Introduction

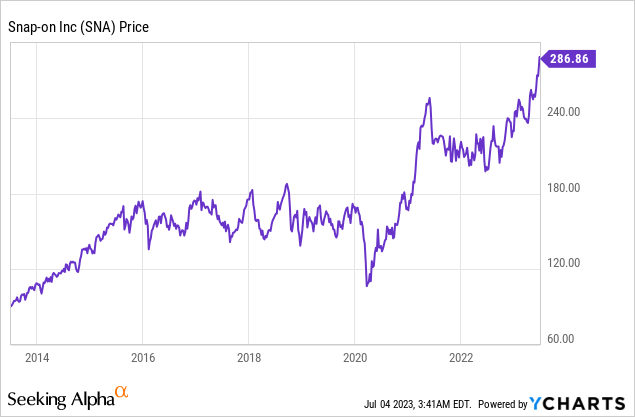

I need to give Snap-on Incorporated (NYSE:SNA) some credit. While I’ve always acknowledged its ability to generate tremendous shareholder value, I still underestimated the company’s potential – especially in light of favorable secular trends.

It’s now more than a year ago since I wrote my most recent article on this company. Back then, I highlighted its sustainable and juicy dividend.

When I started researching SNA again, I wasn’t very optimistic. That was mainly based on its poor long-term performance versus the S&P 500 – considering its relatively high volatility. However, my view on SNA quickly changed. While SNA’s growth is losing momentum, it’s by no means dead money. The company offers a more than decent dividend yield given the average S&P 500 or industrial yield, while its (average) dividend growth rate is not only very high but also sustainable.

Unfortunately, I underestimated how well the company could perform in this current business environment. While economic growth indicators continue to decline, the stock is now at a new all-time high. SNA shares are currently up 26% year-to-date and 50% above their 52-week low.

In this article, we’ll discuss all of this and assess the risk/reward at current levels.

So, let’s get to it!

Secular Growth – The Golden Age

With a market cap of $15 billion, Snap-on is a global leader in the manufacturing and marketing of tools, equipment, diagnostics, repair information, and systems solutions for professional users across various industries.

| Product Category ($millions) | 2022 | 2021 | 2020 |

|---|---|---|---|

| Tools | $2,399.4 | $2,343.0 | $1,984.7 |

| Diagnostics, information, and management systems | $942.4 | $892.5 | $783.8 |

| Equipment | $1,151.0 | $1,016.5 | $824.0 |

| Total | $4,492.8 | $4,252.0 | $3,592.5 |

In other words, it’s somewhat of a healthcare company, except not for people but for cars.

Snap-on products and services are distributed through a network of franchisee vans, direct channels, and distributors under well-known brands. Additionally, the company provides financing programs to support its product sales and franchise operations.

The company operates in over 130 countries, with its largest market being the United States, which accounted for more than 70% of last year’s total sales.

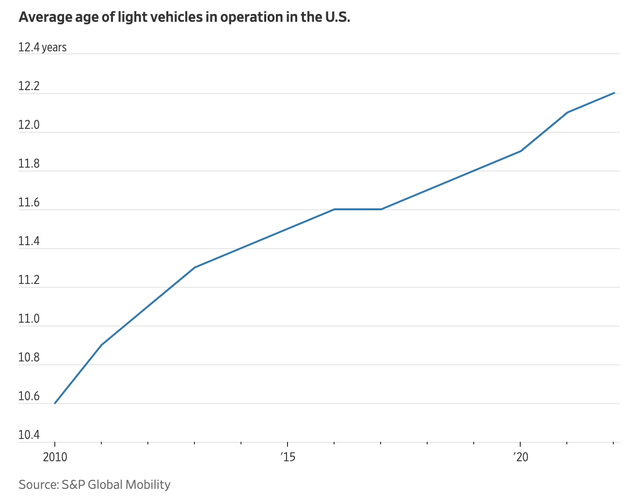

Based on this context, the company reminds me of a recent article I wrote about AutoZone (AZO). AutoZone, which sells auto parts, benefits from a rising trend in the average car age, which requires more maintenance.

