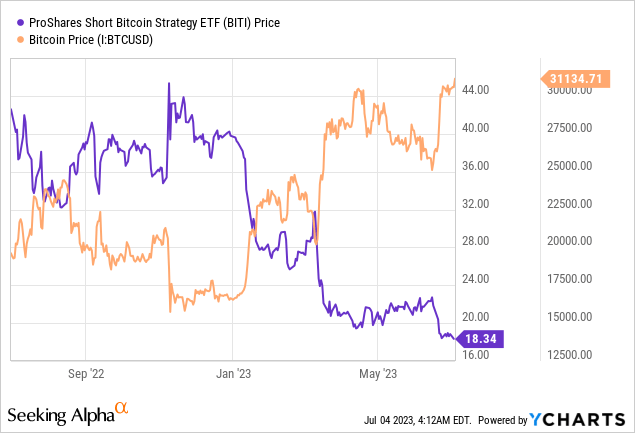

It has been a rough ride for the ProShares Short Bitcoin Strategy ETF (NYSEARCA:BITI) which trades at around $18.34 during the last year as shown in the blue chart below while at the same time, Bitcoin (BTC-USD) has climbed beyond the $30K level. Reaching such highs has been helped by BlackRock (BLK) in the process of launching a Bitcoin spot ETF.

Thus, those who shorted Bitcoin through BITI have suffered from losses and my objective with this thesis is to assess whether volatility episodes could emerge for Bitcoin this time translating into gains. For this purpose, I focus on the recent price actions.

First, looking across the industry, there are already many funds dedicated to cryptocurrency, which means that the enthusiasm suscitated by the giant asset management company needs to be analyzed in more depth to know exactly what value it brings given the effect on the crypto world.

BlackRock is not Alone

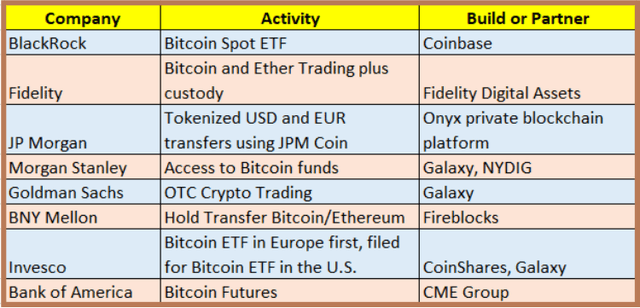

As for filing an application to launch ETFs with crypto holdings, Blackrock is not alone since it is closely followed by Fidelity Digital Assets which intends to launch an Ethereum ETF in addition to Bitcoin as pictured below. Then, there are the big investment banks like JPMorgan (JPM) and Morgan Stanley (MS).

Table Built using Data from (www.cointelegraph.com)

On seeing others including Bank of America (BAC), it is no wonder that the world’s largest crypto by market value was elevated to such highs. Indeed these big names in commercial and investment banking requesting the U.S regulator or the SEC (Security and Exchange Commission) permission to develop financial products indexed to Bitcoin shows that there is considerable demand for such investment vehicles from their client bases.

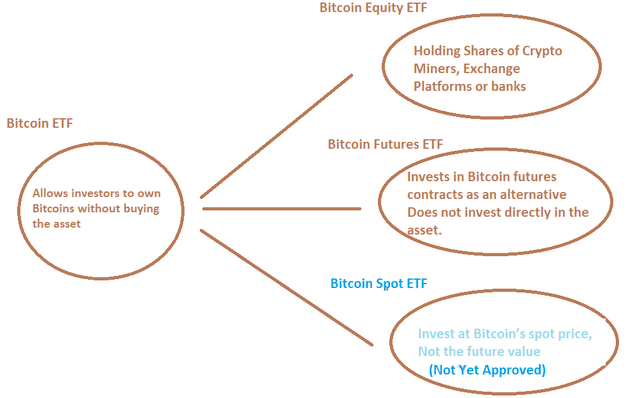

Now, a question that comes to mind is why is there a need to be so excited when there are already so many ETFs dedicated to Bitcoin as tabled below, with this list being far from comprehensive. In this respect, a closer look reveals that while the ProShares Bitcoin Strategy ETF (BITO) trades futures, the VanEck Digital Transformation ETF (DAPP) holds shares of crypto mining companies and exchange platforms. The same is the case with the Bitwise Crypto Industry Innovators ETF (BITQ).

ETFs that are already listed (www.seekingalpha.com)

Moreover, despite already managing the Bitwise Crypto Industry Innovators ETF, Bitwise, a fund manager specializing in cryptocurrencies has reiterated its request to the SEC for a Bitcoin spot ETF, just like BlackRock.

Now, investors will notice that the above funds are all classified as “Alternatives”.

The Risks Posed by Alternatives and the Spot ETF

Investigating further, according to the SEC, these are registered and publicly offered alternative mutual funds, but “hold non-traditional investments or use complex investment and trading strategies”. The U.S. regulator also raises awareness of “their unique characteristics and risks”.

Looking at further clarification from Cointelegraph, and considering the example of SEC-approved BITO which trades Bitcoin futures contracts as an alternative, I found that it cannot invest directly into the cryptocurrency’s actual price in the same way as a spot ETF would do. Thus, with this Proshares ETF, it is more about streamlining the trading process to most accurately track Bitcoin’s value which may even seem like betting on the market instead of the asset itself. Thus, a Bitcoin spot ETF extends the logic of getting exposure to the digital asset without actually holding it, but in doing so, the fund managers deal directly with its actual price point.

