One of my go-to-market assessment visuals is Finviz’s ETF performance heat map. First-half returns were strong, no doubt, but several sectors were actually negative over Q1 and Q2. One niche that was far and away in the black (or green) was the internet space. Popular industry funds rallied some 30%-plus. But will the momentum continue into the back half of this year?

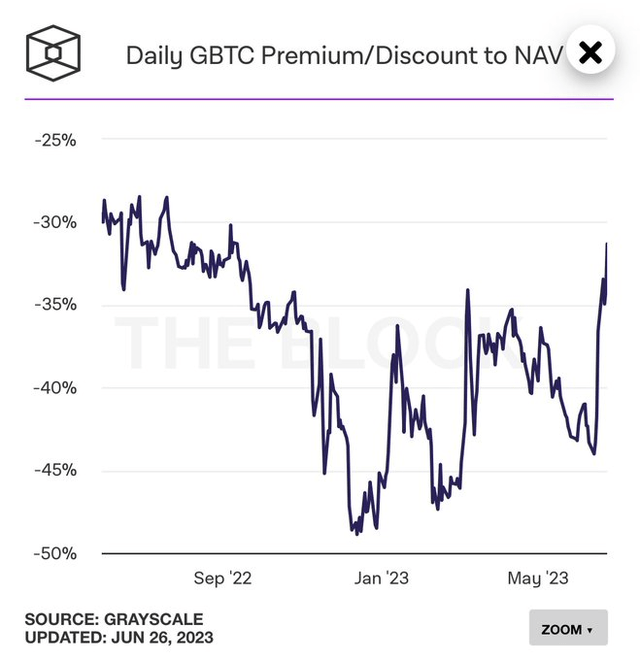

I have a buy rating on the ARK Next Generation Internet ETF (NYSEARCA:ARKW). I see the valuation as lofty but fair, while the growth outlook is robust. Technically, the fund appears strong with A+ momentum. The fund has recently benefitted from the Grayscale Bitcoin Trust’s (OTC:GBTC) discounts to its NAV closing following optimistic headlines that spot Bitcoin ETFs may come about sooner or later. Moreover, strong sales out of Tesla as reported on July 2 is good news for the ETF (its third-biggest position).

Tech, Internet Strong in the First Half

Finviz

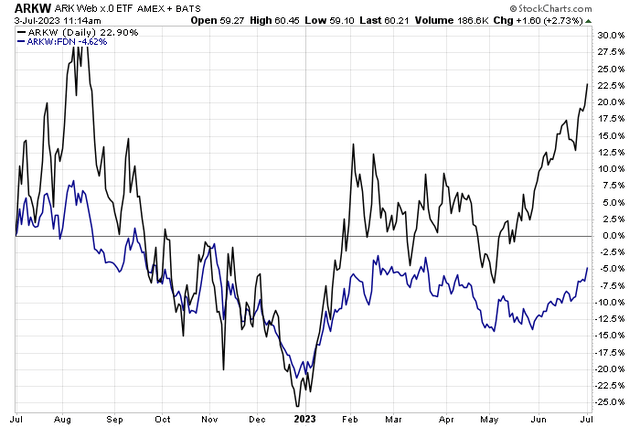

ARKW has Handily Outpaced the FDN Internet ETF

StockCharts.com

GBTC’s Discount has Partially Collapsed

Grayscale

According to the issuer, ARKW is an actively managed ETF that seeks long-term growth of capital by investing under normal circumstances primarily (at least 80% of its assets) in domestic and U.S. exchange-traded foreign equity securities of companies that are relevant to the fund’s investment theme of next-generation internet. The issuer believes companies within this ETF are focused on shifting technology infrastructure to the cloud, enabling mobile, internet-based products and services, new payment methods, big data, artificial intelligence, the Internet of Things, and social media.

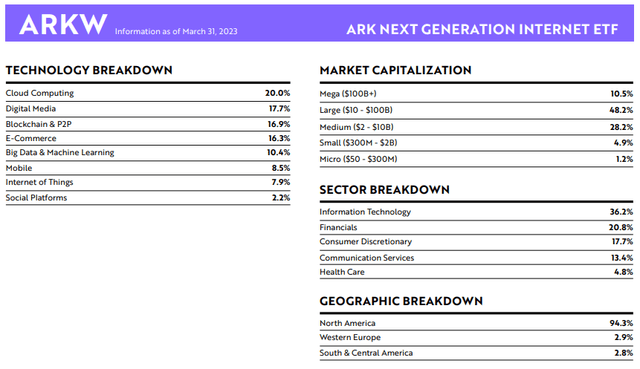

ARKW features total net assets of $1.25 billion as of May 31, 2023. The portfolio offers exposure to the following areas: Cloud Computing & Cyber Security, E-Commerce, Big Data & Artificial Intelligence (AI), Mobile Technology and the Internet of Things, Social Platforms, Blockchain & P2P. With a nearly 9-year track record, its expense ratio is high at 0.88% annually and the allocation typically consists of 35 to 55 individual equity positions.

The weighted average market cap size is $116 billion, while ARKW’s median company market cap is just $17 billion. The ETF’s median 30-day bid/ask spread is just 7 basis points and normal trading volume is 280,000 shares, per Seeking Alpha. Considering the dollar volume is more than $1.4 billion, tradeability is strong in my view.

