Investment thesis

Digital Turbine (NASDAQ:APPS) stock was among the hottest stocks amid the pandemic stock market craze. The share price grew more than tenfold between February 2020 and February 2021. The current stock price is much closer to pre-pandemic levels. Many investors might be tempted to buy the dip, but my analysis suggests that APPS does not look like a good investment. The company’s financial performance over the multiple past quarters was weak, and consensus estimates are not very optimistic about the upcoming quarterly earnings as well. Moreover, my analysis suggests that the upside potential is not worth the level of risks and uncertainties attributed to investing in APPS.

Company information

The company offers mobile app discovery, delivery, advertising, and monetization solutions for app developers and publishers.

The company’s fiscal year ends on March 31. APPS operates through two reportable segments: On Device Solutions [ODS] and App Growth Platform [AGP]. The ODS segment offers products and services that simplify app and content media discovery and delivery for mobile device users. The AGP segment includes Advertising Solutions and Ad Monetization Solutions, enabling app developers, brands, and agencies to execute targeted mobile campaigns on the company’s direct app inventory. For the fiscal year ending March 31, 2023, ODS sales comprised about 63% of the total.

Financials

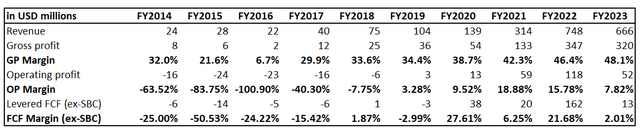

The company delivered an impressive revenue growth over the past decade. Revenue showed a 39% CAGR over the long term, which is solid—on the other hand, the last year demonstrated an 11% decline in revenue, meaning near-term challenges for the business. I like that profitability metrics significantly improved over the past decade, though the operating and the free cash flow [FCF] margins are far from recent years’ peaks.

Author’s calculations

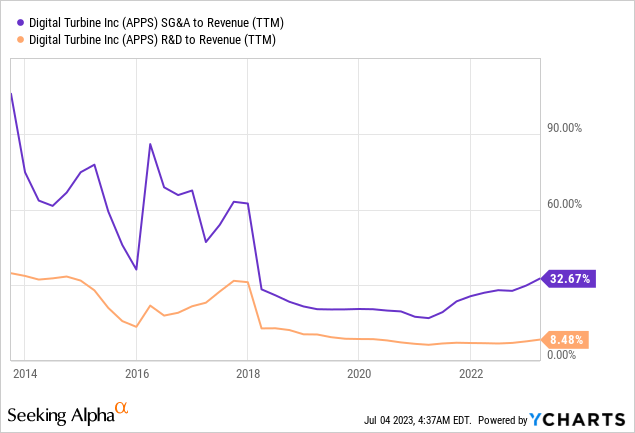

The weakness in operating profit last year was due to the increase in SG&A. Overall, the company spends a far more significant portion of sales on SG&A compared to R&D. This might indicate a lack of long-term mindset where commitment to innovation should prevail. Below you can see that the revenue spent on SG&A has been increasing in recent years despite substantial revenue growth, while R&D investments declined.

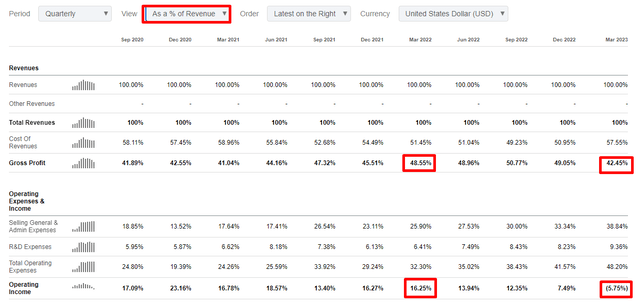

Now let me narrow down my financial analysis to the quarterly level. The company demonstrated a YoY revenue decline in the last three-quarters. Difficulties to drive revenue growth inevitably led to shrinking profitability metrics. In the last reportable quarter, the operating margin even went negative.

Seeking Alpha

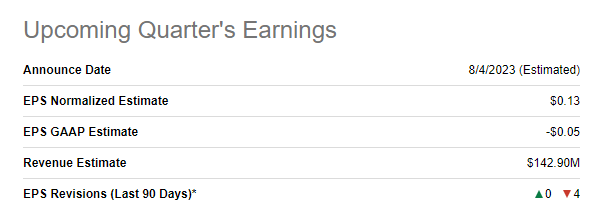

The next quarter is also not expected to demonstrate a turnaround. According to the consensus, quarterly revenue is expected at about $143 million, about 24% lower YoY. The adjusted EPS is also expected to decline dramatically from $0.38 to $0.13. The about triple decline in the bottom line suggests little proactiveness from the management in addressing headwinds for the top line.

Seeking Alpha

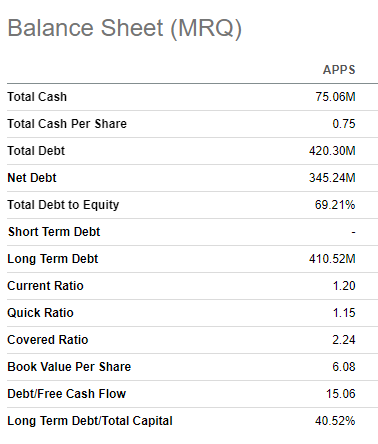

The company’s balance sheet is not strong, mainly because of its substantial net debt position. The vast part of the debt is long-term, though. Liquidity metrics might look decent, but I would not call them a fortress, given the context of declining financial performance.