As I wrote in June, the average age of vehicles on the road has reached a record high of 12.2 years, according to S&P Global Mobility. The wear and tear on cars are expected to continue as traffic recovers.

Wall Street Journal

During its 1Q23 earnings call, Snap-on discussed the strength of the automotive repair environment, with high demand across all disciplines. Snap-on continues to invest in new products to meet the repair challenges posed by newer vehicle models and their increased complexity.

The company emphasized its readiness to assist technicians with tools, diagnostics, and software for both internal combustion engines and electric vehicles. SNA also noted growth in OEM dealerships and independent repair shops, driven by robust demand and increasing technician wages.

Hence, Snap-on sees the potential for a golden age (hence the title of this article) of vehicle repair and believes its Tools Group and Repair Systems & Information Group (RS&I) are well-positioned to benefit from this.

Not only does the company benefit tremendously from these tailwinds, but it also sees tailwinds in a somewhat unexpected area.

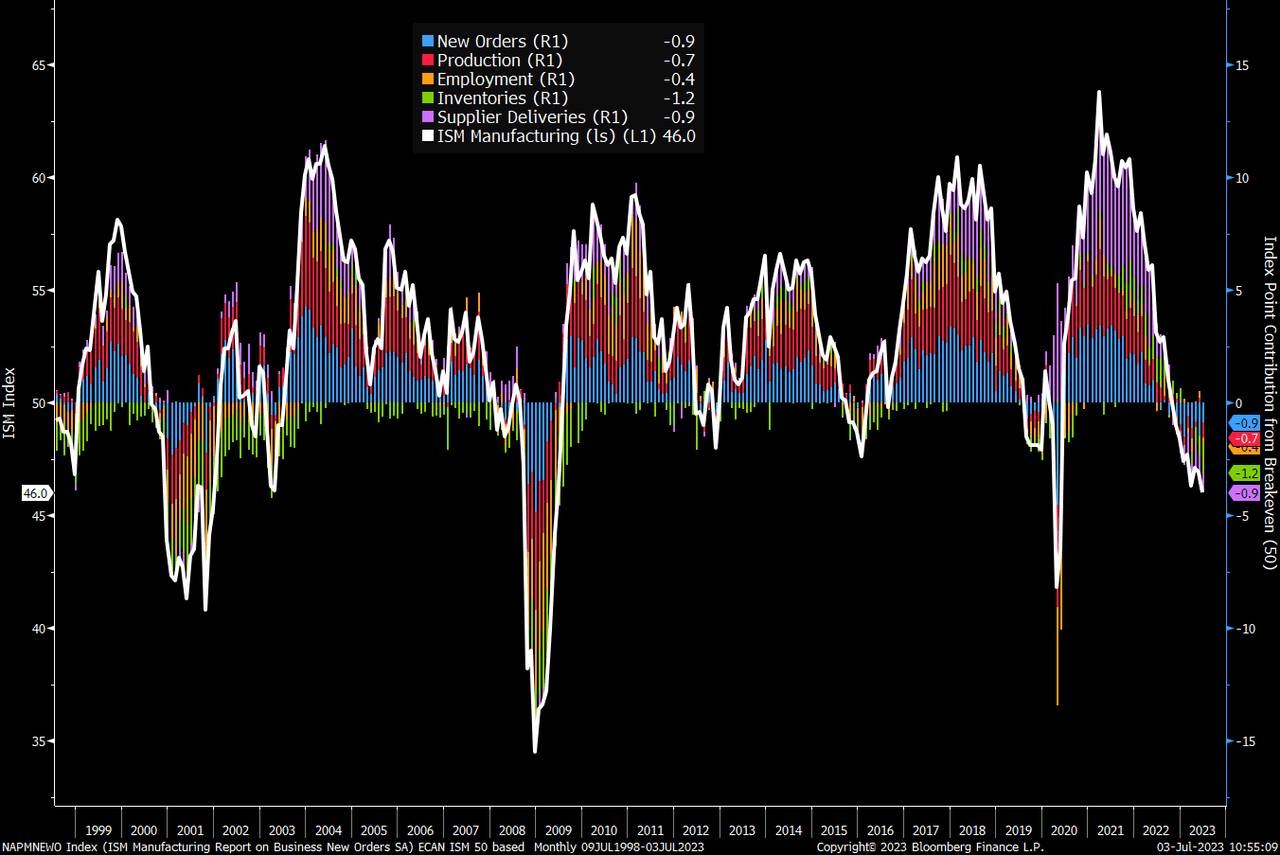

Essentially, Snap-on’s presence in commercial and industrial (C&I) markets is highlighted as an area subject to global headwinds. Right now, economic growth is slowing down tremendously. The just-released ISM Manufacturing Index for the month of June showed an unexpected decline to another multi-year low, which indicates increased weakness in manufacturing – a manufacturing recession is now very likely.

ISM Manufacturing Index & Its Components (Twitter @M_McDonough)

However, the company noted growth across sectors such as aviation, education, heavy-duty fleets, general industry, natural resources, and rebounding demand in the military sector.

This is what’s so fascinating (and tricky!) about the current economic environment. While we’re in a broad economic growth decline, there are so many secular trends that play a major role after the pandemic. Business cycles were much more straightforward prior to 2020, so to speak.

Needless to say, this is good news for the company.

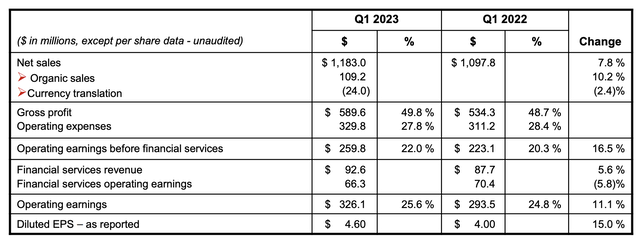

Hence, despite weakness, the start of this year was a big success. In 1Q23, net sales increased by 7.8% to $1.183 million compared to 1Q22, with a 10.2% gain in organic sales partially offset by unfavorable foreign currency translation.

