Investment Thesis

Range Resources Corporation (NYSE:RRC) is a natural gas and oil company. The business is well-hedged right now. However, if prices were to jump higher in 2024, the business may not sufficiently participate in the upside. Even if, for now, high natural gas prices seem like quite an unlikely scenario.

Next, Range Resources carries some debt on its books, so Range Resources continues to pay down on its debt profile, rather than having a concrete shareholder return framework in place.

Altogether, Range Resources is priced at around 6x next year’s free cash flow, in line with many of its peers.

In sum, this stock could be appropriate for investors that are bullish on natural gas but are also seeking a suitable margin of safety, with a well-hedged business.

Moreover, by far the most bullish aspect of Range Resources is that it has more than 30 years’ worth of low-breakeven natural gas inventory. Meaning that investors are only willing to pay for 6 years’ worth of inventory, with the rest of the business being offered for free.

Why Invest in Natural Gas?

I believe that natural gas will continue to gain market share away from coal, as we continue in our quest to decarbonize our energy sources. What’s more, while I strongly believe in our need to clean up our energy supplies away from carbon-based energy sources, I make the case that there’s a difference between aspiration and reality.

The aspiration is to make meaningful progress in reducing our carbon emissions by 2030 and to reach net-zero carbon by 2050.

This will be used by embracing wind and solar energies.

However, I struggle to see wind energy as a viable energy source, for three main reasons.

In the first case, building wind turbines is extremely labor-intensive and by extension time intensive. Secondly, compared with solar energy, a wind turbine will often be very much away from the densely populated city centers, which brings up the need for suitable, multi-day energy storage solutions. And thirdly, building wind turbines is extremely expensive, with steel making up 80% of its components.

In sum, wind turbines are expensive, relatively unreliable since their energy source is intermittent, and require a lot of energy storage solutions.

Consequently, I argue that natural gas will be much more than a bridge fuel to renewable energy. I argue that natural gas will be a destination fuel, but that the market hasn’t quite figured this out.

In fact, I will go so far as to state that in time, natural gas will be the biggest bigger contributor to our energy supply sources, replacing oil. With this in mind, let’s discuss Range Resources.

Why Range Resources Corporation?

Range Resources is a natural gas, natural gas liquids, and oil exploration and production company. About 70% of Range Resources’ production is natural gas, with natural gas liquids making up the bulk of the remainder, and there’s about 5% oil production too.

Natural gas liquids are used as feedstocks for the petrochemical industry, heating fuels, and blending components for gasoline. Meaning that natural gas liquids have a wide range of applications, including as feedstocks, while natural gas is predominantly used as an energy source.

What makes the case for Range Resources interesting is that they have very low breakeven prices.

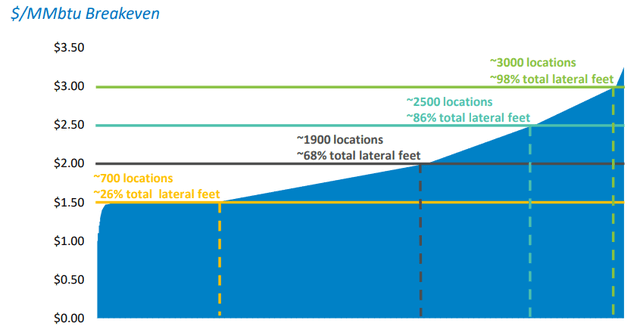

RRC Q1 2023 Presentation

As you can see above, at around $2.7 MMBtu, approximately 90% of their locations have reached breakeven. Consequently, given that they have so low breakeven prices, one has to wonder why does Range Resources bother with hedging their production at all?

