Investment Rundown

Having exposure to the renewable energy market seems to be on most investors’ minds these days. It’s a challenging market to gain exposure to as to find the hidden gems you have to weed through a lot of poorly run companies that can barely turn a profit. The massive run-up that SunPower Corporation (NASDAQ:SPWR) had in 2021 was a massive trap to buy into. The share price has plummeted from a high of around $55 per share to under $10 now. But during this time SPWR has been able to grow revenues very efficiently still though it’s trading at a FWD p/e of 27 it looks like a great buy.

Momentum for the industry is continuing and the recent developments that SPWR secured an additional $1 billion in new capital to fund solar loans is another tailwind for the company. The ambitious targets the company has set for 2025 seem very realistic reach and right now I think that SPWR is worth a buy rating.

Company Overview

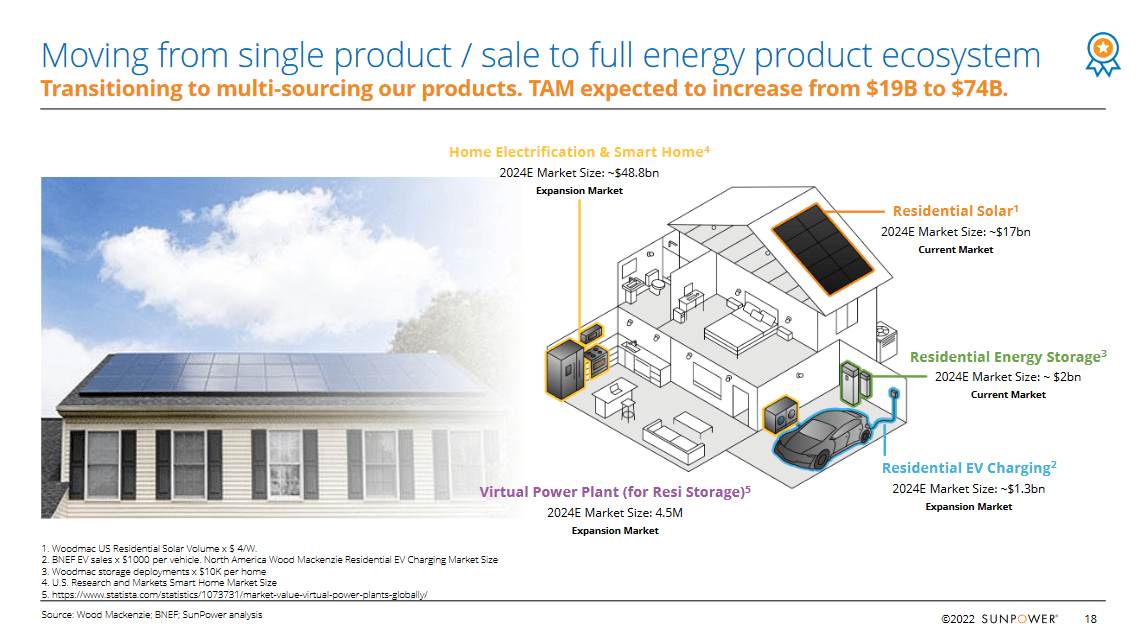

SunPower is a company with direct exposure to the demand for green energy. SPWR operates as a technology and energy service provider, offering solar, storage, and home energy solutions in both the USA and Canada. The demand for solar is only increasing and SPWR has done well in creating an almost ecosystem with their products.

Residential Product (Investor Presentation)

