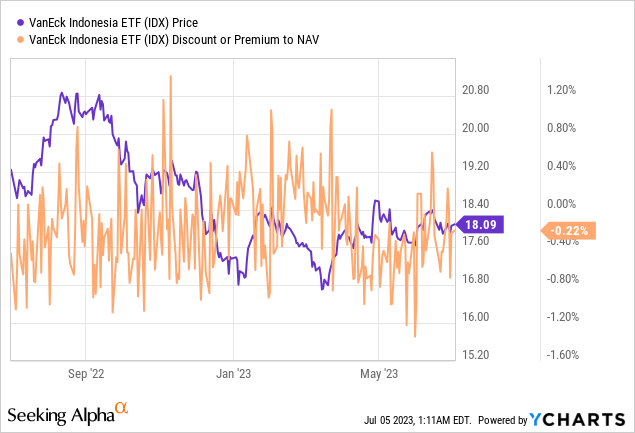

Historically, the fate of the Indonesian economy has been closely tied to the commodities cycle. Yet, the resilience of the macro data this year has surprised positively, with GDP growth up +5% in Q1 on a shallower-than-expected export decline and strong domestic consumption. The government has played a key role here, increasingly pushing for a transition toward higher value-add downstream products (vs. unprocessed ores) and incentivizing foreign direct investment in key sustainability-linked growth areas (e.g., electric vehicles or ‘EVs’). Also boosting Indonesia’s resilience to shocks this cycle are its elevated forex reserves and rapid disinflation (now well within the 2%-4% target). Yet, investor sentiment remains pessimistic, as reflected in the VanEck Indonesia Index ETF’s (NYSEARCA:IDX) 8.6x P/E – in contrast, consensus estimates stand at >30% EPS growth in 2023 and >11% EPS growth in 2024 for the benchmark MSCI Indonesia Index. With Indonesian equities poised to grow into their valuation (and then some), investors willing to look through the near-term uncertainties stand to come out well ahead from here.

Fund Overview – A Competitively Priced Indonesian Large-Cap Fund

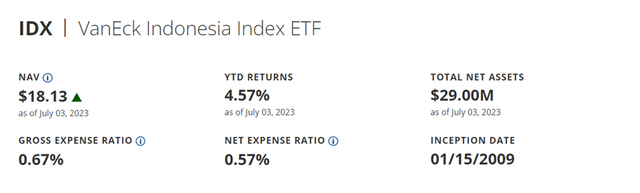

The US-listed VanEck Indonesia Index ETF seeks to track, before fees and expenses, the performance of the MVIS® Indonesia Index, comprising Indonesian large-caps subject to a $150m market cap threshold and a minimum three-month average-daily-trading volume of >$1m. The ETF held ~$29m of net assets at the time of writing and charged a 0.7% gross expense ratio (0.6% net of fee waivers and reimbursements), making it a cost-effective option for investors looking to express a single-country view of Indonesia. A summary of key facts about the ETF is listed in the graphic below:

VanEck

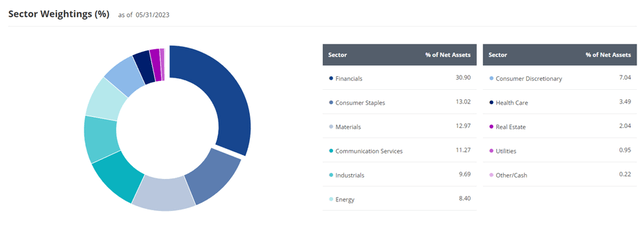

The fund is spread across 56 holdings, with the largest sector allocation going to Financials at 30.9%, followed by Consumer Staples and Materials at 13.0% each. Other notable sector exposures include Communication Services (11.3%) and Industrials (9.7%). On a cumulative basis, the top five sectors accounted for ~78% of the total portfolio – relatively concentrated even by emerging market standards. In line with the fund’s outsized exposure to defensive sectors, its equity beta is relatively low at 0.49 to the S&P 500 (SPY).

VanEck

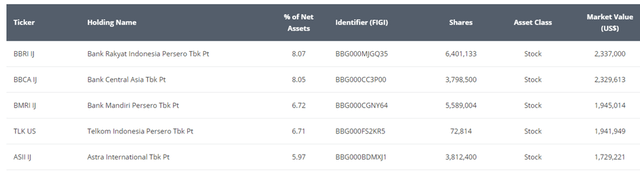

In line with the sector composition, the fund’s three largest holdings are major banks. Leading the way is Bank Rakyat Indonesia (Persero) (OTCPK:BKRKY) at 8.1%, followed by Bank Central Asia (OTCPK:PBCRF) and Bank Mandiri at 8.1% and 6.7%, respectively. Rounding up the top five are telecommunications conglomerate Telkom Indonesia (TLK) at 6.7% and diversified conglomerate Astra International (OTCPK:PTAIF) at 6.0%. In total, the top five holdings account for ~36% of the IDX portfolio.

