you’re not going to pick up a hammer to cut a piece of wood, the same way you’re not going to invest in an index fund if your investment focus is to generate income. The Vanguard Total Stock Market Index Fund ETF Shares (NYSEARCA:VTI) is a tool designed to track the performance of the total market and is constructed from large, mid, and small-cap equities. VTI holdings include an array of investments that range across the spectrum from growth to value. VTI has done well for investors but has lagged the Vanguard S&P 500 ETF (VOO). While VTI is more diversified, both funds are geared toward a long-term buy-and-hold strategy, focusing on capital appreciation, risk mitigation, and diversification. Investing in broad-base ETFs mitigates individual equity risk and is an excellent strategy for any investor. While both VTI and VOO are excellent funds from one of my favorite investment institutions, I have chosen to invest in VOO rather than VTI because it continues to outperform the total market index. I believe VTI will continue to trail VOO in upside appreciation over the years and feel an S&P 500 index fund is more attractive than a total market fund. In my eyes, VTI is a hold, while VOO is a buy no matter where we are in the market cycle.

Seeking Alpha

The tale of the tape between VTI and VOO

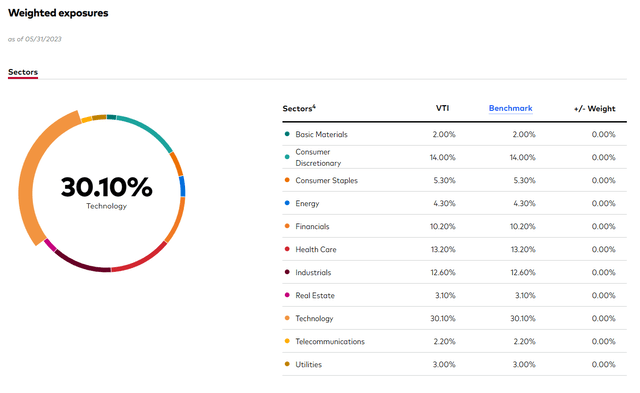

VTI is a large blend ETF that employs a passively managed index strategy tracking the total market. The expense ratio is 0.03% compared to the average expense ratio of similar funds of 0.78%. VTI has 3,883 individual positions within its portfolio with an average earnings growth rate of 18.6%, and an average P/E of 20.6x. VTI has $1.3 trillion in fund total net assets and $288.9 billion in share class total net assets. VTI has 30.1% of its assets invested in tech, and its largest positions include Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN).

Vanguard

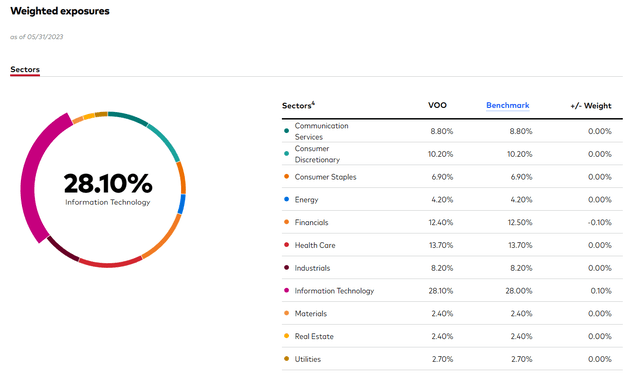

VOO is also a large blend ETF that tracks the equities within the S&P 500 index. VOO also has a 0.03% expense ratio compared to an average expense ratio of 0.78% from similar ETFs. Unlike VTI, VOO has 505 positions, as the S&P 500 is a much more concentrated index. The median market cap of its holdings is $190.2 billion, with an 18.3% earnings growth rate and a 22.1x average P/E. VOO has $823.1 billion in fund total net assets and $296.3 billion in share class total net assets. VOO has 28.1% of its assets invested in tech, and just like VTI, its largest positions are AAPL, MSFT, and AMZN.

Vanguard

When you’re looking for long-term capital appreciation the end results are the determining factor

Many investors utilize index funds, whether an ETF or Mutual Funds, to meet their long-term goals. Regardless of that goal, there is a target that is trying to be reached. In my 401k plan, I don’t have the ability to invest in individual equities, and my options include target date funds, index funds, bond funds, and funds dedicated to small, medium, and large-cap stocks. I have the ability to allocate capital toward a total market index fund or an S&P 500 index fund, and I allocate 100% to an S&P 500 index fund. I want to end my career with the most amount of capital saved in my 401k, and from the options I have, I believe I will achieve this with an S&P 500 index fund rather than a total market fund. Outside of my 401k, I also invest in ETFs, and I have made the same decision I have chosen VOO over VTI because every little bit counts.