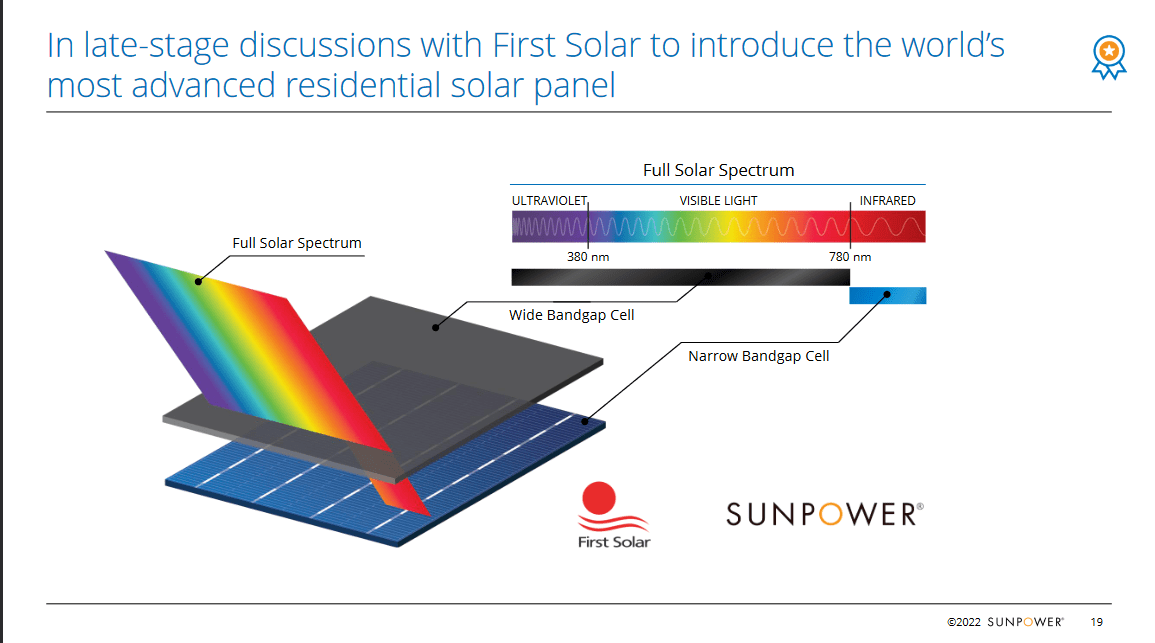

SunPower provides a variety of solar panels catering to residential, commercial, and utility-scale customers. Their Maxeon solar panels stand out as highly efficient and long-lasting. The company also offers energy storage solutions to store surplus solar energy and provides monitoring and maintenance services to ensure the ongoing performance of its systems. SPWR has tried to solidify its position in the market as they begin partnerships with other successful companies, like First Solar (FSLR) for example.

Company Product (Investor Presentation)

