Thesis

PriceSmart, Inc. (NASDAQ:PSMT) is a membership warehouse club, similar to Costco Wholesale Corporation (COST), based in San Diego and operating exclusively in Latin America. PriceSmart exhibits strong financial strength. However, due to the relatively lower purchasing power in Latin America compared to the U.S., PriceSmart may not be able to achieve the impressive returns that Costco has delivered since 2009.

Currently, PriceSmart is trading at a fair value with a stock price of $74.20. Using a Residual Earnings model, I have projected that the stock could potentially increase to $87.76, offering a modest 11.57% upside from 2023 to 2028. Given this slow growth, I would recommend a “hold” rating and set a stock price target of $87.76 for 2028.

Overview

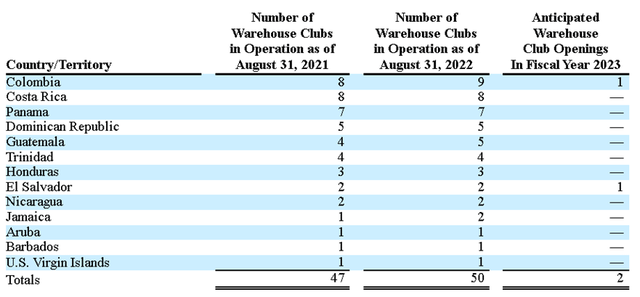

PriceSmart, despite being based in San Diego, operates exclusively in Latin America with the objective of replicating Costco’s business model in the region. Currently, PriceSmart operates 50 clubs in Latin America. Similar to Costco, PriceSmart requires a membership for customers to make purchases. This means their business model essentially subsidizes the price of goods with the money earned from annual memberships. In addition to in-store shopping, customers also have the option to purchase items online through their website. PriceSmart also exports products to a retailer in the Philippines and is exploring expansion in this business segment.

Number of Warehouse Clubs (2022 Annual Report)

The similarities between PriceSmart and Costco are not a coincidence. The founders of PriceSmart were the founders of PriceClub, which merged with Costco in 1993. Therefore, the company embodies the essence of Costco and its strategies.

In terms of competition, PriceSmart does not face direct competition from U.S. membership retailers like Costco. However, it faces fierce competition from Walmart Inc. (WMT) in Central America, and from Grupo Éxito and Cencosud in Colombia.

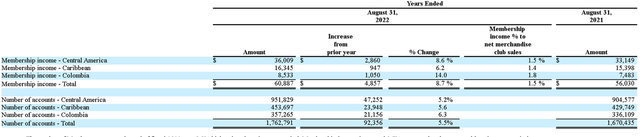

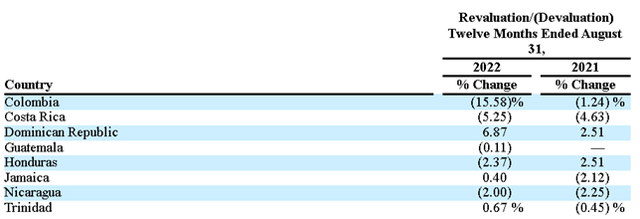

Speaking of countries, PriceSmart’s two most important markets are in Central America. As shown in the table below, these markets generated $36 million in membership income, accounting for approximately 60% of the total membership income.

Membership Income by Region (2022 Annual Report) % of Operating Income by Region (2022 Annual Report)

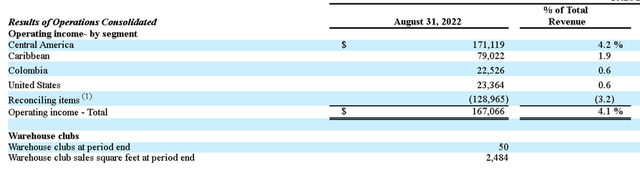

However, one of the challenges and disadvantages of operating in Latin America is the fluctuation of different currencies. Over time, these currencies tend to devalue against the dollar. As you can see, PriceSmart experienced a loss of 15.58% when converting Colombian currency to USD.

