Cognex (NASDAQ:CGNX) is a leading provider of machine vision and barcode reading technology. This is a secular growth opportunity, but the company is currently facing headwinds as customers cut CapEx. While Cognex’s business should rebound on the back of large manufacturing investments in the US, the stock appears fully valued given growth expectations.

Market

Cognex is a relatively mature company, but it continues to benefit from secular and regulatory tailwinds. Rising labor costs, evolving manufacturing requirements and improved technology all support the adoption of machine vision and barcode reading technology. In particular, the following areas are likely to support Cognex’s growth going forward:

- Electric vehicles

- Batteries

- Semiconductors

- Manufacturing automation

- Supply chain automation

- Life sciences automation

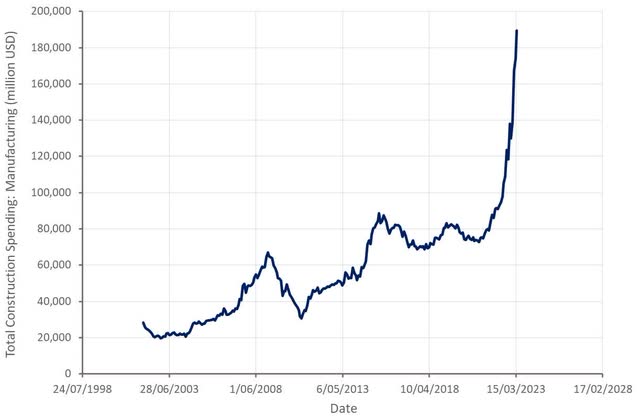

In addition, companies in the US have committed over 200 billion USD to manufacturing projects since the CHIPS Act and the IRA were passed. A lot of this investment is being directed towards Cleantech and semiconductors, although it may take time for Cognex to benefit from this as machine vision is typically implemented in the later stages of these types of projects.

The long-term importance of this manufacturing investment boom is uncertain though. There are already concerns that the US does not have the ecosystem or human capital to be competitive in semiconductor manufacturing. There is also the risk of manufacturing overcapacity globally leading to an extended period of underinvestment.

Figure 1: Total Manufacturing Spending Manufacturing – million USD (source: Created by author using data from The Federal Reserve)

Cognex currently estimates that its served market value is 6.5 billion USD, up from 4.2 billion USD in 2019. This could be considered concerning, as Cognex has already significantly penetrated this market, but growth can still come from market share gains and use case expansion.

Cognex

Cognex is a leader in machine vision and industrial barcode reading technology for automation, specializing in the development and manufacturing of vision systems, software, and sensors. The company has a long history developing technology to support the automation of manufacturing and distribution tasks, having been founded in 1981.

Cognex’s technology can help customers to improve the quality of their products or reduce costs. This is not just about automating tasks performed by people though. Machine vision is particularly useful in cases where human vision is insufficient to meet requirements for size, accuracy, or speed.

Solutions include:

- Vision systems and sensors

- Vision software

- Industrial Image-Based Barcode Readers

Cognex’s solutions also encompass AI to help solve complex applications. AI is a tailwind for Cognex as improved machine vision capabilities support new use cases. It may also end up being a threat, as AI could lower barriers to entry.

Cognex’s customers come from a range of industries, including:

- Manufacturing

- Logistics and Distribution

- Retail

- Pharmaceuticals and Healthcare

- Electronics and Semiconductors

- Food and Beverage

- Automotive

While this provides some level of diversification, Cognex’s largest end markets are cyclical and revenue is dependent on customer investments, meaning the company tends to go through boom-and-bust periods. Cognex’s largest end markets are the automotive, logistics, and consumer electronics industries, which combined represented approximately 69% of total revenue in 2022.

Automotive was Cognex’s largest end market in 2022. Within automotive, Cognex is focused on developing new solutions for electric vehicle manufacturers and suppliers. Battery manufacturing and inspection is likely to be a large part of this due to the importance of ensuring batteries do not have defects. Cognex is working closely with the major EV battery manufacturers in Asia, which are believed to be producing in excess of 90% of the world’s automotive batteries.

Machine vision is widely deployed in vehicle manufacturing, including tasks like:

- Measuring inbound parts

- Guiding robot assembly

- Quality control

The proliferation of electronics in automobiles could be a significant tailwind for Cognex going forward as it increases the number of items that need to be measured, placed, and inspected by machine vision.

