Investment Summary

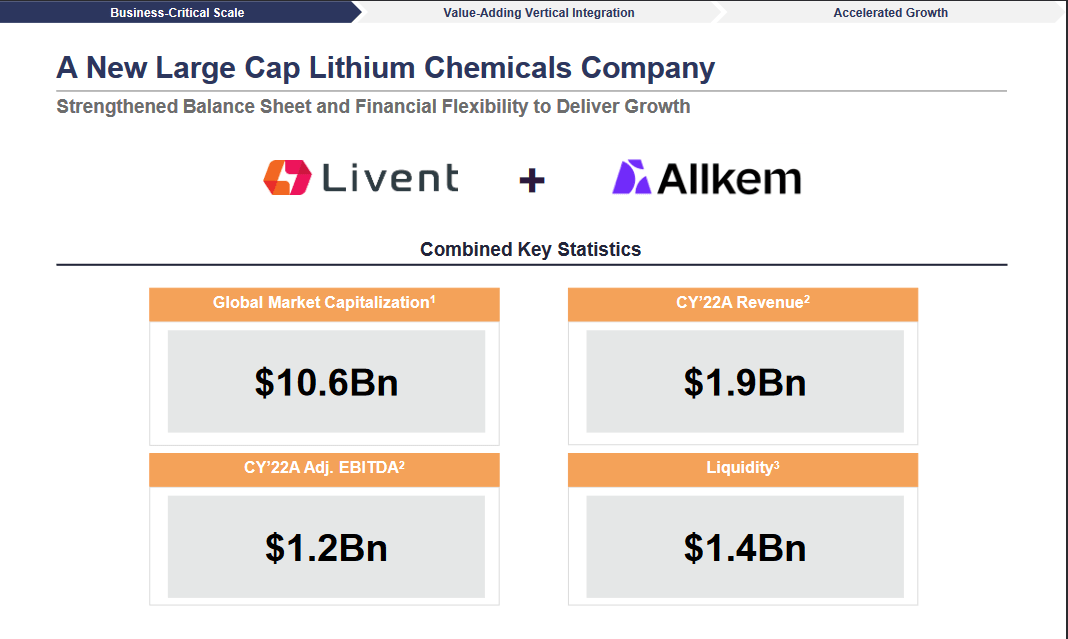

One of the biggest news stories this year in the materials industry has to be the announcement that Livent Corporation (NYSE:LTHM) and Allkem Limited (OTCPK:OROCF) are merging. This will create a leading lithium producer that will benefit greatly from growing demand and I think investors should have a good look at the opportunity that this presents.

Both companies are investing heavily in growing their revenue streams and establishing themselves. Allkem for example was expecting to triple its lithium production by 2026, which is a very ambitious goal. Bringing the two together creates one of the largest companies in the lithium industry. LTHM was already a leader, and Allkem held 10% of the market share. With this merger, it will mean an even more dominant position. I don’t think that LTHM was trading particularly high even before the news and right now the added benefit seems too good to pass up and I will be rating LTHM a buy as a result.

The Merger Deal

The deal that was announced earlier in the year that LTHM and OROCF are merging to create the largest lithium company came as a shock to the market and since the announcement back in early May shares of LTHM has climbed a little to reach around $26 per share. With a p/e of around 13 still on a forward basis the company seems too good to pass on right now.

Merger News (Investor Presentation)