Forex Changes in % (2022 Annual Report)

Finally, shifting our focus to the macro perspective, the revenue of the food market in Central America is expected to grow at a rate of 10.17%, while in the Caribbean, the growth rate is projected to be 15.18%. This implies a combined growth rate of 10.17% for Central America and the Caribbean.

Financials (In millions of USD unless stated otherwise)

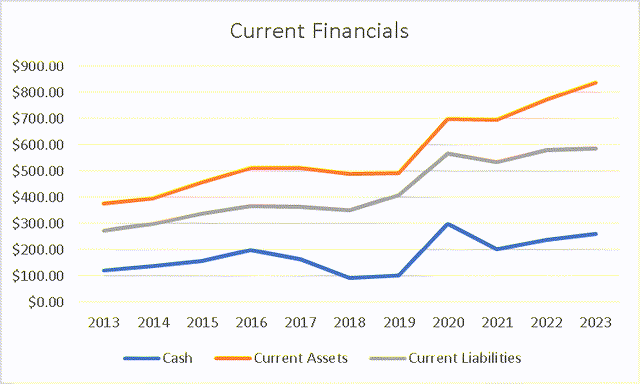

PriceSmart is currently in a strong financial position, with current assets of $836.80 million, which is 42% higher than their current liabilities of $586.60 million. Another significant aspect is their cash reserves, which currently amount to $260.90 million, showing a 10.3% increase since 2013.

Current Financials (Author’s Calculation)

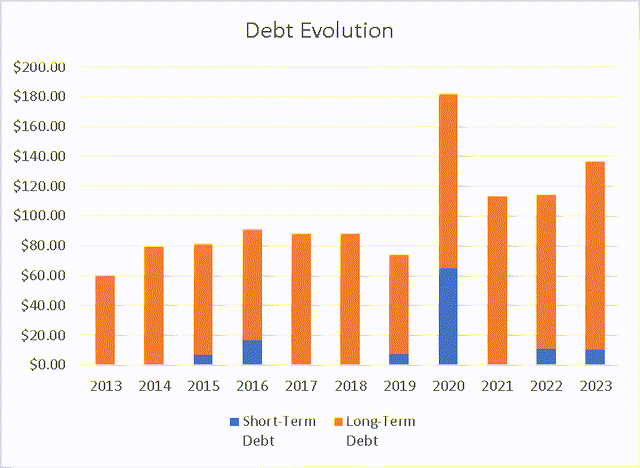

Their debt currently stands at $136.5 million, indicating an annual growth of 11.4% since 2013 when their debt was $60.30 million.

Debt Evolution (Author’s Calculation)

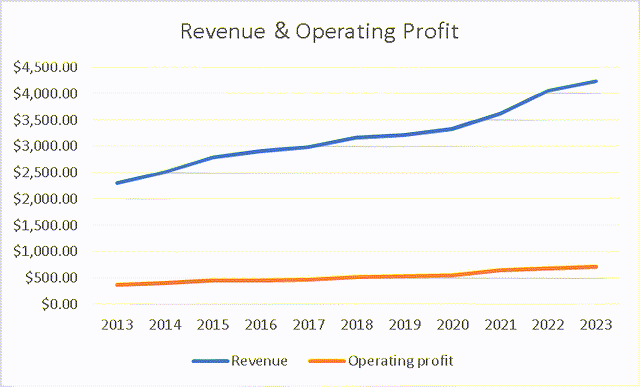

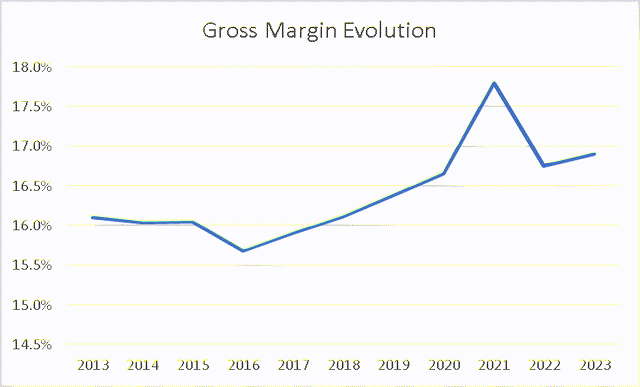

Now turning to their income statement, their revenue stands at $4.25 billion, reflecting an annual growth of 7.7% since 2013. Additionally, their operating profit has shown a growth of 8.5%. This suggests that over the years, PriceSmart has been improving its gross margin, which currently stands at 16.9%, up from 16.1% in 2013.

