Introduction

A creeping inner tension inevitably emerges whenever I sit down and try to analyse and value a company that provides a product or service that I really like. Positivity bias driven by personal preferences can lead to painful investment mistakes, but it is challenging for even the most hard-headed analyst to remain entirely objective and realistic when they have a warm and fuzzy feeling about a product/service. I’ll try my best to avoid positivity bias in this Duolingo, Inc. (NASDAQ:DUOL) note, despite the fact that my kids will complain bitterly if I land at anything but a strong buy rating for their favourite gamified language learning platform.

It would be easier to remain logical and dispassionate about Duolingo if I hadn’t listened to a long interview that Tim Ferriss did with the company’s co-founder and CEO Luis von Ahn last year. In stark contrast to all too many CEO’s, in that interview Luis von Ahn struck me as genuine, humble, interesting and dynamic. For any readers not yet familiar with the Duolingo story, the Tim Ferriss interview is an entertaining and easy way to get started, although it’s worth keeping in mind that Ferris himself may be dealing with positivity bias towards Duolingo given that he was an early stage investor in the company back in 2011.

Impressive Progress

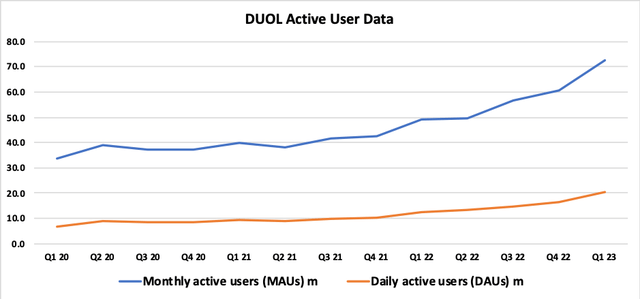

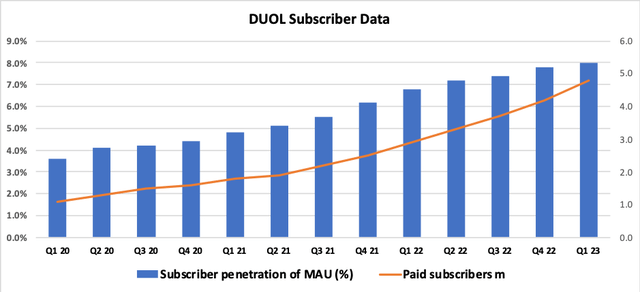

DUOL continues to report strong growth in active user volumes (refer Exhibit 1). Subscriber numbers are also growing at a rapid rate and subscriber penetration continues to increase (refer Exhibit 2). Whilst these trends are very positive, I note that the rate of improvement in subscriber penetration has recently softened.

Exhibit 1:

Source: Analyst calculations based on DUOL quarterly reports.

Exhibit 2:

Source: Analyst calculations based on DUOL quarterly reports.

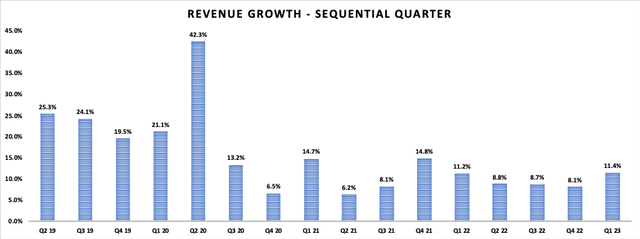

Active user and subscriber growth is feeding nicely through into revenue growth. Exhibit two tracks the rate of sequential revenue growth (note that these %’s are not annualised). 1Q23 showed an improved rate of sequential revenue growth relative to the prior three quarters. DUOL is guiding to FY23E annualised revenue growth of 35-38% and this appears to be achievable. The answer to the question as to how long DUOL can maintain these impressively high revenue growth rates is likely to be one of the main differentials between bull and bear calls on the stock.

Exhibit 3:

Source: Analyst calculations based on DUOL quarterly reports.

