Introduction

Nu Holdings Ltd. (NYSE:NU) is a Brazilian digital bank that was founded in 2013. The company has seen a lot of growth since then and is still well positioned to continue this trend. This growth coincides with an increase in demand for digital banking services as the global utilization of mobile phones grows, which has been especially notable in Latin America in recent years. NU has capitalized off this growth and become one of the leading players in the financial tech industry in Latin America. While there are risks associated with increasing competition in the region and the possibility of an economic slowdown in Latin America, NU’s growth prospects present a unique opportunity for investors to capitalize on the large long-term growth of a company that will inevitably become one of the largest players in the developing Latin American Fintech industry.

Company Overview

Nu Holdings offers a wide array of financial services and products to their consumers in Latin America. Their main revenue drivers are “Nubank,” “Nu Credit,” “Nu Invest,” and “Nu Insurance.” They have over 50 million customers across Brazil, and more recently, Mexico and Colombia. Their disruptive business model stresses ease of use for customers coupled with broad product offerings, a strategy which makes proliferation in new markets more successful than their competitors. Their stock is currently trading at ~$7.66 per share with a market cap of $34.3 billion.

Industry Overview

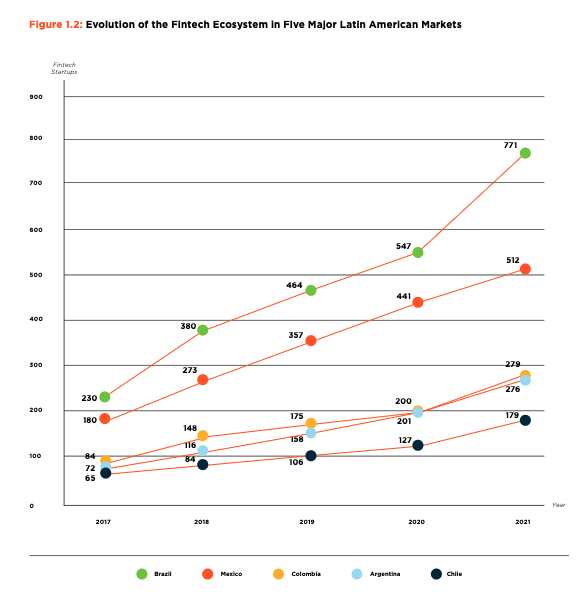

The Latin American digital banking and financial tech industries are still in their early stages of development but have seen a lot of rapid growth in recent years. This growth can mainly be attributed to an increase in wealth in the region, particularly the middle class, and a growing utilization of smartphones. This has been extremely successful in Brazil, which was found to have the highest penetration of digital bank users in Latin America at 77.3%. As penetration rates continue to increase in surrounding countries, the industry as a whole becomes more profitable, attracting foreign venture capital. Backed by investors like Berkshire Hathaway, capital injections will allow major players to scale quickly, independent of their profit utilization. Nu Holdings’ marketing strategy capitalizes off of this new consumer base through an easy to use banking and financial services platform.

Inter-American Development Bank

Competitive Analysis

Nu Holdings’ biggest competitors are MercadoLibre (MELI), XP Investimentos (XPBR), and Creditas. MercadoLibre is the leading e-commerce platform in Latin America but has expanded into financial services. This has proven to be a profitable vertical for them via “Mercado Pago,” their digital banking and financial services platform, which accounted for 44.9% of their net revenue in 2022. MELI is expected to invest billions more into fintech over the coming years, providing a worthy adversary for Nu Holdings. Traditional banks, on the other hand, have failed to invest in technological infrastructure and have given reason to Nu Holdings’ successful verticals, like NuBank, which had the higher valuation at its IPO than any other bank in South America and is currently the largest neobank in the world.

Financials

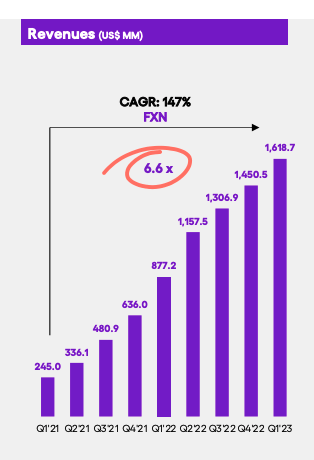

NU’s financials have been strong in recent years. The company’s revenue has grown 87% YoY, reaching $1.6 billion in the first quarter of 2023. This trend is expected to continue with their forward revenue growth rate around 45%. Additionally, their net income has increased a staggering ~$171 million from Q1 of 2022 to Q1 of 2023. With this data, it is clear that NU is still in a state of high growth, relying on increases in their user base to generate the revenue they have been seeing. With their success contingent on their expansion efforts, they are likely to spend millions on marketing campaigns in underbanked markets like Colombia. Even then, their growth is bound to slow in the next 5+ years as their market penetration increases, and the digital banking economy as a whole, begins to stabilize in the countries they are operating in. The risk of existing and potential competitors taking control of market share may expedite this timeline and cause NU to reinvest their efforts in cost efficiency for their existing user base. Investor confidence is currently high for long-term growth, though NU is currently trading at a premium and can be quite volatile in the short term. Other analysts have placed a price target of $8.00/share, further bolstering the overall positive sentiment towards NU’s continued high growth. This is a fair price target considering their most recent earnings beat analyst expectations by as much as 4%, and call option volume has been high over the last few weeks.