Revenue & Operating Profit (Author’s Calculation) Gross Margin Evolution (Author’s Calculation)

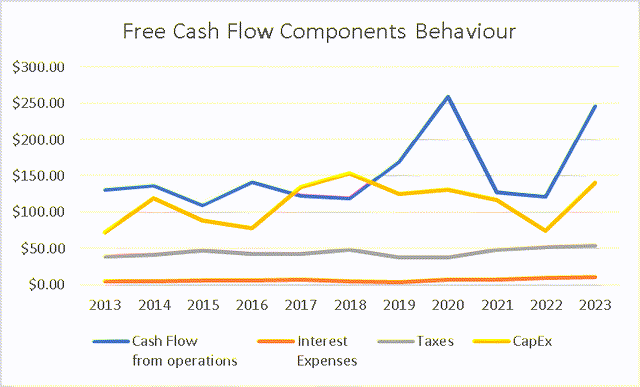

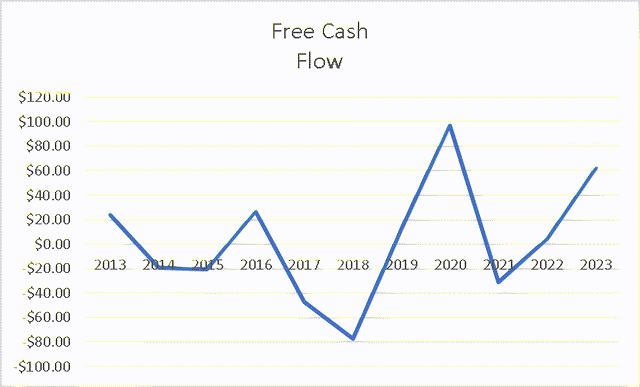

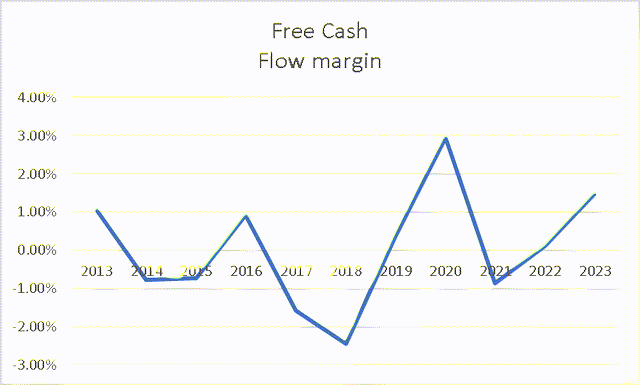

However, now we come to the concerning part – their cash flows. Being a supermarket business, it is expected for them to have slim margins, but not as low as their free cash flow margin of 1.48%. Moreover, there have been years with negative cash flows, specifically in 2014-2015, 2017-2018, and 2021. Interestingly, these years also coincide with the highest capital expenditures, indicating that PriceSmart is doing everything it can to grow.

FCF Components (Author’s Calculation) FCF (Author’s Calculation) FCF Margin (Author’s Calculation)