More Than Language Learning

Duolingo has ambitions to extend beyond language education. Duolingo Math is an app that offers elementary mathematics for children and brain-training games for adults. Users of Duolingo’s language learning technology will find the general structure of the maths platform comfortingly familiar. I think that Duolingo Math has great potential, particularly at the elementary education level. I was slightly surprised that the new math app wasn’t mentioned in the 1Q23 management speech, but two sell-side analysts did ask questions on the topic, so I assume that I’m not alone in seeing the upside potential here.

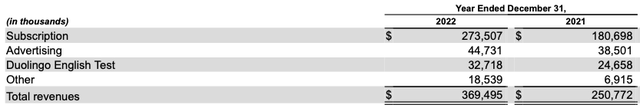

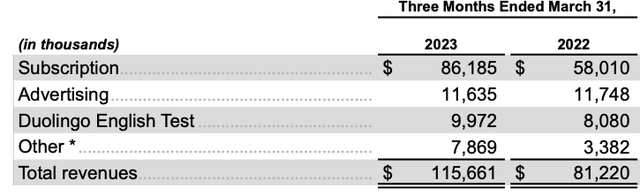

Subscription fees and advertising income relating to DUOL’s core language learning service dominate the group’s revenue, but the company has already shown the capacity to add new income streams. The Duolingo English Test currently contributes ~10% of DUOL’s total revenue (refer to Exhibit 4 and Exhibit 5 below). English testing income will likely increase very materially if Duolingo is able to obtain government and/or institutional recognition for its test result as proof of English language competence; management claim to already be making good progress on this front in the UK, Canada and Australia. Such testing services could easily be extended to other languages over time.

Exhibit 4:

Source: DUOL 4Q22 Form 10K, page 70.

Exhibit 5:

Source: DUOL 1Q23 Press Release, page 2.

Duolingo describes itself as a mobile learning platform. The examples above indicate that the group has the desire and ability to extend services and income streams well beyond the language learning app that Duolingo is already so well known for. A brand that is associated with making learning fun is well-placed to stretch across a wide range of fields.

Look Beyond Adjusted EBITDA

Management’s preferred earnings metric is Adjusted EBITDA, and guidance tends to be set by reference to the Adjusted EBITDA Margin. The use of non-GAAP financials is common in management reporting, but is important for investors to familiarise themselves with the adjustments to statutory reporting that management make. In DUOL’s case, I have a couple of grumbles about the numbers that management want investors to focus on.

Firstly, an EBITDA metric, by definition, excludes depreciation and amortisation. Whilst it is true that D&A is a ‘non-cash’ item, DUOL is also capitalising costs relating to software. D&A is not a small number for DUOL – FY22 Adjusted EBITDA was $15.5m, but some $4.9m of this related to the reversal of D&A. 1Q23 Adjusted EBITDA was $15.1m, with $1.8m of this related to the reversal of D&A.

My second grumble with DUOL’s management reporting relates to another common adjustment made by companies that are still loss-making – being the exclusion of costs relating to stock-based compensation. For DUOL, this means that management’s preferred earnings metric excludes a huge expense item. FY22 Adjusted EBITDA of $15.5m excluded $75.8m of costs relating to stock-based compensation. 1Q23 Adjusted EBITDA of $15.1m excluded $21.7m of costs relating to stock-based compensation. I am willing to accept the argument that the standard accounting treatment for the calculation of stock-based compensation expenses is not perfect, but I find it rather ludicrous to totally exclude what is obviously a very material cost item. Consider the scenario in which DUOL decides that it will no longer issue stock-based compensation to staff, and ask yourself what is likely to happen? The obvious answer is that staff will demand additional cash-based salary or bonuses to neutralise or at least partially offset the value that they were allocating to the stock-based compensation received. DUOL is far from alone in putting through this type of adjustment in management reporting, but that doesn’t make the practice sensible. In my view therefore, investors relying heavily or (even worse) entirely on DUOL’s Adjusted EBITDA metrics when building an investment case for the stock are not doing themselves any favours.

Is The Target 30-35% Adjusted EBITDA Margin Realistic?

In DUOL’s most recent shareholder letter, CEO Luis von Ahn referred to the group’s ‘long-term target of 30-35% Adjusted EBITDA margin’. The Adjusted Margin for 1Q23 came in at 13.1%, and the company is guiding to a FY23E Adjusted Margin of 11-12%. A lot of things need to go well for DUOL in order to improve the Adjusted EBITDA Margin from ~12% to north of 30%.

