The JPMorgan Global Manufacturing Purchasing Managers’ Index™ (PMI™) compiled by S&P Global, registered 48.8 in June, down from 49.6 in May. The decline indicates an increasingly steep deterioration of business conditions, which have now worsened for ten consecutive months.

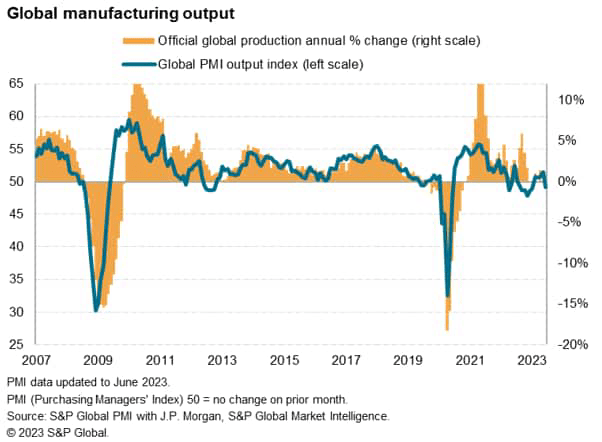

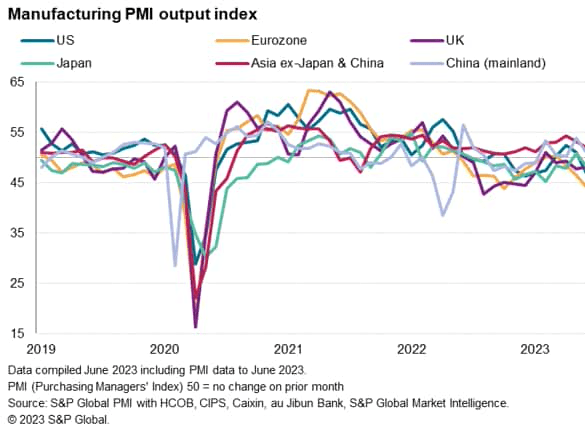

Factory output, which had risen in the prior four months largely on the back of improving supply chains, fell back into decline in June amid a growing dearth of new orders.

New orders have fallen continually over the past year. With pessimism about the outlook also intensifying, factories globally cut back on input buying and focused on inventory reduction, exacerbating the downturn in demand.

The eurozone reported the steepest decline, though output notably also fell in the US, Canada, the UK, Brazil and Japan. Recent resurgent growth in mainland China also lost considerable momentum.

Some encouragement can be gleaned from the overall rate of decline of global production remaining only modest in June. But the forward-looking indicators suggest risks are weighted to the downside for the coming months. The brightest hopes are linked to the inventory cycle acting as less of a drag as the year proceeds, and hopefully a peak being soon seen for central bank policy rates.

Global factories cut output for first time so far in 2023

Global manufacturing output fell for the first time in six months in June, according to the latest PMI surveys compiled by S&P Global, hinting at the start of a new downturn in global goods production after a tepid output recovery in the first five months of the year.

At 49.2, down from 51.4 in May, the output index from the JPMorgan Global Manufacturing PMI – our preferred measure of current factory production – fell to its lowest since January.

Backlogs of work fall sharply

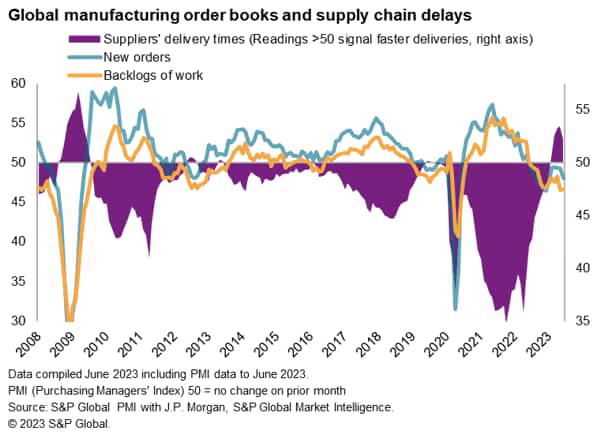

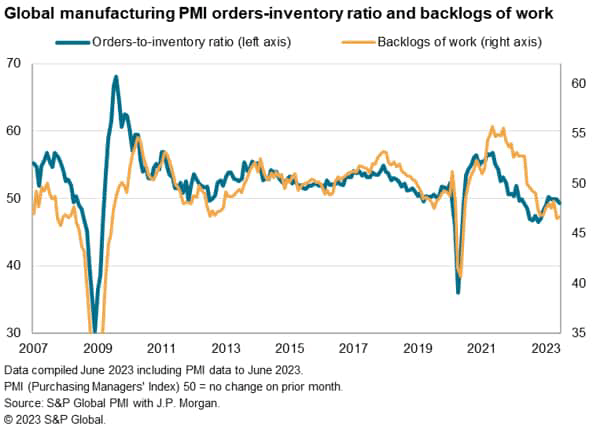

Whereas prior recent months had seen producers benefit from a spell of notable supply chain improvements, which had enabled factories to fulfill backlogs of uncompleted orders – many of which had accumulated due to component shortages in the pandemic – this effect waned in June.

