Dime Community Bancshares (NASDAQ:DCOM) has been subject to the same volatility affecting the regional banking sector since March. When the first round of selling hit, I purchased the bank’s preferred shares (NASDAQ:DCOMP) as the dividend yield soared to over 8%. After reviewing the bank’s first quarter financials, I have opted to sell the 8.3% yielding preferred due to some risks.

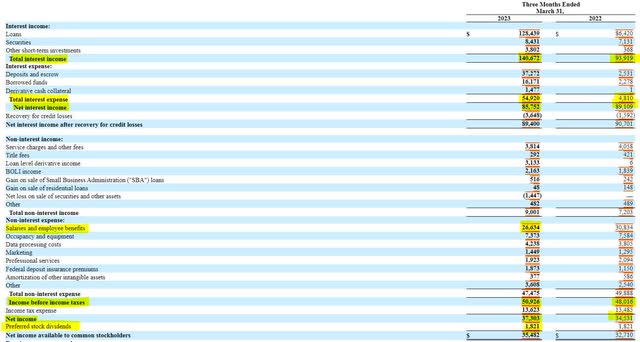

Dime Community’s first quarter earnings were stable compared to a year ago despite an erosion of net interest income. Interest income increased by more than $45 million, but those gains were more than offset by a $50 million increase in interest expense, leading to a $5 million drop in net interest income. Where the bank was able to make up the difference was in their operating costs. Dime Community’s operating expenses fell by approximately $2.5 million, led by a drop in salaries and benefits. The drop in operating expenses was good enough to lead to a near $3 million increase in net income compared to a year ago.

SEC 10-Q

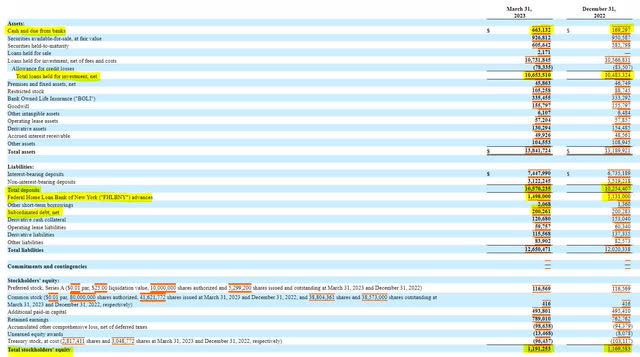

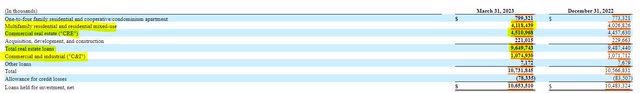

Dime Community’s balance sheet sheds more light into the bank’s capital structure. During the first quarter, Dime Community increased its cash position by $500 million and grew its loans by $200 million. The bank procured these funds through an increase of deposits by $325 million and they borrowed more than $350 million from the Federal Home Loan Bank of New York. The bank was able to grow shareholder equity in the first quarter by more than $20 million, ending the quarter at $1.19 billion.

SEC 10-Q

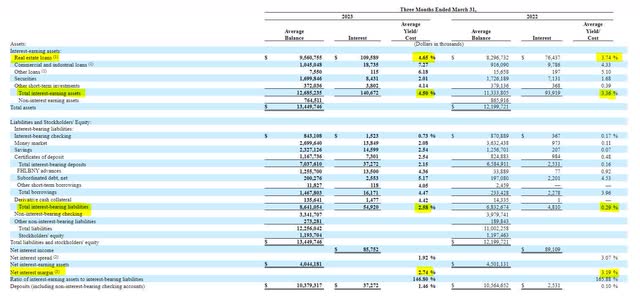

Where my concern lies with Dime Community Bancshares is in examination of the bank’s income relative to the size of its loan portfolio. The bank’s total interest-bearing asset yield is up 114 basis points from last year but sits at just 4.5%. This is lower than the current Fed funds rate, therefore any new borrowing that the bank takes on will need to be at a cost higher than its income. This effect is already starting to show with net interest margin down 45 basis points and net interest spread down by more than 100 basis points.

SEC 10-Q

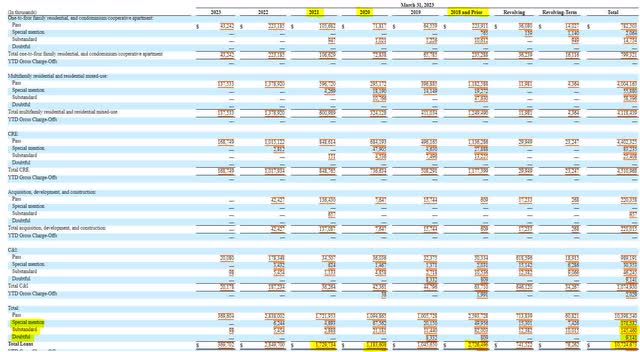

While Dime Community’s loan performance seems to be good (97% of the portfolio is passing), I am also concerned about the amount of pandemic era loans on the balance sheet. The bank currently has over a quarter of its loans originating from 2020 and 2021 as well as another quarter from 2018 and prior. These older, below market rate loans could continue to burden loan yields beyond 2023. The concentration of loans in commercial real estate and multifamily is also concerning as a downward turn in the real estate market coupled with higher refinancing rates would adversely affect nearly the entire loan portfolio.

SEC 10-Q SEC 10-Q

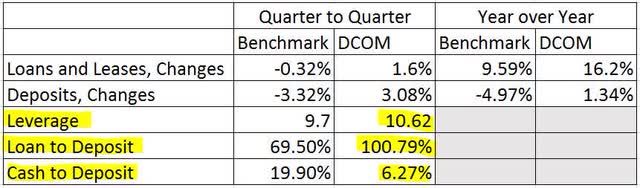

Lastly, in comparing Dime Community’s financial ratios to the benchmarks established by the Federal Reserve’s commercial banking data, I have additional concerns. Despite the increase in cash during the first quarter, the bank has one third of the cash commensurate with its balance sheet than its peer group. Also, the loan to deposit ratio is over 100%, signifying that the bank may need to engage in non-deposit financing should loan demand grow beyond deposit growth or should deposits begin to decline. Should additional borrowing be needed, the bank’s leverage is already nearly a full point higher than its peers, creating additional pressure on the value of the bank’s equity.

SEC 10-Q

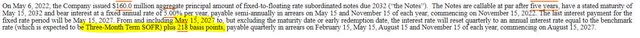

While I sold Dime Community Bancshares preferred shares, there is one option out there for fixed income investors. The bank does have a 5% coupon bond trading at 73 cents on the dollar that matures in 2032. At current prices, the bond yields approximately 9%, but there are two caveats. First, the bond is very thinly traded, with no transactions in the last three months. Secondly, the interest rate on the bond will reset in 2027 to the three-month term SOFR plus 218 basis points. Due to the reset rate being that far out, investors who take on this bond will have to be aware of the interest rate risk presented in the future.

FINRA SEC 10-Q

Overall, Dime Community Bancshares loan concentration combined with its low yielding loan performance has me too concerned to hold the bank’s preferred shares. I would take a position in the bonds if I could find an order opportunity, but they are too thinly traded at this time. Other regional banks are offering competitive yields on preferred shares with better loan performance and less reliability on external debt.

Read the full article here