For the uninitiated, the diagram below illustrates the differences with the example of a Bitcoin equity ETF being DAPP or BITQ.

Illustration Built using data from (cointelegraph.com/)

The above illustration may be somewhat simplistic as things may not be as straightforward in actual practice as a spot ETF to trade crypto’s spot price may also imply that buyers have to hold Bitcoins within the fund, somewhat similar to buying a stock. This in turn signifies more regulatory scrutiny which may be the reason why the SEC did not approve BlackRock’s filing. Instead, it has found some inadequacies and seeks more clarity and comprehensiveness.

This has spooked certain investors as a result of which Bitcoin dropped by around 1% on June 30 and episodic volatility may continue as Coinbase (COIN) defends itself after being accused by the SEC of some asset registration issues. Now, as the second largest crypto exchange and BlackRock’s custodian for its spot ETF (table above), the argument Coinbase puts forward to defend itself and the way these are judged by the court will also impact Bitcoin’s value going forward.

Assessing the Trading Opportunity

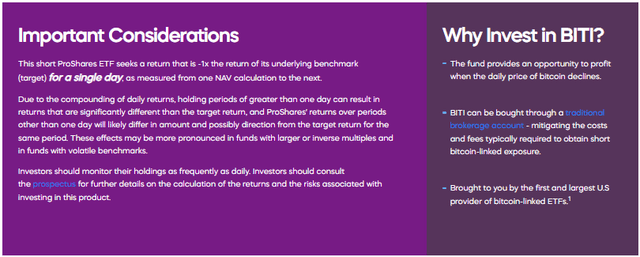

Noteworthily, volatility creates a trading opportunity as BITI thrives on Bitcoin’s pains. In this respect, it inversely (-1x) tracks the daily performance of the S&P CME Bitcoin Futures Index as illustrated below.

Main Characteristics of Leveraged and Inverse BITI (www.proshares.com)

Thus, looking at the price action and as encircled in red below, BITI did gain about 2% on June 30 but has since then retrenched by more than 3% while BTC is up as evidenced by the blue chart. Also, for those who still have a long position on BITI in the hope of an upside, it is better to exit due to the compounding effect suffered by leveraged ETFs. This occurs when there are many ups and downs within the trading period resulting in capital losses, and this is the reason why the issuers advise traders to calculate gains over a period not exceeding one day.

Moreover, in contrast to a buy-and-hold strategy for a normal ETF as highlighted by the SEC, and which can be rewarding in terms of capital gains over time, price appreciation is less probable for leveraged BITI unless Bitcoin suffers from a prolonged downside, which is not likely to be the case in the near future as I further elaborate upon.

Illustrating the Short-term Price action (www.seekingalpha.com)

The main reason is Bitcoin has now become an asset of interest for some of the world’s largest financial institutions, whereas only three years back, Wall Street majors were fearing that the cryptocurrency would form an integral part of the financial system, at the expense of their own lines of business. This may be the reason why the world of cryptos is being spared the high degree of volatility it experienced since November last year when Bitcoin lost about 20% of its value in a relatively short period of time. This was also subsequent to the highly-publicized demise of Sam Bankman-Fried’s FTX, a major cryptocurrency exchange platform that was also contagious to others like Genesis.

BITI as a Shorting Opportunity

Nearly eight months later, the outlook for crypto has changed completely, and after early interest shown by the major fund managers like ProShares and Invesco in 2021 (as per the inception dates in the above table), it is now the turn of the world’s largest institutions to file applications for launching their own ETFs. There are other less high-profile issuers like Grayscale which are reiterating previous applications which were turned down by the SEC earlier.

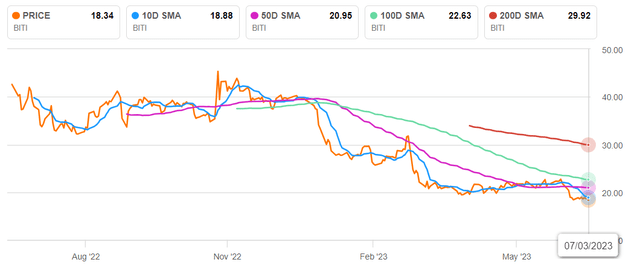

While enthusiasts will certainly view a spot ETF as a more direct method of investment, there is also the fact that there is more interest, this time not from retail investors but from Wall Street’s largest institutions. Moreover, traditional finance (when viewed from the crypto perspective) now being involved to such a degree should change the way people perceive Bitcoin and possibly engender a complete redistribution of the cards in the ecosystem, in such a way to be more acceptable to regulators. This can only bode well for digital assets and conversely, be an opportunity to short BITI. As per the charts below, this position is supported by its lower share price compared to the 10-day, 50-day, 100-day, and 200-day moving averages, which means that momentum indicators point to a downside in the ProShares ETF.

Momentum Indicator: MMA (www.seekingalpha.com)

To come to a target price, I consider that Bitcoin has broken through the $30K resistance level, and could see a 13% ((35-31)/31)) upside in case the cryptocurrency climbs back to $35K based on the current value of around $31K. Now given BITI inversely tracks Bitcoin, it could fall by another 13%, to $15.95 ((18.34 x 0.87) based on its share price of $18.34.

Finally, traders will note that there are likely to be additional clarification requests by the SEC which means more time is likely to pass before a spot ETF is finally approved, which would be the first of its kind in the U.S. This means more volatility, but, by shorting a short ETF, you are in fact taking advantage of the very compounding effect which plays against you when you are long.

Read the full article here