Bulls on the stock may argue that with such high revenue growth rates (discussed above), DUOL is set to benefit greatly from margin expansion due to scale benefits. It should be noted that different costs impacting the Adjusted EBITDA Margin will have varying sensitivities to scale leverage. DUOL must continue to increase its expense base in order to grow users/subscribers, to develop and implement new products, to successfully market new and existing products, and to expand and improve its technology infrastructure. DUOL increased staff headcount from 140 at the end of December 2018 to over 650 by 31 March 2023, and further material increases in staff numbers should be anticipated.

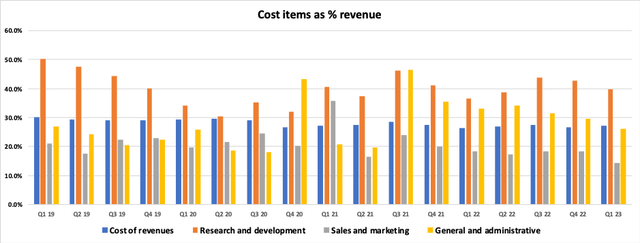

Exhibit 5 tracks DUOL’s cost buckets as a percentage of revenue. Note that this chart uses the statutory reporting numbers and does not make the adjustments that management include in DUOL’s Adjusted EBITDA. Looking at this data, despite DUOL’s rapid revenue growth, it is not immediately obvious that additional scale is benefiting operational efficiency. Investment in research and development has been and will continue to be vital in order for DUOL to attract and retain subscribers and I am not convinced that this cost item will show much leverage to scale. The two cost buckets that have the greatest potential to deliver scale benefits in terms of margin expansion are sales/marketing and G&A. I think there is already some evidence of scale leverage in the sales and marketing data shown in Exhibit 5. G&A expenses tend to be quite volatile but as a percentage of revenues these items have drifted lower in recent quarters.

Exhibit 5:

Source: Analyst calculations based on DUOL quarterly reports.

My current view is that management’s target of an Adjusted EBITDA Margin of 30-35% is a challenging but achievable goal. That said, it is important for investors to remember that it will likely take several years for DUOL to hit even the bottom end of the target range.

Valuation

For a stock such as DUOL, I find valuation work rather angst-inducing. Readers of my prior Seeking Alpha work will know that I’m a value-oriented investor who typically relies heavily upon the concept of sustainable earnings to assess a company’s fundamental worth. Valuing loss-making technology businesses on ‘industry standard’ or ‘benchmark’ sales multiples makes almost zero sense to me. Once a metric becomes the norm, such as 10x sales, the validity of said metric is rarely questioned. Even more perplexing is that benchmark sales multiples are often applied across companies that have very different cost profiles and market structures.

A detailed DCF model with a 10-15 year earnings forecast period and a discounted terminal value is one way of bypassing the industry standard/benchmark valuation approach. But this path involves coming up with a whole bunch of assumptions and inputs that I would have very little confidence in. As things currently stand, from a fundamental analysis perspective, any valuation for DUOL is based on a lot of guesswork. Over time, as the company matures and a clearer picture regarding DUOL’s sustainable earnings emerges, the valuation process will become much more reliable and less uncertain.

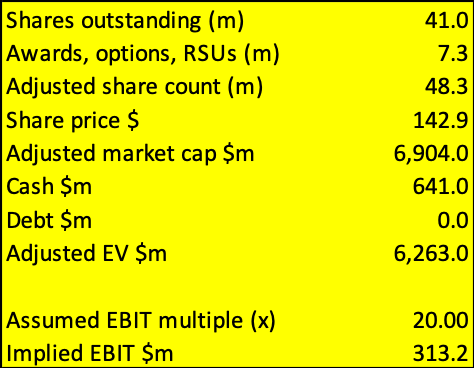

As an alternative to a traditional valuation, one way to look at DUOL is to consider what the company’s current market capitalisation is telling us about expectations for its future earnings potential and to incorporate this into a ‘sense check’ analysis. In Exhibit 6, I put forward some numbers that can be used in such an exercise. First, I assume that DUOL has already reached maturity and that an EV/EBIT multiple of 20x is reasonable.