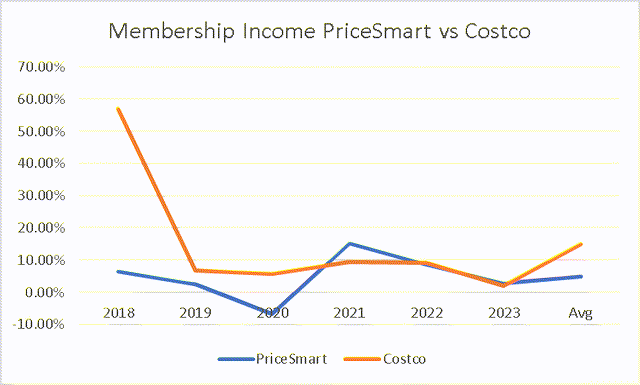

Now, the important question arises: Is PriceSmart the next Costco? Well, PriceSmart’s gross margin is indeed higher than Costco’s 12.27%, and its free cash flow margin is higher than Costco’s 1.41%. However, Costco’s growth can be observed through their membership income, which is also an indicator of membership growth. It is important to remember that it is much easier to grow in the U.S., given that American consumers have significantly more purchasing power than the average Latin American consumer. Additionally, the U.S. represents a larger market, which means companies are less exposed to risks such as forex fluctuations, unpredictable politics, and different laws. PriceSmart’s membership income has grown by 4.4% since 2017, whereas Costco’s has grown at a pace of 15.8% during the same period.

Membership Income PriceSmart vs Costco (Author’s Calculation)

As mentioned earlier, Costco’s advantage lies in operating in the U.S., where people have higher spending capacity. Meanwhile, PriceSmart’s key markets are Colombia, Panama, and Costa Rica, as other countries are either too poor or, if wealthy, have a small population, such as Aruba. For PriceSmart to achieve extraordinary growth, they would need to expand into markets like Chile and Uruguay, which are relatively wealthy markets with considerable populations.

In conclusion, PriceSmart has achieved impressive growth in terms of revenue and size. Their gross margin and free cash flow margin are slightly better than Costco’s, the company they aim to emulate. However, the challenge lies in the markets where PriceSmart operates. While PriceSmart may have better gross margins and free cash flow margins, they still represent a relatively small amount of money. For example, PriceSmart’s free cash flow margin is 1.48%, representing a few million dollars, whereas in Costco’s case, it represents a few billion dollars. This is the underlying problem, and it’s why Costco is poised for better growth than PriceSmart. To address this situation, PriceSmart needs to enter more lucrative markets like Chile and Uruguay. Unfortunately, PriceSmart won’t be able to access the Mexican market, as Costco already has operations there.

Valuation (In millions of USD unless stated otherwise)

Since 2013, PriceSmart has opened 15 clubs, averaging approximately 1.36 new clubs per year. In comparison, Costco has opened 7.36 new clubs during the same period.

To value PriceSmart, I will employ a Residual Earnings Model, assuming that PriceSmart will continue to open 1.36 clubs annually. These clubs contribute to 97% of PriceSmart’s revenue. As of 2023, the trailing twelve months (TTM) revenue stands at $4.2 billion. When divided by the 50 clubs, this implies that each club has generated approximately $84.98 million to date. Therefore, each new club is projected to generate $115.6 million (84.98 million x 1.36).

Additionally, it is crucial to project the expected food revenue growth of 10.17% until 2028. Incorporating these projections into PriceSmart’s revenue, the following figures emerge:

| Revenue | |

| 2023 | $4,249.20 |

| 2024 | $4,841.53 |

| 2025 | $5,494.52 |

| 2026 | $6,214.38 |

| 2027 | $7,007.95 |

| 2028 | $7,882.78 |

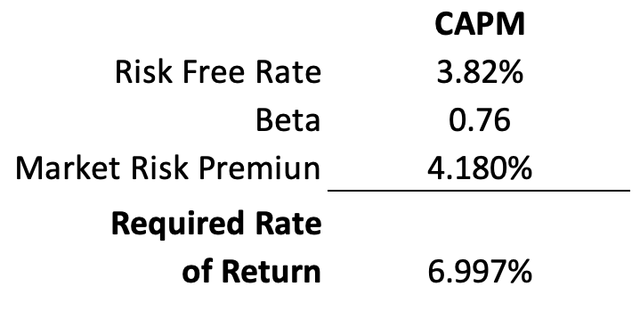

Before proceeding to the next step, I input the necessary variables into the CAPM model. I consider the US10Y yield of 3.82%, the Beta of 0.76 (obtained from MarketWatch), and a market return of 8%. Using these values, the calculation yields a Required Rate of Return (RRR) of 6.997%.