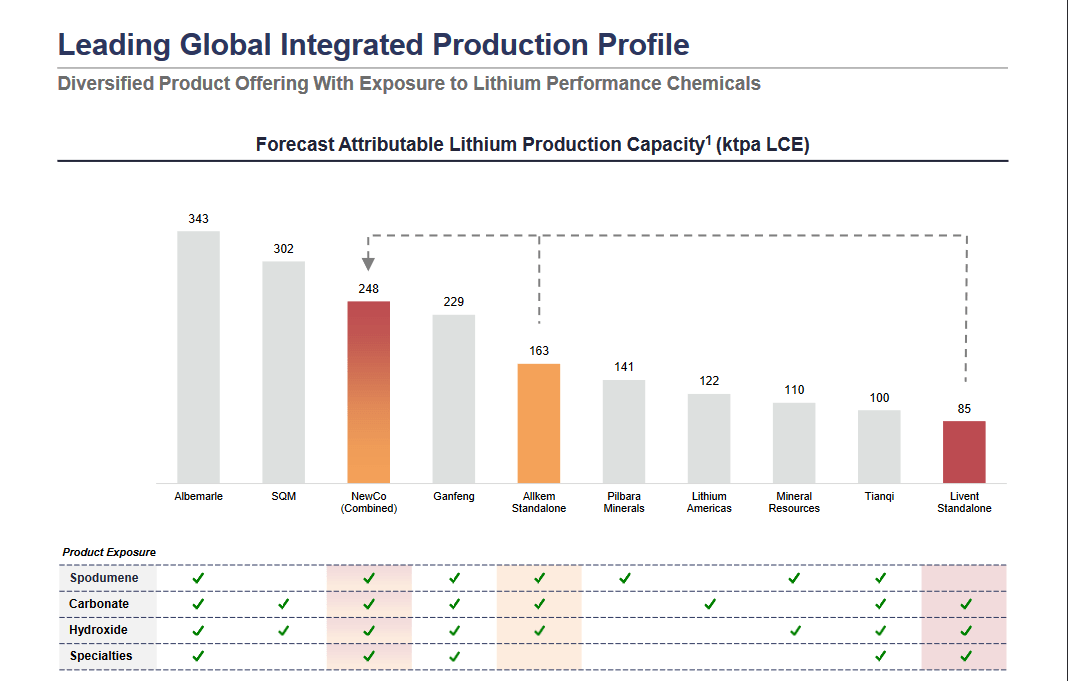

With the deal expected to close at the end of 2023, 2024 will be a major year for investors in both of these companies. Shareholders of Allkem will receive 56% of the new company and Livent shareholders 44%. The deal will make the company the third-largest producer of lithium in the world. Ahead of them are still Albemarle Corporation (ALB) and SQM.

Market Position (Investor Presentation)

One of the slightly overlooked aspects of this deal is that now the combination of the two companies will net them a very broad exposure and the geographical assets that they operate will help them in capturing strong growth. This combination will help ensure that the capabilities of the two are further enhanced and in time they could move up the ranks of who is the largest lithium producer.

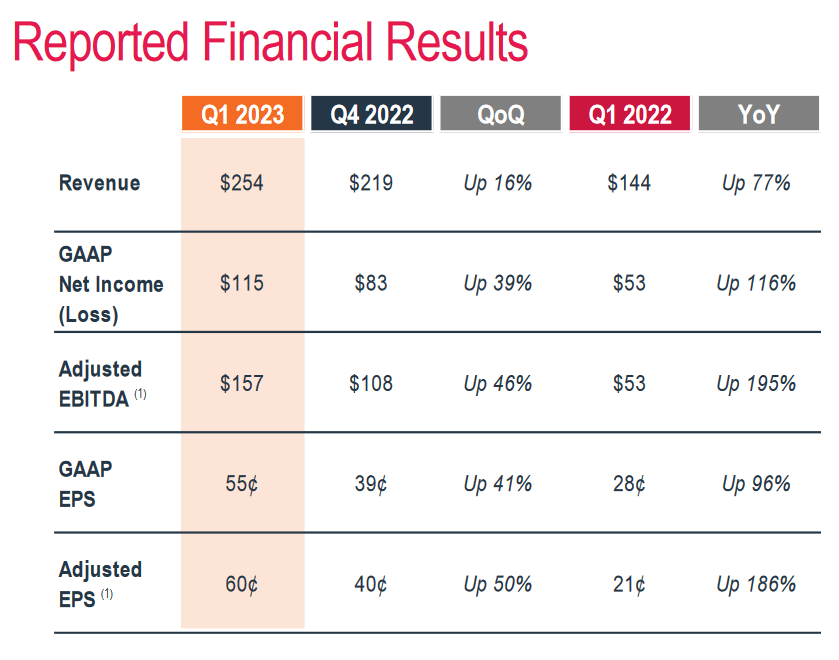

Recent Earnings Report

The last earnings report from LTHM showcased its ability to grow strongly and that the investments they have been making are paying off. Revenues were up 77% on a YoY basis whilst the adjusted EPS up 186% helped to justify an increase to the guidance for 2023.

Financial Results (Earnings Presentation)

The revised guidance would mean that LTHM would grow its adjusted EBITDA by 54% YoY, reaching $530 – $600 million in total. Despite that, LTHM isn’t trading at a valuation of a growth company, most likely due to the relative instability of lithium prices we have had. That seems to bring some risk factors in when evaluating the company. In my view, the long-term outlook remains sound and LTHM seems to share that view as well. For 2023 the supply of lithium is expected to remain tight which could help fuel further growth in the price, a direct benefit to LTHM if materialized. Helping with this market condition is the continued announcements of project delays across the industry which seems to create a permanent undersupply. Therefore I think that LTHM taking steps to establish partnerships is why they come out ahead anyway. They can pass down costs and maintain decent margins even through downturns in the industry.

Risks

It’s been made pretty clear that the combination of the two companies will provide investors with a stake in the third’s largest lithium producer. But I think there are some risks present here too. The border geographical position that will be achieved after the merger I think most expect will help increase volumes and fuel margin expansion for the company. If there is a failure in doing so then the current p/e of LTHM seems fair, being around 13 – 14.