Seeking Alpha

Valuation

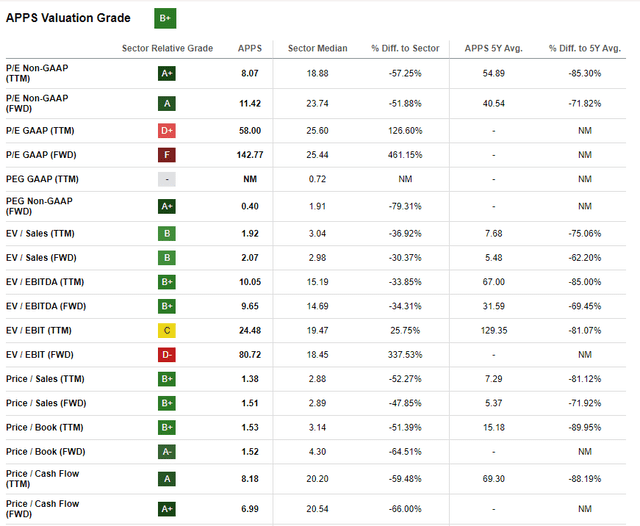

APPS stock significantly underperformed the broad market this year, with about a 36% decline year-to-date. Seeking Alpha Quant assigned APPS a decent “B+” valuation grade, meaning multiples are attractive. Currently, valuation ratios are substantially lower than the sector median and the company’s 5-year average levels.

Seeking Alpha

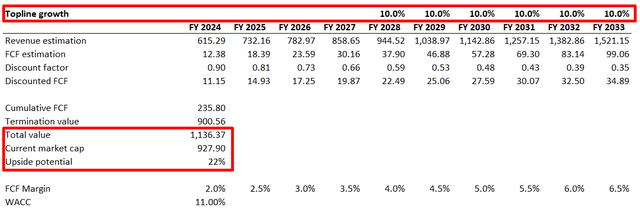

I will run a discounted cash flow [DCF] simulation to cross-check multiples analysis. I use an 11% WACC for discounting, a round-up of the estimation from valueinvesting.io. We have earnings consensus estimates projecting revenue growth up to FY 2027. For the years beyond, I have implemented a 10% topline CAGR. I use the latest full-year FCF margin for the base year and expect it to expand yearly by half a percentage point.

Author’s calculations

As shown above, the stock looks substantially undervalued under the mentioned assumptions. On the other hand, the level of uncertainty is very high. First, sustaining a 10% revenue CAGR over the long term is challenging. Second, the company’s track record of the FCF margin was unstable, while the DCF model assumes a steady margin expansion. Third, we should also remember that the company is in a substantial net debt position, higher than the gap between my fair value estimation and the current market cap.

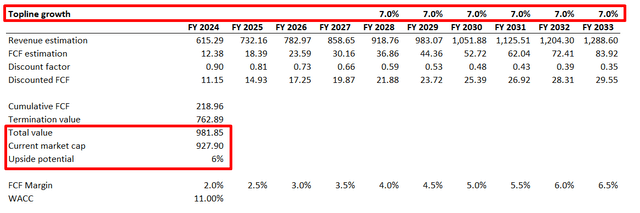

The DCF model is susceptible to changes in underlying assumptions, especially related to revenue growth. For example, if I implement a 7% revenue growth for the years beyond FY 2027 instead of 10%, the stock now looks overvalued.

Author’s calculations

To conclude this part, I cannot conclude that the stock looks attractively valued. The level of uncertainty is very high and overweighs the upside potential. Moreover, substantial risks are associated with investing in APPS, I will discuss them in the next section.

Risks to consider

I think that the risks of investing in the APPS stock are substantial. First, APPS is an apparent growth stock meaning that a significant part of its current market cap comprises aggressive growth expectations. A substantial decline in revenue over multiple quarters might suggest that the near-term peaks are already in the rearview mirror. The portion of revenue reinvested into the business looks insignificant, meaning the likelihood of unlocking new revenue growth drivers is low. Given the massive stock selloff over the past few years, investors are already disappointed in the growth prospects. But the investors’ disappointment will continue as long as the company demonstrates a YoY decline in financial performance. Therefore, the stock price is expected to be under substantial pressure until the company demonstrates a turnaround.

The company operates in a very competitive market with relatively low entry barriers. The lack of innovation might make the company’s offerings inferior to the ones produced by competitors. We see that the company’s investment in R&D was relatively low in recent years, meaning that the obsolescence risk is very high for APPS.

Bottom line

To conclude, APPS is not a good investment for me. The company’s financial performance has been consistently weak over multiple quarters, and challenges are still in place because the upcoming earnings are also expected to be weaker YoY. The DCF model outcomes suggest a double-digit upside potential, but the level of uncertainty is very high. Moreover, we should not forget the substantial net debt position of APPS. Therefore, I assign APPS stock a “Hold” rating.

Read the full article here