Brazilian oil giant Petrobras (NYSE:PBR) continues to report robust financial results and trade at a discount compared to its global peers. However, I observe numerous cautionary signs that discourage investment in the company. In this article, I’ll focus primarily on the several yellow flags regarding the political situation in Brazil that weighs on the company’s control, which may, in the long run, impact the company’s profitability and slow down the distribution of dividends.

As Petrobras reported record dividends and profits last year, it is difficult for the trend to continue at the same level for the upcoming years. Although the company trades at a discount compared with its peers, the share price is not as attractive as at the end of last year. The tendency for the long term is that the company will have difficulties reporting results as impressive as in the previous two years.

Still, many positive aspects, including a very attractive dividend yield, justify a potential investment in Petrobras. But considering the likely volatility considering political risk in Brazil, I prefer to remain neutral to an investment thesis in the Brazilian oil giant.

Understanding Petrobras’ shares rebound this year.

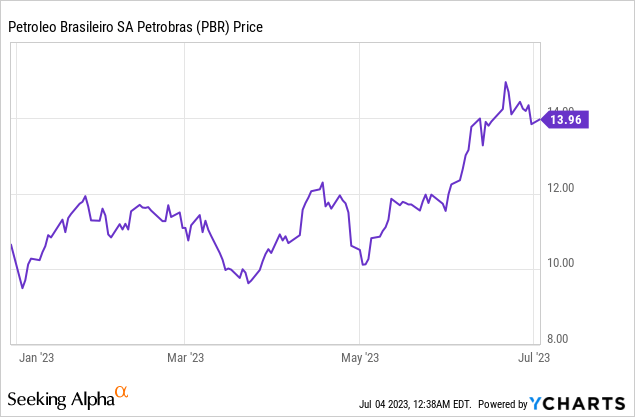

Petrobras shares, as they enter the month of July 2023, are very close to their highs of the last five years, signaling a rebound of more than 50% compared to their price in December last year.

In my view, the strong rebound in the price of the Brazilian oil company can be attributed to two key factors: (1) the reduction of risk concerning the Brazilian economy as a whole and (2) the reduction in the perception of risk of Petrobras itself.

The first point is something that benefits not only Petrobras but Brazilian companies in general. At the end of last year, the newly elected president of Brazil, Luiz Inácio Lula da Silva (Lula), brought to the markets a considerable perception of the country’s fiscal side and new economic policies because of their interventionist bias.

Risks were underway at the end of last year when the Proposed Constitutional Amendment of extraordinary expenses was approved. However, the fiscal framework passed by the Brazilian congress significantly reduced this risk, in a kind of “it was not as bad as expected” market message.

The second point is that Petrobras reported decent quarterly results and a new gasoline pricing policy, a bit vague but not destructive to value creation for the company, as many analysts predicted. Although the investment announcements were not extremely clear, they were at least not apocalyptic, such as massive investments in offshore companies.

Thus, as Petrobras traded at a heavily discounted valuation multiple at the beginning of the year, I attribute part of Petrobras’ robust performance to the market, seeing the risk of runaway control significantly reduced. The fact that the company reported in May, under the new management, an expressive dividend payment for August also sounded positive, showing a view to attract investors on account of the dividend.

Intervention noises are too loud

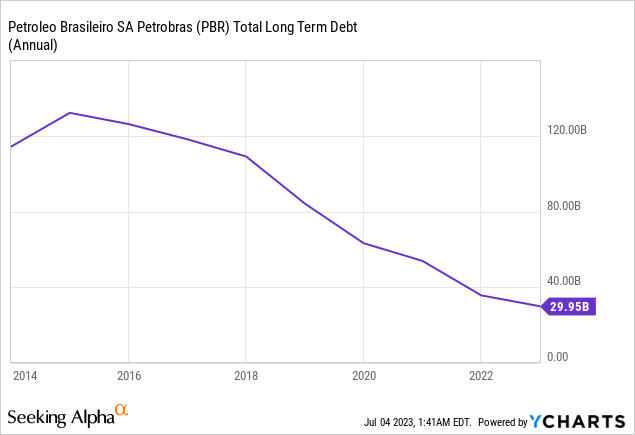

Seven years ago, Petrobras had the most prominent corporate debt in the world, was involved in corruption schemes like “Petrolao,” and had a bizarre pricing policy and a capital allocation logic quite different from capitalist logic. Shares in the company were worth about $3 per share during this dark period in the company’s history.

Today, the situation is different. There have been many normative changes in laws, the company’s statute, and international agreements, including with the American justice system. Thus, Petrobras today has a governance framework constituted in the last five years more robust than in the past, a better policy of capital allocation, and, because of the performance of Petrobras shares in recent years, the market has been discovering this little by little.

