With every new generation come with dreams of riches to be made from the stock market, and it seems the latest craze around speculative growth names in the AI space has gotten plenty of attention.

While capital gains can be fun to see on paper, realizing those gains can come at a substantial cost. For one thing, short-term capital gains are taxed as ordinary income rates, which can take a big bite out of those hard won gains.

That’s why ‘been there, seen that’-investors are keen to pick income generating names that are undervalued with capital appreciation potential and meaningful income to boot. These investors know that the key to long-term wealth isn’t just about how much you make, but about how much you keep and continue to make through recurring income.

This brings me to HP Inc. (NYSE:HPQ), which I last covered here back in January, highlighting its strong cash flows and capital returns. The stock has performed well since then, giving investors an 11.6% total return, thanks in part to dividends, nearly matching the 12% return of the S&P 500 (SPY) over the same timeframe. In this article, I discuss why HPQ remains a good bargain for potentially rewarding long-term returns from here.

Why HPQ?

HP Inc. is a leading player in the mature industry for personal computers, printers, and imaging equipment, having been formed after its former parent split into two companies, with the other one being HP Enterprise (HPE). Beyond consumers, HPQ also does substantial business with corporations, as their employees need new laptops every 2-3 years.

HPQ strikes me as one of those companies that investment legend Peter Lynch would describe as a company that MBAs don’t want to go to, and that’s a good thing, as it’s a business that doesn’t require a ton of constant innovation. That’s also likely why Warren Buffett invested in HPQ last year through Berkshire Hathaway (BRK.A)(BRK.B), becoming its largest shareholder past Vanguard. Investors today are getting an even better deal, as Buffett paid ~$40 per share for his initial stake.

It’s no secret that HPQ largely benefitted during the 2020-2022 timeframe, when work from home trends and corporate hiring were robust. As with all good things, those times have slowed down, as reflected by net revenue declining by 18% YoY on a constant currency basis during the fiscal second quarter, due primarily to headwinds that are felt across the industry.

Notably, despite personal systems revenue (representing 46% of revenue) being down by 29% YoY, management was able to maintain a flat PS operating margin of 5.4% on a sequential basis, due to variable cost management. HPQ is on track with its targeted cost savings, with the objective of delivering 40% of its 3-year cost savings by the end of this year.

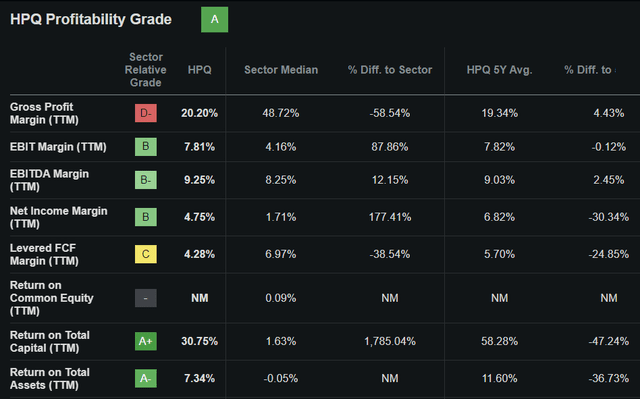

HPQ remains a highly profitable enterprise relative to its sector, due in large part to its highly profitable printing op margin of 19%. As shown below, HPQ scores an A grade for profitability with above median EBITDA and Net Income margins.

Seeking Alpha

Looking ahead, it’s easy to buy into risks around a prolonged slump in PC demand, and while that may be the case for the remainder of the year, I don’t believe this is going to be a long-term trend, especially after the current elevated inventory levels are worked down.

Plus, management believes that hybrid work is here to stay, and that may well be true. This is considering that even tech giants like Meta (META) and Google (GOOGL) are requiring employees back into the office just 3 days a week, giving them 2 days a week to work from home.

During an industry conference hosted by Bank of America (BAC) last week, management noted that there are 19 million rooms belonging to professional households out there, and that only 10% of those rooms are fully kitted out for productivity. This implies that there remains plenty of greenfield opportunity for HPQ and its competitors to serve this underserved market over the near to medium term.

Meanwhile, HPQ remains solidly profitable, generating $0.5 billion in free cash flow in the last reported quarter, more than covering its $0.3 billion dividend. The dividend is also well-covered from a TTM earnings perspective, with a 29.8% payout ratio.

While HPQ didn’t repurchase any shares in the last reported quarter, it is making good progress toward debt reduction, having paid down long-term debt by $449 million since October 2022 (end of fiscal year 2022). It also has a BBB investment grade credit rating from S&P and a very reasonable net debt to TTM EBITDA ratio of 1.9x.

Lastly, HPQ remains a good value at the current price of $30.75 with a forward PE of 9.1. This implies that HPQ would be getting an attractive 11% earnings yield on share buybacks if and when they resume. The current valuation remains a low bar in terms of expectations, with even mid-single digit annual EPS growth being appealing, and analysts expect 6% to 8% annual EPS growth over the next 2 years. Considering all the above, I view a forward PE in the range of 10 to 12 to be reasonable, which could result in potential double-digit total returns including the 3.4% dividend yield.

Investor Takeaway

HPQ is a good option for investors looking to gain exposure to the IT sector at an attractive valuation, while also getting meaningful dividend income. The company remains solidly profitable despite the recent PC downturn, which I don’t view as lasting into perpetuity.

Meanwhile, the company is reducing debt and remains far below the level at which Buffett initially paid for it through Berkshire Hathaway. As such, value investors may want to give HPQ a hard look at the present level for income and potentially rewarding long-term capital gains.

Read the full article here