Last month, I discussed the very disappointing Q1 report from Chinese electric vehicle maker Nio (NYSE:NIO). Not only did the company miss revenue estimates, but guidance for Q2 was much weaker than expected. While the company has continued to give very aggressive unit growth forecasts, it has not delivered as expected. That pattern continued over the weekend when Nio management announced its Q2 delivery count.

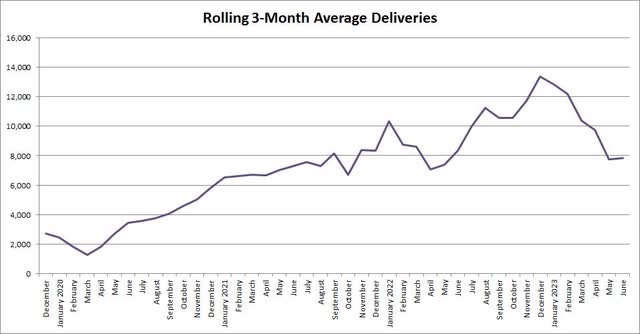

For the second quarter of 2023, Nio delivered 23,520 vehicles. This number is down about 1,500 units from the year ago period, but June itself was down over 2,250 vehicles. Don’t forget that last year’s quarter was significantly impacted by Covid-related shutdowns, so not even getting to that quarter’s sales number is extremely disappointing. As the chart below shows, the rolling 3-month average for the company has flatlined recently, falling back to levels from late 2021 and more than 5,500 vehicles off the peak.

Nio 3-Month Rolling Deliveries (Company Press Releases)

The company’s goal for this year was to double deliveries to about 245,000. Part of that hope was based on the fact that new vehicles were launching, and older models were getting meaningful upgrades. The Q2 count is even more disappointing when you consider that it was with just 3 weeks until the quarter’s end that management guided to a range of 10,187 to 12,187 units for June, and they missed the midpoint by nearly 500 vehicles.

In the first six months of this year, Nio hasn’t even reached 55,000 deliveries. I find it especially hard to see how they will double their units sold for 2023, especially as BYD continues its China dominance and Tesla (TSLA) just announced a very strong Q2 delivery count partially due to a record quarter in China. With Tesla’s Berlin factory ramping up to volume production, Tesla’s Shanghai plant can now focus more on the domestic market.

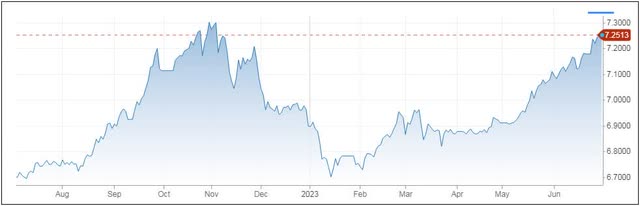

Another major issue for Nio currently is the strength in the US Dollar against the Chinese Yuan. As the greenback continues to rally, it hurts results for Nio when they are translated into dollars. As the chart below shows, the US Dollar has continued higher in recent weeks, rallying nearly an additional 2% since the company provided guidance in early June. With Chinese economic data not bouncing back as many have hoped so far this year, the US Dollar could continue to march higher, adding to the revenue headwind.

Dollar / Yuan (CNBC)

I have mentioned in previous articles that Nio’s cash balance and working capital have come down a bit in recent quarters. With the company continuing to report large losses as well as investing heavily in its growth efforts, there was likely the need to raise funds again at some point. Since I last covered the name, Nio did just that, announcing an investment of nearly $740 million from an investment arm of the Abu Dhabi Government. The company has continued to meaningfully dilute investors over time. Since Q1 2019, the share count used to determine earnings (or losses) per share has gone from 1.03 billion to 1.65 billion at this year’s Q1 report.

Since my previous earnings article, the average price target on the street has continued lower, now sitting at just $11 per share. While that still represents a little bit of upside from Friday’s close of $9.69, the average target was in the low $60s just a couple of years ago. With another disappointing monthly delivery report, and perhaps another guidance take down for Q3 on the horizon, it would not surprise me to see analysts cut their average valuation into the single digits.

At the moment, I would personally rate Nio shares as a sell. The stock has rallied more than 27% from its 52-week-high, but the company continues to report disappointing numbers quarter after quarter. It is quite clear that sales are not growing as fast as hoped, despite new vehicle launches and large price cuts that I previously mentioned. In the last year alone, the average revenue estimate for this year has gone from more than $16 billion to just over $9 billion, and I think we’ll see more estimate cuts coming.

In the end, Nio announced another disappointing quarter of vehicle deliveries. The company couldn’t even hit the midpoint of guidance it delivered just three weeks ago, and Q2 deliveries were below last year’s Covid-impacted period. As revenue estimates and price targets continue to be cut, I’m not sure how much more patience investors will have here. It would not surprise me to see Nio shares trade back down to that yearly low as investors worry about future growth and perhaps another capital raise is needed as losses continue.

Read the full article here