This restructuring of the company has resulted in a job well done since 2016 of restructuring its balance sheet, reducing the highest corporate debt in the world to a superficial level by 2021.

However, since President Lula returned to power in 2023, the noises about state intervention have returned strongly.

Lula, who has a leftist and interventionist bias, belongs to the Labor Party, which defends the idea that Petrobras needs to be the inducer of economic growth. Some representatives of his party have publicly attacked Petrobras’ dividend policy.

This is an approach which, in my view, brings several negative points for the company’s shareholders. Therefore, to invest in Petrobras, it is necessary to understand what the government wants and will be able to do.

Thus, I see some yellow flags that investors need to have as a basis before investing in Petrobras, which may converge into severe risks in the long run.

#1 Yellow Flag: A former politician as Petrobras new CEO

The first yellow flag is on account of the new CEO of Petrobras, Jean-Paul Prates. He has previously held political positions, including Senator of the Republic for the Labor Party – the same as Lula.

Despite his extensive academic résumé, there is an argument about this candidate’s eligibility for the CEO post since the Federal Law establishes a 36-month quarantine for political party decision-makers to assume a new position in the state-owned company.

The Brazilian House of Representatives and the Senate approved with a vast majority the reduction of this quarantine period to 30 days, which is not a positive sign for the corporate governance of Petrobras and Brazilian state-owned companies.

The company’s capture by partisan political interests can generate extensive contamination, increasing exposure to corruption and exaggerated benefits and reduce hiring market professionals with proven technical expertise.

#2 Yellow Flag: State intervention in fuel prices

The second yellow flag is because of the feared risk of intervention in Petrobras’ fuel pricing policy, which has recently occurred. Petrobras’ import parity prices policy (IPP), established in 2016, was discontinued in May of this year. Although, a big tumble in the company’s shares did not occur, as many market participants expected, because at that time, the company’s new pricing policy was not so different from the IPP, and this would not affect the company’s profits and dividends.

But recently, this fear resurfaced with introduction of a new price-cutting measure, which seemed untimely. Petrobras announced on June 30th the price cut on gasoline and cooking gas – which caused shares to plummet about 5% on the news. If not for this decision, gasoline prices would generally have gone up.

This surprise for many investors correlated with fears that Petrobras is intervening in gasoline prices to prevent the image of President Lula from being damaged.

It is worth remembering that as recently as 2022, during the administration of Brazilian President Jair Bolsonaro, the federal government took a measure, also considered to be populist, that would potentially bring fiscal risk by deciding to cut federal fuel taxes to lower domestic gasoline prices.

With Lula stepping up as President, his economic team decided not to proceed with the tax cut, deciding instead to re-tax the federal government. A few months ago, the federal government introduced a program to cheapen affordable cars that cost up to R$120,000. Much of the tax offset used for the cheapening came from partial compensation on fuel, bringing back some fuel tax rates that had been erased during Bolsonaro’s government.

Recently, the federal government announced the extension of the popular car measure. But this compensation would mean increasing the price of gasoline to offset taxes. The curious thing is that the decision of the Petrobras price cut came precisely at this moment, and many investors interpreted it as cooperation with the government’s plans.

The impact for shareholders of these measures is uncertainty regarding Petrobras’ future profits destination in a direct intervention in the company to prevent gasoline prices from rising and the president’s popularity from falling. That is, the risks of political interference in the state-owned company have increased significantly.

However, the CEO of Petrobras, through its social networks, refuted this supposed “theory” by saying:

“We reiterate that this decision is based on the economic and commercial variables of the products and crude oil in the Brazilian and international markets, according to our business criteria that guarantee us due profitability and regional market shares. “

In any case, this price-cutting decision of the current new management of Petrobras did not sound good, and it could be interpreted as a prelude to the state intervention that should come in the following years. Even if these are still considered as “noises,” the not-so-distant past involving Petrobras and interventions by the Federal government leaves room to fear.

Dividends are tempting, I must admit

It is hard to make a bear case on Petrobras when Petrobras’ dividends should remain tempting. In May, Petrobras’ new management announced the dividend to be paid in August while maintaining the current dividend policy in the first quarter. The company announced the payment of R$24.7 billion to shareholders or R$1.89 per share.

In the last twelve months, Petrobras’ dividend yield was above 48% jumping from 19.87% in 2021, probably being one of the highest dividend payers among large global companies. But the big question that stakeholders must ask is whether this yield is sustainable. In 2022, the exceptionally high dividends occurred due to mainly two factors:

- During the war in Ukraine, where energy commodities rose sharply, Brent rose to $120 – the highest price in the last ten years. Petrobras passed on this increase to fuel prices in Brazil, resulting in excellent profits.