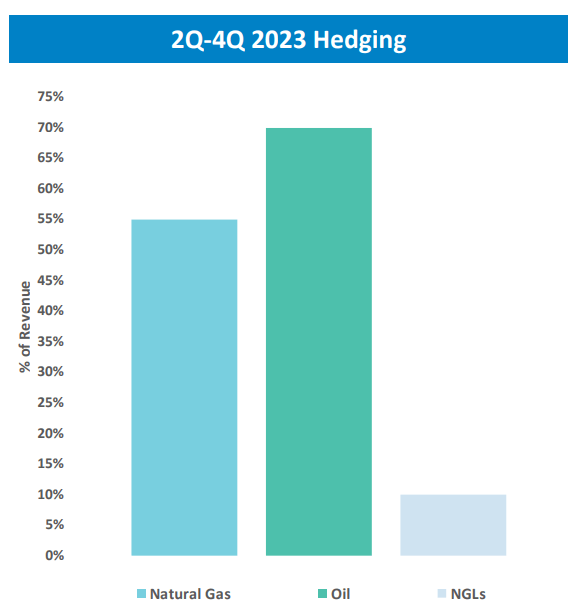

RRC Q1 2023 Presentation

As you can see above, more than half of its natural gas production is hedged. And a hedge works both ways, of course. When things are challenging in the market, being hedged provides a safety net.

But assuming prices for natural gas were to improve in 2024 and beyond, being hedges could cap some of Range Resources’ upside potential.

Put another way, if one is super bullish on natural gas, there may be better natural gas companies to invest in. On the other hand, if one is bullish on natural gas, but wants a safety net on their investment, Range Resources could provide a middle ground.

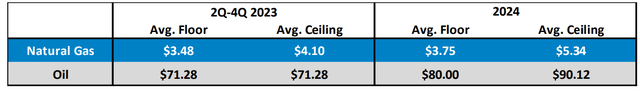

All that being said, Range Resources’ hedges for 2024 look very attractive.

RRC Q1 2023 Presentation

So perhaps, I’m unduly concerned with a consideration that is little more than a theoretical concern. After all, we are not even at $3 MMBtu right now, so the climb to $5.35 and higher, at present, feels quite unrealistic.

On the other hand, I would make the case that right now the price of natural gas is more than 5x different from the price in Asia and Europe. And if China were to become a significant importer of natural gas in 2024, then Europe would be competing for LNG cargos, and then, all of a sudden $5.35 MMBtu doesn’t seem so unrealistic.

In sum, there are a lot of moving parts, and for now, Range Resources could be perfectly well hedged.

Free Cash Flow Profile

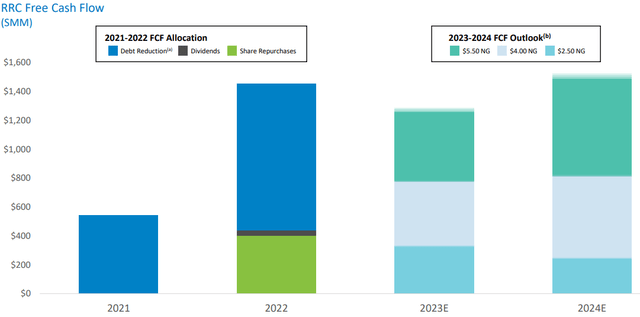

RRC Q1 2023 Presentation

Range Resources could make around $1 billion of free cash flow in 2024 if natural gas prices average around $4.25. This would put the stock today priced at about 6x free cash flow.

This is very much in line with many of its peers, such as Coterra (CTRA) and Southwestern Energy Company (SWN). That being said, if I were to highlight one pesky aspect, it would be that Range Resources still carries about $1.6 billion of net debt, and until its net debt is in the range of $1.5 to $1 billion of net debt, it will continue to prioritize paying down debt, rather than having a concrete capital return program, as some of its peers have recently adopted. Here’s a quote from the earnings call echoing this:

We believe a stable, reliable fixed cash dividend is appropriate at this time and in this market, while remaining opportunistic in our share repurchases with capacity available totaling $1.1 billion, alongside our primary objective of reaching target debt levels.

The Bottom Line

Range Resources Corporation may not fully benefit if natural gas prices rise in 2024, however, at present this appears to be an unlikely scenario.

It is suitable for investors who are bullish on natural gas and seek a margin of safety with a well-hedged business. However, the company’s hedging strategy may limit its upside potential if natural gas prices improve.

Nonetheless, the hedges for 2024 look promising. Meaning that Range Resources could generate approximately $1 billion of free cash flow in 2024 if natural gas prices average around $4.25, resulting in a stock price of about 6 times free cash flow, similar to its peers.

Range Resources carries some debt and focuses on paying it down rather than implementing a concrete shareholder return framework.

In sum, Range Resources provides a nicely balanced risk-reward profile.

Read the full article here