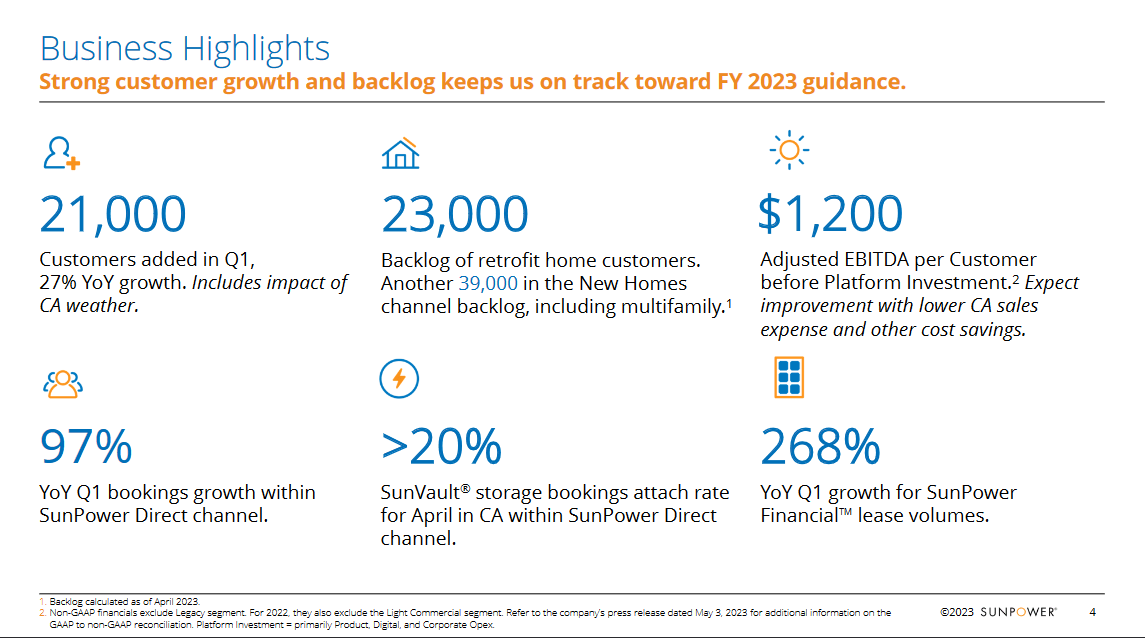

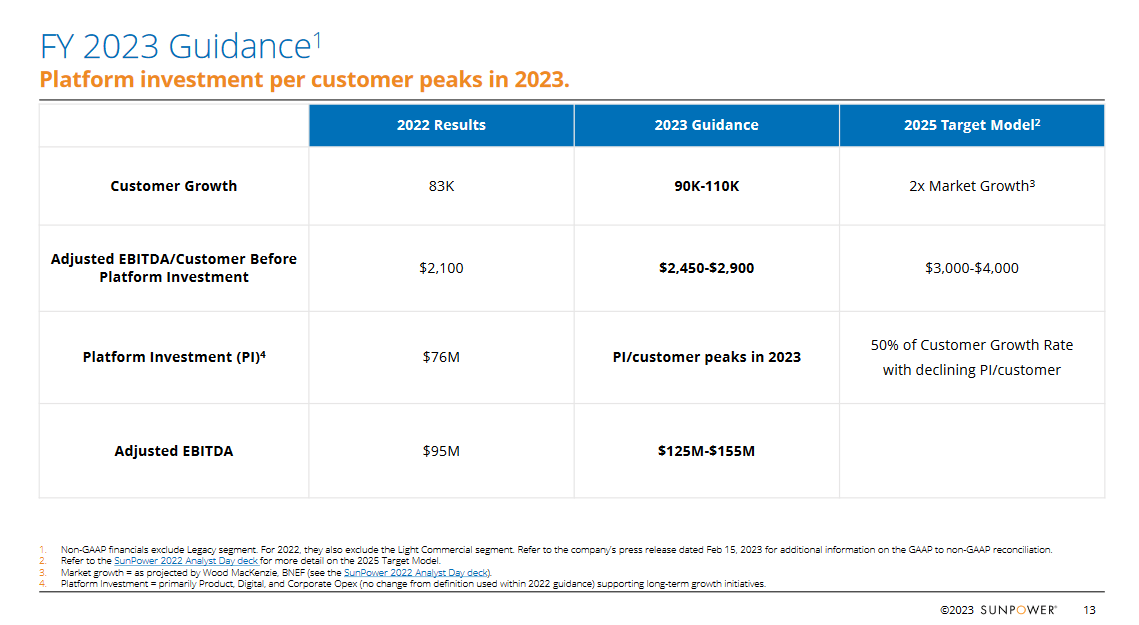

This broader exposure seems to be bringing in a lot of new customers for the company. The guidance for 2023 is that SPWR will have between 90,000 – 110,000 k customers in total. The company added 21,000 new customers in Q1 FY2023 so plenty of growth is still expected for the remained of the year. What looks reassuring with SPWR right now is its ability to grow customers at a solid rate, but also grow revenue even faster. This suggests that SPWR can hike prices and still enjoy the benefits of growth as it hasn’t deterred new customers.

Earnings Highlights

The most recent report from SPWR showed them able to grow on the back of strong industry momentum and they grew revenues 32% YoY on a non-GAAP basis. The CEO Peter Faricy seemed very pleased with the quarter, “We exited the first quarter with high customer growth, significant new financing commitments, and unprecedented retrofit backlog driven by our efforts securing customers under NEM 2.0”. This highlights the measures that SPWR has taken so far are paying off significantly, like partnering with General Motors (GM).

Business Highlights (Earnings Presentation)

SPWR has grown its Adjusted EBITDA per customer to an impressive $1200 and still, expects improvements here as the company is implementing cost savings. The TAM for SPWR remains largely underpenetrated which presents SPWR will a long-run way to growth in my opinion. By 2026 the adoption rate of solar would only be around 6.1% by SPWR on estimations.

2023 Guidance (Earnings Presentation)

As for the targets that SPWR has they remain very ambitious and if they come true would mean strong growth for the new several years. 2023 estimates suggest an EPS of $0.35, which by 2025 would grow to $0.91. This represents an increase of 160%, which seems realistic as SPWR sees the cost measures and overall improvement in their business resulting in Adjusted EBITDA per customer growing to $3000 – $4000 per customer. On the upper end that would be an improvement of 37%.

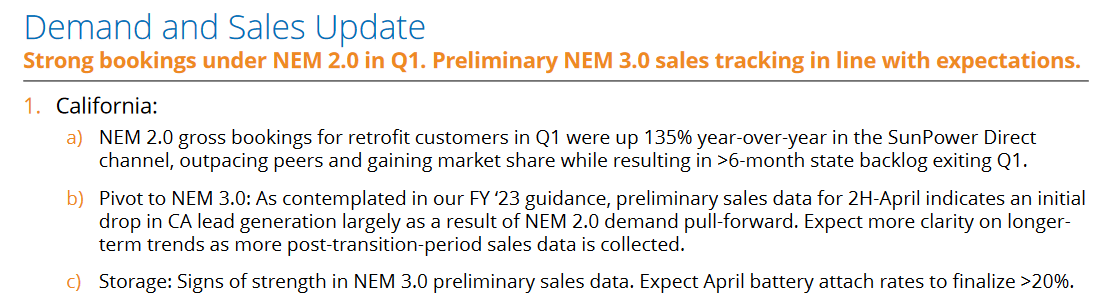

Sales Update (Earnings Presentation)