Snap-on Inc.

The growth was broad-based across all segments, with double-digit organic sales growth in North America and low single-digit gains in Europe. Gross margin improved to 49.8%, driven by increased sales volumes, pricing actions, and benefits from the company’s RCI initiatives.

Furthermore, operating expenses as a percentage of net sales improved to 27.8%. Operating earnings before financial services increased to $259.8 million, and net earnings reached $248.7 million, which represents a 15% increase in diluted earnings per share.

The good news continues, as the company reported cash provided by operating activities of $301.6 million for the quarter, which is a significant increase compared to $193.9 million in the same period last year.

- The increase was primarily attributed to lower year-over-year increases in working investment, improved net earnings, and lower cash tax and compensation payments.

- The net cash used by investing activities amounted to $72.9 million, including net additions to finance receivables of $49.6 million and capital expenditures of $23 million.

- The net cash used by financing activities was $152.1 million, which involved cash dividends of $86.1 million and the repurchase of 356,000 shares of common stock for $87.2 million under the existing share repurchase programs.

- The company also had remaining availability to repurchase up to an additional $345.4 million of common stock under existing authorizations.

In other words, the company generated a lot more cash, which led to significant shareholder distributions. After all, the company has a healthy balance sheet, which does not require special attention. Meaning it can prioritize shareholders over debtholders. This year, the company is expected to end up with just $130 million in net debt, which would be a 0.1x net leverage ratio. Hence, the company enjoys an A credit rating.

This is what S&P Global (SPGI) wrote in December of 2022 when it affirmed the company’s A-rating:

Snap-on’s ratings are supported by its strong market position, high level of customer brand loyalty, conservative financial management and consistent FCF generation. Rating constraints include risks associated with Snap-on Credit (“SOC”) and end market concentration towards the auto repair market.