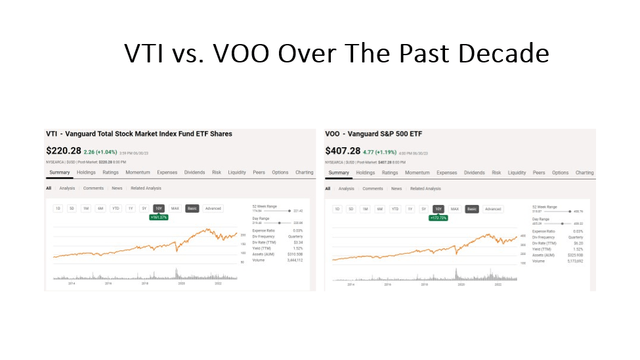

Seeking Alpha, Steven Fiorillo

VOO has outperformed VTI in every time frame I have looked at in the past decade. YTD, VTI has appreciated by 15.69% compared to 16.37% from VOO. Over the past year, VTI has trailed VOO as it appreciated by 16.79% compared to 17.41% from VOO. Using the past 5-years, VTI has trailed VOO by -6.56% on its returns as VTI has appreciated by 56.48% while VOO has appreciated by 63.04%. Going back a decade, VTI has appreciated by 161.37%, while VOO has appreciated by 172.72%.

When it comes to investing, I don’t like leaving money on the table, and when the choice is between VTI and VOO, it’s irrefutable that money has been left on the table investing in VTI. Past performance is not an indication of future outcomes, but it provides a framework for what may occur. An investment has done well with VTI, but VOO has done better. Both are set-it-and-forget-it investments, and if I have the ability to generate an additional 11.35% over a decade, I am going in that direction, especially when the choices are a total market fund vs an S&P 500 index fund.

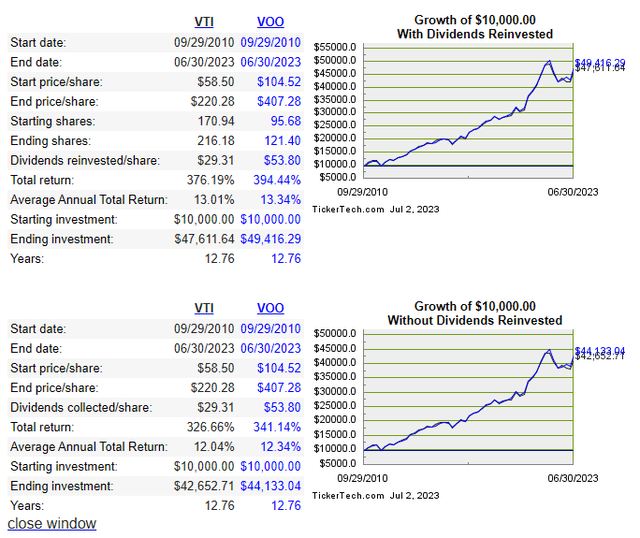

I was able to go as far back as 9/29/10 to compile the data and show what an investment of $10,000 in VTI and VOO would look like today. If you were reinvesting the dividends, your total return on VTI would be 376.19%, as the investment would have grown to $47,611.64. If you had invested the $10,000 in VOO, the investment would have turned into $49,416.29, and the return would have been 394.44%. I am cheap, and I want the most upside I can generate from my investments. By investing in VOO rather than VTI, you could have generated an additional $1,804.65 since 9/29/2010. This may not seem like a lot considering the end investments amounted to $47,611.64 and $49,416.29, but when you look at it from an invested capital standpoint, VOO generated an additional 18.05% on invested capital. VTI has been a good investment, but the end result hasn’t been as good as VOO, no matter how close it has been.