CAPM (Author’s Calculation)

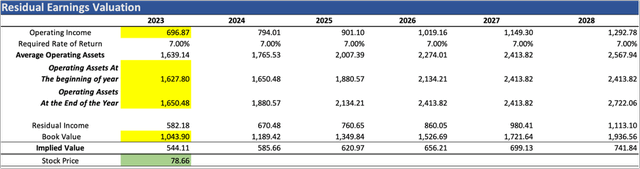

To derive the operating income, book value, and operating assets, I will utilize proportions. Firstly, to calculate operating income, I multiply the revenues mentioned in the preceding chart by the average gross margin observed from 2013 to 2023, which amounts to 16.4%. Secondly, for operating assets, I divide revenue by the operating assets in 2023, resulting in a quotient of 2.57. This figure indicates that operating assets generate 2.57 times the revenue. Lastly, I employ a similar approach for book value by dividing revenue by the book value in 2023, yielding a ratio of 4.07. This suggests that revenue is 4.07 times the book value. These proportions are projected as dependent variables of the revenue.

In the Residual Earnings Valuation table below, you will find the outcomes produced by each of these proportions. Notably, the model provides a stock price of $78.66, which closely aligns with the current stock price of $74.20. Consequently, it can be inferred that the stock is fairly valued at present.

Residual Earnings Model (Author’s Calculation)

Next, let us determine the stock price target for 2028. I calculate the future value of the current fair price derived from the model, resulting in a stock price of $87.76. This translates to an upside of 11.57%. Due to the slow growth and limited potential for further increase, I assign a “hold” rating and set a stock price target of 11.57% for 2028. However, it is worth noting that if the stock had been purchased at $58.14 on October 7, 2022, the upside would have been 50.95%%, with an annual return of 8.4%, I am not saying that the stock would reach 50.95%, I am stating that I’m late to enter this stock.

Risks to Thesis

The primary risk of my thesis is if PriceSmart was able to open 3 clubs annually, which would result in a stock price of $92.12. If they were able to open 8 clubs per year, the stock price target would be $108.34. However, even with the latter scenario, the annual return of 7.6% would still be considered low and highly improbable that PriceSmart is going to open 8 clubs annually.

These are the risks to my thesis. Now, let’s consider the risks that may impact PriceSmart itself. It includes the possibility that Central America & the Caribbean’s development falls short of expectations, causing the projected 10.17% growth in food revenue to lag behind. Other risks include political and economic instability within the region, as well as the potential for management to make poor decisions that strain the company’s balance sheet, making it difficult to navigate adverse economic conditions.

Furthermore, there is the potential risk of Costco expanding into the region, which is a risk for PriceSmart, since it’s essentially a Costco, a situation like that would trigger a price war that PriceSmart will probably not win.

Conclusion

The company’s financial position appears solid, with higher current assets than liabilities and increasing cash reserves. However, its debt has also grown over the years. Revenue and operating profit have experienced steady growth, driven by an improvement in gross margin. Nevertheless, the company’s cash flows, particularly the slim free cash flow margin and occasional negative cash flows, indicate challenges in generating substantial profits.

PriceSmart’s markets primarily reside in Central America, with its key countries being Colombia, Panama, and Costa Rica. Operating in Latin America poses challenges due to currency devaluation and market limitations. Compared to Costco, PriceSmart’s growth potential is constrained by the lower purchasing power of Latin American consumers and exposure to risks like currency fluctuations, political instability, and varying regulations.

While PriceSmart has expanded its club count, the pace of growth significantly lags behind Costco. The company’s valuation, based on a Residual Earnings Model, suggests that the stock is currently fairly valued. However, the projected stock price for 2028 indicates a limited upside potential, leading to a “hold” rating.

Risks to the thesis include the possibility of PriceSmart significantly increasing club openings, which is improbable since it could lead to overleveraging. Macro risks include Latin America’s development outpacing expectations, political and economic instability, and poor management decisions affecting the company’s balance sheet.

In summary, while PriceSmart exhibits certain strengths and growth potential, the challenges of operating in Latin America and the comparatively slower growth rate make it less likely to match Costco’s success. To achieve extraordinary growth, PriceSmart would need to expand into wealthier markets with larger populations.

Read the full article here