VanEck

Fund Performance – Lackluster Capital Growth Despite the Blockbuster Early Years

On a YTD basis, the ETF has risen by 4.0% and has compounded at an annualized +7.4% rate in NAV terms (+7.3% in market price terms) since its inception in 2009. Returns have largely been back-ended, though, with IDX’s portfolio outperforming significantly post-financial crisis but underperforming over the next decade (-3.4% per annum in market price terms). Zooming in, total returns stand at -14.8% and -3.0% over a one and five-year time period, respectively, largely mirroring comparable Southeast Asian funds.

VanEck

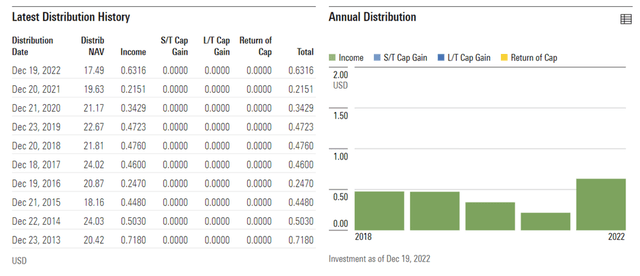

Supported by the fund’s cash-generative holdings, IDX has consistently delivered solid distributions – even through the COVID-impacted years. The current trailing twelve-month yield, for instance, stands at 3.5% – well above comparable Southeast Asian funds and its counterpart, the iShares MSCI Indonesia ETF’s (EIDO) 2.4% yield. Expect more upside to distributions this year as well, given the portfolio’s underlying earnings growth potential. Fundamentally, the fund’s ~8.6x P/E valuation also stands out (EIDO trades at 11.9x despite a similar portfolio composition), particularly given consensus estimates for MSCI Indonesia peg EPS growth at +31% this year (+11% next year).

Morningstar

This Commodity Cycle is Different

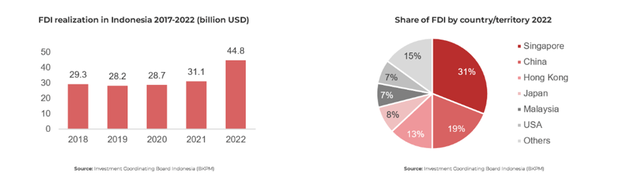

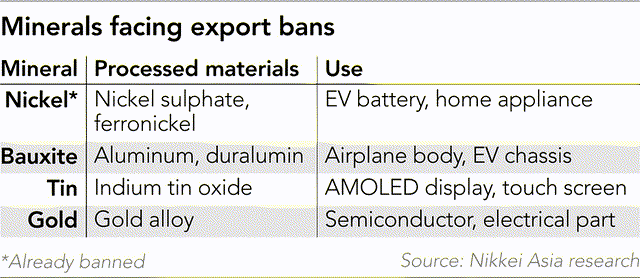

Recent years have seen Indonesia leverage its vast reserves (note Indonesia is the leading global nickel producer) to accelerate its progress up the commodity value chain. Having pushed for a reinstatement of the ban on unprocessed nickel ore shipments in 2020 (note Indonesia first implemented restrictions in 2014 before subsequently relaxing them in 2017), the country has seen a surge in base metal export volumes relative to unprocessed ore exports. The FDI inflows in the aftermath of nickel restrictions, along with the subsequent expansion of Indonesia’s down-streaming footprint, have been a testament to its policy success. For instance, the Indonesia Morowali Industrial Park, a China-Indonesia joint venture to process nickel pig iron and stainless steel, has already added significant production capacity (18 smelters in operation and another 22 smelters set to come on stream over the next three years) and boosted the growth of base metal exports over the last year.

ARC

With President Jokowi also pushing for more export restrictions on other key resources such as bauxite, copper, and tin, down-streaming growth likely has more legs. As one of the largest renewable sources globally, Indonesia also has unique leverage in these base metals and is, thus, well-positioned to replicate the success of its nickel playbook. Early signs have been resoundingly positive on the FDI front, with the likes of Freeport-McMoRan (FCX) building out a $3bn copper smelter (commencing production in 2024) and Vale (via its Indonesian subsidiary PT Vale Indonesia Tbk (OTCPK:PTNDY)) also constructing one of the world’s largest nickel processing plants for EV batteries (production to start in 2025). So even in the likely event that these bans weigh on near-term export proceeds, the long-term down-streaming benefits bode well for Indonesia’s increasingly relevant role in sustainability-linked value chains globally. While light on materials, IDX’s portfolio focus on major banks means it should broadly track the economic growth benefits.

Nikkei

Turning the Page on Indonesian Equities

Indonesian equities have generally treaded water in recent years, as reflected by the IDX’s negative annualized return over the last decade. But the underlying economic drivers are shifting as the country increasingly weans off its historical dependence on unprocessed commodity exports. The government’s effort to attract FDI from the global EV supply chain has been a key positive in this regard, helping to accelerate the transition from unprocessed raw material exports to high value-add downstream products. Along with the consumption tailwinds from Indonesia’s ‘demographic dividend,’ the prospect of higher quality long-term economic growth bodes well for IDX’s financials/consumer-heavy portfolio. The current ~9x P/E valuation (~1.6x book) presents a compelling entry point.

Read the full article here