Cognex believes it has an advantage inspecting battery materials and finished batteries for damage that can result in fires. Cognex acquired the German lighting technology provider SAC in late 2022 to support its battery business. SAC provides advanced lighting technology to identify challenging defects. Lighting is key to battery inspection because it illuminates small defects on surfaces that could result in safety-critical failures. The acquisition should also help expand Cognex’s footprint across industries that manufacture at high speed with minimal tolerance for safety-critical failures. Cognex also has AI capabilities that it has been developing for the past 7 years, which helps it to inspect dents and scratches and identify those that are problematic.

Within logistics, Cognex is trying to move beyond barcode reading to more complex applications, including:

- Ecommerce and omni-channel retail distribution centers

- Parcel and post warehouses

Vision applications in logistics include:

- Inspecting packages for damage

- Object and symbol recognition, and dimensioning

Logistics has been one of Cognex’s largest growth drivers over the past 5 years, but it should be noted that there has been an overbuilding of logistics infrastructure over the past 3 years. It will take time for the market to grow into this excess capacity, meaning that this business could be a drag for an extended period.

Logistics growth is likely to be driven by greater online fulfillment and increased usage of robotic automation. Geographic expansion should be another tailwind as Cognex’s logistics business is currently primarily within the US. Cognex’s large ecommerce customers account for over 50% of the company’s logistics revenue and yet represent less than 5% of global warehouse space. Therefore, penetration of the long tail of the logistics market is another significant growth opportunity.

Life Sciences is another potentially important area for Cognex. It is also a market that is protected by regulatory approval requirements. Cognex’s products are currently specified in over 100 different machine designs, which are expected to become a source of recurring revenue as they enter the market.

Applications include:

- Lab automation

- Medical device inspection

Cognex has also seen increased machine vision demand from manufacturers of diagnostic tests, vaccines, and protective equipment in recent years.

Cognex also has exposure to semiconductor manufacturing that should provide a tailwind as fab construction efforts in the US progress. Machine vision is used to ensure precise alignment of wafers during masking and etching processes. It is also used to provide traceability of wafers and dies and perform quality control.

Penetrating smaller or less technically sophisticated customers is another focus area for Cognex. The company wants to provide easy to deploy automation solutions to this customer segment to accelerate adoption. While this initiative is nascent, Cognex is pleased with progress so far and believes this segment could increase its customer base by up to 10x. While the revenue impact will be far smaller than this, it should still be a significant growth opportunity provided that Cognex gets the technology and distribution right.

Competitors

While Cognex is a leader in its field, it faces strong competition from companies providing point solutions, as well as systems. Cognex also faces competition from larger customers insourcing development and open-source tools.

Competitors include:

Keyence – a Japanese company offering a wide range of automation solutions (machine vision, sensors, barcode readers, measurement instruments). They have a strong presence in various industries and are known for their advanced technology and high-quality products.

Basler – a German company that specializes in the development and manufacturing of industrial cameras and vision systems. They provide a broad portfolio of high-performance cameras, software, and accessories for industrial image processing applications.

Teledyne Technologies – a diversified technology company offering machine vision solutions through its Teledyne DALSA and Teledyne Imaging brands. Teledyne provides cameras, sensors, software, and systems for a wide range of applications.

Omron Corporation – a Japanese company offering machine vision systems, sensors, robotics, and control components targeting industrial automation. Omron has a strong presence within the manufacturing, automotive, and electronics industries.

National Instruments Corporation – provides test, measurement, and control solutions. This includes machine vision products, software, and systems through its NI Vision platform.

Datalogic – an Italian company specializing in automatic data capture and industrial automation solutions. Datalogic provides barcode readers, vision systems and sensors for various industries.

Given the capabilities of some of Cognex’s competitors it is difficult to pinpoint a specific source of competitive advantage. The company clearly has one though, as evidenced by its long history of growth and high margins. Rather than competency in any specific area, it appears to be Cognex’s capabilities across technology (hardware, software, and machine learning) and sales that create a competitive advantage.