One of the driving forces behind SPWR is the demand experienced in the state of California. The residential market here is a massive reason for the success SPWR has had here because of them focusing on the residential side and not just the commercial one. 135% increase in customers for the SunPower Direct channel is showing why SPWR can outpace competitors and the company maintains its strong market share in the region.

Risks

Utility companies face risks related to utility regulatory business models, environmental and climate policy, and tax policy. Changes in regulations can introduce uncertainty, and environmental and climate policies may lead to higher costs or service disruptions.

Expenses are becoming more and more challenging to handle as the effects inflation has had seems to indicate companies are struggling to pass on some costs to customers. With SPWR for example, the Total Operating Expenses have largely remained around the 20% mark but recently started moving upwards slightly, using the TTM numbers it sits at around 20.8%. This isn’t a good move to see and it makes future margins come into question about whether they seem realistic or not. I think these are short-term headwinds though and the bigger picture stills look very appealing.

Financials

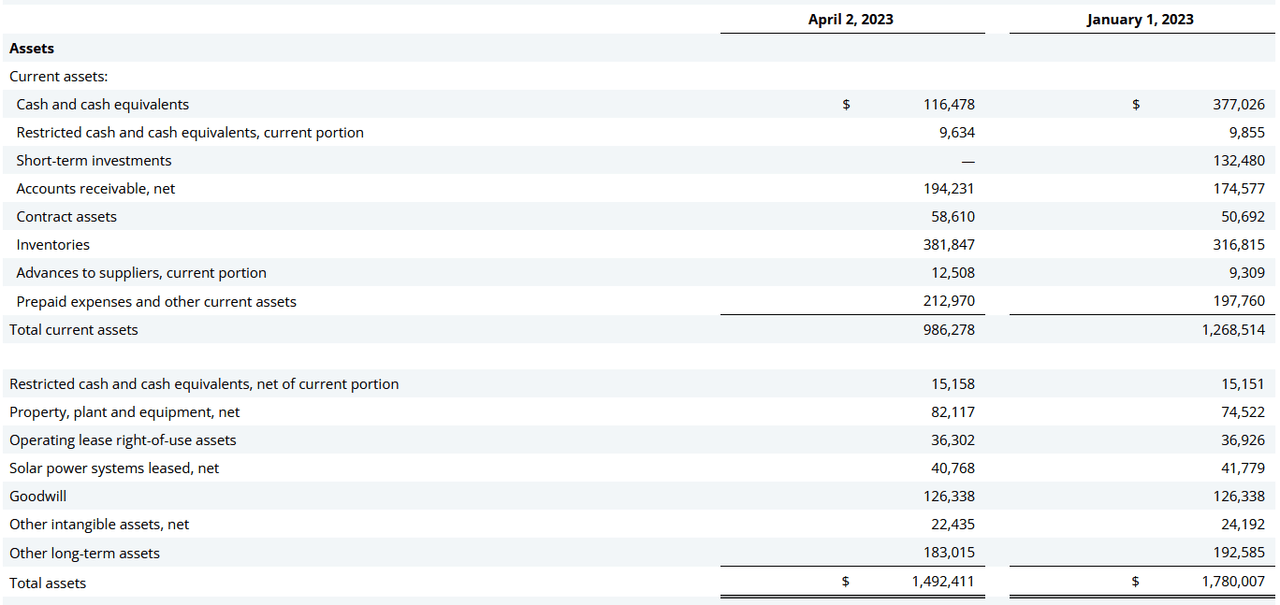

SunPower isn’t exactly a new company, it was founded back in 1985 and has had a long time to establish a solid balance sheet that they can leverage for future growth. The cash position for the company has been slightly inconsistent however in the last few years, and looking on a QoQ basis this is certainly highlighted.

Balance Sheet (Earnings Report)

The cash has gone from $377 million to $116 million sequentially, but SPWR is expected to generate positive operating cash flows in 2023. This should help support the rebuild of the cash position and also help support the relatively large CAPEX the company has for 2023 of $55 – $65 million.