With that said, let’s focus a bit more on shareholder distributions – after all, that’s the main reason I’m writing this article.

SNA Shareholder Distributions

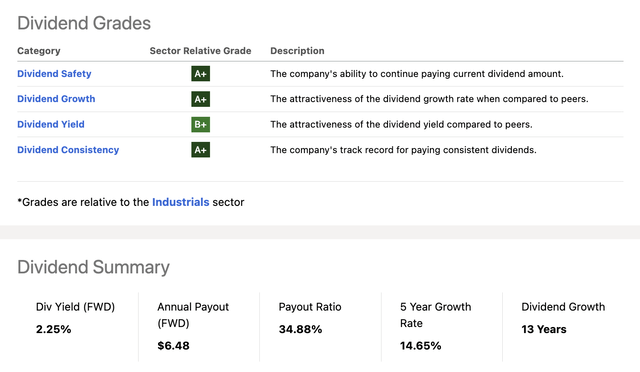

SNA has a fantastic dividend scorecard – provided by Seeking Alpha. The company scores high in every category except for its yield, which is still a satisfying score.

Seeking Alpha

As the overview above shows, the company has a 2.3% dividend yield, which is still above the sector median of 1.5%, despite the recent stock price surge.

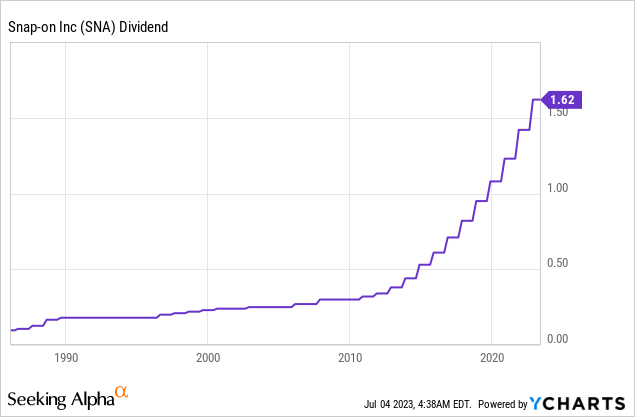

This dividend is backed by a 35% payout ratio and almost 15% average annual dividend growth over the past five years.

The most recent hike was announced on November 4, 2022, when the company hiked by 14.1%.

Furthermore, the company has had 13 consecutive years of dividend growth. Prior to that, it had multiple periods without growth to deal with economic uncertainty. The company did NOT cut its dividends in the past.

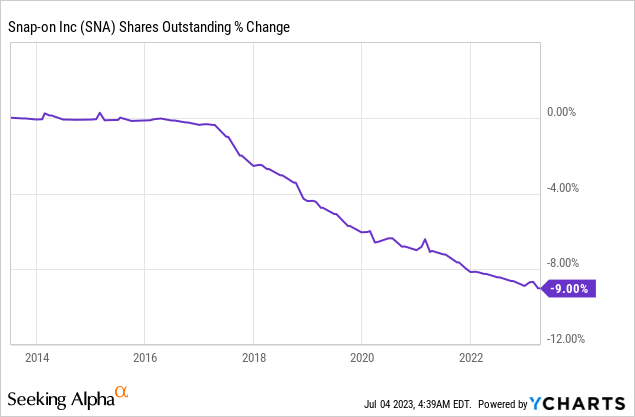

With regard to buybacks, the company started to step things up after the 2016 manufacturing recession. Over the past ten years, SNA bought back 9% of its shares. All of this came after 2017.

