Dear readers/followers,

Canon (OTCPK:CAJPY) is a company I’ve been reviewing a few times over the past year and one of the few Japanese companies I have a position in. Read my previous coverage on Canon here. I’ve identified my international portfolio as part of the reason why I have had such a good result this year, despite an otherwise difficult year on the market thus far.

Now, because we have recent results representing the first quarter of the year, it’s a good time to review the company’s results and upside. As of a few days back, we have 1Q23 results which will show continued upside for the company. While risks exist, the upside for the company is significant here.

Canon – 1Q23 in the bag, looking forward

So, Canon’s targets for 2023 are obvious. Following 2 excellent years of growth, the company wants to achieve third consecutive year of not only sales but profit growth. It’s a difficult environment to do so in, but Canon has some of the needed operating fundamentals to do just that.

Canon is a market leader in several relevant markets. On the opposite side, we have geopolitical macro, inflation, supply chain, and other instability issues. That’s why it’s such a good set of news that the company 1Q23 was absolutely stellar.

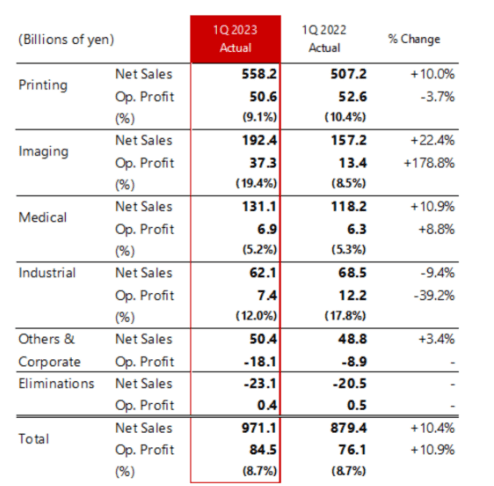

Canon’s net sales increased by 10.4%, gross profit by 15.1%, and operating profit by 10.9%. Let me break this down – when you have an increase in gross and operating profit larger than your revenue increase, it means that you’re doing something right either in operating costs or in other areas. The net income was up 22.7% – again, the company is doing things right.

What is causing this outperformance?

Well, normalization for one. Canon is seeing significant normalization towards a post-COVID-19 market. The company’s new business areas area showing outperformance, even greater potential than legacy. But all four businesses are showing growth – this includes things like network cameras, which are showing double-digit growth.

Legacy businesses such as cameras and Office MFDs are growing as well. Canon relates this to the competitive strength of its product selection and portfolio – and I have a hard time finding this flawed or incorrect. Because in the end, Canon has maintained profitability despite rising logistical and SCM costs.

Basically, all results were in line with expectations and plans.

Seeing Canon from a broader perspective as a business is tricky. Typical sector comps put it in the “Hardware” category, but this is a rough category to be compared to because it involves everything from NetApp (NTAP), and Dell (DELL) to Lenovo, Western Digital, Toshiba, and others. It’s a tricky comp group, and many of them really have nothing to do with what Canon does.

Despite this, Canon is still either at average or above-average profitability in this tricky segment. More importantly, since comps are difficult, I want to highlight profitability, where ROIC in relation to WACC has been positive for the past 10+ years. Canon has really never had a “bad year” in terms of this perspective.

The company’s sales mix is attractive. It has 29.3% in the US, 25.6% in Europe, 21.8% in Asia-Ex Japan, and 21.5% in Japan. It’s a very attractive mix overall.

Any sort of weakness in the segments?

There is some small weakness in Printing – the Op. profit is down around 3.7%, and industrial saw some sales decline, but industrial is also the near-smallest segment for the company. The imaging segment is the star of the show here.

Canon IR (Canon IR)

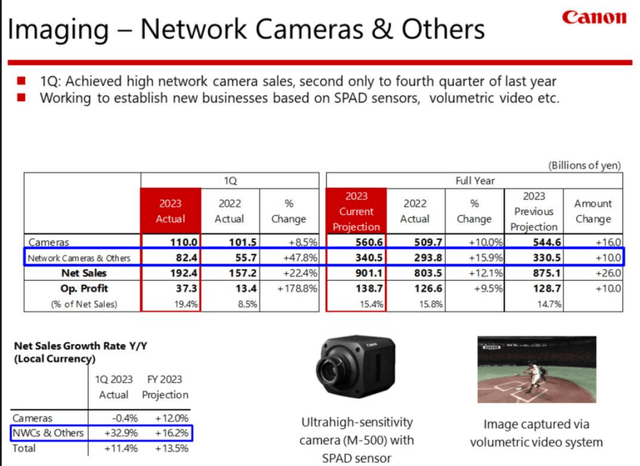

There have been significant improvements in imaging thanks to new sales of interchangeable-lens cameras and network cameras. Demand for these cameras is only expected to grow on a forward basis.

Secondly, Medical. The company’s sales and profit growth are moving upward thanks to installing large equipment across the world and across multiple sub-segments.

From a profit bridge/analysis point of view, the company’s main positive impacts were FX, sales volume/mix, pricing increases, and good cost control. On the negative side, operational expenses dragged things down by 31.5B yen for 1Q23 alone. This is the key indicator to keep an eye on in the next few quarters.

If we assume that FX normalizes, what remains is still the positives from pricing and mix – and we want to make sure that the company’s expense increase does not outstrip what it makes on the other side. The Yen has been weaker during 1Q23, but it’s the same with most currencies I’m investing in – they have seen weakness compared to the USD.