The risk that makes that scenario a reality is that lithium prices remain suppressed. Compared to November 2021 then the price has seen a significant decline and that creates inconsistent revenues for companies in the industry, but that is the nature of commodity companies. That will over time translate to LTHM and the company after the merger trade at a lower multiple and investors won’t be able to realize the appreciation they had hoped for.

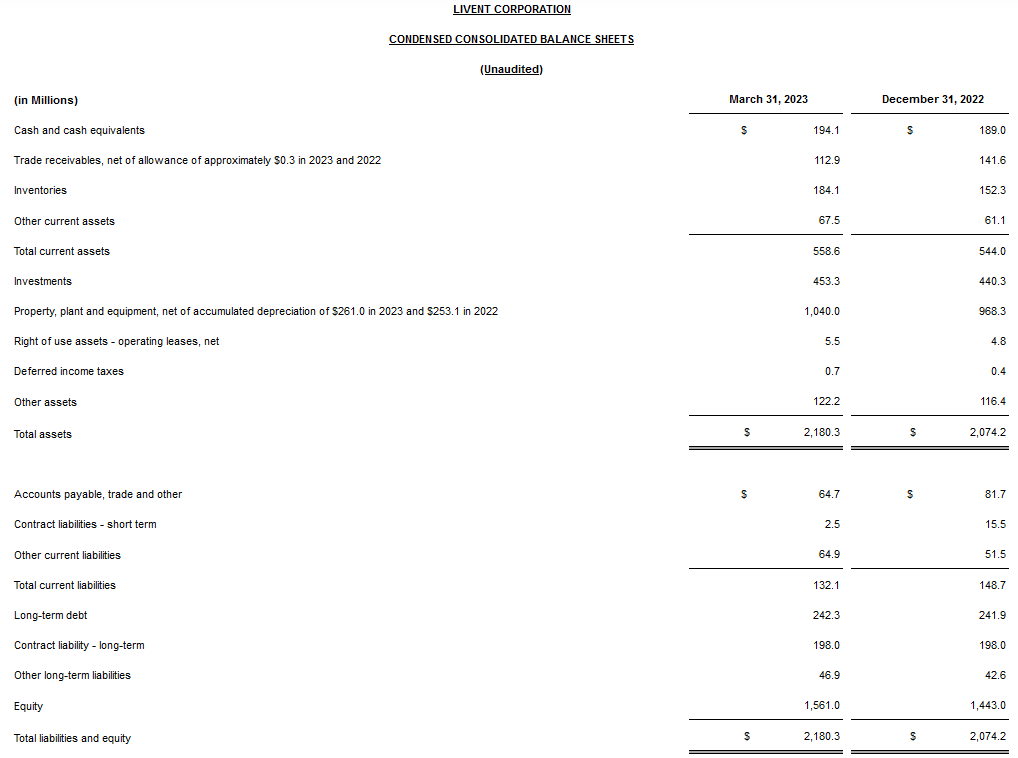

Financials

Taking a quick peek at the financials of the company I think LTHM is in great shape right now. The cash position sitting at $194 million equates to a slight QoQ increase. With that amount, they can make a serious impact on long-term debts of $242 million. A factor I think should come with a premium as the risk level is reduced if the balance sheet remains healthy.

Balance Sheet (Earnings Report)

To further highlight why I think LTHM is in a fantastic spot with their balance sheet, the net debts are only $53 million whilst the EBITDA sits at $470 million in TTM. That comes out to a ratio of 0.11. I don’t think Livent will face any struggles with debt in the coming years.

With Allkem having $770 million in cash themselves, the combination of the two won’t cause for a more risky balance sheet, instead, the opposite, I think.

Valuation & Wrap Up

Being exposed to the lithium industry is something that most investors interested in the EV space already are. Lithium being a vital product for this industry means that during times of higher prices the margins for users of the product will go up, something that LTHM for example can benefit from. A p/e of around 13 right now seems like a great entry point, as the sector is trading at the same. This suggests you aren’t overpaying for the company if you want exposure to the industry. Comparing the current p/e to the 5-year average, which is 97, makes the current price even more appealing. In fact, for most metrics looking at the 5-year average for the company it’s trading below them. The industry might be volatile as commodity prices shift in demand and price, I’d still say paying 13x earnings is fair, especially when estimates suggest that earnings will expand rapidly to reflect the demand coming from several end markets.

Stock Chart (Seeking Alpha)

The combination of LTHM and Allkem will create the third-largest lithium producer and with expectations being that the market will continue to be tight and in high demand. I expect there to be some inconsistent quarters going forward, but the long-term outlook remains very solid in my opinion. Buying LTHM at the price it currently at seems fair and a good way to get exposure to the industry and a way to benefit from the merger. I am rating LTHM stock a buy.

Read the full article here