Dividend Channel

Why I think VOO will continue to outperform VTI over the next decade

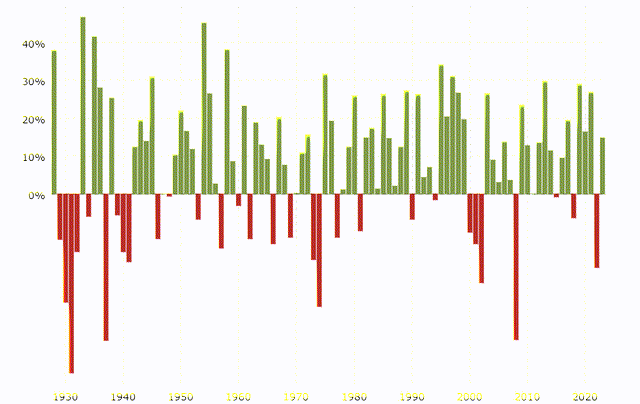

I don’t know what is going to occur tomorrow, let alone the next decade, and quite frankly, nobody does. I can only make assumptions based on the data I have. Going back to 1957, the S&P 500 index has an average annual return of 8.37%, and if you go back to 1928 and calculate for all of the years that include the largest downturn in the market, the average annual return over the past 96 years has been 7.77%. Over the past 96 years, the market has finished in the red 30 times while finishing positive 65 times, assuming it finishes positive in 2023. This works out to a 31.25% chance of seeing a negative year in the market. There has only been 1 occasion since 1928 (1929-1932) where the market declined for 4 consecutive years. There have been 2 periods (1939-1941) (2000-2002) where the market declined for 3 consecutive years, and only 1 occurrence (1973-1974) where the market declined for 2 consecutive years.

S&P 500 Historical Annual Returns

Macrotrends

No matter how bleak the economic environment has looked, over time, the markets always appreciate. For me, the main question becomes, what areas will drive the markets higher? My assumptions are that big tech will continue to lead the markets higher. While there will be winners outside of big tech, this is a much different environment than the early 2000s, and the balance sheets of big tech should allow them to innovate and keep competitors at bay. We are on the cusp of an AI revolution, and many are predicting this to be the next evolution of computing.

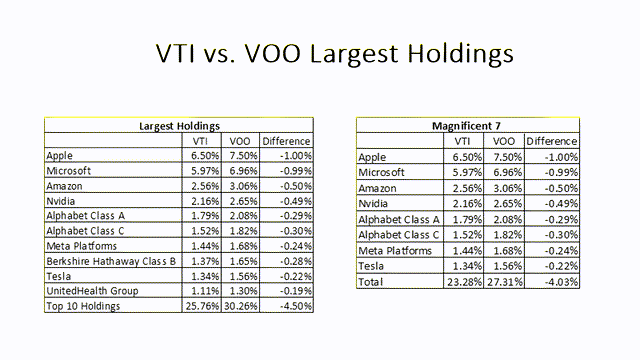

I believe tech is going to lead the way over the next decade, and I am personally invested in AAPL, AMZN, Alphabet (GOOGL), Meta Platforms (META), and Tesla (TSLA) directly. When I look at VOO and VTI, VOO has a larger concentration into its top-10 holdings by 4.5% compared to VTI. When I strip out Berkshire Hathaway (BRK.B), and UnitedHealth Group (UNH) I am left with what is being referred to as the magnificent 7. VOO has an additional 4.03% of its fund’s assets allocated toward the magnificent 7 compared to VTI. I could be wrong, but I feel that big tech will drive the markets higher, as we have seen in 2023, and if they do I want to be in VOO rather than VTI.

Steven Fiorillo, Vanguard

Conclusion

VTI has been a strong investment for many investors, generating large amounts of capital appreciation. VTI provides exposure to the total market, but as I have shown throughout the article, VTI has trailed VOO over the years, focusing on the S&P 500. When it comes to index funds, I stick with the S&P 500 because it provides access to the largest companies in the United States, which is more than enough diversification, in my opinion, as these are battle-tested companies. I don’t like leaving money on the table, and the bottom line is that VOO has outperformed VTI no matter what period I have looked at since 9/29/10. I believe that big tech will lead the markets higher, and VOO has a higher concentration of its assets in these companies which makes me believe that VOO will outperform VTI in the future. I think there is more upside and that VOO is a better bang for the buck than VTI. I think VTI is a hold as the markets should continue to appreciate over time, but I feel VOO is the better buy for new capital.

Read the full article here