Financial Analysis

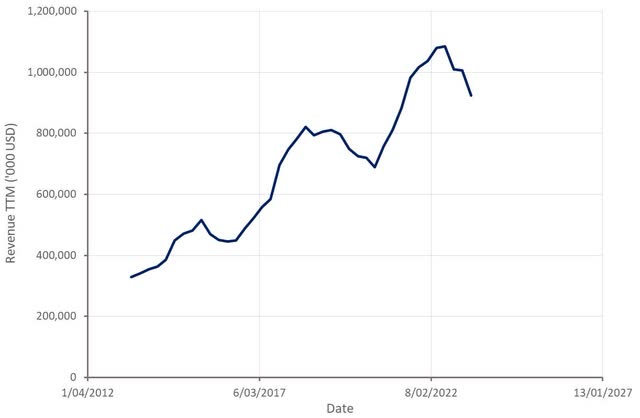

Cognex’s revenue declined by approximately 29% YoY in the first quarter of FY2023. Automotive spending in the first quarter of 2023 was weak as manufacturers have become cautious in the face of soft demand. This is a situation that could worsen significantly over the course of the year as consumer spending is under pressure and auto manufacturers are facing excess inventory problems. Cognex expects EV battery revenue to grow significantly in 2023, although it has stated that this revenue can be lumpy as it is dependent on the timing of large projects.

Logistics is also currently another weak spot for Cognex, with declines at a handful of ecommerce customers accounting for more than half of the company’s YoY revenue decline. Outside of these larger customers Cognex’s logistics business has continued to grow.

Cognex’s consumer electronics business has also been struggling, in large part because the company has an outsized exposure to the premium segment of smartphones and other devices. The pandemic and subsequent stimulus pulled forward a lot of electronics demand, and the market is still trying to digest this. Smartphone shipments were down in 2022 and are expected to be down again in 2023. This weakened demand has led to conservative capital spending.

Europe was Cognex’s best-performing region in the first quarter, with revenue flat YoY on a constant currency basis. Revenue in the Americas was down 36%, driven by the concentration of large e-commerce customers. Revenue in Asia was down 35% YoY, with softness across markets. Momentum began to pick up in China in March and April, but there are signs that China is facing macro difficulties despite its reopening.

Cognex’s revenue is expected to decline by approximately 14% YoY in the second quarter. This is a significant improvement over growth in the first quarter and could indicate headwinds are beginning to ease. This will likely depend on the course of the economy though, with a further slowdown creating downside risk. Growth in the second half will be artificially aided by a weak comparable period in 2022, due to a fire in one of Cognex’s main contract manufacturer’s warehouses.

Figure 2: Cognex Revenue (source: Created by author using data from Cognex)

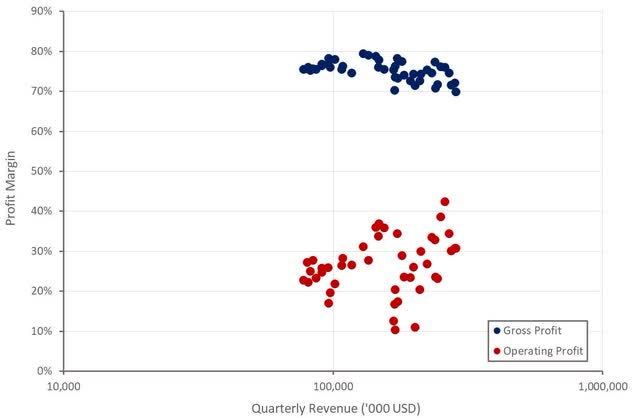

While Cognex’s gross profit margins have been under pressure in recent years, the company has generally improved operating profit margins with scale. Supply chain pressures have likely contributed to lower gross profit margins over the past few years.

Cognex reorganized its product development efforts in 2020 to focus on common products and platforms. It believes that this has improved efficiency and led to more rapid product launches. While this could help support operating profit margins, sales and marketing efficiency are the real drivers of the bottom line. Cognex has a long-term operating margin target of 30%, which seems reasonable based on recent performance.

Figure 3: Cognex Profit Margins (source: Created by author using data from Cognex)

Valuation

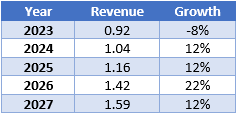

Cognex is targeting 15% annual growth over the long-term, which is broadly in line with analyst expectations. This strong growth, coupled with Cognex’s high margins and high ROIC, is supportive of a premium valuation.

Table 1: Cognex Growth Estimates (source: Created by author using data from Seeking Alpha)

Given recent AI hype and Cognex’s exposure to the manufacturing boom in the US, it is somewhat surprising that the stock hasn’t moved higher. This may be a result of the logistics business weighing on growth. Cognex’s EV/S multiple is broadly in line with its historical average and the stock appears fairly valued based on a discounted cash flow analysis. Given the quality of the company, investors may not get a much better entry point but outside of government stimulus and EVs, Cognex may continue to face significant headwinds in the near term.

Figure 4: Cognex Relative Valuation (source: Seeking Alpha)

Read the full article here