NU Earnings Presentation

Key Catalysts

NU’s main catalysts for continued growth will be based around the success of their expansionary efforts, low-cost business model, and the prolonged growth of the middle class in Latin America. The success of their NuBank vertical in Brazil is indicative of a pattern that many economists believe will emerge in Mexico and other underbanked markets with similar demographics. They currently control 3% of the market in Mexico and 2% in Colombia, compared to 46% in Brazil. Minimizing the cost of expansion in these markets will be key to increasing the profitability of NU’s operations, especially as start-ups and traditional banks become more successful at usurping market share. Their average cost per active customer remains at $.80/month, one of the best performers for cost per user in Latin America. They have so far demonstrated penetrative success, increasing their customer base in Mexico by 52% and in Colombia by 200% YoY. Furthermore, this demonstrates how scalable their product is as long as they don’t face strict governmental regulation or a change in the trajectory of economic performance in the region.

Valuation

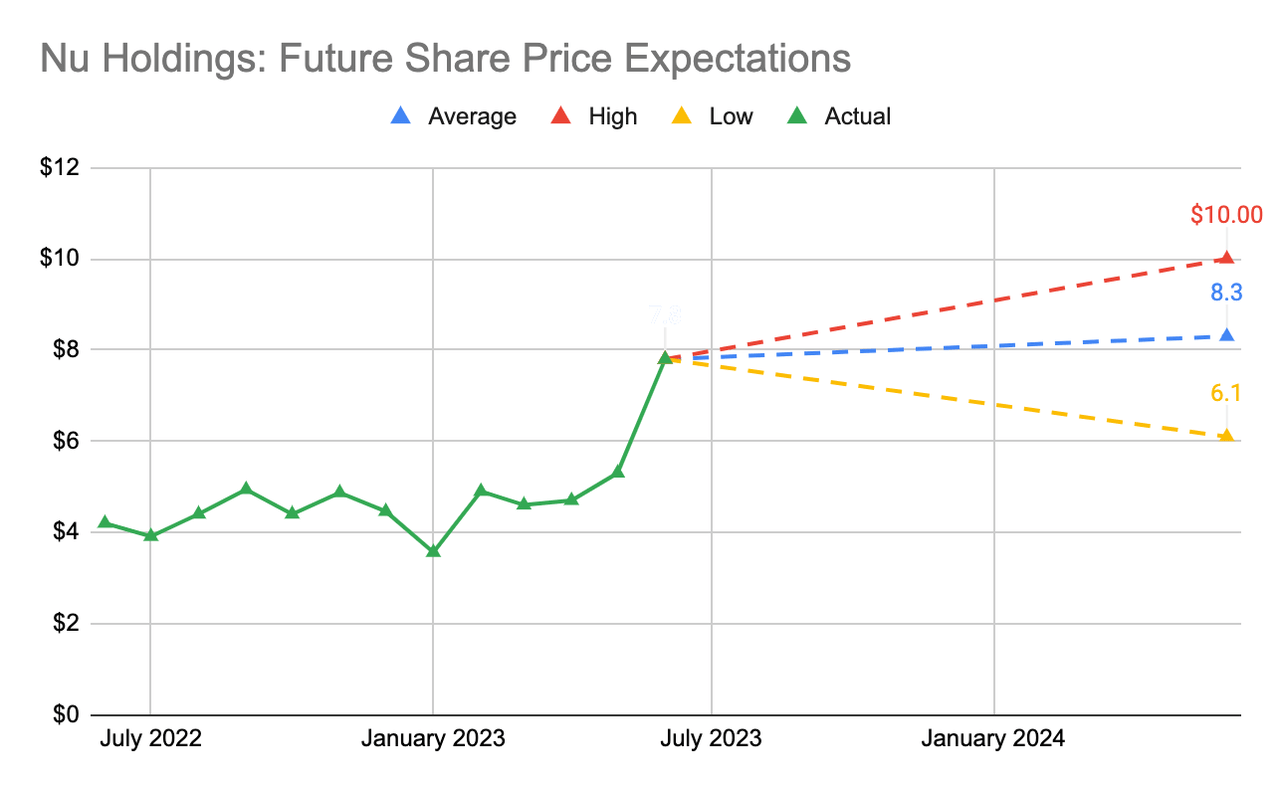

NU is currently trading at a premium compared to historical data, though not as high as when the stock was initially given its valuation. The company’s price to earnings ratio (P/E) is expected to be 50.4x for 2023, which is indicative of high investor confidence in their growth potential. Their price to sales ratio (P/S) is 10.11x, indicating that investors are willing to pay a premium for shares of NU. When compared to MercadoLibre’s P/E and P/S of 100.53x and 5.58x respectively, it is clear that NU is catching up in profitability as their sales continue to increase year on year. The premium valuation NU currently has is reasonable on the basis that NU is still relatively young with strong product offerings. They are early in their expansion efforts, having already led in Brazil’s market share and will be expected to continue this growth pattern in Mexico and Colombia as long as they are reinvesting in technological infrastructure and staying ahead of competition. This is demonstrated through their forward P/E of 46.30, which is higher than most digital banking companies in Latin America. Investors looking to turn a profit in the short-term may be better off waiting for a bigger dip to capitalize on, though buy and hold investors will reap the most benefits from owning shares of NU. My price target model accounts for this growth, with an average price target at $8.30 per share by June 2024. Assuming continued aggressive growth, it is reasonable to estimate a range as high as $10 per share by June 2024. I was still fairly conservative for this upper range considering how historically volatile the share price has been. This model utilizes the P/E multiples methodology to predict an overall range for next year’s price target, dependent on estimated earnings per share and the forward P/E.