The current financial projection from the company itself calls for a full-year improvement of around 16-17% on the net income side, and around 7% on the net sales side – between 7-16% improvement across gross, operating, and net, while operating expenses are to be kept at below 37.1% of net sales. That’s compared to 36.5% of revenues/sales for 2022. This means that the company expects a ~60 bps decline/worsening in operating expenses.

The demand for Canons products remains absolutely stellar – and the company expects the availability of its products to improve as part of shortages ease up. This will further improve the potential for its sales, and the company has increased the forecasts based on these trends. I have no issues with these forecasts, and I expect similar levels to this. I would also add to this that I expect improvements based on normalization in travel, which is expected to improve sales of consumer-level cameras and equipment.

What I would be most excited about, however, is the potential of imaging such as network cameras and other products. This is a high-growth market with exposure to security and safety, and this is a very attractive prospect going forward.

Canon IR (Canon IR)

There are plenty of examples of how these products are working and being used.

We succeeded in developing a high-definition SPAD sensor with 3.2 million pixels, and in March, we announced the development of the world’s first ultra-sensitive camera equipped with a SPAD sensor. By amplifying the captured photons, it is possible to capture clear color images even in the dark, and when combined with an abundant range of lenses, it is possible to capture images at great distances. Using this, we aim to expand in areas where growth is expected, like critical infrastructure, which include borders, ports, and power plants. In addition, a volumetric video system that can instantaneously process images taken by multiple cameras and provide 360 degrees of free 3D viewing has been installed permanently at the Tokyo Dome since this season. It is already being used as part of baseball broadcasting, and we will continue to expand its use and establish it as a business.

(Source: Canon Earnings)

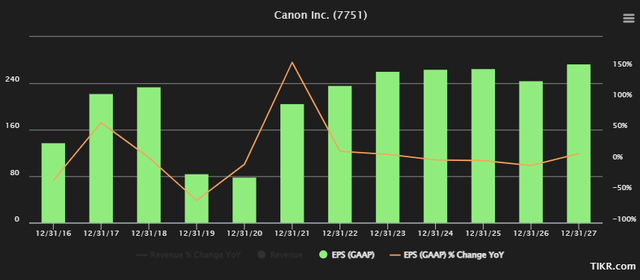

These are excellent and telling examples of how Canon’s products will be part of future solutions in these areas. My estimates for Canon remain a 2-4% revenue growth going forward, with GAAP earnings improving at a 2-4% going forward as well. I believe the fundamental strength of the company’s product portfolio and pricing will outperform any inflation and cost increase we’re seeing.

Canon Forecast (Tikr.com)

The forecasts you see above are, as such, not wrong as I see them.

Canon Valuation – it remains attractive

Since my last article, this is what has happened.

Seeking Alpha Canon Article (Seeking Alpha)

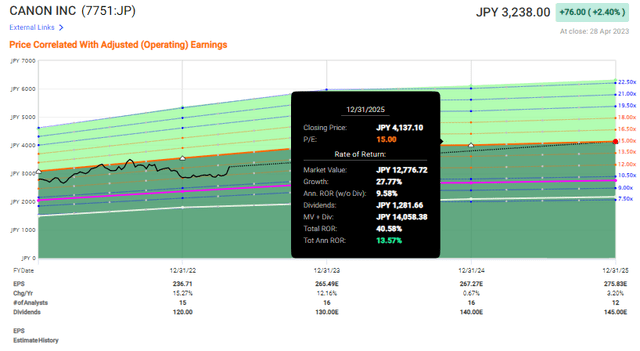

While this is decent, in outperforming the total market, I believe there is plenty of more to go here. In order to expect good results from Canon and a market outperformance, you only have to assume a 15x P/E on a forward basis. Based on this, you could expect a 13.5% annualized RoR, even after this latest 7.24% improvement.

Canon upside (F.A.S.T. Graphs)

If you’re willing to consider the company at a premium of around 17.5x, which by the way is the 5-year average, your upside is almost 20% per year, or 62.3% until 2025E. I don’t see as much as that – that’s a bit too optimistic – but I also don’t see much downside from this particular valuation.

Even in the case of flat development for 14-15x P/E, your returns would still be double digits here, as seen above. And remember – A grade credit, and the company’s portfolio with its global appeal makes a good case for why this company isn’t going anywhere in the near term.

The upside comes not from one, but several possibilities. We have dividend growth and payout growth. You have fundamentals, and you have growing key markets. This is one of the few Japanese-based businesses I invest continually in.

Simply put, and I’ve touched on this before, Canon is way too good to be ignored at this price. 1Q23 confirmed that, and the current valuation and upside definitely confirmed that.

Even if you don’t believe in the fundamentals, remember that Canon is the 3rd-largest owner worldwide of active patents, and generates over 2,500 new patents, on average, every year.

It remains, at this time, the best Japanese-market “BUY” I have, and here is my thesis for it at this time.

Thesis

My thesis for Canon is as follows:

- Canon is one of the premier imaging, camera, and printing companies on the planet. It has a solid foundation as well as excellent growth prospects. At the right valuation, this company goes from being a possible buy to being a very compelling prospect for long-term investing.

- At a conservative 12-13x P/E, I not only consider the company somewhat attractive but a definite “Buy”. I’ve established a starter position – my first position in a native Japanese ticker.

- I follow Canon with a $24.5 ADR price target, or 3,500Y for the native Tokyo ticker. It’s closing on my PT, but it’s still a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This company fulfills all of my valuation criteria for investing – it’s therefore a “Buy” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here