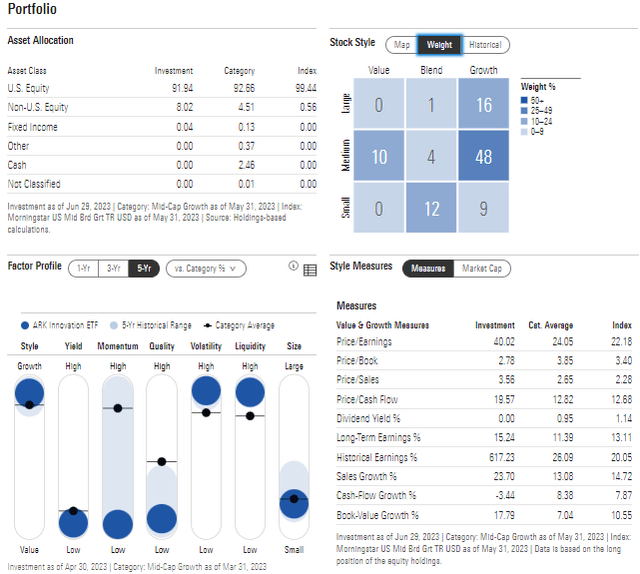

Digging into the portfolio, Morningstar’s style box shows that ARKW is all over the place, which is unusual. There’s large-cap growth exposure with a material small-cap presence. Still, the ETF is primarily mid-cap in nature and there is a high bent to the growth style versus value.

With a very low yield and high volatility, the fund has had strong momentum this year, but poor momentum over the last few years. As always, knowing your timeframe is key. If we assume 15% long-term earnings growth and its current 40x P/E, then the PEG is a bit high at 2.6, but a 3.6 price-to-sales ratio is not overly high given the growth profile.

ARKW: Portfolio & Factor Profiles

Morningstar

ARKW is a concentrated portfolio with 63% of assets in the top 10 holdings as of June 30, 2023. Coinbase (COIN), GBTC, and Tesla (TSLA) are the three biggest holdings.

Sector-wise, the fund is 36% invested in the Information Technology space, with a surprisingly high 21% allocation to Financials. Only three other sectors are represented, largely growth related. Finally, it is primarily a North America-based fund, with just small percentage weights to Western Europe and South & Central America.

ARKW: Portfolio Snapshot

ARK Invest

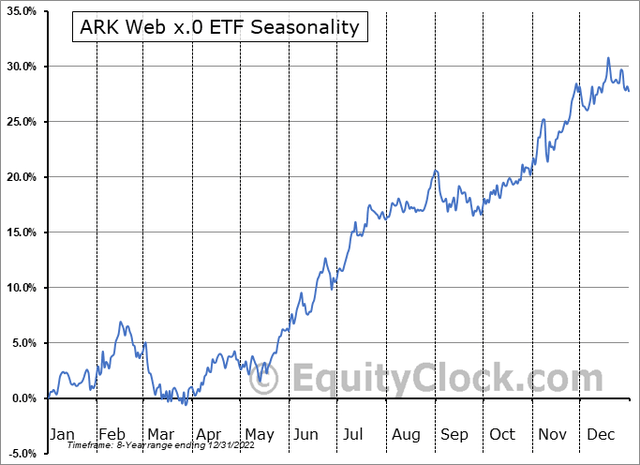

ARKW: Neutral Season Trends Late July-September

Seasonally, ARKW tends to consolidate gains that typically take place from April through mid-July during much of the third quarter. According to data from Equity Clock, waiting until late September to buy could be a more favorable risk-adjusted return play rather than buying today, but July and August are by no means historically bearish.

EquityClock

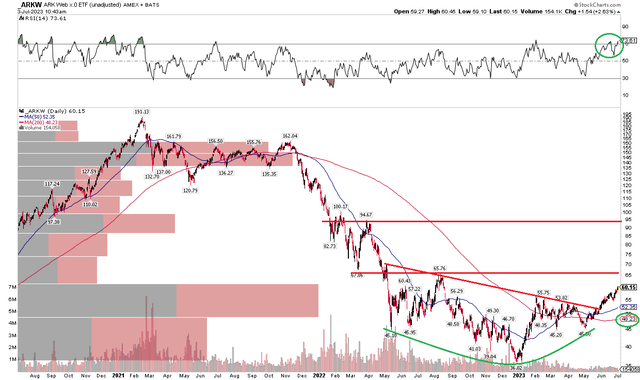

The Technical Take

I like the reversal signature on the ARK Next Gen Internet ETF. Notice in the chart below that shares continue to work on a bearish to bullish rounded bottom reversal pattern. I see resistance, though, in the $65 to $68 range, which could cap further upside potential. The next layer of future selling pressure may come into play in the $95 to $100 zone. In terms of downside support, keep your eyes on $45 (25% below the latest share price).

The good news is that the long-term 200-day moving average has turned positively sloped, and the RSI momentum indicator at the top of the graph is solidly in bullish territory. The ETF had a brief pullback in June, but in general, it has been straight up from its early May nadir, and ARKW managed to break above a key downtrend resistance line dating back to May of last year.

Overall, I see about 10% to 15% more upside ahead before we could see some sellers come about.

ARKW: Bearish to Bullish Reversal, $66 Resistance, Strong Momentum

StockCharts.com

The Bottom Line

I have a buy rating on ARKW. The fund has an A+ momentum rating, though its valuation could be considered expensive. I assert, though, that robust growth expectations, sprinkled with some sanguine news around Bitcoin ETFs, promote the possibility of further gains this quarter.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here