Simplify Enhanced Income ETF (NYSEARCA:HIGH) is an actively managed fund that makes options plays in order to generate income. It is run by the same company that runs some highly popular funds such as Simplify Volatility Premium ETF (SVOL) and Simplify Managed Futures Strategy ETF (CTA).

This fund is a bit different compared to other popular high-yielding funds that utilize options plays such as JPMorgan Equity Premium Income ETF (JEPI) and Global X NASDAQ 100 Covered Call ETF (QYLD). The difference is that this fund sells option credit spreads instead of covered calls. In a covered call play, one would buy 100 shares of a stock and write 1 call option against those 100 shares to generate income. Instead of that, this fund sells a number of put and call options and buys the same option a few dollars away from the strike price of the options it sold. For example, the fund could sell a SPY (SPY) $425-420 put spread which would mean that it is selling $425 puts and buying $420 puts, limiting its downside potential.

Typically the fund makes monthly or weekly plays and gets in and out of positions very quickly as soon as its goal has been met in the play. The fund doesn’t specify that criteria it uses in order to pick strike price or width of options spreads it sells but after looking at a few of the fund’s recent plays it looks like the fund mostly targets a delta range of 25-30 for its options plays. What this means is that the fund picks a price point where probability of losing money is about 25-30%.

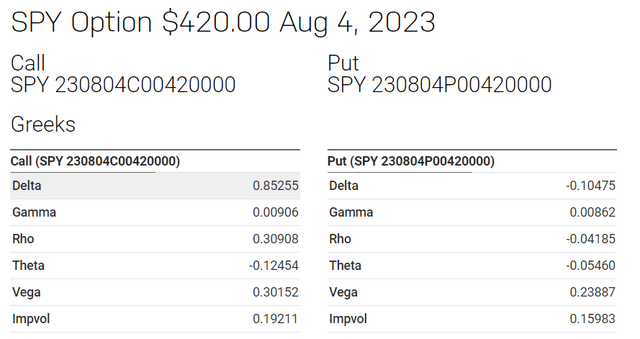

How does any of this work? Let me show you an example. Let’s take a specific SPY option, puts and calls expiring on August 4th 2023 at a strike price of $420. Each specific option carries several inherent set of metrics called “Greeks” because they are associated with certain letters of the Greek alphabet. For example, Theta refers to the time decay and time value of the option and how much time decay could be expected from an option per day. Vega refers to volatility of the option and how it reacts to each point increase or decrease in volatility. Delta is a number that tells us how much value an option will gain or lose when the underlying stock moves by $1. In the below example, $420 calls have a Delta value of 0.85 which means this option will gain 85 cents for each dollar SPY rises and lose 85 cents for each dollar SPY drops. Put option has the same relationship in the opposite direction.

Example of Greeks of an option (Nasdaq)

Delta values of options can also be used to calculate probabilities of an option expiring worthless though. For example, if a put option has a delta value of 0.15 it means there is only 15% chance that it will be profitable for the buyer and 85% chance that it will be profitable for the seller. These probabilities are based on past movements, volatility and timing of the option and they tend to be highly accurate.

This fund basically sells options with delta values around 0.25-0.30 which indicate low probability of failure but it comes with a caveat which is the fact that options with low deltas also tend to be cheaper which means payout is also small for the option seller. If the option seller wants to generate more income, they have to pick a higher delta but this also means taking on more risk. After all there is no free lunch in options trading whether you are on the buying or selling side.

The fund distributes 20 cents per share per month and it’s on track to have an annual dividend of $2.40 which would translate into a yield of close to 10% against the share price of $25.

Actually the fund currently has majority of its assets in short term treasuries that yield about 5.25% and the fund passes this onto investors as part of its dividend. The fund also uses this as collateral for its options plays. Since the fund has committed to pay about 10%, it only has to generate about another 5% to cover its dividend plus expenses. This means that the fund doesn’t have to go overly aggressive to generate its yield but this could change if short term interest rates drop. For example if short term treasury rates were to drop to 2%, the fund would have to generate another 3.25% from its options plays in order to cover its dividend and it might have to make more aggressive plays overall.

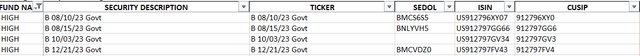

When I look at the fund’s current holdings I am not seeing any options at the moment which means the fund finished its plays and now looking to initiate new positions. HIGH isn’t invested in options plays 100% of the time and it often moves in and out of positions which leaves some time gaps where it has no active plays other than the bonds it holds for collateral. The fund takes an opportunistic approach in its plays and it will only initiate a position if it has conviction in it. This nature of the fund’s plays also makes it difficult for me to examine and offer my take on their specific positions.

HIGH’s current holdings (Simplify)

Investors who feel uncomfortable with the idea of a highly active fund that quickly moves in and out of options positions should probably either avoid this fund or make it a very small position within their portfolio. I already have a very small position of this fund because I personally feel comfortable with the idea of selling option spreads for income and I even sell spreads myself from time to time. Having said that, this fund is certainly not for everyone. Conservative and risk-aversive investors could probably find more value in more traditional options funds such as JEPI and Global X S&P 500 Covered Call ETF (XYLD) and sleep better at night compared to this fund.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here