Exhibit 6:

Analyst’s calculations.

This admittedly oversimplified analysis points to DUOL requiring a sustainable EBIT of ~$313m pa to support the stock’s current share price of ~$143. My next step in this ‘sense check’ approach is to convert the implied EBIT into an implied revenue number. Taking the midpoint of management’s 30-35% Adjusted EBITDA Margin and allowing for the impact of D&A and stock-based compensation (which DUOL excludes in its Adjusted EBITDA Margin), I get to an EBIT margin of 12.5%. Working back from an assumed EBIT of $313m and assuming an EBIT margin of 12.5%, we get to an implied revenue outcome of ~$2.5bn.

DUOL’s current revenue run rate is ~$500m pa. Based on the analysis above, in order to justify the stock’s current share price, we need to think about DUOL being ~5x bigger than it is today (and ignoring the time value of money). DUOL’s current monthly active user (MAU) count is 72.6m. If we increase the MAU measure by 5x, we get to an implied MAU of 363.8m. DUOL management state that there are currently ‘a couple of billion people out there actively learning a language’ (source: 1Q23 DUOL Seeking Alpha Transcript, page 21). If we (very simplistically) assume that 2 billion people is a fair assessment of DUOL’s potential addressable market, then my sense check analysis points to DUOL needing to get to a global market share of ~18% (being 2 billion people, divided by MAU of 363.8m).

Given that language learning is a highly competitive industry, and that not all language learners will desire to use an online gamified service such as DUOL, I’m struggling to imagine a scenario in which DUOL achieves a global language learning market share of ~18%. However, my admittedly over-simplistic sense check analysis makes no allowance for the ability of DUOL to broaden its product offering and to move into new, large and lucrative market segments (such as that being explored with Duolingo Math).

Risks

The online language learning market is extremely competitive, with many providers and products for learners to choose from, including an array of free services (of varying quality). Given this fragmented and open market structure, the ability of DUOL to fully monetise what is undoubtedly an excellent product is highly questionable.

AI is both an opportunity and a threat for DUOL. Competing platforms also have access to AI, so the opportunity upside may actually be rather limited. The threat from AI in terms of the provision of language tools that totally negate the need for someone to understand a foreign language is obvious – from a purely practical perspective, why bother spending countless hours learning a new language when your phone can solve all your problems using an AI-backed language app? I’m not fully persuaded by such an argument, as I think that many people get a kick out of the sense of achievement and competence that is associated with language learning; it’s also true that human interactions are also much more enjoyable without the need to have technology as a go-between.

Redundancy risk is a further issue for DUOL. Once users have reached a desired level of language ability, the motivation for them to continue using DUOL will rapidly diminish. User and subscriber numbers must therefore be considered in the context of an expected natural decline due to competency attainment, and are therefore not comparable to certain other subscriber-based tech models in terms of value generation/support.

With high inflation rates putting the squeeze on discretionary consumer spending, DUOL’s near-term ability to grow subscription and advertising fee income looks likely to be challenged by macro-economic conditions. My sense is that DUOL’s share price is highly sensitive to near-term growth rates for subscriber numbers; a slowing in this metric triggered by changes in consumer spending patterns represents a material near-term downside risk.

Conclusion

DUOL’s language learning technology is industry-leading and highly effective. The company has demonstrated consistent growth in user numbers and subscribers and I do not doubt continued positive trends in these metrics. The ambition for DUOL to extend beyond language learning and to become a broader educational platform provides interesting medium-term upside potential. AI is both a threat and an opportunity, but on balance I see AI as a negative risk factor for the company.

Deriving a fundamental valuation for DUOL requires a range of assumptions regarding highly uncertain outcomes, and I would argue that any such valuation should be treated cautiously and taken with a large pinch of salt. Based on a simple and high level sense check analysis, my view is that DUOL’s current share price of ~$143 is too high relative to the level of earnings that the company can realistically be expected to generate within a reasonable timeframe. Acknowledging that I arrive at this view coming from the perspective of a value investor, and feeling somewhat nervous about the reaction of my Duolingo-obsessed kids, I land at a Sell rating for DUOL.

Read the full article here