Author’s Material

ESG

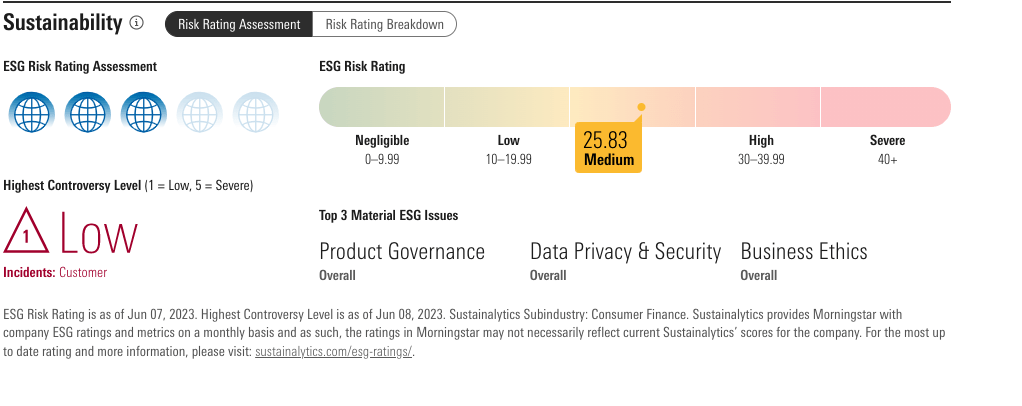

In terms of their ESG commitments, NU has recently embraced the ten commitments of the UN Global Compact; offered programming training for employees attempting to further their careers; and published a report that illustrates how NuBank brought 3.8 million Latin Americans to the financial system in Brazil. As these campaigns mature and more are developed, their ESG risk rating is bound to improve. Although when weighed against their competitors, they are performing very similarly.

Sustainalytics

Risks

NU faces a number of risks when attempting to forecast the stock’s future performance. The most notable of these risks include potential regulation from governments, increasing competition, and overall economic instability in Latin America. Operating in several countries, it is a good assumption that they will face some form of government regulation. The Central Bank of Brazil weighed in on this issue last year with the announcement of stricter regulations for larger fintech companies like NU, raising the capital reserve and risk management requirements for these companies. The intention of this is to stabilize the industry’s growth and provide standardized transparency for consumers, a long term benefit for these players and the economy of the region as a whole. Additionally, NU faces the risk of increasing competition like MercadoLibre as the industry attracts more players. While MercadoLibre has a higher valuation than NU, the maturity and broad scope of their verticals don’t indicate that they will deter the growth of NU’s ventures.

Conclusion

NU is a high-growth fintech company that is well positioned for growth. As the Latin American market continues to mature, NU is expected to remain as one of the top players, having invested heavily in cost efficiency and expansion. Their scalability and existing market share give them an advantage over other, newer and more mature, companies that exist in the industry. While they face some risks, these are generally in line with risks faced by the whole industry. As a result, NU remains an overall great option for investors looking for a long-term fintech stock to invest in.

Analyst Recommendation By: Caden-Alexander Fernando

Read the full article here