Although suppliers’ delivery times continued to improve on average globally, a dearth of new orders meant the overall order book situation deteriorated in June to the extent that backlogs of work-in-hand fell again.

Having risen to an unprecedented degree during the pandemic, backlogs of work have now fallen for 12 successive months – dropping in recent months at a rate not seen since the global financial crisis barring only the initial pandemic lockdowns.

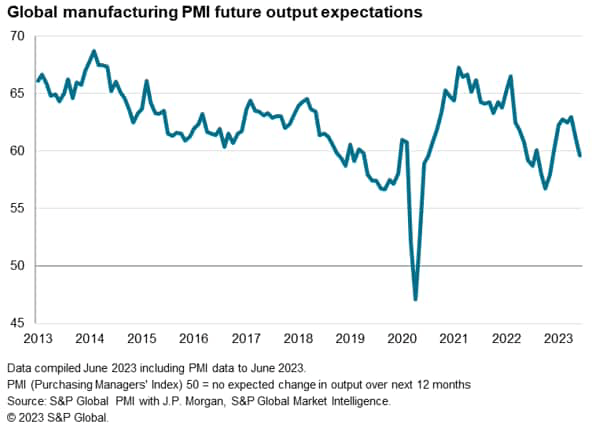

Optimism descends further below long-run average

Manufacturers are accordingly less optimistic about their output in the year ahead. Having risen to a 14-month high in April, business expectations for the next 12 months fell for a second successive month in June, dropping to the lowest since November and descending further below the series’ long-run average.

Increased drag from inventory draw-down

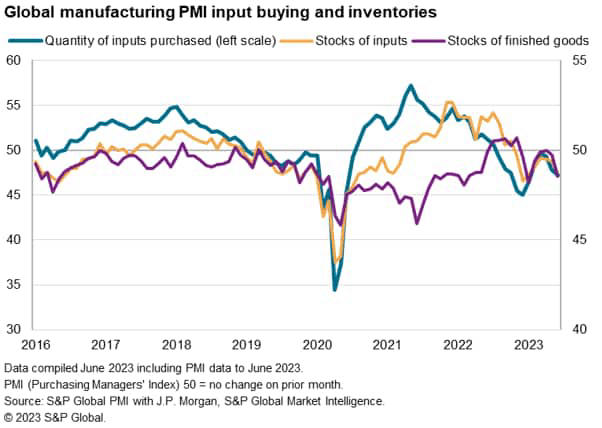

The ongoing drop in demand and increasingly downbeat prospects for the year ahead prompted more producers to scale back their input buying and reduce their inventories for cost considerations.

Input buying and inventories of inputs both fell at the sharpest rates since January. Stocks of finished goods were meanwhile also allowed to fall at the fastest rate since January.

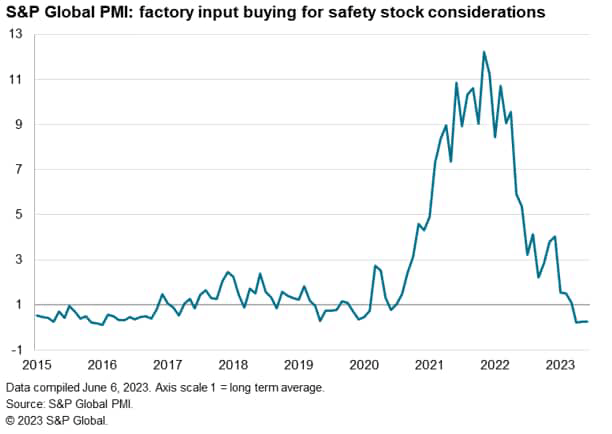

Digging deeper into the inventory reduction trend, plentiful supply now means the amount of input buying by factories for safety stock considerations is now running at one of the lowest rates recorded by the survey.

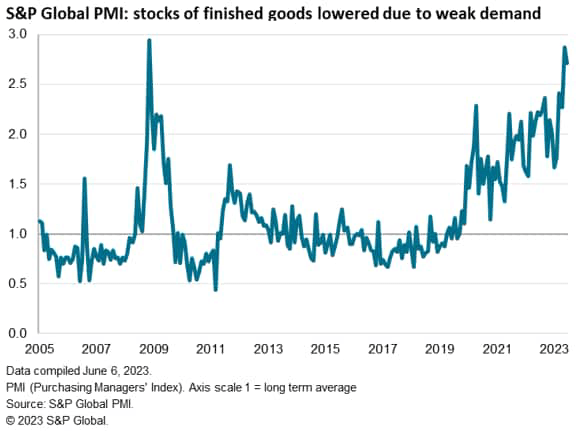

Meanwhile the incidence of factories deliberately unwinding their stock holdings of finished goods is running at one of the highest rates ever recorded by the survey. Only the peak of the global financial crisis witnessed a more severe case of deliberate destocking than evident in the second quarter of 2023.