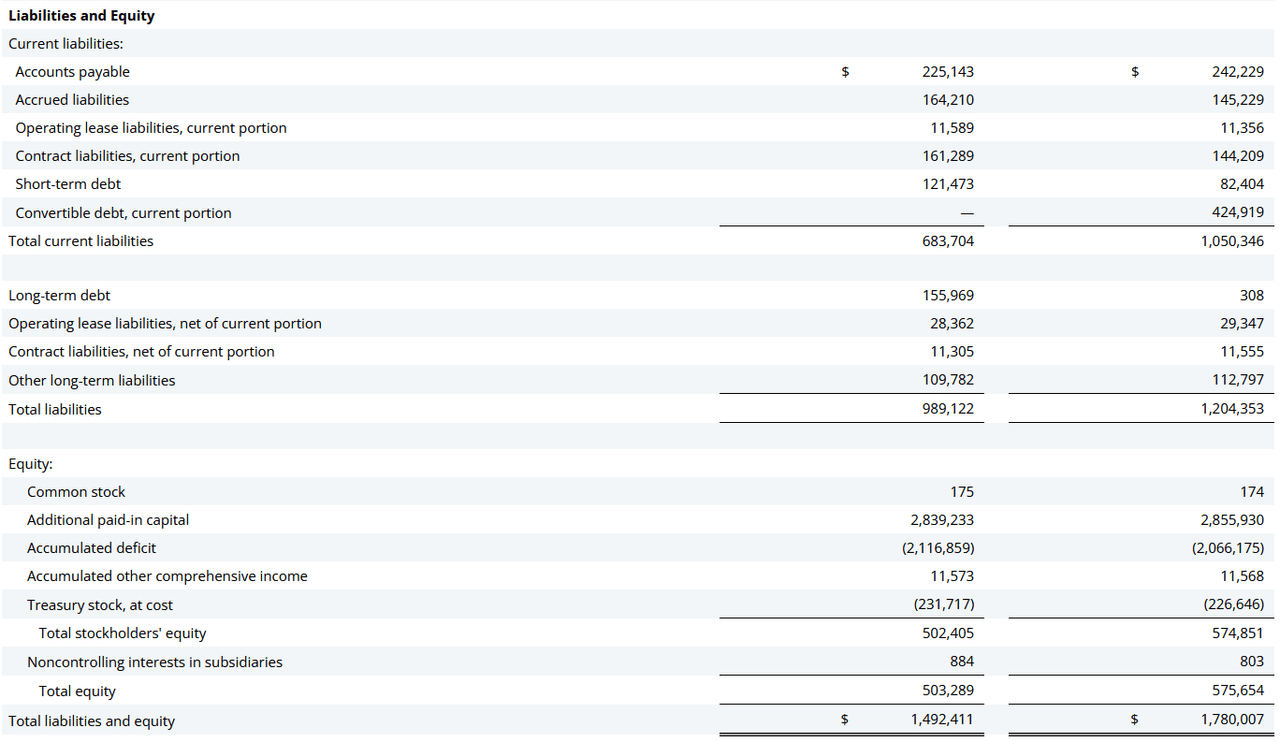

Balance Sheet (Earnings Report)

As for the liabilities, I don’t see anything alarming. The total assets outweigh the total liabilities with a ratio of around 1.4. The long-term debts as just slightly higher than the current cash position which puts SPWR in a sound position right now. What should be mentioned is that the company did take on $155 million of long-term debts between the two quarters. But it’s still at a very low point compared to some years ago when long-term debts were nearing $1.7 billion. I think the overall picture of SPWR’s financials is that they have made it much less leveraged and in a better position to take on debt if necessary and risk it creating too large hurdles down the road as it matures.

Final Words

I think that in this time and age, most investors should have some sort of exposure to the renewable energy and solar market. It’s a massive market opportunity that still is largely underpenetrated. SPWR has grown into one of the most well-known and well-established businesses in the industry. Going with an already winner of a company I think is the best way to enter the market.

The share price for SPWR has massively plummeted and now I think it sits at a decent entry point for the long term. An FWD p/e of 27 might be too much for most investors, but we need to realize that SPWR is expecting to significantly improve its top and bottom lines over the coming years as it aggressively adds more customers to its collection. By 2025 the p/e would be under 11 which leaves plenty of upside potential as the sector’s average is 17. Margins still have some ways to go, but as customers are streaming in I think the coming few years will be focused on consolidating what they have and improving business practices to ultimately grow margins, something I can very well see them doing. This concludes me rating SPWR as a buy right now.

Read the full article here