- The excellent work of the management of Petrobras being very well executed in the last six years allowed the company to restructure its balance sheet, revert the highest corporate debt in the world, and bring a cash flow to the company in 2021 and 2021 with the high price of oil reaching $112 in June last year. Petrobras had little destination for these profits, so it returned many of them to its shareholders. The payout was 152% in 2022 – yes, for each real profit, the company distributed R$1.52 of the profit.

Logically, a payout above 100% is only sustainable for a short time. Petrobras’ current payout for this year is 62% of profit; some analysts forecast 2024 to be around 40% – the lowest since 2000. It is worth remembering that. Currently, most American oil companies pay 50% or more.

Furthermore, due to the price of Brent falling and the price of the dollar falling compared to the Real, the profitability of Petrobras will be lower, and thus the 40% plus dividend yield will appear unattainable in the distant future.

The dividend yield forecast 2023 will most likely remain between 10% to 20% —still an attractive percentage but lower than Petrobras’ last twelve months.

Therefore, the tendency is that Petrobras’ dividends should fall but remain at high levels.

Valuations are still cheap, but not super cheap anymore

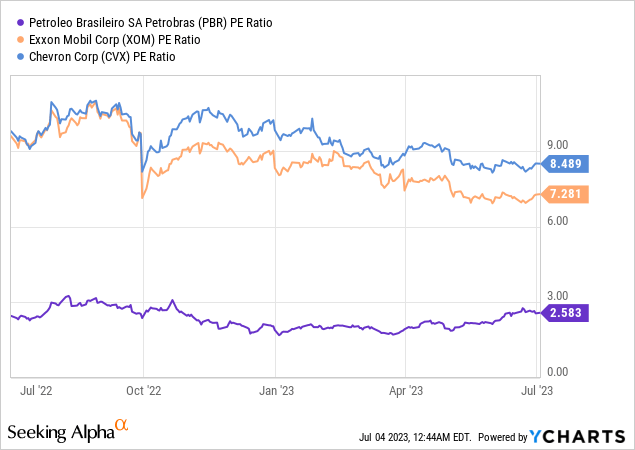

Many investors have had a bullish investment thesis on Petrobras in recent years based on the disproportionate valuation multiples the company was (and still is) trading at, even though this “disproportion” could be explained by the exaggerated state risk.

Currently trading at a price-to-earnings ratio (P/E) of 2.5 times its earnings, Petrobras is still trading at a significant discount versus its peers. Exxon (XOM) trades at 7.2 times its earnings, and Chevron (CVX) at 8.4 times. Historically, both companies trade at a 40% discount to Petrobras; today, that discount is about 65%.

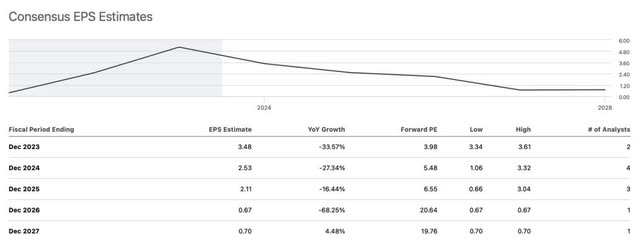

Looking at forward estimates, Petrobras trades at a forward P/E ratio of 3.9 times, considering there is a consensus that the company will report a decrease in its EPS for the end of this year of 33.5% compared to last year.

The projections for the next five years are even worse. By the end of 2024, with the company reporting EPS of $2.53 – a 27% drop from 2023, the forward P/E multiple should go to 5.4 times, which is still reasonable. Looking at the forecast for three years from now, 2026, the situation gets uglier.

The consensus is that the company could report an EPS of $0.67, considering that the oil demand will decrease significantly with the growth of renewable energies. Should the consensus be correct, Petrobras could see an 80% drop in earnings, and this would cause the company to trade at a forward price-to-earnings multiple stretched to 20.6 times.

Seeking Alpha

The bottom line

In conclusion, I still find it challenging to be a Petrobras bear based on its robust financial performance in recent years and its discounted valuation compared to its global peers. However, investors should consider several yellow flags before investing in the company.

Although Petrobras posted record dividends and profits last year, maintaining this trend is unsustainable for the upcoming years. The recovery in Petrobras’ share price this year can be attributed to reduced risk perception in the Brazilian economy and the company. I believe there is relativization because of this risk, and the return of interventionist movements shows signs of being formed.

In my opinion, given these factors and the anticipated volatility linked to political risk in Brazil, it would be prudent to adopt a neutral stance on Petrobras for the time being.

Read the full article here