Such increasingly common inventory reduction policies are acting as a further drag on the global manufacturing sector, exacerbating the downturn in final demand from customers.

Global trade retrenchment

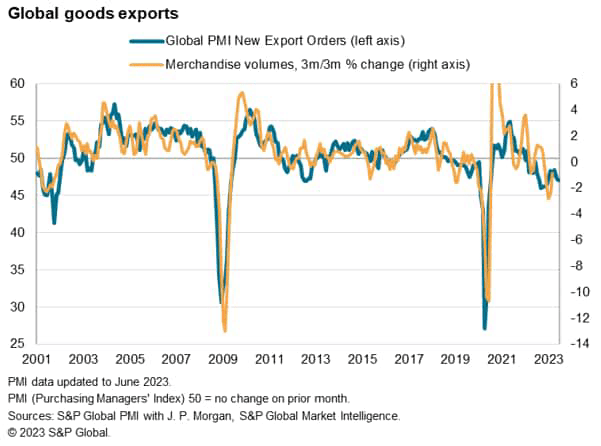

The downturn in demand has led to a further drop in global trade. New export orders for goods fell globally in June for the sixteenth successive month, marking the most severe and protracted retrenchment of world trade since the global financial crisis in 2008-9.

Eurozone reports especially poor performance

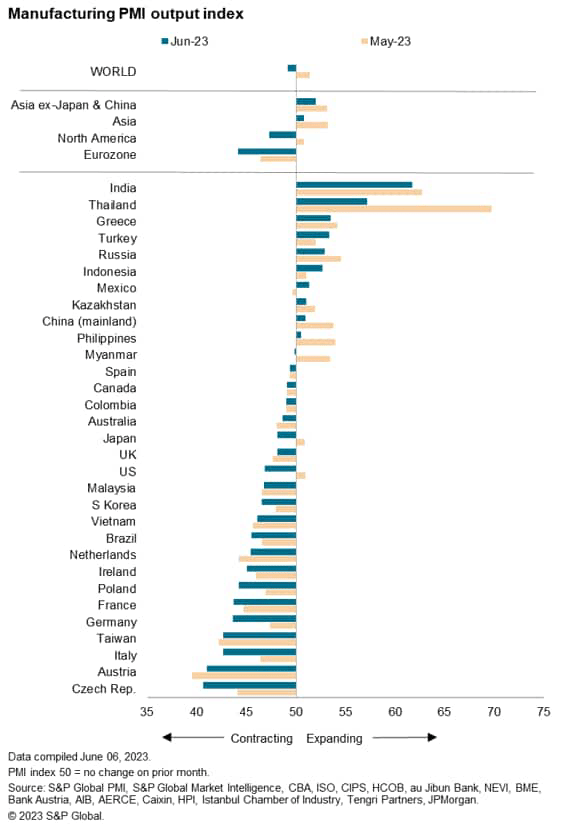

Of the 31 economies for which manufacturing PMI data from S&P Global are available for June, only ten reported higher output and, of these, only modest gains were seen in four economies. The largest increase was recorded in India, followed by Thailand. Greece, Turkey, Russia and Indonesia were the only other countries reporting noteworthy production gains.

At the other end of the scale, the steepest production declines were recorded in the Czech Republic, Austria and Italy, followed by Taiwan, Germany and France.

The weakness evident in many European economies meant the eurozone was the worst-performing region, recording a sharp and steepening loss of production during the month.

However, the downturn in North America also deepened, with US production falling at a rate not seen since January and output dropping for a second month in Canada, offsetting a modest return to growth in Mexico.

In Asia, the steep downturn in production in Taiwan was accompanied by falling output in Vietnam, South Korea, Malaysia and Japan. Although output continued to rise in mainland China for a fifth successive month, the increase was only slight and considerably weaker than the gain seen in May.

Outlook

Putting the current drop in global production into perspective, the June decline remains reassuringly modest by historical standards. There also remain some encouraging pockets of growth around the world, notably India.

On the other hand, the deterioration in business expectations and the concomitant worsening order book situation bode ill for global output in the third quarter.

The potential for further hikes to policy rates in the US and Europe add downside risks to demand in the months ahead, adding to the prior aggressive monetary tightening that has yet to fully feed through to demand.

The situation in manufacturing may therefore get worse before it gets better, with the turnaround likely to be signaled ahead by the switching of policies from inventory reduction to the rebuilding of stocks. However, at the moment there is scant evidence of this policy shift.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here