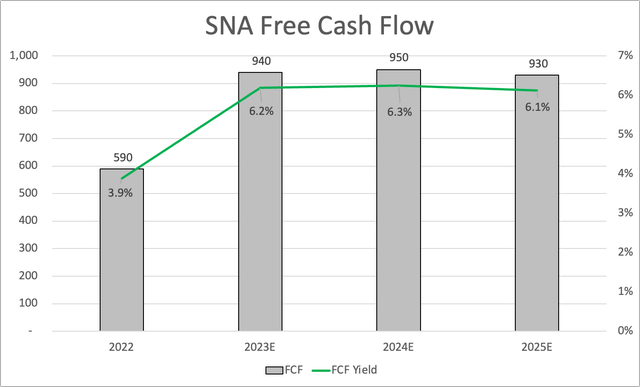

Having said that, the company should be in a great spot to maintain strong dividend growth and buybacks. Looking at analyst estimates, we see that SNA is expected to consistently generate close to $950 million in free cash flow – albeit without free cash flow growth between 2023 and 2025.

Leo Nelissen

These numbers imply a 37% cash dividend payout ratio, which is very sustainable.

Valuation

Based on its 1Q23 numbers and looking ahead, SNA remains focused on executing its strategic initiatives to drive growth and profitability. The company aims to continue expanding its product offerings, enhancing customer engagement, and leveraging its RCI initiatives to improve operational efficiency.

However, SNA also acknowledged the presence of certain challenges and uncertainties, including global economic conditions, supply chain disruptions, and currency fluctuations.

Despite these challenges, SNA is optimistic about its prospects and expects to achieve its long-term financial goals. The company aims to deliver mid-single-digit annual sales growth and expand operating margins through a combination of organic growth and strategic acquisitions.

Analysts expect full-year EBITDA growth to be 3%, followed by 4% growth in 2024.

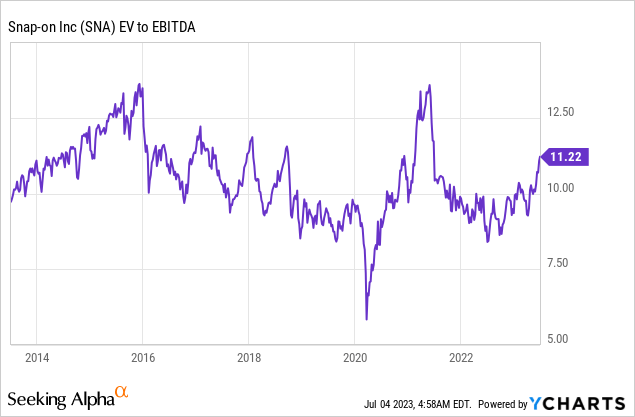

With all of this in mind, SNA is trading at 10.9x 2024E EBITDA. In this case, I only used its market cap and expected EBITDA of $1.4 billion, as expected net cash offsets pension liabilities and minority interest. If anything, I’m a bit conservative, as the company will likely end up with more net cash.

This multiple is close to the longer-term median, which makes me believe that the company is trading at a fair price. However, please note that I’m using 2024 EBITDA estimates, which means that a lot has been priced in already.

Analysts seem to agree. The current consensus price target is $251, which is below the current price of $287.

On May 18, the company got an upgrade from neutral to buy from ROTH MKM, which believes that SNA has a fair value of $298.

I agree with that.

However, I won’t be buying SNA at these levels. Not only because I do have 50% industrial exposure already but because I believe other investments have a better risk/reward. At this point, I rather add to some of my railroads and machinery stocks with better yields and better valuations.

If SNA were to come down 10% to 15%, I might become interested.

Moreover, despite all the good news, my rating will be neutral to reflect the valuation and the related fact that a lot of growth has been priced in.

Takeaway

Snap-on Incorporated has proven to be a pleasant surprise, outperforming expectations and capitalizing on favorable trends.

Despite a slowing economy, the company’s strong presence in the automotive repair environment and other sectors positions it for continued growth.

With robust shareholder distributions, a healthy balance sheet, and a solid credit rating, SNA impressively balances dividends and buybacks.

While it currently trades at a fair price, I remain cautiously optimistic about its future potential.

A slight dip in its stock price would make it a more attractive investment, but for now, I maintain a neutral stance considering the growth already priced in.

Read the full article here